Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, August 06, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, August 05, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Intel Corp.(INTC), Cisco Systems(CSCO) and Johnson & Johnson, perennial favorites of money managers seeking US stocks with the fastest profit growth, are becoming staple for so-called value investors. Shares of growth companies in the S&P 500 trade at an average 16.3 times estimated earnings, while value stocks, those priced at a discount to the market or their historical average, trade at 14 times profits. The gap between them, now 2.3 points, has narrowed from 25.5 at the beginning of the decade, data compiled by Bloomberg show.

- Bear Stearns Cos.(BSC) Co-President Warren Spector resigned after credit market losses and eroding investor confidence increased pressure for management changes at the second-largest underwriter of securities tied to the slumping US housing market.

- The US House completed congressional passage of anti-terrorist legislation that gives President Bush more power to conduct electronic surveillance for the next six months.

- Federal Reserve Chairman Ben Bernanke may respond to the latest squall in financial markets the same way he did when turbulence hit four months ago: with a change in words rather than policy.

- Jones Apparel Group(JNY) said it plans to accept an increased $950 million offer from Fast Retailing Co. of Japan for its Barneys New York stores chain, turning down a bid from

- Democratic US House Speaker Nancy Pelosi Risks Losing Support by Continuing to Fund Pet Projects.

- Lead, the best-performing commodity in 2007, has peaked and may plummet for the rest of the year.

- Yields on 10-year notes fell below where they started in January after climbing to a five-year high in June. Government securities are on track to return 5.3% this year, the best performance since gaining 12% in 2002, Merrill Lynch index data show.

- The US House for the first time approved a requirement that investor-owned utilities produce electricity from renewable energy sources.

-

- The US House approved a $16 billion tax plan and a renewable electricity mandate in broad energy legislation that shifts the government’s focus to wind, solar and biomass production at the expense of traditional energy sources.

- Reliance Industries Ltd., India’s largest company by market value, will invest as much as $14 billion over the next three years in oil exploration and production as the government offers new rigs to drill each year.

- The NY Times will shrink the width of its newspaper by 1 ½ inches tomorrow to cut newsprint expenses, almost eight months ahead of schedule, according to a note to its readers.

- Chrysler LLC's new owner, Cerberus Capital Management LP, picked former Home Depot(HD) CEO Robert Nardelli as CEO, succeeding Tom LaSorda.

Wall Street Journal:

- News Corp.(NWS/A) Chairman Murdoch, who agreed to buy Dow Jones(DJ) last week, said the Wall Street Journal “needs a little more urgency” on its front page.

- Imperial Chemical Industries Plc reached a tentative agreement to be taken over by Akzo Nobel NV and a German partner for about $16.3 billion.

NY Times:

- The US government will begin enforcing rules for new highway bridges in October intended to ensure they are safe and their foundations can withstand river currents.

- Many dogs wear collars with ID tags. Now some collars also have Global Positioning System units, motion sensors or other additions to help owners keep track of their pets the high-tech way.

Barron’s:

- EchoStar Communications(DISH) and GMAC LLC are among companies whose high-yield bonds are attractive after a recent decline in the fixed-income market.

MarketWatch.com:

- Newly minted ETF targets companies that cater to the rich.

- Health-care fund manager Rob Junkin is Stockpicker of the Quarter.

AP:

- US Senator Hillary Rodham Clinton drew boos and hisses in

IBD:

- Credit Woes Grow As Fear Over Fears Worsen Problems.

Reuters:

- Markets give short-sellers long-awaited gains.

DigiTimes:

- Acer Inc.’s notebook computer shipments will surpass 1.5 million units this month, up from an average 1 million a month in the second quarter.

Washington Post:

- Hedge Funds to the Rescue. A decade ago, financial globalization seemed terrifying. Crises swept from East Asia to Russia and Brazil; the implosion of a globe-spanning hedge fund, Long-Term Capital Management, forced the Fed to orchestrate a bailout. But this decade may be remembered for the opposite lesson.

Financial Times:

- On Wall Street: Hedge fund storm is no reason to panic.

London-based Times:

- Jacques Nasser, former chief executive officer of Ford Motor(F), may visit the Land Rover and Jaguar factories in the UK, as part of an attempt to buy the brands.

Observer:

- British troops serving in

AFP:

- The Al-Qaeda terror network has warned that US diplomatic missions are legitimate targets and the group would attack them, citing a video posted on a terror-monitoring Web site.

Finanz & Wirtschaft:

- Credit Suisse Group reduced its investments in the

-

Kyodo News:

-

Xinhua:

-

- China still faces serious challenges in ensuring the safety of medicines, meat and other products even after recent improvements, citing Hui Lusheng, assistant director of the State Food and Drug Administration.

Weekend Recommendations

Barron's:

- Made positive comments on (CLX), (LBTYA) and (BR).

- Made negative comments on (ACA).

Citigroup:

- Inventories at semiconductor manufacturers declined 3.5% in 2Q07, well below normal seasonal builds of 7.1%. While the inventory correction has been underway since September, the possibility of tightness in a strong end-market environment creates potential for strong sector fundamentals in 2H07.

Night Trading

Asian indices are -1.75% to -1.0% on average.

S&P 500 futures -.26%.

NASDAQ 100 futures -.21%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (

- (BMC)/.34

- (CNO)/.19

- (CXW)/.26

- (CTRP)/.15

- (DNB)/.97

- (JCOM)/.35

- (MNT)/.34

- (QSII)/.33

- (ZQK)/.02

- (ROG)/.18

- (SINA)/.24

- (ELOS)/.36

- (TRID)/.25

- (WYNN)/.53

Upcoming Splits

- (HCSG) 3-for-2

Economic Releases

- None of note

Other Potential Market Movers

- The CIBC Enterprise Software Conference and the Pacific Crest Tech Forum could also impact trading today.

Weekly Outlook

Click here for The Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are several economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Non-farm Productivity, Unit Labor Costs, FOMC Rate Decision, Consumer Credit, weekly retail sales

Wed. – Weekly MBA Mortgage Applications, Wholesale Inventories

Thur. – Initial Jobless Claims, ICSC Chain Store Sales

Fri. – Import Price Index, Monthly Budget Statement

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Blue Nile(NILE), BMC Software(BMC), Conseco(CNO), Dun & Bradstreet(DNB), Quiksilver(ZQK), Sina Corp.(SINA), Trident Microsystems(TRID), Wynn Resorts(WYNN)

Tues. – Cisco Systems(CSCO), Dean Foods(DF), Duke Energy(DUK),

Wed. – Advance Auto Parts(AAP), American International Group(AIG), Barr Pharma(BRL), Brightpoint(CELL), Cablevision Systems(CVC), Flowserve(FLS), Georgia Gulf(GGC), Hansen Natural(HANS), Jack in the Box(JBX), News Corp.(NWS/A), Nuance Communications(NUAN), Polo Ralph Lauren(RL), Sprint Nextel(S), Station Casinos(STN)

Thur. – Brinker Intl.(EAT), California Pizza Kitchen(CPKI), Cardinal Health(CAH), Diebold(DBD), Dillard’s(DDS), Dynegy(DYN), Emulex(ELX), Limelight(LLNW), Nvidia Corp.(NVDA), Urban Outfitters(URBN)

Fri. – Bausch & Lomb(BOL), EchoStar Communications(DISH), International Rectifier(IRF), Kohl’s(KSS), Pacific Sunwear(PSUN), Triarc(TRY)

Other events that have market-moving potential this week include:

Mon. – CIBC

Tue. – RBC Tech Conference, CIBC

Wed. – CSFB Electrical Equip. & Multi-Industry Conference, Canaccord Adams Global Growth Conference, Pacific Crest Tech Forum

Thur. – CSFB Electrical Equip. & Multi-Industry Conference, RBC Tech Conference, Canaccord Adams Global Growth Conference, (BBY) Investor and Analyst Day

Fri. – None of note

Friday, August 03, 2007

Weekly Scoreboard*

Indices

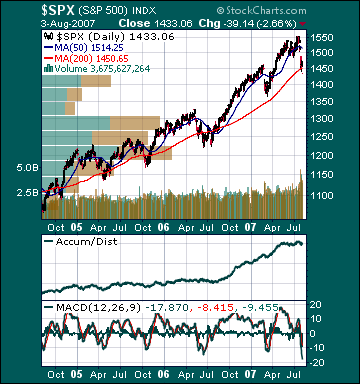

S&P 500 1,433.06 -1.78%

DJIA 13,181.91 -.63%

NASDAQ 2,511.25 -1.99%

Russell 2000 755.42 -2.88%

Wilshire 5000 14,389.19 -1.87%

Russell 1000 Growth 579.44 -1.25%

Russell 1000 Value 800.71 -2.27%

Morgan Stanley Consumer 700.95 -.21%

Morgan Stanley Cyclical 1,016.40 -.92%

Morgan Stanley Technology 617.81 -2.49%

Transports 4,873.81 -3.28%

Utilities 476.75 +.41%

MSCI Emerging Markets 130.82 -1.65%

Sentiment/Internals

NYSE Cumulative A/D Line 65,800 -2.09%

Bloomberg New Highs-Lows Index -735 -11.03%

Bloomberg Crude Oil % Bulls 16.0 -65.1%

CFTC Oil Large Speculative Longs 264,395 +4.53%

Total Put/Call 1.43 +10.0%

NYSE Arms 3.52 +156.93%

Volatility(VIX) 25.16 +4.1%

ISE Sentiment 103.0 -21.97%

AAII % Bulls 45.88 +3.78%

AAII % Bears 40.0 +8.58%

Futures Spot Prices

Crude Oil 75.48 -2.04%

Reformulated Gasoline 202.90 -2.65%

Natural Gas 6.09 -2.09%

Heating Oil 203.40 -2.87%

Gold 684.40 +1.86%

Base Metals 255.51 +.73%

Copper 347.90 -1.90%

Economy

10-year US Treasury Yield 4.69% -7 basis points

4-Wk MA of Jobless Claims 305,500 -1.1%

Average 30-year Mortgage Rate 6.68% - 1 basis points

Weekly Mortgage Applications 607.10 -.31%

Weekly Retail Sales +2.8%

Nationwide Gas $3.86/gallon -.06/gallon

US Cooling Demand Next 7 Days 27.0% above normal

ECRI Weekly Leading Economic Index 142.50 -.77%

US Dollar Index 80.18 -.95%

CRB Index 318.17 -.45%

Best Performing Style

Large-Cap Growth -1.25%

Worst Performing Style

Small-Cap Value -3.66%

Leading Sectors

Defense +2.16%

Engineering & Construction +1.81%

Gaming +1.29%

Medical Equipment +1.19%

HMOs +.77%

Lagging Sectors

Insurance -4.28%

Coal -5.41%

Biotech -5.42%

Oil Service -6.4%

I-Banks -7.6%