Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, October 28, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks advanced for the sixth time in seven weeks after earnings from Microsoft Corp.(MSFT) and Apple Inc.(AAPL) bolstered speculation that the economy is growing enough to sustain profits.

- Billionaire investor Carl Icahn sued BEA Systems(BEAS), the software maker that spurned a $6.7 billion offer from Oracle Corp.(ORCL), demanding that the company hold an annual meeting and allow shareholders to vote on a sale.

- Apple Inc.(AAPL) said it will restrict iPhone sales to two phones a customer and require credit or debit card payment on those phones to discourage unauthorized resellers and maintain enough stock for the holidays.

- The real mavens in the

- Bank shares are so cheap and their dividends so high that some of the world’s biggest investors now say the combination is unbeatable.

- Merrill CEO Stan O’Neal Decides to Leave, WSJ Reports.

-

Wall Street Journal:

- NYSE Files to End Trading ‘Collars.’

NY Times:

- Democrats in Congress Plan to Shorten Their Workweek.

- Some Bulls See Hope in Buybacks.

- In a major shift, NY Democratic Governor Eliot Spitzer is backing off his plan to allow illegal immigrants to obtain the same kind of driver’s licenses as other New Yorkers, after weeks of furor over the proposal. Instead, the governor said on Saturday, illegal immigrants in the state would be able to obtain a license that would permit them to drive but would not be accepted as identification to board plans or cross borders.

- Lehman Brothers(LEH) increased its hedges on mortgages and started to reduce its commitment to leveraged loans in the second quarter, citing an interview with CEO Richard Fuld.

- After Succeeding, Young Tycoons Try, Try Again.

- Workers at Chrysler Approve Contract.

TheStreet.com:

- Tech Funds Still Unloved.

MarketWatch.com:

- Tech drives third-quarter earnings season. Sector sees average earnings growth of 15% while overall market slips.

- Market’s volatility making timers skittish; that’s bullish.

- On a need-to-know-everything basis. Work gets personal when you enter the online world of social networking.

- Parsons to end reign at Time Warner(TWX).

- Old favorites holding ground in TV season.

- Plastics that are green in more ways than one. Bioengineers develop grasses that yield environmentally friendly polymers.

- Bullish bargain hunting from the inside. Insiders picked up buying in wake of past week’s market drop.

IBD:

- Dismal Financial Profits Mash Real Strength in Techs, Medicals.

- The Q3 Glass is Half Full for US Drug Firms.

- General David Petraeus, the top

Bespoke Investment Group:

- One thing that has changed about the sell-side though, is that just like the media, analysts as a whole are not a very optimistic group. Over the last seven years they have been steadily becoming more bearish in their calls.

Dept. of Justice:

- Fact Sheet: Commodities Fraud and Manipulation.

Business Week:

- US House Democratic lawmakers on Thursday called for giving the Commodity Futures Trading Commission more oversight of energy-trading markets, and promised to hold hearings to scrutinize the agency’s operations. The Democrats, including Rep. Bart Stupak of Michigan, made their case on the same day that oil company BP PLC(BP) agreed to pay $373 million to settle charges that it manipulated the price of propane.

- Stealth Rally for Computer Hardware Stocks.

San Francisco Chronicle:

- Nintendo Co. raised the worldwide sales forecast for its Wii game player twice as “overwhelming” demand means the product lasts “roughly a day on the shelf,” said Reginald Fils-Aime, president of Nintendo of America.

- Mortgage rates fall to lowest level in six weeks.

CNNMoney.com:

- Hackers Install Leopard on Intel PCs.

Forbes.com:

- Best Ways to Avoid Cancer.

Reuters:

- IPOs year to date; a risky bet pays off.

- Yahoo!(YHOO) stock surges ahead of Alibaba IPO pricing.

- Oracle(ORCL) withdraws bid for BEA(BEAS) as deadline expires.

Financial Times:

- Mergers may yet be on the cards.

Economist.com:

- Replacing worn-out eye lenses has never been simpler or better.

Le Figaro:

- NYSE Euronext(NYX), operator of the world’s largest securities exchange, is interested in a stake in the

Weekend Recommendations

Barron's:

- Made positive comments on (FMC), (MRK), (GOOG) and (WY).

Citigroup:

- Reiterated Buy on (URBN), raised estimates, target $30.

- Reiterated Buy on (CVH), target $69.

- Reiterated Buy on (OI), raised target to $52.

Night Trading

Asian indices are +.75% to +1.25% on average.

S&P 500 futures +.26%.

NASDAQ 100 futures +.43%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (NNDS)/.63

- (ACV)/.35

- (CNA)/.68

- (HTZ)/.57

- (LTR)/.95

- (LPX)/-.15

- (NWA)/.78

- (RSH)/.26

- (SCHN)/1.35

- (VZ)/.62

- (HUM)/1.49

- (K)/.73

- (ATHR)/.26

- (CBG)/.57

- (EOG)/.80

- (OSG)/.69

- (PPS)/.05

- (SOHU)/.23

- (VMC)/1.59

- (BOL)/.63

- (PBI)/.73

Upcoming Splits

- (MNRK) 6-for-5

Economic Data

- None of note

Other Potential Market Movers

- The Johnson Rice Consumer Conference and (ETH) Investor Conference could also impact trading today.

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Consumer Confidence, weekly retail sales reports

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report, ADP Employment Change, Advance 3Q GDP, Advance 3Q Personal Consumption, Advance 3Q GDP Price Index, Advance 3Q Core PCE, 3Q Employment Cost Index, Chicago Purchasing Manager Index, Construction Spending, FOMC Rate Decision

Thur. – Challenger Job Cuts, Personal Income, Personal Spending, PCE Core, Initial Jobless Claims, ISM Manufacturing, ISM Prices Paid, Total Vehicle Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Factory Orders

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – CNA Financial(CNA), Loews Corp.(LTR), Louisiana-Pacific(LPX), Northwest Air(NWA), RadioShack(RSH), Verizon Communications(VZ), Humana(HUM), Kellogg(K), CB Richard Ellis(CBG), Post Properties(PPS), Vulcan Materials(VMC), Bausch & Lomb(BOL), Pitney Bowes(PBI)

Tues. – Automatic Data Processing(ADP), BJ Services(BJS), Gartner Inc.(IT), Goodyear Tire(GT), Liz Claiborne(LIZ), MGM Mirage(MGM), Qwest Communications(Q), Under Armour(UA), Chipotle Mexican Grill(CMG), DreamWorks(DWA), McKesson Corp.(MCK), Omniture Inc.(OMTR), Sirf Technology(SIRF), AGCO Corp.(AG), Avon Products(AVP), Becman Coulter(BEC), Buffalo Wild Wings(BWLD), Colgate-Palmolive(CL), Energizer Holdings(ENR), Masco(MAS), Office Depot(ODP), Procter & Gamble(PG), Safeco(SAF), Titanium Metals(TIE), United States Steel(X), Vornado Realty(VNO), Wynn Resorts(WYNN)

Wed. – Constellation Energy(CEG), Foundation Coal(FCL), Garmin Ltd.(GRMN), IAC/InterActiveCorp(IACI), Mastercard Inc.(MA), SPX Corp(SPW), Transocean Inc.(RIG), Weyerhaeuser(WY), Boyd Gaming(BYD), Kraft Foods(KFT), AvalonBay(AVB), Conseco(CNO), JDS Uniphase(JDSU), MetLife(MET), Advance Auto Parts(AAP), Amdocs(DOX), Clorox(CLX), Gerber Scientific(GRB), Hilton Hotels(HLT), Jones Apparel(JNY), MicroStrategy(MSTR), Newmont Mining(NEM)

Thur. – Administaff(ASF), Alliant Techsystems(ATK), American Superconductor(AMSC), AmerisourceBergen(ABC), Becton Dickinson(BDX), Dominion Resources(D), Medco Health(MHS), Nymex Holdings(NMX), Timberland(TBL), Williams Cos(WMB), Eastman Kodak(EK), Sprint Nextel(S), Electronic Arts(ERTS), Western Digital(WDC), CA Inc.(CA), CVS Caremark(CVS), Electronic Data(EDS), Exxon Mobil(XOM), International Game Technology(IGT), Las Vegas Sands(LVS), OfficeMax(OMX), Sina Corp.(SINA), Tesoro Corp.(TSO), VeriSign(VRSN), NYSE Euronext(NYX)

Fri. – Barnes Group(B), Martha Stewart(MSO), Viacom(VIA/B), Cigna Corp.(CI), Duke Energy(DUK), Applebees(APPB), aQuantive Inc.(AQNT), Chevron Corp.(CVX), Morningstar(MORN), Station Casinos(STN), Washington Post(WPO)

Other events that have market-moving potential this week include:

Mon. – Johnson Rice Consumer Conference, (ETH) Investor Conference

Tue. – Johnson Rice Consumer Conference, (AKAM) analyst meeting, (YUM) Investor Day

Wed. – (GR) Analyst Meeting

Thur. – Oppenheimer Restaurant Conference

Fri. – (FFIV) Analyst Meeting, (PKI) Analyst Meeting

Friday, October 26, 2007

Weekly Scoreboard*

Indices

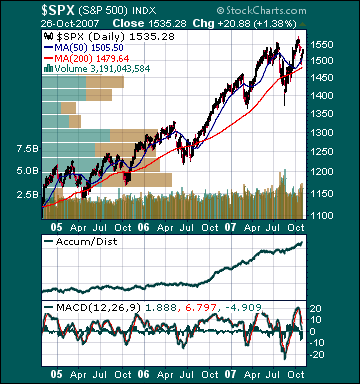

S&P 500 1,535.28 +2.31%

DJIA 13,806.70 +2.1%

NASDAQ 2,804.19 +2.9%

Russell 2000 821.39 +2.83%

Wilshire 5000 15,445.80 +2.25%

Russell 1000 Growth 630.68 +2.63%

Russell 1000 Value 845.14 +1.83%

Morgan Stanley Consumer 743.11 +2.0%

Morgan Stanley Cyclical 1,054.36 +1.51%

Morgan Stanley Technology 669.44 +.63%

Transports 4,866.97 +1.37%

Utilities 522.60 +4.80%

MSCI Emerging Markets 161.82 +4.95%

Sentiment/Internals

NYSE Cumulative A/D Line 70,298 +3.1%

Bloomberg New Highs-Lows Index +286 +226.5%

Bloomberg Crude Oil % Bulls 41.86 +203.5%

CFTC Oil Large Speculative Longs 243,931 -2.8%

Total Put/Call .81 -28.3%

NYSE Arms .57 -83.8%

Volatility(VIX) 19.56 -14.8%

ISE Sentiment 159.0 +57.4%

AAII % Bulls 31.25 -25.52%

AAII % Bears 48.21 +35.0%

Futures Spot Prices

Crude Oil 91.86 +5.7%

Reformulated Gasoline 227.40 +4.94%

Natural Gas 7.22 +2.24%

Heating Oil 243.25 +4.35%

Gold 787.50 +2.25%

Base Metals 248.90 -1.49%

Copper 353.75 -.48%

Economy

10-year US Treasury Yield 4.39% unch.

4-Wk MA of Jobless Claims 324,800 +2.5%

Average 30-year Mortgage Rate 6.33% -7 basis points

Weekly Mortgage Applications 656.50 +.03%

Weekly Retail Sales +2.3%

Nationwide Gas $2.82/gallon +.02/gallon

US Cooling Demand Next 7 Days 6% below normal

ECRI Weekly Leading Economic Index 139.70 -.29%

US Dollar Index 77.03 -.49%

CRB Index 345.87 +1.69%

Best Performing Style

Large-cap Growth +2.63%

Worst Performing Style

Mid-cap Value +1.78%

Leading Sectors

Software 8.0%

Homebuilders +6.3%

Steel +6.2%

Construction +5.3%

I-Banks +4.2%

Lagging Sectors

Drugs +1.03%

Telecom +.74%

Foods +.39%

Oil Tankers -3.1%

Semis -5.1%