Market Snapshot

Detailed Market Summary

Quick Summary

Economic Commentary

Movers & Shakers

Today in IBD

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, April 09, 2007

Sunday, April 08, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stock index futures rose on Friday after employers added 180,000 jobs last month and the jobless rate unexpectedly fell, bolstering speculation that consumer spending will keep the economy growing. Moreover, sales at US wholesalers increased faster than inventories during February, which may set the stage for a rebound in manufacturing in coming months. The US Dollar Index rose .4% and the 10-year yield gained 7 basis points on Friday’s reports.

- The US war in Iraq is showing signs of progress and the Bush administration’s new strategy should be given a chance to succeed, Republican presidential contender Senator John McCain said.

- Senate Armed Services Committee Chairman Carl Levin said Democrats may be ready to compromise in the showdown with President Bush over linking funding for US troops in Iraq with a deadline for withdrawal.

- Mitsui & Co., Japan’s second-largest trading company, and Norwegian utility Statkraft AS are considering building hydropower plants in Russia as the country prepares a law to support alternative energy.

- Achuthan, of the Economic Cycle Research Institute(ECRI) says the US economy is turning up. (video)

- Emerging-market investors, anticipating the smallest gains in stocks of developing nations since 2003, are snapping up shares that pay dividends.

- A federal judge barred Vonage Holdings(VG) from signing up new customers while it appeals a ruling that it infringed three Verizon Communications(VZ) patents.

- Google Inc.(GOOG) settled a lawsuit filed by Agence France-Presse and signed an agreement to post content from the news service on its site.

- Russia, the world’s biggest energy supplier, will back an Iranian plan to improve cooperation among gas producers at an industry meeting in Qatar next week, Energy Minister Viktor Khristenko said. Russia won’t, though, sign an accord creating a cartel or “gas OPEC,” Khristenko said.

- The US may file a complaint at the World Trade Organization as early as next week over what it calls China’s piracy of copyrighted movies and books, according to four people briefed by the Bush administration.

- Sir Richard Branson’s plans to launch a space-tourism venture in rural New Mexico has won the thumbs-up from voters in Dona Ana Country, who approved a $130 million tax to help pay for a futuristic local “spaceport.”

- The 15 UK sailors and marines who were held hostage in Iran for 13 days said today they were kept in solitary confinement for much of the time. While they were subjected to “psychological pressure” and “mind games,” none of them were physically harmed, said Captain Christopher Air of the Royal Marines.

- Lockheed Martin Corp.(LMT) and three others will split US Navy awards together valued at as much as $500 million to provide antiterrorism equipment that will protect naval bases.

- Warren Buffett’s Berkshire Hathaway(BRK/A) has acquired a 10.9% stake in Burlington Northern(BNI), according to SEC filings, making the billionaire’s company the largest holder in the railroad.

- Zach Johnson shot a 3-under-par 69 in the final round to win golf’s Masters Tournament.

- Drugs that treat Parkinson’s disease may slow or stop deadly brain tumors, according to a genetic study of stem cells that fuel the cancer's growth.

Wall Street Journal:

- Private equity firms are interested in Kroger Co.(KR), the biggest US supermarket chain

- Illinois Tool Works(ITW) has turned managers of its business units into acquisition specialists to help counter a takeover slump.

- China’s government disclosed new rules regulating organ transplants that say such donations must be voluntary and approved by physicians.

NY Times:

- Florida’s clemency board will allow most non-violent felons to automatically regain their right to vote after being released from prison.

LA Times:

- Californian authorities have seized more than $100 million worth of marijuana grown indoors in the past year, with plants increasingly being found in middle- and upper-class suburban homes.

Forbes:

- Akamai(AKAM) seemed destined to become another casualty of the dot-com calamity. But six years later it has made and audacious comeback.

AP:

- The US Federal Trade Commission’s Do Not Call registry grew by 25 million phone numbers in the fiscal year ending in September, a 23% increase over the previous 12 months.

- Walt Disney Co.(DIS), the world’s largest theme-park operator, will allow gay couples to hold marriage ceremonies at its theme parks and on its cruise-line ships. Disney had previously only allowed couples with valid marriage licenses to participate in its Fairy Tale Wedding program.

Inside MBS & ABS:

- Fannie Mae(FNM) and Freddie Mac(FRE), the largest packagers of home loans into securities, last quarter hard their greatest share of US mortgage-backed bond issuance since 2004.

Sunday Express:

- US buyout firms and Middle Eastern investors are preparing a bid of at least $50 billion for Dow Chemical(DOW) that may be made by the end of this week. The offer may be made between $52 and $58 a share.

London-based Times:

- Lee Iacocca, the former chairman of DaimlerChrysler AG’s(DCX) Chrysler unit, is backing Kirk Kerkorian’s $4.5 billion bid for the carmaker.

Daily Telegraph:

- Royal Dutch Shell Plc may risk angering the US government and the UK public after the British sailors’ hostage standoff should it continue with a study on potential investment in Iran.

Frankfurter Allgemeine Sonntagszeitung:

- Germany’s renewable energy sector will generate more sales and employ more people than the automotive and machine building industries in the future, citing a study by consultant company Roland Berger.

Bild-Zeitung:

- Car dealers in German will have to show customers a “climate pass” that indicates the environmental friendliness of the vehicles they sell, citing Transport Minister Wolfgang Tiefensee.

Financial Times Deutschland:

- The International Monetary Fund will lower its 2007 forecast for US economic growth this year to 2.2% from 2.9%, citing a draft version of the fund’s semiannual World Economic Outlook. The IMF expects global growth to fall to 4.9% this year from 5.3% last year.

Commercial Times:

- Intel Corp.(INTC) will license its chipset technology to Taiwanese chipmaker Via Technologies Inc.

Yomiuri:

- China will express its intention to participate actively in negotiations to reduce greenhouse gas emissions from 2013 in a joint statement after the Japan-China summit next week.

Tehran Times:

- Trade between Iran and China will rise 14% to $16 billion this year, citing the chairman of the Iran-China Chamber of Commerce.

Gulf Daily News:

- Japan may provide a $700 million loan to Iraq for the reconstruction of the country's crude oil production and power transmission facilities.

Weekend Recommendations

Barron's:

- Made positive comments on (PETM), (SCUR) and (GCI).

Citigroup:

- Reiterated Buy on (WMB), target $35.

Night Trading

Asian indices are +.50% to +1.0% on average.

S&P 500 indicated +.35%.

NASDAQ 100 indicated +.55%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAE)/.76

- (DLP)/.29

- (LI)/.42

Upcoming Splits

- (CMI) 2-for-1

- (FMCN) 2-for-1

Economic Releases

- None of note

Bloomberg:

- US stock index futures rose on Friday after employers added 180,000 jobs last month and the jobless rate unexpectedly fell, bolstering speculation that consumer spending will keep the economy growing. Moreover, sales at US wholesalers increased faster than inventories during February, which may set the stage for a rebound in manufacturing in coming months. The US Dollar Index rose .4% and the 10-year yield gained 7 basis points on Friday’s reports.

- The US war in Iraq is showing signs of progress and the Bush administration’s new strategy should be given a chance to succeed, Republican presidential contender Senator John McCain said.

- Senate Armed Services Committee Chairman Carl Levin said Democrats may be ready to compromise in the showdown with President Bush over linking funding for US troops in Iraq with a deadline for withdrawal.

- Mitsui & Co., Japan’s second-largest trading company, and Norwegian utility Statkraft AS are considering building hydropower plants in Russia as the country prepares a law to support alternative energy.

- Achuthan, of the Economic Cycle Research Institute(ECRI) says the US economy is turning up. (video)

- Emerging-market investors, anticipating the smallest gains in stocks of developing nations since 2003, are snapping up shares that pay dividends.

- A federal judge barred Vonage Holdings(VG) from signing up new customers while it appeals a ruling that it infringed three Verizon Communications(VZ) patents.

- Google Inc.(GOOG) settled a lawsuit filed by Agence France-Presse and signed an agreement to post content from the news service on its site.

- Russia, the world’s biggest energy supplier, will back an Iranian plan to improve cooperation among gas producers at an industry meeting in Qatar next week, Energy Minister Viktor Khristenko said. Russia won’t, though, sign an accord creating a cartel or “gas OPEC,” Khristenko said.

- The US may file a complaint at the World Trade Organization as early as next week over what it calls China’s piracy of copyrighted movies and books, according to four people briefed by the Bush administration.

- Sir Richard Branson’s plans to launch a space-tourism venture in rural New Mexico has won the thumbs-up from voters in Dona Ana Country, who approved a $130 million tax to help pay for a futuristic local “spaceport.”

- The 15 UK sailors and marines who were held hostage in Iran for 13 days said today they were kept in solitary confinement for much of the time. While they were subjected to “psychological pressure” and “mind games,” none of them were physically harmed, said Captain Christopher Air of the Royal Marines.

- Lockheed Martin Corp.(LMT) and three others will split US Navy awards together valued at as much as $500 million to provide antiterrorism equipment that will protect naval bases.

- Warren Buffett’s Berkshire Hathaway(BRK/A) has acquired a 10.9% stake in Burlington Northern(BNI), according to SEC filings, making the billionaire’s company the largest holder in the railroad.

- Zach Johnson shot a 3-under-par 69 in the final round to win golf’s Masters Tournament.

- Drugs that treat Parkinson’s disease may slow or stop deadly brain tumors, according to a genetic study of stem cells that fuel the cancer's growth.

Wall Street Journal:

- Private equity firms are interested in Kroger Co.(KR), the biggest US supermarket chain

- Illinois Tool Works(ITW) has turned managers of its business units into acquisition specialists to help counter a takeover slump.

- China’s government disclosed new rules regulating organ transplants that say such donations must be voluntary and approved by physicians.

NY Times:

- Florida’s clemency board will allow most non-violent felons to automatically regain their right to vote after being released from prison.

LA Times:

- Californian authorities have seized more than $100 million worth of marijuana grown indoors in the past year, with plants increasingly being found in middle- and upper-class suburban homes.

Forbes:

- Akamai(AKAM) seemed destined to become another casualty of the dot-com calamity. But six years later it has made and audacious comeback.

AP:

- The US Federal Trade Commission’s Do Not Call registry grew by 25 million phone numbers in the fiscal year ending in September, a 23% increase over the previous 12 months.

- Walt Disney Co.(DIS), the world’s largest theme-park operator, will allow gay couples to hold marriage ceremonies at its theme parks and on its cruise-line ships. Disney had previously only allowed couples with valid marriage licenses to participate in its Fairy Tale Wedding program.

Inside MBS & ABS:

- Fannie Mae(FNM) and Freddie Mac(FRE), the largest packagers of home loans into securities, last quarter hard their greatest share of US mortgage-backed bond issuance since 2004.

Sunday Express:

- US buyout firms and Middle Eastern investors are preparing a bid of at least $50 billion for Dow Chemical(DOW) that may be made by the end of this week. The offer may be made between $52 and $58 a share.

London-based Times:

- Lee Iacocca, the former chairman of DaimlerChrysler AG’s(DCX) Chrysler unit, is backing Kirk Kerkorian’s $4.5 billion bid for the carmaker.

Daily Telegraph:

- Royal Dutch Shell Plc may risk angering the US government and the UK public after the British sailors’ hostage standoff should it continue with a study on potential investment in Iran.

Frankfurter Allgemeine Sonntagszeitung:

- Germany’s renewable energy sector will generate more sales and employ more people than the automotive and machine building industries in the future, citing a study by consultant company Roland Berger.

Bild-Zeitung:

- Car dealers in German will have to show customers a “climate pass” that indicates the environmental friendliness of the vehicles they sell, citing Transport Minister Wolfgang Tiefensee.

Financial Times Deutschland:

- The International Monetary Fund will lower its 2007 forecast for US economic growth this year to 2.2% from 2.9%, citing a draft version of the fund’s semiannual World Economic Outlook. The IMF expects global growth to fall to 4.9% this year from 5.3% last year.

Commercial Times:

- Intel Corp.(INTC) will license its chipset technology to Taiwanese chipmaker Via Technologies Inc.

Yomiuri:

- China will express its intention to participate actively in negotiations to reduce greenhouse gas emissions from 2013 in a joint statement after the Japan-China summit next week.

Tehran Times:

- Trade between Iran and China will rise 14% to $16 billion this year, citing the chairman of the Iran-China Chamber of Commerce.

Gulf Daily News:

- Japan may provide a $700 million loan to Iraq for the reconstruction of the country's crude oil production and power transmission facilities.

Weekend Recommendations

Barron's:

- Made positive comments on (PETM), (SCUR) and (GCI).

Citigroup:

- Reiterated Buy on (WMB), target $35.

Night Trading

Asian indices are +.50% to +1.0% on average.

S&P 500 indicated +.35%.

NASDAQ 100 indicated +.55%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAE)/.76

- (DLP)/.29

- (LI)/.42

Upcoming Splits

- (CMI) 2-for-1

- (FMCN) 2-for-1

Economic Releases

- None of note

BOTTOM LINE: Asian Indices are mostly higher, boosted by automaker and technology shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

Click here for Stocks in Focus for Monday by MarketWatch

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - IBD/TIPP Economic Optimism Index, weekly retail sales

Wed. - MBA Mortgage Applications, March 21 FOMC minutes, Monthly Budget Statement, weekly EIA energy inventory data

Thur. - Initial Jobless Claims, Import Price Index, ICSC Chain Store Sales

Fri. - Trade Balance, Producer Price Index, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Delta & Pine Land(DLP)

Tues. - Alcoa Inc.(AA), Schnitzer Steel(SCHN), Transaction Systems Architects(TSAI)

Wed. - Bed Bath & Beyond(BBBY), Christopher & Banks(CBK), Genentech(DNA), Progressive Corp.(PGR), Ruby Tuesday(RI)

Thur. - Advanced Micro Devices(AMD), Cost Plus(CPWM), Fastenal(FAST), JOS A Bank(JOSB), Lam Research(LRCX), MGIC Investment(MTG), Pier 1 Imports(PIR), Polaris Industries(PII), Rite Aid(RAD)

Fri. - Claire’s(CLE), General Electric(GE), DivX Inc.(DIVX)

Other events that have market-moving potential this week include:

Mon. - BOE Policy Meeting, BOJ Policy Meeting

Tue. - BOJ Policy Meeting, CSFB Real Estate Conference, SunTrust Institutional Conference, (PALM) Analyst/Investor Day, (TTWO) conference call, Fed’s Plosser speaking

Wed. - CIBC Biotech & Specialty Pharma Conference, CSFB Real Estate Conference, SunTrust Institutional Conference, Fed’s Lacker speaking, Fed’s Moskow speaking

Thur. - ECB Policy Meeting, CSFB Real Estate Conference, CIBC Biotech & Specialty Pharma Conference

Fri. - CIBC Commodity Products Conference

Click here for Stocks in Focus for Monday by MarketWatch

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - IBD/TIPP Economic Optimism Index, weekly retail sales

Wed. - MBA Mortgage Applications, March 21 FOMC minutes, Monthly Budget Statement, weekly EIA energy inventory data

Thur. - Initial Jobless Claims, Import Price Index, ICSC Chain Store Sales

Fri. - Trade Balance, Producer Price Index, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Delta & Pine Land(DLP)

Tues. - Alcoa Inc.(AA), Schnitzer Steel(SCHN), Transaction Systems Architects(TSAI)

Wed. - Bed Bath & Beyond(BBBY), Christopher & Banks(CBK), Genentech(DNA), Progressive Corp.(PGR), Ruby Tuesday(RI)

Thur. - Advanced Micro Devices(AMD), Cost Plus(CPWM), Fastenal(FAST), JOS A Bank(JOSB), Lam Research(LRCX), MGIC Investment(MTG), Pier 1 Imports(PIR), Polaris Industries(PII), Rite Aid(RAD)

Fri. - Claire’s(CLE), General Electric(GE), DivX Inc.(DIVX)

Other events that have market-moving potential this week include:

Mon. - BOE Policy Meeting, BOJ Policy Meeting

Tue. - BOJ Policy Meeting, CSFB Real Estate Conference, SunTrust Institutional Conference, (PALM) Analyst/Investor Day, (TTWO) conference call, Fed’s Plosser speaking

Wed. - CIBC Biotech & Specialty Pharma Conference, CSFB Real Estate Conference, SunTrust Institutional Conference, Fed’s Lacker speaking, Fed’s Moskow speaking

Thur. - ECB Policy Meeting, CSFB Real Estate Conference, CIBC Biotech & Specialty Pharma Conference

Fri. - CIBC Commodity Products Conference

BOTTOM LINE: I expect US stocks to finish the week modestly higher on better economic data, mostly positive earnings reports, a firmer US dollar, buyout speculation, lower energy prices, short-covering and bargain-hunting. My trading indicators are giving mostly bullish signals and the Portfolio is 100% net long heading into the week.

Market Week in Review

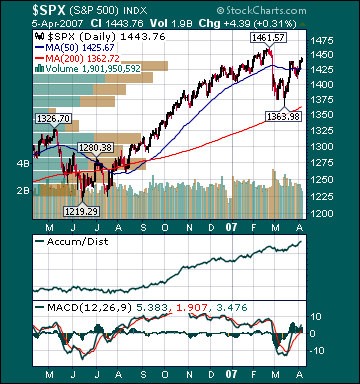

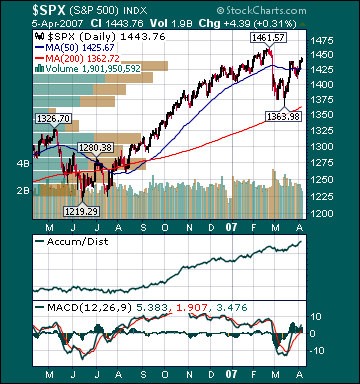

S&P 500 1,443.76 +1.49%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish as the S&P 500 is off to its best start to a second quarter since 2004. The cumulative advance/decline line rose to an all-time high, almost every sector gained and volume was above average on the week. Measures of investor anxiety finished the week slightly above average levels. The AAII percentage of bulls fell to 32.26% this week from 42.68% the prior week. This reading is now approaching depressed levels. The AAII percentage of bears soared to 39.78% this week from 25.61% the prior week. This reading is now approaching elevated levels. The 10-week moving average of the percentage of bears is currently 34.22%, an above-average level. The 10-week moving average of the percentage of bears peaked at 43.0% at the major bear market low during 2002. Moreover, the 50-week moving average of the percentage of bears is currently 37.52%, a very high level seen during only two other periods since tracking began in the 1980s. Those periods were October 1990-July 1991 and March-May 2003, both being near major market bottoms. The extreme readings in the 50-week moving average of the percentage of bears, during those periods, peaked at 41.6% on January 31, 1991 and 38.1% on April 10, 2003. We are very close to eclipsing the peak in bearish sentiment during the 2000-2003 market meltdown, which is remarkable considering the macro backdrop now compared to then and the fact that the DJIA is only 1.5% off an all-time high.

I continue to believe that steadfastly high bearish sentiment in many quarters is mind-boggling, considering the 19.5% rise in the S&P 500 in just over nine months, the 95.7% gain for the S&P 500 since the 2002 major bear market lows, the cumulative advance/decline line recently hit a new record high, one of the best August/September/October runs in U.S. history, the fact that the Dow made another all-time high recently and that we are in the early stages of what is historically a very strong period for U.S. equities after a midterm election.

As well, despite recent gains, the forward P/E on the S&P 500 is a very reasonable 15.5, falling from 16.2 at the beginning of the year, due to the historic run of double-digit profit growth increases and recent stock pullback. The S&P P/E multiple has contracted for three consecutive years. It has only contracted four consecutive years two times since 1905. Each point of multiple expansion is equivalent to a 6.6% gain in the S&P 500. The many bears still remain stunningly complacent, in my opinion.

As I have said many times over the last few months, the many bears see every pullback as a major top and every move higher as just another shorting/selling opportunity. I see few signs of capitulation by the bears and their crowded ranks are still swelling by the day. Even most bulls have raised substantial cash of late, anticipating a more meaningful correction. I still sense very few investors believe the market is done with its recent pullback.

As well, there are many other indicators registering high levels of investor anxiety. The ISE Sentiment Index plunged an extraordinarily depressed 46.0 last month and to a depressed 80.0 just last week. Its all-time low was 36.0 in July of last year, right before the market went on a tear. Moreover, the 10-day moving average of the ISE Sentiment Index made a historic low recently at 87.06.

The NYSE Arms Index hit 15.98 last month, the highest level since record-keeping began in the 1960s. The three-day moving average of the NYSE Arms hit an amazing 5.46 during that period, also the highest on record. The VIX had its largest one-day percentage increase in history last month. The CBOE total put/call ratio ten-day moving average hit 1.31 last month, the highest since at least 1995 when Bloomberg began tracking the number. NYSE short interest surged 10% last month to a new all-time high. Moreover, public short interest continues to soar to record levels as odd-lot shorting recently spiked, and U.S. stock mutual funds have seen outflows for most of the last year, according to AMG Data Services. The percentage of U.S. mutual fund assets in domestic stocks is still the lowest since at least 1984, when record-keeping began.

There has been a historic explosion of hedge funds created with absolute return, low correlation or negative correlation U.S. stock strategies that directly benefit from the perception of a stagnant or declining U.S. stock market. Commodity funds, which typically have a low or negative correlation with stocks, have been created in record numbers. A short-sighted day-trading pessimistic mentality has thoroughly permeated the investment landscape. Research boutiques with a negative bias have sprung up to cater to these many new funds that help pump air into the current U.S. "negativity bubble." Wall Street analysts have made the fewest "buy" calls on stocks this year since Bloomberg began tracking in 1997. "Buy" calls have been trending lower for nine months, despite the big rally in stocks.

Many of the most widely read stories on financial sites are written with a pessimistic slant to gain readers regardless of their accuracy. "Permabears" or “fearleaders” are more widely followed than ever, despite the market's near-triple digit gain from the major bear market lows during 2002-03. At this major market bottom, "permabulls" had been shunned and chastised for a couple of years. Investment blogger sentiment recently hit extreme levels of pessimism at 18.9% Bulls, 54.1% Bears. Finally, the UltraShort QQQQ ProShares (QID) continue to see soaring volume. There is a very high wall of worry for stocks to climb substantially from current levels as the public and many professionals remain very skeptical of this bull market and continue to trade with "one foot out the door."

I continue to believe this is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. There is still overwhelming evidence that investment sentiment by the general public regarding U.S. stocks has never been this poor in history, with the Dow near an all-time high. This is serving to further widen the so-called "wealth gap." I still expect the herd to finally embrace the current bull market this year, which should result in another substantial move higher in the major averages as the S&P 500 breaks out to an all-time high to join the Dow and Russell 2000.

It is hard to believe, after the recent bombardment of pessimism, depression comparisons and "crash" calls, that the average U.S. stock is still doing very well this year. The Value Line Geometric Index(VGY), the best gauge of the broad market, is 4.8% higher this year. Moreover, mid-caps stocks are sporting 6%+ gains already this year. Based on the market action over the last month, even more cash has piled up on the sidelines as money market funds recently hit record levels.

I continue to believe that a significant portion of this cash will be deployed into true "growth" companies as their outperformance vs. value stocks gains steam throughout the year. There is massive bull firepower on the sidelines at a time when the supply of stock is still shrinking. I still believe the coming bullish shift in long-term sentiment with respect to U.S. stocks will result in the "mother of all short-covering rallies."

The average 30-year mortgage rate rose 1 basis point this week to 6.17%, which is 63 basis points below July 2006 highs. There is still mounting evidence that the worst of the housing downturn is over, despite recent worries over sub-prime lending, and that sales activity is stabilizing at relatively high levels. About 14% of total mortgage loans are sub-prime. Of those 14%, another 13.3% are delinquent. Thus, only about 2% of total mortgage loans outstanding are currently problematic. I do not believe sub-prime woes are nearly large enough or will become large enough to meaningfully impact the prime market and bring down the U.S. economy. The Fed’s Bernanke said recently that the prime market is still strong and that he sees no spillover from the sub-prime problems. As well, the Fed’s Poole said recently that, “there is no danger to the economy from sub-prime loan defaults.” There are just too many other positives that outweigh this negative. Moreover, the Fed’s Hoenig, Lacker, Plosser, Fisher and Bies all made positive comments recently regarding the prospects for the US housing market. Finally, the ABX-HE-BBB-07-1 sub-prime Index, the source of much concern, has surged 9% from its lows last month.

Mortgage applications fell -3.2% this week, but continue to trend higher with the decline in mortgage rates and healthy job market. Existing Home Sales, which make up around 85% of the US housing market, surged 3.9% in February, the largest gain since December 2003. The NAHB Housing Market Index came in at 36 in February, up from 30 in September of last year. Within the NAHB Housing Index for February, the future sales component came in at 50. The future sales component is now up 35.1% since its cycle low of 37 in September. The Mortgage Bankers Association said recently that the US housing market will “fully regain its footing” by year-end. Moreover, the California Building Industry Association recently gave an upbeat forecast for housing, saying production would be near last year’s brisk levels. Finally, the House Price Index, which was reported recently, rose 1.1% in the fourth quarter of last year versus a 1.0% gain in the third quarter.

The Housing Index(HGX) has risen 17% from July 2006 lows, notwithstanding its recent pullback. The Case-Schiller housing futures have improved and are now projecting only a 3.0% decline in the average home price through August, up from projections of a 5.0% decline 8 months ago. Considering the median house has appreciated over 50% during the last few years with record high US home ownership, this would be considered a “soft landing.” The overall negative effects of housing on the US economy and the potential for significant price drops are still being exaggerated by the many US stock market bears in hopes of dissuading buyers from stepping up, in my opinion. Housing activity and home equity extractions had been slowing substantially for 2 years and the negative effects were mostly offset by many other very positive aspects of the US economy.

Home values are more important than stock prices to the average American, but the median home has barely declined in value after a historic run-up, while the S&P 500 has risen 19.5% in just over nine months and 95.7% since the Oct. 4, 2002 major bear market low. Americans’ median net worth is still at record high levels as a result, a fact that is generally unrecognized or minimized by the record number of stock market participants that feel it is in their financial and/or political interests to paint a bleak picture of America.

Moreover, energy prices are down significantly, consumer spending remains healthy, unemployment is low by historic standards, interest rates are low, inflation is below average rates and wages are rising at above-average rates. The economy has created almost 2 million jobs in just the last year. Challenger, Gray & Christmas reported that March job cuts fell -24.6% from year-ago levels. As well, the Monster Employment Index hit another record high in March. The 50-week moving average of initial jobless claims has been lower during only two other periods since the 70s. Finally, the unemployment rate is a historically low 4.4%, down from 5.1% in September 2005, notwithstanding fewer real estate-related jobs and significant auto production cutbacks. The unemployment rate’s current 12-month average is 4.6%. It has only been lower during two other periods since the mid-50s.

The Consumer Price Index for February rose 2.4% year-over-year, down from a 4.7% increase in September of 2005. This is meaningfully below the 20-year average of 3.1%. Moreover, the CPI has only been lower during four other periods since the mid-1960s. Many other measures of inflation have recently shown substantial deceleration to below-average rates. The Import Price Index for February rose .2% month-over-month. Moreover, the six-month average of month-over-month import price declines is -0.65%. It has only been lower during three other periods since tracking began in the 1980s. Furthermore, most measures of Americans’ income growth are now almost twice the rate of inflation. Americans’ Average Hourly Earnings rose 4.0% year-over-year in March, substantially above the 3.2% 20-year average. The 10-month moving-average of Americans’ Average Hourly Earnings is currently 4.07%. 1998 was the only year during the 90s expansion that it exceeded current levels.

The benchmark 10-year T-note yield rose 3 basis points for the week as global stock markets rose and recession worries diminished further. According to Intrade.com, the chances of a US recession beginning this year have fallen to 17.2% from 35% in January. In my opinion, many investors’ lingering fears over an economic “hard landing” still seem misplaced. The housing slowdown and auto-production cutbacks impacted manufacturing greatly over the last six months, but those drags on growth are starting to subside. Moreover, for all of 2006, US GDP growth was an above-average 3.2%.

While the drag from housing is subsiding, housing activity will not add to economic growth in any meaningful way this year as homebuilders continue to reduce inventories and sales stabilize at lower, but still relatively high by historic standards, levels. As well, recent substantial manufacturing inventory de-stocking will help produce below-average growth again this quarter. However, the Fed’s Beige Book report released recently said manufacturing was now “steady or expanding” in most districts. Moreover, the March Chicago Purchasing Managers Index soared by the largest amount since record keeping began in 1968. I still expect a smaller GDP deflator, inventory rebuilding, rising auto production, increased business spending and a still healthy service sector to boost US economic growth back to around 3% before year-end.

Manufacturing accounts for roughly 12% of US economic growth, while consumer spending accounts for about 70% of growth. U.S. GDP growth came in at a sluggish 1.1% and 0.7% during the first two quarters of 1995. During May 1995, the ISM Manufacturing Index fell below 50, which signals a contraction in activity. It stayed below 50, reaching a low of 45.5, until August 1996. During that period, the S&P 500 soared 31% as its P/E multiple expanded from 16.0 to 17.2. This was well before the stock market bubble began to inflate. As well, manufacturing was more important to overall US economic growth at that time. Stocks can and will rise as P/E multiples expand, even with more average economic and earnings growth.

Weekly retail sales surged 4.1% last week vs. a 3.9% gain the prior week and a 1.7% gain during this week last year. This is well above the long-term average and the highest weekly increase since early May of last year. Weekly retail sales have gained 3.4%, 3.7%, 3.9% and 4.1% over the last four weeks vs. weekly gains of around 2.75% the prior 3 months. The job market remains healthy, housing has improved modestly, wage growth has accelerated, stocks are higher and inflation has decelerated to below average rates. Many consumers are chomping at the bit to buy new spring clothing after such a warm fall muted holiday clothing sales. Finally, I expect consumer confidence to make new cycle highs later this year as gas prices fall, the job market remains healthy, stocks rise further, home sales stabilize at relatively high levels, inflation decelerates more and interest rates remain low. This should help sustain healthy consumer spending over the intermediate-term.

Just take a look at commodity charts, gauges of commodity sentiment and inflows into commodity-related funds over the last couple of years. Net assets invested in the Goldman Sachs Commodity Index rose to almost $70 billion in 2006 from $15 billion in 2003. There has been a historic mania for commodities by investment funds that has pushed prices significantly higher than where the fundamentals dictate. That mania is now in the stages of unwinding. The CRB Commodities Index, the main source of inflation fears has declined -5.8% over the last 12 months and -14.4% from May highs despite a historic flood of capital into commodity-related funds and numerous potential upside catalysts. Oil has declined $14/bbl from July highs. As well, this year oil plunged $12/bbl. over the first 18 days of trading of the new year. Last year, oil rose $2.05/bbl. on the first trading day of the year and $7.40/bbl. through the first three weeks of trading as commodity funds, flush with new capital, drove futures prices higher.

I suspect, given the average commodity hedge fund fell around double-digits last year as the CRB Index dropped 7.4%, that many energy-related funds saw outflows at year-end. Recent reports have also indicated that institutional investors are switching from commodity funds that trade energy futures to hedge funds that buy energy-related equities. The commodity mania has also pumped air into the current US “negativity bubble.” Talk of runaway inflation, drought, world wars, global warming, a US dollar collapse, recession/depression and global pandemics, to name a few, has been fueled by the mania for commodities. In my opinion, that is why it is so easy for most to believe that US housing was in a bubble, but then act shocked when commodities plunge. I continue to believe inflation fears have peaked for this cycle as global economic growth slows to average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies fell substantially more than expectations as refineries remain very slow to come back online after recent “outages.” However, gasoline supplies remain around average levels for this time of the year, notwithstanding low refinery utilization. Gasoline futures rose for the week, but have plunged 27% from September 2005 highs even as some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline crack spreads are now at levels seen during Hurricane Katrina’s aftermath and last year's euphoric top in oil prices. It will be interesting to see if members of Congress threaten investigations as they did the last time spreads hit current levels. Gasoline crack spreads peaked last August right before oil fell $28/bbl. in less than six months. Is also interesting to note that commercials remain net short oil futures into this spike in crack spreads, which is very unusual. The very elevated level of gas prices will further dampen global fuel demand, sending gas prices still lower over the intermediate-term.

Recently, the EIA lowered second and third quarter global demand growth for oil by 400,000 barrels per day. The 10-week moving-average of US oil inventories is also still approaching 8-year highs, as well. Oil consumption in the 30 OECD countries fell last year for the first time in over two decades, while global economic growth boomed 5.3%. Global demand destruction is pervasive. Since January 2004, global oil demand is only up 1.9%, despite the strongest global growth in almost three decades, while global supplies have increased 4.5%, according to the Energy Intelligence Group. The EIA recently forecast that bio-fuels should rise to the equivalent of more than five million barrels of crude oil production a day within four years. Recently, Energy Secretary Bodman said the US will likely remove tariffs to boost bio-fuel imports, which should reduce fears over a potential corn shortage. Corn has already dropped 16% from February highs.

As well, OPEC said recently that global crude oil supply would exceed demand by 100 million barrels this quarter. Worldwide oil inventories are poised to begin increasing at an accelerated rate over the next year. There is a very fine line in the crude oil market between perceptions of "significantly supply constrained" and "massive oversupply." One of the main reasons I believe OPEC has been slow to actually meet their pledged cuts has been the fear of losing market share to non-OPEC countries. Moreover, OPEC actually needs lower prices to prevent any further long-term demand destruction. I continue to believe oil is priced at elevated levels on record speculation by investment funds, not the fundamentals.

The Amaranth Advisors hedge fund blow-up last year was a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels for consumers and businesses. This is considered “paper demand”, which is not real demand for the underlying commodity. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices. I continue to believe a number of other funds will experience similar fates over the coming months after managers “pressed their bets” in hopes of making up for recent poor performance, which will further pressure energy prices as these funds unwind their leveraged long positions to meet rising investor redemptions. Moreover, the same rampant speculation that has driven the commodity mania will work against energy as downside speculation increases and drives down prices even further than the fundamentals would otherwise dictate.

Cambridge Energy Research, one of the most respected energy research firms in the world, put out a report late last year that drills gaping holes in the belief by most investors of imminent "peak oil" production. Cambridge said that its analysis indicates that the remaining global oil base is actually 3.74 trillion barrels, three times greater than "peak oil" theory proponents say and that the "peak oil" theory is based on faulty analysis. I suspect the substantial contango that still exists in energy futures, which encourages hoarding, will begin to reverse over the coming months as more investors come to the realization that the "peak oil" theory is hugely flawed, global storage tanks fill and Chinese/US demand slows further.

Global crude oil storage capacity utilization is running around 98%. Recent OPEC production cuts have resulted in a complete technical breakdown in crude futures, notwithstanding the recent bounce higher. Spare production capacity, which had been one of the main sources of angst among the many oil bulls, rises with each OPEC cut. As well, demand destruction which is already pervasive globally will only intensify over the coming years as many more alternative energy projects come to the fore. Moreover, many Americans feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices plunge further from current levels, as I expect. If OPEC actually implements all their announced production cuts, with oil still at very high levels and weakening global growth, it will only further deepen resentment towards the cartel and result in even greater long-term demand destruction.

I continue to believe oil made a major top last year during the period of historic euphoria surrounding the commodity with prices above $70/bbl. and calls for $100/bbl. oil commonplace. Even during the peak of anxiety in the recent Iranian/UK hostage stand-off, oil only rose about $6/bbl. despite renewed calls from numerous traders for $100/bbl. oil. Falling demand growth for oil in emerging market economies, an explosion in alternatives, rising global spare production capacity, increasing global refining capacity, the complete debunking of the hugely flawed "peak oil" theory, a firmer U.S. dollar, less demand for gas guzzling vehicles, accelerating non-OPEC production, a reversal of the "contango" in the futures market, a smaller risk premium and essentially full global storage should provide the catalysts for oil to fall to $35 per barrel to $40 per barrel later this year. I fully expect oil to test $20 per barrel to $25 per barrel within the next three years.

Natural gas inventories rose more than expectations this week. However, prices for the commodity fell just slightly as historic investment fund speculation continues even with supplies now 27.5% above the 5-year average and near all-time high levels for this time of year as winter winds down. Moreover, inventories are still around 84% of their pre-season capacity. Usually natural gas supplies are down to 58% at this point in the year. Furthermore, the EIA recently projected global liquefied natural gas production to soar this year, with the US poised to see a 34.5% surge in imports and another 38.5% increase in 2008. Natural gas prices have collapsed 51.7% since December 2005 highs. Notwithstanding this severe decline, natural gas anywhere near current prices is still ridiculous with absolute inventories poised to hit new records this year. The long-term average price of natural gas is $4.63 with inventories much lower than current levels.

Gold rose on the week despite the decline in oil prices on a weaker US dollar and lessoning fears over emerging market demand. Copper soared this week on diminished worries over global demand and short-covering. Copper is still 17.2% lower from the euphoric highs set last year. I suspect the recent bounce in copper has almost run its course. Natural gas, oil, gold and copper all look both fundamentally and technically weak longer-term. The US dollar declined for the week on some weaker-than-expected economic data and an end to the Iranian/UK tensions.

I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual rate cut is more likely this year as inflation continues to decelerate substantially. An eventual Fed rate cut should actually boost the dollar as currency speculators anticipate faster US economic activity relative to other developed economies. Moreover, the US budget deficit is now 1.4% of GDP, well below the 40-year average of 2.3% of GDP. As well, the trade deficit has been shrinking over the last five months I expect foreign investors’ demand for US securities to remain strong. Coal stocks outperformed for the week on buyout speculation and short-covering. Banks underperformed on lingering earnings concerns.

Current US stock prices are providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A CSFB report late last year confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are cheaper than value stocks for the first time since at least 1977. The entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. Many “value” investors point to the still “low” price/earnings ratios of commodity stocks, notwithstanding their historic price runs over the last few years. However, commodity equities always appear the “cheapest” right before significant price declines. I still expect the most overvalued economically sensitive and emerging market stocks to underperform over the intermediate-term as the manias for those shares subside as global growth slows to more average rates.

The emerging markets’ mania, which has mainly been the by-product of the commodity mania, is likely nearing an end, as well. I continue to keep a close eye on the Vietnam Stock Index(VNINDEX), which has recently dwarfed the Nasdaq’s meteoric rise in the late 90s, rocketing 320% higher over the last 24 months. Moreover, it is already 38% higher this year. Vietnam said recently that it may impose capital controls to curb gains in the dong. The country may require overseas investors to hold investments in stocks and bonds for a minimum of 12 months, and withdrawal of funds after the 12-month holding period may require 30-days written notice. The bursting of this bubble in Vietnam, may well signal the end of the mania for emerging market stocks. I continue to believe a chain reaction of events has already begun that will result in a substantial increase in demand for US equities.

S&P 500 profits have risen at double-digit rates for 18 consecutive quarters, the best streak since recording keeping began in 1936. Notwithstanding a 95.7% total return(which is equivalent to a 16.1% average annual return) for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.5. The 20-year average p/e for the S&P 500 is 23.0.

In my opinion, the US stock market continues to factor in way too much bad news at current levels. One of the characteristics of the current US “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated, trumpeted, obsessed over and promptly priced in to stock prices. “Irrational pessimism” by investors has resulted in a dramatic decrease in the supply of stock. Booming merger and acquisition activity is also greatly constricting supply. Many commodity funds, which have received a historic flood of capital inflows over the last few years are now seeing redemptions as the CRB Index continues to languish. Some of this capital will likely find its way back to US stocks. As well, money market funds are brimming with record amounts of cash. There is massive bull firepower available on the sidelines for US equities at a time when the supply of stock has contracted.

A recent Citigroup report said that the total value of U.S. shares dropped last year, despite rising stock prices, by the most in 22 years. Last year, supply contracted, but demand for U.S. equities was muted. While overall US public sentiment is still depressed given the macro backdrop, I am seeing some signs that irrational pessimism is lifting a bit. US stock mutual funds have seen cash inflows for seven out of the last ten weeks. This should make the many bears very nervous as keeping the public excessively pessimistic on U.S. stocks has been one of their main weapons. I still suspect accelerating demand for U.S. stocks, combined with shrinking supply, will make for a lethally bullish combination this year.

Considering the overwhelming majority of investment funds failed to meet the S&P 500's 15.8% return last year, I suspect most portfolio managers have a very low threshold of pain this year for falling substantially behind their benchmark once again. The fact that last year the US economy withstood one of the sharpest downturns in the housing market in history and economic growth never dipped below 2% and averaged 3.2% illustrates the underlying strength of the economy as a whole. While significant inventory de-stocking has led to a mid-cycle slowdown, I expect inventory rebuilding to begin adding to economic growth next quarter.

I continue to believe the historically extreme readings in many gauges of investor angst over the last month indicated the US market was cleansing itself of “weak hands” at an extraordinarily rapid rate. Buyout/merger speculation, a stronger US dollar, lower commodity prices, election cycle strength, decelerating inflation readings, a pick-up in consumer spending, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is poised to rise around average rates should provide the catalysts for another substantial push higher in the major averages this year as p/e multiples expand significantly. I still expect the S&P 500 to return a total of about 17% for the year. "Growth" stocks will likely lead the broad market higher, with the Russell 1000 Growth iShares(IWF) rising a total of 25%. Finally, the ECRI Weekly Leading Index fell slightly this week, but is still forecasting healthy US economic activity. The 10-week moving average of the ECRI Weekly Leading Index is still near cycle highs.

*5-day % Change

Friday, April 06, 2007

Unemployment Rate Falls to 5-year Low, Hourly Earnings Rising at Almost Twice Inflation Rate, Payrolls Rise More Than Expected, Wholesale Sales Surge

- The Unemployment Rate for March fell to 4.4% versus estimates of 4.6% and 4.5% in February.

- The Change in Non-farm Payrolls for March was 180K versus estimates of 130K and an upwardly revised 113K in February.

- The Change in Manufacturing Payrolls for March was -16K versus estimates of -12K and an upwardly revised -11K in February.

- Average Hourly Earnings for March rose .3% versus estimates of a .3% gain and a .4% increase in February.

- Wholesale Inventories for February rose .5% versus estimates of a .4% gain and a .6% increase in January.

- The Change in Non-farm Payrolls for March was 180K versus estimates of 130K and an upwardly revised 113K in February.

- The Change in Manufacturing Payrolls for March was -16K versus estimates of -12K and an upwardly revised -11K in February.

- Average Hourly Earnings for March rose .3% versus estimates of a .3% gain and a .4% increase in February.

- Wholesale Inventories for February rose .5% versus estimates of a .4% gain and a .6% increase in January.

BOTTOM LINE: Hiring in the US rose more than forecast and the jobless rate unexpectedly fell to a five-year low, giving the economy a spark, Bloomberg reported. New jobs and higher wages are giving more Americans the means to spend, helping to shield the US economy from the weakness in housing. Upward revisions to the prior two months showed 32,000 more jobs were created than earlier estimated. Service industries, which include banking, insurance, restaurants and retailers, added 137,000 new employees. Overtime at manufacturing companies rose to 4.3 hours from 4.2 hours the prior month. “The continuing increases in employment, together with some pickup in real wages, have helped sustain consumer spending,” Fed Chairman Bernanke said last week. “Growth in consumer spending should continue to support the economic expansion in coming quarters,” he said. The economy has created about 2 million jobs in the last year. Challenger, Gray & Christmas reported this week that March job cuts fell -24.6% from year-ago levels. As well, the Monster Employment Index hit another record high in March. The current 50-week moving average of initial jobless claims has been lower during only two other periods since the 70s. The unemployment rate is a historically low 4.4%, down from 5.1% in September 2005, notwithstanding fewer real estate-related jobs and significant auto production cutbacks. The unemployment rate’s current 12-month average is 4.6%. It has only been lower during two other periods since the mid-50s. Furthermore, most measures of Americans’ income growth are now almost twice the rate of inflation. Americans’ Average Hourly Earnings rose 4.0% year-over-year in March, substantially above the 3.2% 20-year average. The 10-month moving-average of Americans’ Average Hourly Earnings is currently 4.07%. 1998 was the only year during the 90s expansion that it exceeded current levels. I continue to believe the job market will remain healthy over the intermediate-term without generating substantial inflation concerns. Considering many more investors are worried about economic growth than inflation, I suspect today’s news will provide a positive catalyst for US stocks on Monday. I still believe inflation is not at problematic levels and the 10-year yield, the best longer-term predictor of inflation, is nowhere near levels that would prompt an interest rate hike from the Fed. I continue to believe the Fed will remain on hold throughout the year, however a rate cut is much more likely than a rate hike.

Sales at US wholesalers increased faster than inventories during February, which may set the stage for a rebound in manufacturing in coming months, Bloomberg said. Sales rose 1.2% versus a -.9% decline the prior month. Moreover, goods on hand equal 1.15 months supply at the current sales pace versus 1.16 months in January. Inventories of autos fell 2.2% and supplies of computers/electrical equipment declined. I continue to believe significant inventory de-stocking will result in 1Q growth coming in substantially below trend. However, as companies gain confidence in the sustainability of the current expansion with lean stockpiles, inventory rebuilding should help begin boosting growth back to more average rates next quarter.

Thursday, April 05, 2007

Weekly Scoreboard*

Indices

S&P 500 1,443.76 +1.49%

DJIA 12,560.20 +1.71%

NASDAQ 2,471.34 +2.21%

Russell 2000 813.35 +1.80%

Wilshire 5000 14,584.96 +1.56%

Russell 1000 Growth 569.83 +2.05%

Russell 1000 Value 833.27 +1.05%

Morgan Stanley Consumer 711.36 +1.43%

Morgan Stanley Cyclical 969.13 +1.57%

Morgan Stanley Technology 572.79 +2.95%

Transports 4,917.46 +2.39%

Utilities 510.34 +1.39%

MSCI Emerging Markets 119.76 +2.88%

Sentiment/Internals

NYSE Cumulative A/D Line 71,976 +5.7%

Bloomberg New Highs-Lows Index +477 +407.4%

Bloomberg Crude Oil % Bulls 25.0 -67.8%

CFTC Oil Large Speculative Longs 196,329 +9.29%

Total Put/Call .75 -35.3%

NYSE Arms .81 -17.34%

Volatility(VIX) 13.23 -12.62%

ISE Sentiment 126.0 +28.6%

AAII % Bulls 32.26 -24.4%

AAII % Bears 39.78 +55.3%

Futures Spot Prices

Crude Oil 63.99 -2.96%

Reformulated Gasoline 212.25 +2.57%

Natural Gas 7.62 -.42%

Heating Oil 185.97 -.91%

Gold 679.80 +1.81%

Base Metals 265.88 +9.0%

Copper 338.50 +9.5%

Economy

10-year US Treasury Yield 4.68% +3 basis points

4-Wk MA of Jobless Claims 315,800 -.5%

Average 30-year Mortgage Rate 6.17% +1 basis point

Weekly Mortgage Applications 649.50 -3.2%

Weekly Retail Sales +4.1%

Nationwide Gas $2.71/gallon +.08/gallon

US Heating Demand Next 7 Days 53.0% above normal

ECRI Weekly Leading Economic Index 140.30 -.14%

US Dollar Index 82.70 -.50%

CRB Index 317.60 -.04%

Leading Sectors

Coal +8.2%

Biotech +5.1%

Gold +5.0%

HMOs +4.8%

Airlines +4.2%

Lagging Sectors

Energy +1.1%

Oil Service +1.0%

Insurance +.73%

Foods +.46%

Banks -.73%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

S&P 500 1,443.76 +1.49%

DJIA 12,560.20 +1.71%

NASDAQ 2,471.34 +2.21%

Russell 2000 813.35 +1.80%

Wilshire 5000 14,584.96 +1.56%

Russell 1000 Growth 569.83 +2.05%

Russell 1000 Value 833.27 +1.05%

Morgan Stanley Consumer 711.36 +1.43%

Morgan Stanley Cyclical 969.13 +1.57%

Morgan Stanley Technology 572.79 +2.95%

Transports 4,917.46 +2.39%

Utilities 510.34 +1.39%

MSCI Emerging Markets 119.76 +2.88%

Sentiment/Internals

NYSE Cumulative A/D Line 71,976 +5.7%

Bloomberg New Highs-Lows Index +477 +407.4%

Bloomberg Crude Oil % Bulls 25.0 -67.8%

CFTC Oil Large Speculative Longs 196,329 +9.29%

Total Put/Call .75 -35.3%

NYSE Arms .81 -17.34%

Volatility(VIX) 13.23 -12.62%

ISE Sentiment 126.0 +28.6%

AAII % Bulls 32.26 -24.4%

AAII % Bears 39.78 +55.3%

Futures Spot Prices

Crude Oil 63.99 -2.96%

Reformulated Gasoline 212.25 +2.57%

Natural Gas 7.62 -.42%

Heating Oil 185.97 -.91%

Gold 679.80 +1.81%

Base Metals 265.88 +9.0%

Copper 338.50 +9.5%

Economy

10-year US Treasury Yield 4.68% +3 basis points

4-Wk MA of Jobless Claims 315,800 -.5%

Average 30-year Mortgage Rate 6.17% +1 basis point

Weekly Mortgage Applications 649.50 -3.2%

Weekly Retail Sales +4.1%

Nationwide Gas $2.71/gallon +.08/gallon

US Heating Demand Next 7 Days 53.0% above normal

ECRI Weekly Leading Economic Index 140.30 -.14%

US Dollar Index 82.70 -.50%

CRB Index 317.60 -.04%

Leading Sectors

Coal +8.2%

Biotech +5.1%

Gold +5.0%

HMOs +4.8%

Airlines +4.2%

Lagging Sectors

Energy +1.1%

Oil Service +1.0%

Insurance +.73%

Foods +.46%

Banks -.73%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

Subscribe to:

Comments (Atom)