Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Empire Manufacturing, Net Long-term TIC Flows, NAHB Housing Market Index

Tues. – Current Account Balance, Producer Price Index, Housing Starts, Building Permits, Industrial Production, Capacity Utilization, weekly retail sales reports

Wed. – Weekly EIA Energy Inventory report, weekly MBA Mortgage Applications report

Thur. – Initial Jobless Claims, Philly Fed, Leading Indicators

Fri. – None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Titan Machinery(TITN), Lehman Brothers(LEH), Adobe Systems(ADBE)

Tues. – Goldman Sachs(GS)

Wed. – Factset Research(FDS), Best Buy(BBY), Commercial Metals(CMC), Carmax(KMX), Morgan Stanley(MS)

Thur. – JMSmucker(SJM), Carnival Corp.(CCL), Circuit City(CC), Actuant Corp.(ATU)

Fri. – Ameron Intenational(AMN)

Other events that have market-moving potential this week include:

Mon. – Fed’s Bernanke speaking, Fed’s Lacker speaking, (SSW) analyst meeting, BIO International Convention

Tue. – (MAT) analyst conference, (FSL) analyst meeting, (WTM) investor meeting, CSFB Global Nanotech Conference, William Blair Growth Stock Conference, BIO International Convention, Merrill Lynch Transports Conference

Wed. – Fed’s Yellen speaking, (PLXS) investor day, (GET) analyst day, BIO International Convention, Merrill Lynch Transports Conference, William Blair Growth Stock Conference, Deutsche Bank Consumer/Food Retail Conference

Thur. – (MET) investor day, (TD) analyst meeting, (ARO) analyst day, (HIG) investor day, (MCK) analyst meeting, BIO International Convention, Deutsche Bank Consumer/Food Retail Conference, William Blair Growth Stock Conference, BMO Capital Emerging Media Forum, , Merrill Lynch Transports Conference, CSFB Consumer Conference, Bank of America Homebuilders Conference

Fri. – (WU) investor conference, BIO International Convention

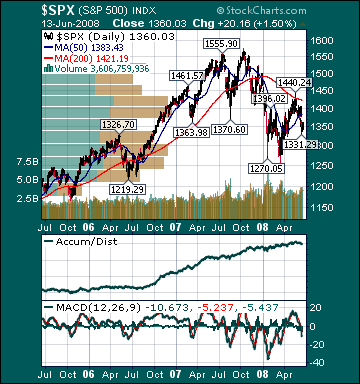

BOTTOM LINE: I expect US stocks to finish the week modestly higher on a rising US dollar, diminishing credit market angst, a decline in energy prices, less economic pessimism, a bounce in emerging market shares, a bounce in financial stocks, bargain-hunting and short-covering. My trading indicators are giving mixed signals and the Portfolio is 100% net long heading into the week.