Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a few economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Existing Home Sales, Richmond Fed Manufacturing, weekly retail sales reports

Wed. – Weekly MBA Mortgage Applications report, weekly EIA energy inventory data

Thur. – Durable Goods Orders, Initial Jobless Claims, New Home Sales

Fri. – Univ. of Mich. Consumer Confidence Index

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Bank of America(BAC), Halliburton(HAL), Merck(MRK), Quest Diagnostics(DGX), Hasbro(HAS), Eli Lilly(LLY), Gannett Co.(GCI), Mattel(MAT), Texas Instruments(TXN), Lincare Holdings(LNCR), Nabors Industries(NBR), Ethan Allen(ETH), Novellus Systems(NVLS), SL Green(SLG)

Tues. – Sherwin-Williams(SHW), CME Group(CME), Coach Inc.(COH), Baker Hughes(BHI), Lockheed Martin(LMT), Boston Scientific(BSX), UnitedHealth Group(UNH), Brinker Intl.(EAT), SunTrust Banks(STI), Wyeth(WYE), AT&T(T), Freescale Semi(FSL), Robert Half(RHI), Norfolk Southern(NSC), Illumina Inc.(ILMN), Cymer Inc.(CYMI), Cerner Corp.(CERN), VMware Inc.(VMW), Broadcom Corp.(BRCM), Raymond James(RJF), Yum! Brands(YUM), National City(NCC), UAL Corp.(UAUA), Omnicom(OMC), Kimberly-Clark(KMB), Yahoo! Corp.(YHOO), McDonald’s(MCD), Lexmark Intl.(LXK)

Wed. – Moody’s(MCO), Biogen Idec(BIIB), Freeport-McMoRan(FCX), Ryder(R), AmerisourceBergen(ABC), PF Chang’s(PFCB), Philip Morris(PM), Boeing(BA), United Parcel Service(UPS), Chipotle Mexican Grill(CMG), QUALCOMM(QCOM), Allstate(ALL), Aflac(AFL), Pulte Homes(PHM), Ryland Group(RYL), Alcon(ACL), Terex Corp.(TEX), EMC Corp.(EMC), Northwest Air(NWA), F5 Networks(FFIV), Allegheny Technologies(ATI), Lam Research(LRCX), Delta Air(DAL), Amazon.com(AMZN), Xilinx Inc.(XLNX), Anheuser-Busch(BUD), Apple Inc.(AAPL), General Dynamics(GD), Schering-Plough(SGP), Genzyme(GENZ), XTO Energy(XTO)

Thur. – 3M Co.(MMM), L-3 Communications(LLL), Starwood Hotels(HOT), Whirlpool(WHR), Aetna(AET), Dow Chemical(DOW), Zimmer Holdings(ZMH), Raytheon(RTN), Motorola(MOT), PepsiCo(PEP), Electronic Data(EDS), ConocoPhillips(COP), Altria Group(MO), Cheesecake Factory(CAKE), Kla-Tencor(KLAC), McAfee(MFE), American Express(AXP), Lattice Semi(LSCC), Juniper Networks(JNPR), Baidu.com(BIDU), Western Digital(WDC), Amgen(AMGN), Bristol-Myers(BMY), Celgene(CELG), Travelers(TRV), Newmont(NEM), Ingram Micro(IM), Stanley Works(SWK), Microsoft(MSFT), Sybase(SY), Black & Decker(BDK), Diamond Offshore(DO), ImClone Systems(IMCL), Royal Caribbean(RCL), AutoNation(AN), Northrop Grumman(NOC), Exelon(EXC), Deckers(DECK), Hershey(HSY), Safeway(SWY), Franklin Resources, Avid Tech(AVID), Fortune Brands(FO)

Fri. – ITT Corp.(ITT), Wendy’s Intl.(WEN), XM Satellite(XMSR), Southern Copper(PCU), Coventry Health(CVH), Ford Motor(F)

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. – (URS) analyst day, Dow Jones Wireless Innovations Conference, JPMorgan China Conference

Wed. – (GM) conference, Dow Jones Wireless Innovations Conference, JPMorgan China Conference

Thur. – JPMorgan China Conference

Fri. – (ETR) analyst conference, (IFX) analyst meeting, JPMorgan China Conference

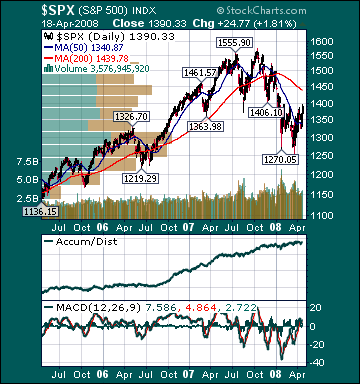

BOTTOM LINE: I expect US stocks to finish the week mixed as a firmer US dollar, lower energy prices, less economic pessimism and mostly positive earnings reports are offset by profit-taking and more shorting. My trading indicators are giving bullish signals and the Portfolio is 100% net long heading into the week.