Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 23, 2008

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, June 22, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Refinery executives are buying more of their own stock than at any time since 2000, prompting investors to bet that a retreat in oil will boost profits and reverse the biggest share decline in a decade. Executives at 10 refining companies snapped up $2 million of their shares last month, twice what they sold., which helped raise the average level of purchases to the highest in eight years. Caxton Associates, Citadel Investment Group and Renaissance Technologies, which oversee $64 billion in hedge-fund assets, also boosted bets that the shares will rebound. “Anyone right now buying the refiners would have to be banking on a pullback in oil prices,” said Jack Ablin, who oversees $65 billion as chief investment officer at Harris Private Bank in

- Saudi Arabia is ready to keep on increasing crude output after July if the market needs it, Saudi Oil Minister Ali al-Naimi said.

- Crude oil fell in NY after Saudi Arabia pledged to increase production next month and militants in Nigeria called a cease-fire in their attacks on oil pipelines and vessels.

- Walt Disney’s(DIS) ESPN, the most-watched sports channel is in partnership talks with the NFL to carry more games.

- McCain, Helped by Republican Party, Has More Money Than Obama.

- India’s central bank, which has raised interest rates to a six-year high and reduced cash in the banking system, will take further measures to curb the fastest inflation in 13 years, the government said.

- President Bush said lifting the ban on US offshore oil and gas drilling might eventually help reduce gasoline prices, and Congress should be held accountable if it doesn’t take action.

- Sales of sport-utility vehicles in China may slow after the government raised gasoline prices, Fitch Ratings Ltd. said.

- Japanese manufacturers said they are pessimistic about the outlook for the country’s export-led expansion because of surging energy and commodity costs and the risk of a US recession.

Wall Street Journal:

- As 2008 approaches its midpoint, two of the world’s worst-performing stock markets were not long ago investors’ biggest darlings – China and India.

- Fed, SEC Near Accord To Redraw Wall Street Regulation.

MarketWatch.com:

- Retail investors: Beware Hong Kong shenanigans. Changes in listing rules raise questions.

NY Times:

- Demand for certifications of homes as environmentally friendly is growing, reflecting the popularity of “green” living.

- The New Fight for Financial News. Thomson Reuters is going hard after Bloomberg LP, which has long been the marquee name on Wall Street for financial information.

- Papers Facing Worst Year for Ad Revenue. The flow of advertising dollars to Web sites from print has picked up speed.

- Obama’s Campaign Closely Linked With Ethanol.

IBD:

- Diabetes Care Drives Novo’s(NVO) Profit Growth.

TheStreet.com:

- Corning(GLW) said Friday that it continues to see strength in US liquid crystal television display sales in the first five months of 2008.

LA Times:

- Researchers have uncovered a new clue to the cause of Alzheimer’s disease.

- Google’s(GOOG) Cutts: Good directions drive traffic to your website.

CNNMoney.com:

- Stocks we love: 5 big earners.

- Selling big business on the iPhone.

- Gold: Don’t count on $1,000.

Financial Times:

- Australia overtook the US as the most obese nation in the world, with more than a quarter of the population diagnosed with the condition, citing a study published yesterday. Four million Australians, or 26%, are obese, compared with 25% in the US, according to a study by The Baker Heart Institute in Melbourne.

- Royal Dutch Shell Plc, Europe’s biggest oil producer, delayed drilling in the waters off Alaska for a year because of a court case brought by environmentalists, citing a company manager. The delay will extend and aggravate the energy supply crisis in the US, according to Pete Slaiby, Shell’s general manager for Alaska.

- Bond insurers such as Ambac(ABK), MBIA(MBI) and FGIC are talking to banks about wiping out $125 billion of insurance on risky debt securities in what could be the only way to limit the financial damage surrounding the bond insurers. If agreements are struck about the value of these CDS contacts - and the discussions could take months - it could be significant for the entire financial system, which is clogged up by the uncertainty around the value of derivatives and complex bonds linked to mortgage-backed securities.

- Out of India. Market sell signals seldom come much clearer than this. Two of India’s top industrialists are poised to trade in controlling stakes in their businesses.

TimesOnline:

- Citigroup(C) and Goldman Sachs(GS) cut more staff as effect of credit crunch lingers.

Wirtschaftswoche:

- German export business confidence declined to the lowest since the end of 2001 in May as the global economy is slowing, citing figures from the Ifo research institute. Orders from abroad dropped 3.8% in April from March.

Le Temps:

- Hedge funds control as much as 30% of the world’s commodity trades, citing Syngenta AG CEO Michael T. Mack. That’s “sufficient to potentially disturb” normal price-fixing mechanisms, he said. Mack also reiterated Syngenta plans to introduce a corn seed with an enzyme that can boost the efficiency of ethanol factories next year.

-

-

Nikkei English News:

- OPEC plans to spend $220 billion by 2012 to increase oil production. $160 billion will be spent on drilling and other related operations to boost output by 5 million barrels a day. The remaining $60 billion will be spent to increase refining capacity by 3 million barrels a day. It is the largest five-year investment by the 13-nation oil producing cartel.

21st Century Business Herald:

-

- Saudi Arabia May Convince OPEC Colleagues to Raise Output Too.

Haaretz.com:

- Israel is a long way from attacking Iran.

Weekend Recommendations

Barron's:

- Made positive comments on (MRO), (XOM), (NFX), (KFT), (RCN), (ONXX) and (SHOR).

Citigroup:

- Reiterated Buy on (OI), target $70.

Night Trading

Asian indices are -1.25% to -.50% on avg.

S&P 500 futures +.30%.

NASDAQ 100 futures +.19%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (WAG)/.59

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The (ECA) analyst meeting, (FEIC) investor meeting and Wachovia Nantucket Equity Conference could also impact trading today.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – S&P/CaseShiller Home Price Index, Consumer Confidence, Richmond Fed Manufacturing Index, House Price Index, weekly retail sales

Wed. – Durable Goods Orders, New Home Sales, FOMC rate decision, weekly MBA Mortgage Applications report, weekly EIA energy inventory data report

Thur. – Final 1Q GDP, Final 1Q, Personal Consumption, Final 1Q GDP Price Index, Final 1Q Core PCE, Initial Jobless Claims, Existing Home Sales, weekly EIA natural gas inventory report

Fri. – Personal Income, Personal Spending, PCE Core,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Walgreen Co.(WAG)

Tues. – Jabil Circuit(JBL), Darden Restaurant(DRI), Sonic Corp.(SONC), Kroger

Wed. – Monsanto(MON), General Mills(GIS), Nike Inc.(NKE), Oracle Corp.(ORCL), CKE Restaurants(CKE), Herman Miller(MLHR), Red Hat Inc.(RHT), Bed Bath & Beyond(BBBY), American Greeting(AM)

Thur. – Discover Financial(DFS), Lennar Corp.(LEN), ConAgra Foods(CAG), Palm Inc.(PALM), Christopher & Banks(CBK), Paychex(PAYX), Accenture(ACN), Rite Aid(RAD), McCormick & Co.(MKC), Micron Tech(MU)

Fri. – KB Home(KBH), Steelcase Inc.(SCS), Finish Line(FINL)

Other events that have market-moving potential this week include:

Mon. – (ECA) analyst meeting, (FEIC) investor meeting, Wachovia Nantucket Equity Conference

Tue. – (ALD) investor day, (POR) analyst day, (RDC) conference call, Wachovia Nantucket Equity Conference, Jeffries Healthcare Conference, Bank of America Utilities Conference, Deutsche Bank Alternative Energy Conference, UBS Global Financial Markets & Technology Conference

Wed. – (PRXL) investor meeting, (WMB) analyst day, (MORN) investment conference, Jeffries Healthcare Conference, Wachovia Nantucket Conference, UBS Global Financial Markets & Technology Conference

Thur. – (MORN) investment conference, (GT) investor meeting, (XLNX) analyst meeting, (AUXL) conference call, (BRCD) technology day, Wachovia Nantucket Conference, Jeffries Healthcare Conference, UBS Insurance Conference

Fri. – (MORN) investment conference, JPMorgan Tobacco Conference, UBS Insurance Conference

Saturday, June 21, 2008

Friday, June 20, 2008

Weekly Scoreboard*

Indices

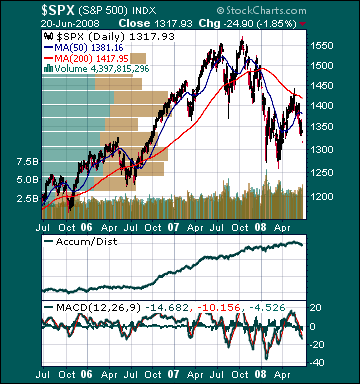

S&P 500 1,317.93 -3.10%

DJIA 11,842.69 -3.77%

NASDAQ 2,406.09 -1.97%

Russell 2000 725.73 -1.07%

Wilshire 5000 13,440.00 -2.70%

Russell 1000 Growth 571.14 -2.37%

Russell 1000 Value 698.67 -3.53%

Morgan Stanley Consumer 668.21 -3.32%

Morgan Stanley Cyclical 909.27 -3.72%

Morgan Stanley Technology 582.78 -2.23%

Transports 5,194.02 +.88%

Utilities 518.85 -.99%

MSCI Emerging Markets 138.91 -1.33%

Sentiment/Internals

NYSE Cumulative A/D Line 53,362 +.10%

Bloomberg New Highs-Lows Index -423

Bloomberg Crude Oil % Bulls 29.0 +38.1%

CFTC Oil Large Speculative Longs 203,806 -6.72%

Total Put/Call 1.29 +41.8%

OEX Put/Call 1.43 +22.2%

ISE Sentiment 76.0 -40.3%

NYSE Arms 1.36 +98.53%

Volatility(VIX) 22.87 +7.78%

G7 Currency Volatility (VXY) 9.91 -7.04%

Smart Money Flow Index 8,378.52 -.18%

AAII % Bulls 32.98 +5.54%

AAII % Bears 45.74 -14.62%

Futures Spot Prices

Crude Oil 134.95 +.02%

Reformulated Gasoline 343.0 -.93%

Natural Gas 13.03 +3.11%

Heating Oil 376.07 -1.90%

Gold 904.0 +3.58%

Base Metals 247.87 +4.93%

Copper 382.0 +6.74%

Agriculture 469.38 -.19%

Economy

10-year US Treasury Yield 4.17% -9 basis points

10-year TIPS Spread 2.50% -2 basis points

TED Spread .95 +10 basis points

N. Amer. Investment Grade Credit Default Swap Index 116.20 +4.19%

Emerging Markets Credit Default Swap Index 239.06 +3.77%

Citi US Economic Surprise Index +12.30 +83.6%

Fed Fund Futures 10.0% chance of 25 hike, 90.0% chance of no move on 6/25

Iraqi 2028 Govt Bonds 73.0 -1.93%

4-Wk MA of Jobless Claims 375,300 +.9%

Average 30-year Mortgage Rate 6.42% +10 basis points

Weekly Mortgage Applications 507,900 -8.83%

Weekly Retail Sales +2.2%

Nationwide Gas $4.08/gallon +.01/gallon.

US Cooling Demand Next 7 Days 2.0% above normal

ECRI Weekly Leading Economic Index 132.60 -.23%

US Dollar Index 73.03 -1.50%

Baltic Dry Index 9,474 -6.59%

CRB Index 455.38 +2.13%

Best Performing Style

Small-cap Growth -.57%

Worst Performing Style

Large-cap Value -3.53%

Leading Sectors

Airlines +2.21%

Steel +2.07%

Oil Service +1.64%

Alternative Energy +1.59%

Biotech +.35%

Lagging Sectors

Insurance -4.33%

Telecom -5.14%

Gaming -5.31%

Banks -5.86%

HMOs -11.24%

Stocks Finish Sharply Lower, Weighed Down by Airline, Gaming, Technology, Steel, Financial Shares

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play