Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, April 07, 2008

Links of Interest

Sunday, April 06, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Credit-default swaps capped their biggest three-week drop ever after the Federal Reserve’s moves to prevent bank failures deflated concerns of a deeper credit crisis and forced investors braced for the worst to capitulate. Credit-default saps on the Markit CDX North America Investment Grade Index, linked to the debt of 125 companies in the

- Former President Bill Clinton has earned $15.4 million from billionaire Ron Burkle’s Yucaipa Cos. investment firm since 2003, according to tax documents released by his wife. The earnings represent 20% of the approximately $75 million Bill Clinton earned during the same period. “Most people who make that much money work for it,” said Yale University tax law professor Michael Graetz, a former Treasury Dept. official. “What are they being paid for, and if it’s the Sheikh of Dubai paying the husband of somebody who might be the next president of the US, what do they think they’re paying for?”

- European finance ministers will press their counterparts from the G-7 nations for greater coordination in battling the credit squeeze that threatens global economic growth.

- The US dollar rose the most against he yen since November and advanced versus the euro on speculation global banks will withstand what the IMF has called the worst credit crisis since the Great Depression.

- US stocks posted the biggest weekly rally in two months after Lehman Brothers(LEH), Merrill Lynch(MER) and UBS AG(UBS) triggered speculation that banks will weather mortgage-related losses.

- Microsoft Corp.(MSFT), whose $44.6 billion takeover offer was spurned by Yahoo! Inc.(YHOO), said the Internet company’s directors risk facing a proxy battle and a lower bid if they fail to agree to terms in three weeks.

- Dell Inc.(DELL) is getting bids for its consumer-lending unit after putting the business up for sale, CEO Michael Dell said.

- The proposed Gulf single currency will be pegged to the US dollar, and the greenback’s depreciation won’t change that, Qatar Central Bank Governor Abdullah Bin Saud al-Thani said.

- Republican US presidential candidate John McCain issued a call for bipartisan cooperation as he ended a weeklong “Service to America” tour that highlighted his life and public career.

Wall Street Journal:

- American Axle CEO Richard Dauch and UAW President Ron Gettelfinger are to meet tomorrow. The meeting is a possible sign both sides want to start talks aimed at ending a strike by about 3,650 American Axle workers that has lasted more than a month. The strike forced General Motors(GM) to idle all or part of 30 factories.

- Recession? Think Stocks for Recovery. Many say the future might be brightest for one of the worst-performing sectors this year (technology) and one of the best (energy). And despite election-year uncertainty, they are finding things to like among health-care stocks. There is a common theme here: In a slow economy, investors are willing to pay for earnings growth, and they see it in these stocks.

CNBC.com:

- What Recession? Investors Go Shopping for Bargains.

MarketWatch.com:

- Now’s the time to buy airline stocks, at least one contrarian says.

NY Times:

- Thousands of tourists, lured by the high price of gold, are traveling to California, Arizona, Colorado and Alaska to pan for the precious metal. “Gold fever is a real thing,” Gary Hawley of the 140-member Gold Prospectors of the Rockies said. People will find a speck of gold, and “before you know it, you can end up with $7,000, $8,000 worth of equipment but still no gold.” The Gold Prospectors Association of America membership has grown nearly 40% from 2006 to 45,000 members and mining supply stores are struggling to keep up with demand.

- Democratic presidential candidate Hillary Clinton’s story about a woman’s death, told to illustrate failures in the US health-care system, was disputed by the Ohio hospital where she was treated.

- BMW Turns to the Web to Advertise Its 1-Series.

- DirecTV Deal Will Subsidize ‘Friday Night Lights.’

- Smaller, less-thirsty, cheaper cars enjoy big sales boom.

CNNMoney.com:

- House Financial Services Committee Chairman Barney Frank has asked the SEC to scrutinize trading in all large investment banks in the days before the collapse of Bear Stearns(BSC), citing “strong indications” of manipulative short sales. “Depending on what the Commission finds, this may lead to a broader inquiry into short selling by the SEC and Congress,” Frank said. Frank said there are “strong indications of similar market activity in the stocks of other investment banks,” and allegations by some of a coordinated effort by market participants who spread rumors that the banks were in trouble in an effort to drive down share prices.

- A couple of new surveys gauging employers’ entry-level hiring plans show that jobs for new grads are plentiful. In fact, 22% of US companies intend to hire more new grads this year than they did in 2007. About half will hire roughly the same number and only 12% of US companies are cutting back, according to Challenger, Grey & Christmas. Meanwhile, the results of CollegeGrad.com’s annual survey were even more upbeat: It found 60% of companies anticipate recruiting more new grads than last year, 21% will hire the same, and just 19% will bring fewer on board. The big surprise: College recruitment may actually be benefiting from the current slowdown.

SmartMoney.com:

- The Recession Boogeyman. It’s you who are being unrealistic if you think we’re in a recession. In fact, if you think this is a recession, then you’ve never really lived through a recession.

- Developers Help Home Buyers Fix Their Credit.

Reuters:

- Citigroup(C) on Friday sold $4.5 billion of debt, taking advantage of improved demand for US corporate bonds after Federal Reserve liquidity measures relieved worries about financial meltdowns.

- Short interest on the NYSE rose another .8% in late march, the exchange said on Friday, hitting a fresh all-time high. Short interest soared 22% in shares of Lehman Brothers(LEH) from mid-March to month’s end. About 56.6 million of the company’s shares were held short at month’s end. Short interest in shares of GAP Inc.(GPS) surged 25% during the same period. About 28.9 million of the company’s shares were held short at the end of March.

- The Five Biggest Increases/Decreases in Short Interest on the NYSE. Short interest in shares of General Electric(GE) rose by 13,036,920 shares to 57,930,098 shares.

Financial Times:

- Delta Air Lines(DAL) and Northwest Airlines have restarted merger negotiations that stalled in February when their pilot unions weren’t able to reconcile seniority issues. Delta’s board members met last week and agreed to continue talks, which are now intensifying. Both sides are to meet again this week.

- Comparisons between the US today and Japan in the 1990s are misleading and could lead to the wrong conclusions for economic policy, Richard Fisher, the president of the Federal Reserve Bank of Dallas, said.

- The Fed is blameless on the property bubble by Alan Greenspan.

- Yahoo’s(YHOO) directors were in discussions late on Sunday about Microsoft’s(MSFT) latest gambit in its unsolicited takeover approach, amid signs that the embattled internet company was preparing to dig in deeper against its suitor. “The offer still undervalues us,” said one person close to Yahoo.

- The US Fed’s intervention in the fate of Bear Stearns(BSC), the Wall Street investment bank, might have been a “turning point” in the latest financial market turmoil, according to Stanley Fischer, the governor of the Bank of Israel. Mr. Fischer, who as first deputy managing director of the IMF played a central role in tackling the Asian and Russian financial crises in the late 1990s, said that the Fed’s action had calmed the panic in the financial markets.

- A foolish overreaction to climate change. Over the past five years I have become increasingly concerned at the scaremongering of the climate alarmists, which as led the governments of Europe to commit themselves to a drastic reduction in carbon emissions, regardless of the economic cost of doing so.

TimesOnline:

- Recession unlikely if US economy gets through next two crucial months. I am probably the only economist in the world who still believes that a US recession is likely to be avoided. (very good article)

Finanz & Wirtschaft:

- The “worst of the storm” is over for financial markets, citing an interview with Blackrock, Inc.(BLK) CEO Fink.

Capital:

- The Bundesbank still expects the German economy to grow 1.6% this year, spokesman Christian Burckhardt said. Recent financial turbulence, the

Sonntag:

- UBS AG(UBS) will prepare its investment banking business for a possible sale in two to three years’ time.

tutor2u:

- Chart of the Day: Global Hedge Fund Investments.

The Australian:

- Short selling must be banned. It is irresolvably incompatible with the fundamental integrity of the market. I refer to real- or so-called “naked” – short selling. Now the ASX has called for public consultation on the issue of short selling.

- Copper hunters race for new deposits.

United Daily News:

-

Caijing.com:

- Economist: The End of the Dollar Crisis.

Gulf Times:

- Islamic bonds dive in Q1, latest credit crisis victims.

Weekend Recommendations

Barron's:

- Made positive comments on (CCL), (F), (WYE) and (DRYS).

Citigroup:

- Reiterated Buy on (UA), target $65.

- Reiterated Buy on (ISIL), target $31.

- Reiterated “Event Buy” on (YHOO), target $34.

- Downgraded (COLM) to Sell, target $41.

- Upgraded (KLAC) to Buy, target $56.

- Maintained Buy on (AMAT), target $26.

- Swapped out of (AMAT) and into (KLAC) in Top Picks Live(Citi’s dynamic list of highest conviction ideas we should be or sell today).

- Reiterated Buy on (MOS), raised estimates and target to $153.

Night Trading

Asian indices are -.25% to +1.0% on avg.

S&P 500 futures +.43%.

NASDAQ 100 futures +.39%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (AA)/.53

Upcoming Splits

- None of note

Economic Data

3:00 pm EST

- Consumer Credit for February is estimated to fall to $6.0 billion versus $6.9 billion in January.

Other Potential Market Movers

- The Fed’s Yellen speaking, Fed’s Kohn speaking and Howard Weil Energy Conference could also impact trading today.

Weekly Outlook

Click here for the weekly economic preview by Bloomberg.

Click here for stocks in focus for Monday by MarketWatch.

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Consumer Credit

Tues. – Pending Home Sales, IDB/TIPP Economic Optimism Index, Minutes of March 18 FOMC Meeting, weekly retail sales

Wed. – Weekly EIA energy inventory report, weekly MBA Mortgage Applications report, Wholesale Inventories

Thur. – Trade Balance, Initial Jobless Claims, ICSC Chain Store Sales, Monthly Budget Statement

Fri. – Import Price Index,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Alcoa Inc.(AA)

Tues. – Sealy Corp.(ZZ)

Wed. – Shaw Group(SGR), Christopher & Banks(CBK),

Thur. – Genentech(DNA), Pier 1(PIR), Rite Aid(RAD), VeriFone(PAY), Fastenal(FAST)

Fri. – General Electric(GE)

Other events that have market-moving potential this week include:

Mon. – Fed’s Yellen speaking, Fed’s Kohn speaking, Howard Weil Energy Conference

Tue. – (AWI) analyst meeting, Howard Weil Energy Conference, CSFB Global Real Estate Conference

Wed. – Fed’s Fisher speaking, (WBSN) analyst meeting, (AWI) analyst meeting, CSFB Global Real Estate Conference, Howard Weil Energy Conference

Thur. – (NVDA) analyst day, (EMKR) analyst day, (DNR) analyst meeting, CSFB Global Real Estate Conference, Howard Weil Energy Conference

Fri. – Fed’s Fisher speaking

Friday, April 04, 2008

Weekly Scoreboard*

Indices

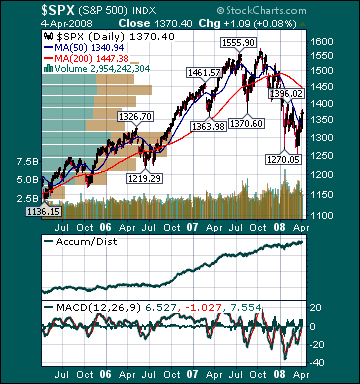

S&P 500 1,370.40 +4.2%

DJIA 12,609.42 +3.2%

NASDAQ 2,370.98 +4.9%

Russell 2000 713.73 +4.5%

Wilshire 5000 13,770.24 +4.3%

Russell 1000 Growth 568.13 +4.2%

Russell 1000 Value 748.54 +4.5%

Morgan Stanley Consumer 701.92 +1.7%

Morgan Stanley Cyclical 973.19 +5.7%

Morgan Stanley Technology 554.96 +5.1%

Transports 4,976.39 +4.7%

Utilities 498.29 +5.3%

MSCI Emerging Markets 140.49 +4.4%

Sentiment/Internals

NYSE Cumulative A/D Line 56,681 +5.6%

Bloomberg New Highs-Lows Index -201

Bloomberg Crude Oil % Bulls 29.0 -21.2%

CFTC Oil Large Speculative Longs 225,434 -.4%

Total Put/Call 1.2 +4.3%

OEX Put/Call 1.53 +64.5%

ISE Sentiment 124.0 +12.7%

NYSE Arms 1.20 -26.38%

Volatility(VIX) 22.45 -12.68%

G7 Currency Volatility (VXY) 11.67 -6.2%

Smart Money Flow Index 8,675.33 +1.8%

AAII % Bulls 36.7 -11.8%

AAII % Bears 39.4 +17.1%

Futures Spot Prices

Crude Oil 106.23 +1.2%

Reformulated Gasoline 275.74 +1.8%

Natural Gas 9.32 -5.0%

Heating Oil 299.15 +.4%

Gold 917.90 -2.4%

Base Metals 257.17 -1.5%

Copper 395.25 +3.2%

Agriculture 434.09 +1.2%

Economy

10-year US Treasury Yield 3.47% +3 basis points

10-year TIPS Spread 2.30% -5 basis points

TED Spread 1.36 +3 basis points

N. Amer. Investment Grade Credit Default Swap Index 109.2 -20.0%

Emerging Markets Credit Default Swap Index 244.76 +8.2%

Citi US Economic Surprise Index -83.80 +14.9%

Fed Fund Futures 60.0% chance of 25 cut, 40.0% chance of 50 cut on 4/30

Iraqi 2028 Govt Bonds 69.75 -1.6%

4-Wk MA of Jobless Claims 374,500 +4.4%

Average 30-year Mortgage Rate 5.88% +2 basis points

Weekly Mortgage Applications 688,300 -28.7%

Weekly Retail Sales +1.1%

Nationwide Gas $3.30/gallon +.02/gallon.

US Heating Demand Next 7 Days 11.0% below normal

ECRI Weekly Leading Economic Index 129.90 -1.4%

US Dollar Index 71.96 +.5%

Baltic Dry Index 7,690 -2.5%

CRB Index 395.09 +.1%

Best Performing Style

Mid-cap Growth +5.9%

Worst Performing Style

Small-cap Value +4.1%

Leading Sectors

Homebuilders +10.0%

I-Banks +9.7%

Semis +8.8%

Steel +8.3%

Retail +7.2%

Lagging Sectors

Drugs +2.3%

HMOs +1.8%

Computer Services +1.6%

Gold +.74%

Tobacco +.73%