Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – NAHB Housing Market Index

Tues. – Weekly retail sales reports, Producer Price Index, Housing Starts, Building Permits

Wed. – Weekly EIA energy inventory report, weekly MBA mortgage applications report

Thur. – Initial Jobless Claims, Philly Fed, Leading Indicators

Fri. – None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Lowe’s Cos(LOW)

Tues. – Myriad Genetics(MYGN), Medtronic Inc.(MDT), Analog Devices(ADI), Jack Henry(JKHY), Hewlett-Packard(HPQ), Home Depot(HD), Saks Inc.(SKS), Target Corp.(TGT)

Wed. – BJ’s Wholesale(BJ), Ross Stores(ROST), Eaton Vance(EV), JDS Uniphase(JDSU), Gymboree(GYMB), Salesforce.com(CRM), Synopsys Inc.(SNPS), Ltd Brands(LTD), Longs Drug Stores(LDG), Phillips-Van Heusen(PVHI)

Thur. – Burger King(BKC), Tech Data(TECD), Patterson Cos(PDCO), Dick’s Sporting Goods(DKS), Stage Stores(SII), Hormel Foods(HRL), Pacific Sunwear(PSUN), Gap Inc.(GPS), Intuit Inc.(INTU), Hibbett Sports(HIBB), Cost Plus(CPWM), Barnes & Noble(BKS), GameStop(GME), Children’s Place(PLCE), Bebe Stores(BEBE), Zumiez(ZUMZ)

Fri. – AnnTaylor Stores(ANN), HJ Heinz(HNZ), Foot Locker(FL), Perry Ellis(PERY), Aeropostale(ARO)

Other events that have market-moving potential this week include:

Mon. – (CSR) analyst meeting, (AER) investor meeting

Tue. – The Fed’s Fisher speaking, Intel Developers Forum

Wed. – None of note

Thur. – (VSEA) analyst meeting

Fri. – None of note

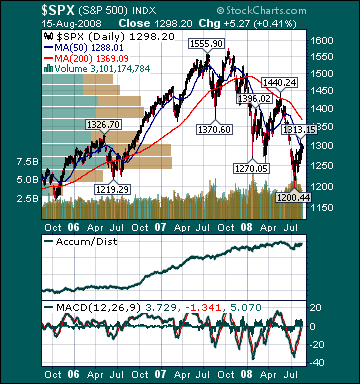

BOTTOM LINE: I expect US stocks to finish the week modestly higher on less inflation concern, diminishing financial sector pessimism, mostly positive earnings reports, lower commodity prices, a firmer US dollar and short-covering. My trading indicators are giving bullish signals and the Portfolio is 100% net long heading into the week.