Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 13, 2008

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, October 12, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- The cost of protecting Australian corporate bonds from default declined by the most ever after Prime Minister Kevin Rudd and European leaders pledged yesterday to guarantee bank borrowing. The Markit iTraxx Australia Index of credit-default swaps was quoted 65 basis points lower at 200 at 12:25 p.m. in

- The hedge-fund industry may lose as much as one-fifth of its $1.93 trillion in assets by the end of the year as markets decline and investors withdraw their money, according to Commerzbank AG. “The amount of firepower in the form of capital deployed will be a shadow of its former self,” Mehraj Mattoo, global head of alternative investments for Commerzbank, said.

- The record 39% decline in commodities since July 3 is nowhere near finished, if history is any guide. The Reuters/Jefferies CRB Index of 19 commodities from coffee to silver would have to drop another 37% to reach the trough of the 2001 recession and 35% for the 1998 slide, when crude bottomed at $10.35 a barrel. The measure is 28% above its lowest during the economic contraction that ended in November 1982. Copper, after its biggest weekly loss in two decades last week, is still triple 2001 levels. Investors say rising stockpiles of copper and slowing energy demand mean prices will continue to fall.

- Rio Tinto Group(RTP) and BHP Billiton Ltd.(BHP), the world’s second- and third-largest iron ore suppliers, may have to cut annual contract iron ore prices next year because oversupply may send spot prices lower, Macquarie Group Ltd. said. “Reports from

- Goldman Sachs Group Inc.(GS), the biggest independent Wall Street firm, lowered its price forecasts for crude oil after underestimating the depth of the global financial crisis. Goldman reduced its estimate for the US benchmark West Texas Intermediate crude for the fourth quarter to $75 a barrel from $110, and cut its year-end target to $70 a barrel from $115, Goldman’s research analysts led by Jeffrey Currie and Giovanni Serio said today. The analysts also lowered their price forecasts for 2009, with the average for the year reduced to $86 a barrel from $123, the analysts said.

Wall Street Journal:

NY Times:

- eBay(EBAY) Stumbles, Amazon(AMZN) Surges Amid Economic Storm.

IBD:

- Axsys Technologies(AXYS): Military Contractor Sets Sights On New Markets, New Products.

Reuters:

Financial Times:

Guardian:

International Herald Tribune:

Kronen Zeitung:

- European Central Bank council member Ewald Nowotny said the ECB opened an “unlimited window” of liquidity for the market this week. A common European solution of the problem is needed, Nowotny said.

Saudi Press Agency:

- The global oil markets are well balanced and there is no shortage of supplies, citing an interview with Finance Minister Ibrahim al-Assaf.

- The

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL), (EPB), (BWP), (OKE), (CS), (PFE), (RNWK), (MSFT) and (PCAR).

Citigroup:

- Reiterated Buy on GOOG, target $590. How much of a severe recession outlook is in GOOG’s stock price? On our severe recession eps of $20, GOOG currently trades at 16.7x p/e, the average S&P p/e of the last two decades. Given the secular growth outlook of internet advertising, GOOG’s strong competitive position within internet advertising, and its identifiable option value, we view this as creating a very attractive risk-reward for long-term investors.

- Reiterated Buy on (AMZN), target $93. How much of a severe recession outlook is in AMZN’s stock price? We go back to the 5-year trough in AMZN’s stock(August ’06), when the macro outlook was much brighter, but AMZN’s fundamental outlook was much poorer. And we conclude that on a price/sales, price/eps & p/fcf basis, AMZN may be within a single-digit % of its recession trough valuation.

- Reiterated Buy on (MRK), target $42.

Night Trading

Asian indices are -1.75% to +1.50% on avg.

S&P 500 futures +3.19%.

NASDAQ 100 futures +2.42%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (FAST)/.50

- (MHK)/1.12

- (SCHW)/.25

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- None of note

BOTTOM LINE: Asian indices are mostly higher, boosted by commodity and financial shares in the region. I expect US stocks to open higher and to maintain gains into the afternoon. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – IBD/TIPP Economic Optimism Index, weekly retail sales reports, Monthly Budget Statement

Wed. – Weekly MBA Mortgage Applications Report, weekly EIA energy inventory data, Producer Price Index, Advance Retail Sales, Empire Manufacturing, Business Inventories, Fed’s Beige Book

Thur. – Consumer Price Index, Initial Jobless Claims, Net Long-term TIC Flows, Industrial Production, Capacity Utilization, Philly Fed, NAHB Housing Market Index

Fri. – Housing Starts, Building Permits,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Fastenal(FAST), Mohawk Industries(MHK), Charles Schwab(SCHW)

Tues. – PepsiCo(PEP), Johnson & Johnson(JNJ), Altera Corp.(ALTR), CSX Corp.(CSX), Genentech(DNA), Domino’s Pizza(DPZ), Linear Tech(LLTC), Intel Corp.(INTC), Polaris Industries(PII), Adtran Inc.(ADTN)

Wed. – Coca-Cola(KO), Abbott Labs(ABT), JPMorgan Chase(JPM), Wells Fargo(WFC), AMR Corp.(AMR), JB Hunt(JBHT), Xilinx Inc.(XLNX), eBay Inc.(EBAY), Shaw Group(SGR), Piper Jaffray(PJC), Delta Air(DAL), Novellus Systems(NVLS)

Thur. – Merrill Lynch(MER), Harley Davidson(HDI), United Technologies(UTX), BB&T(BBT), Bank of NY(BK), Citigroup(C), Illinois Tools Works(ITW), Stryker Corp.(SYK), Capital One(COF), Gilead Sciences(GILD), IBM Inc.(IBM), Baxter Intl.(BAX), Google Inc.(GOOG), Southwest Air(LUV), Nucor Corp.(NUE), Hershey Co.(HSY), Intuitive Surgical(ISRG)

Fri. – Honeywell Intl.(HON), Comerica Inc.(CMA), Schlumberger Ltd.(SLB), BlackRock Inc.(BLK)

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. – (JCI) analyst presentation, Lazard Alternative Energy Conference, Wachovia Consumer Growth Conference

Wed. – (UGI) analyst meeting, (GPN) analyst day, (AUY) analyst day, (EW) analyst lunch, (KR) analyst day, (UMH) investor forum, (CHK) analyst meeting, Lazard Alternative Energy Conference, Wachovia Consumer Growth Conference

Thur. – (CHK) analyst meeting, (UMH) investor presentation

Fri. – None of note

Friday, October 10, 2008

Weekly Scoreboard*

Indices

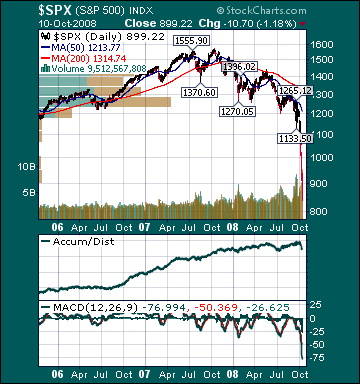

S&P 500 899.22 -18.20%

DJIA 8,451.19 -18.15%

NASDAQ 1,649.51 -15.30%

Russell 2000 522.48 -15.65%

Wilshire 5000 9,088.30 -18.02%

Russell 1000 Growth 374.77 -16.60%

Russell 1000 Value 479.23 -19.83%

Morgan Stanley Consumer 544.77 -14.50%

Morgan Stanley Cyclical 585.98 -15.43%

Morgan Stanley Technology 363.35 -15.93%

Transports 3,744.74 -9.43%

Utilities 324.57 -21.17%

MSCI Emerging Markets 24.66 -21.2%

Sentiment/Internals

NYSE Cumulative A/D Line 20,609 -34.11%

Bloomberg New Highs-Lows Index -6,667 -256.71%

Bloomberg Crude Oil % Bulls 30.0 -10.0%

CFTC Oil Large Speculative Longs 165,772 -14.0%

Total Put/Call 1.23 +10.81%

OEX Put/Call 1.18 +78.79%

ISE Sentiment 108.0 -9.24%

NYSE Arms .91 -24.2%

Volatility(VIX) 69.95 +54.96%

G7 Currency Volatility (VXY) 19.79 +35.73%

Smart Money Flow Index 5,795.85 -25.14%

AAII % Bulls 31.47 -5.58%

AAII % Bears 60.84 +10.62%

Futures Spot Prices

Crude Oil 77.70 -16.65%

Reformulated Gasoline 180.70 -18.44%

Natural Gas 6.54 -11.33%

Heating Oil 221.0 -16.27%

Gold 859.0 +2.11%

Base Metals 156.09 -12.67%

Copper 214.45 -17.96%

Agriculture 295.69 -10.21%

Economy

10-year US Treasury Yield 3.87% +26 basis points

10-year TIPS Spread .93% -54 basis points

TED Spread 4.64 +76 basis points

N. Amer. Investment Grade Credit Default Swap Index 207.13 +24.44%

Emerging Markets Credit Default Swap Index 629.49 +57.50%

Citi US Economic Surprise Index -6.90 -675%

Fed Fund Futures imply 72.0% chance of 25 basis point cut, 28.0% chance of 50 basis point cut on 10/29

Iraqi 2028 Govt Bonds 60.75 -7.60%

4-Wk MA of Jobless Claims 482,500 +1.7%

Average 30-year Mortgage Rate 5.94% -16 basis points

Weekly Mortgage Applications 465,500 +2.22%

Weekly Retail Sales +1.3%

Nationwide Gas $3.35/gallon -.25/gallon

US Cooling Demand Next 7 Days 19.0% above normal

ECRI Weekly Leading Economic Index 120.60 -1.31%

US Dollar Index 83.0 +3.34%

Baltic Dry Index 2,221 -16.29%

CRB Index 289.89 -11.22%

Best Performing Style

Small-cap Growth -15.58%

Worst Performing Style

Large-cap Value -19.83%

Leading Sectors

Road & Rail -6.55%

REITs -9.42%

Restaurants -12.46%

Semis -14.22%

Wireless -14.39%

Lagging Sectors

I-Banks -25.60%

Gaming -26.25%

Energy -26.40%

Insurance -26.96%

Oil Service -30.27%

Stocks Finished Mixed as Gains in Airline, REIT, Restaurant and Financial Stocks Offset Losses in Medical, Utility and Energy Stocks

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play