Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, November 05, 2007

Links of Interest

Sunday, November 04, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Citigroup Inc.(C) Chairman and CEO Charles Prince resigned after $6.5 billion of writedowns and losses from the credit markets and shares of the biggest US bank slumped to a four-year low.

- Ford Motor(F) and the union representing its 58,500

- Iraq will take “visible measures” to crack down on Kurdish guerrillas to dissuade Turkey from launching military operations against rebel bases in the country’s north, Iraqi Foreign Minister Hoshyar Zebari said.

- The hedge-fund industry is grappling with its first shakeout in a decade as investors increasingly recoil from startups considered susceptible to the toxic shocks of this year’s credit markets. New hedge funds are opening at the slowest pace since 2003 with almost all of the $164 billion of new investments going to managers with proven records, data compiled by Chicago-based Hedge Fund Research Inc. show.

- Former Prime Minister Benazir Bhutto accused President Pervez Musharraf of staging a “second coup” in Pakistan by imposing emergency rule and said judges, lawyers and opposition parties will protest the move today.

- Berkshire(BRK/A) Profit Surges 64% on Sale of PetroChina(PTR) Stake.

Wall Street Journal:

- Ford Motor(F) told labor leaders at its Jaguar and Land Rover units to be ready to meet potential buyers as soon as Nov. 20 after receiving three “firm bids.”

- With two months left in 2007, the winners and losers on Wall Street are shaping up. Technology stocks have taken the lead down the stretch. At the back of the pack: financials.

NY Times:

- Citigroups’s(C) board is highly likely to name Robert E. Rubin, the former Treasury secretary and an influential adviser to its embattled leader, as its interim chairman at an emergency meeting today, according to a person briefed on the situation.

- Why Google(GOOG) Turned Into a Social Butterfly.

- Wireless Workplaces, Touching the Sky.

CNBC.com:

- American International Group(AIG) shareholder and former CEO Maurice “Hank” Greenberg said on Friday he was considering “strategic alternatives” for the world’s largest insurer.

- Fink Considers Merrill Lynch(MER) CEO Position.

MarketWatch.com:

- Citigroup(C) shares open 5.8% higher in Tokyo debut.

- Excess body weight, even just a little, increases your risk of cancer, according to a study released this week by the American Institute for Cancer Research. But staying active and following six rules for good eating can turn the odds back in your favor, researchers says.

- Legg Mason’s Miller: Buy financials, housing stocks. Fund manager says today’s battered sectors are market’s next leaders.

IBD:

- 166,000 New Jobs Created Last Month, Double Expectations.

- Living In a Networked World. Video is a voracious consumer of network capacity. YouTube – and other “Web 2.0”-oriented sites – are driving demand for more gear to handle that growing traffic.

Time:

- Invention Of the Year: The iPhone.

CNNMoney.com:

- Big solar power plant planned for California’s central coast.

Oil & Gas Journal:

- Doubling of oil recovery efficiency seen possible.

Financial Times:

- Britons may buy as many as 200,000 Apple Inc.(AAPL) iPhones over Christmas and the New Year, citing Telefonica SA’s 02 unit, one of the retailers.

- Democrats wake up to being the party of the rich. A legislative proposal that was once on the fast track is suddenly dead. The Senate will no consider a plan to extract billions in extra taxes from mega-millionaire hedge fund managers.

TimesOnline:

- Saudi Arabia is hub of world terror. The desert kingdom supplies the cash and the killers. Saudis make up half of foreign fighters in

Reuters:

- Google Inc.(GOOG) will announce its mobile phone strategy next week, including an operating system and deals with several service providers and handset makers.

- Oil prices fell on Monday, pulling back from previous session’s 2.5% surge, as easing tensions in the Middle East encouraged investors to take profits.

- Canada’s CIBC said on Sunday it would sell a major part of its US capital markets business to Oppenheimer Holdings as it focuses on its core operations.

Mainichi:

- Toyota Motor(TM) plans to develop robots to help with household chores and nursing care as part of its “Global Vision 2020” plan unveiled yesterday.

MEED:

-

Weekend Recommendations

Barron's:

- Made positive comments on (NTRS), (GRMN), (AAPL), (GOOG), (RIMM), (AKAM) and (KCP).

- Made negative comments on (DPTR), (BIDU) and (MAT).

Citigroup:

- Reiterated Buy on (RIMM), Top handset pick.

- Reiterated Buy on (BRCM), target $49.

- Reiterated Buy on (INTC), target $33. Despite some suggestion that Intel would build inventory in 4Q07, we now view this as an unlikely scenario. Essentially, at the

- Reiterated Buy on (ATVI), raised estimates, target $29.

Morgan Stanley:

- Reiterated Overweight on (ERTS), raised estimates.

Night Trading

Asian indices are -1.50% to -1.0% on avg.

S&P 500 futures -.42%.

NASDAQ 100 futures -.38%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (BKC)/.33

- (MVL)/.29

- (CAH)/.87

- (DNB)/1.01

- (DIVX)/.12

- (SIE)/.59

- (CUZ)/.08

- (FST)/.55

- (CECO)/.23

- (ATVI)/-.02

- (WMS)/.19

- (SYY)/.41

- (JAVA)/.03

Upcoming Splits

- (ATU) 2-for-1

Economic Data

10:00 am EST

- ISM Non-Manufacturing for October is estimated to fall to 54.0 versus 54.8 in September.

Other Potential Market Movers

- The (NUS) analyst meeting, JPMorgan SMid Cap Conference, CIBC Healthcare Conference and UBS Building Conference could also impact trading today.

Friday, November 02, 2007

Weekly Scoreboard*

Indices

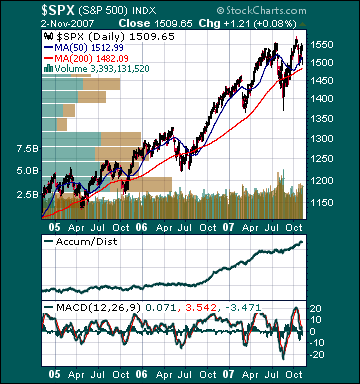

S&P 500 1,509.65 -1.67%

DJIA 13,595.10 -1.53%

NASDAQ 2,810.38 +.22%

Russell 2000 797.78 -2.87%

Wilshire 5000 15,194.27 -1.63%

Russell 1000 Growth 629.14 -.24%

Russell 1000 Value 820.02 -2.97%

Morgan Stanley Consumer 737.33 -.78%

Morgan Stanley Cyclical 1,044.66 -.92%

Morgan Stanley Technology 673.42 +.60%

Transports 4,802.75 -1.32%

Utilities 525.84 +.62%

MSCI Emerging Markets 160.98 -.52%

Sentiment/Internals

NYSE Cumulative A/D Line 69,033 +.41%

Bloomberg New Highs-Lows Index -197 -3,183%

Bloomberg Crude Oil % Bulls 60.0 +43.2%

CFTC Oil Large Speculative Longs 246,342 +.99%

Total Put/Call 1.15 +42.0%

NYSE Arms 1.11 +89.47%

Volatility(VIX) 23.01 +18.0%

ISE Sentiment 136.0 -15.72%

AAII % Bulls 44.7 +43.1%

AAII % Bears 36.5 -24.3%

Futures Spot Prices

Crude Oil 95.98 +4.59%

Reformulated Gasoline 243.85 +7.45%

Natural Gas 8.38 +7.99%

Heating Oil 257.02 +5.1%

Gold 809.80 +2.74%

Base Metals 245.84 -1.23%

Copper 335.95 -6.07%

Economy

10-year US Treasury Yield 4.32% -8 basis points

4-Wk MA of Jobless Claims 327,000 +.5%

Average 30-year Mortgage Rate 6.26% -7 basis points

Weekly Mortgage Applications 681.70 +3.84%

Weekly Retail Sales +2.2%

Nationwide Gas $2.94/gallon +.12/gallon

US Heating Demand Next 7 Days 4% below normal

ECRI Weekly Leading Economic Index 139.40 -.21%

US Dollar Index 76.27 -.90%

CRB Index 353.57 +2.23%

Best Performing Style

Large-cap Growth -.24%

Worst Performing Style

Small-cap Value -4.0%

Leading Sectors

Software +4.4%

Gold +4.11%

Disk Drives +2.8%

Defense +1.4%

Computer Hardware +1.0%

Lagging Sectors

Insurance -4.0%

Homebuilders -4.63%

Steel -4.2%

Banks -6.7%

Coal -7.49%

Stocks Mixed into Final Hour as Tech Strength Offsets Financial Weakness

Job Creation Healthy, Unemployment Still Historically Low, Earnings Rising Almost Twice Inflation, Factory Orders Rebound

- The Change in Non-farm Payrolls for October was 166K versus estimates of 85K and 96K in September.

- The Unemployment Rate for October was 4.7% versus estimates of 4.7% and 4.7% in September.

- Average Hourly Earnings for October rose .2% versus estimates of a .3% gain and a .3% increase in September.

- Factory Orders for September rose .2% versus estimates of a .7% decline and a 3.5% decline in August.

BOTTOM LINE: American employers added almost twice as many jobs as forecast in October, Bloomberg reported. The unemployment rate held at a historically low 4.7%. Service industries, which includes banks, insurance companies, restaurants and retailers, added 190,000 jobs. Average Hourly Earnings rose 3.8%, which is very high by historic stands and almost twice most measures of inflation. For two years, we have been hearing that the housing downturn would lead to imminent massive job loss, and there remains little evidence of this. Fed fund futures now imply a 72% chance for another 25 basis-point-cut at the upcoming December meeting, up from a 60% chance yesterday. I continue to believe the

Orders to US factories unexpectedly rose in September, suggesting companies remain confident the economy will continue to grow, Bloomberg reported. Excluding transports, demand jumped 1.4%. Bookings for capital goods excluding aircraft and military equipment, a measure of future business investment, rose .6% versus a .1% gain in August. Manufacturers had enough goods on hand to last 1.24 months, the same as the prior month. I continue to believe manufacturing will help boost overall