Style Outperformer:

Small-cap Value (+3.27%)

Sector Outperformers:

Oil Service (+5.02%), Homebuilders (+4.18%) and HMOs (+3.58%)

Stocks Rising on Unusual Volume:

LGCY, SM, ALJ, AXA, CS, HBC, DB, HES, AG, GSK, AZN, IAI, FUN, B, HMY, APA, FITBP, ANGO, IPSU, GMCR, DGIT, ATHN, NITE, JJSF, PAAS, ISRG, SHPGY, CYMI, AKAM, IDCC, NTCT, SBAC and ORLY

Stocks With Unusual Call Option Activity:

1) BCS 2) STLD 3) CCI 4) WYE 5) VMW

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, January 26, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, January 25, 2009

Monday Watch

Weekend Headlines

Bloomberg:

Wall Street Journal:

Barron’s:

- Billionaire investor Warren Buffett’s equity portfolio may have declined 14% this year through Jan. 22 as the share price of three banks he owns slipped, citing an estimate. Buffett, who is chairman and CEO of insurer Berkshire Hathaway(BRK/A), holds stakes in American Express(AXP), Wells Fargo(WFC) and US Bancorp(USB). The estimate was based on the change in the value of the 16 largest equity stakes in his portfolio, which account for more than 85% of the total.

MarketWatch.com:

NY Times:

- Wal-Mart(WMT) Goes Green to Improve Its Bottom Line.

Business Week:

- A Guide to Self-Employment. Advice for recently laid-off workers considering going into business for themselves.

NY Post:

Institutional Investor:

Forbes.com:

The

CNNMoney.com:

AP:

-

Reuters:

Financial Times:

Guardian:

- Twenty-five people at the heart of the meltdown…

Spiegel:

- The IMF will revise down its 2009 forecast for global growth to between 1% and 1.5% from 2.2%, citing IMF Deputy Director Axel Bertuch-Samuels.

O Estado de S. Paulo:

- Exxon Mobil Corp.(XOM), Hess Corp.(HES) and Petroleo Brasileiro SA’s(PBR) BM-S-22 offshore block in Brazil’s so-called pre-salt area may hold as much as 10 billion barrels of oil. The block operated by Exxon Mobil in

livemint.com:

Daijiworld.com:

Gulf News:

- Petrochemical prices in

Weekend Recommendations

Barron's:

- Made positive comments on (BHP), (TDS), (GASS), (BP), (XOM), (PBR), (BRK/A), (ORLY) and (HNZ).

Citigroup:

- Upgraded (LEN) to Buy, target $11.

Night Trading

Asian indices are +.25 to +.50% on avg.

S&P 500 futures -.62%.

NASDAQ 100 futures -.56%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (FCX)/-1.01

- (COV)/.70

- (DGX)/.80

- (MCD)/.83

- (ETN)/1.04

- (CAT)/1.30

- (TSN)/-.23

- (MCK)/.86

- (NFLX)/.34

- (TXN)/.11

- (AMGN)/1.06

- (VMW)/.25

- (STLD)/-.30

- (AXP)/.22

- (QLGC)/.29

- (SEE)/.33

- (SLG)/1.31

- (KMB)/1.03

- (HAL)/.73

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Leading Indicators for December are estimated to fall .2% versus a .4% decline in November.

- Existing Home Sales for December are estimated to fall to 4.4M versus 4.49M in November.

Other Potential Market Movers

- The Dallas Fed Manufacturing Activity report, (CBSH) analyst presentation, (STD) shareholders’ meeting, (ALOG) stockholders meeting, (ENR) shareholders meeting could also impact trading today.

BOTTOM LINE: Asian indices are slightly higher, boosted by financial and technology shares in the region. I expect US stocks to open modestly lower and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Leading Indicators, Existing Home Sales,

Tues. – S&P/CS Home Price Index, Consumer Confidence, Richmond Fed Manufacturing Index, weekly retail sales reports

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory data report, FOMC Rate Decision

Thur. – Durable Goods Orders, Initial Jobless Claims, New Home Sales

Fri. – Advance 4Q GDP, Advance 4Q Personal Consumption, Advance GDP Price Index, Advance Core PCE, Advance 4Q Employment Cost Index, Chicago Purchasing Manager, Univ. of Mich. Consumer Confidence, NAPM-Milwaukee

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Eaton Corp.(ETN), Covidien(COV), Freeport-McMoRan(FCX), McDonald’s(MCD), Quest Diagnostics(DGX), Caterpillar(CAT), Tyson Foods(TSN), McKesson(MCK), NetFlix(NFLX), Texas Instruments(TXN), Amgen(AMGN), VMware(VMW), QLogic(QLGC), American Express(AXP), Steel Dynamics(STLD), Kimberly-Clark(KMB), Halliburton(HAL)

Tues. –

Wed. – Tidewater(TDW), Baker Hughes(BHI), WellPoint(WLP), Boeing(BA), Wells Fargo(WFC), AT&T(T), ConocoPhillips(COP), Robert Half(RHI), Qualcomm Inc.(QCOM), Allstate(ALL), Symantec(SYMC), Ryland Group(RYL), Western Digital(WDC), Starbucks(SBUX), Boston Scientific(BSX), Owens-Illinois(OI), Becton Dickinson(BDX), General Dynamics(GD), Pfizer(PFE), Hess Corp.(HES), Southern Copper(PCU), JB Hunt(JBHT), Lam Research(LRCX), Franklin Resources(BEN), Stanley Works(SWK)

Thur. – Starwood Hotels(HOT), Alliant Techsystems(ATK), L-3 Communications(LLL), 3M(MMM), Eli Lilly(LLY), International Paper(IP), Smith Intl.(SII), Under Armour(UA), Altria Group(MO), Ford Motor(F), Zimmer Holdings(ZMH), Eastman Kodak(EK), Illinois Tool Worls(ITW), Raytheon(RTN), Continental Air(CAL), Maxim Integrated(MXIM), CA Inc.(CA), Broadcom(BRCM), Microchip Tech(MCHP), Juniper Networks(JNPR), YRC Worldwide(YRCW), Celgene(CELG), Autonation(AN), Royal Caribbean(RCL), Fortune Brands(FO), Kla-Tencor(KLAC), Wyeth(WYE), Amazon(AMZN), Black & Decker(BDK), Colgate-Palmolive(CL)

Fri. – Honeywell(HON), Chevron(CVX), Procter & Gamble(PG), Exxon Mobil(XOM)

Other events that have market-moving potential this week include:

Mon. – (CBSH) analyst presentation, (STD) shareholders’ meeting, (ALOG) stockholders meeting, (ENR) shareholders meeting

Tue. – Citi Financial Services Conference, (SNX) analyst meeting, (DMND) analyst meeting, (GMR) analyst meeting, (GNK) analyst meeting, (ANW) analyst meeting, (PBR) analyst meeting

Wed. – Citi Financial Services Conference, World Economic Forum, (SQNM) analyst day

Thur. – World Economic Forum, (DFS) financial briefing, (KMP) analyst meeting, (ASH) shareholders meeting, (SCHW) business update

Fri. – World Economic Forum

BOTTOM LINE: I expect US stocks to finish the week higher on bargain-hunting, short-covering, technical buying, diminishing financial sector pessimism, less extreme economic fear and declining credit market angst. My trading indicators are giving neutral signals and the Portfolio is 100% net long heading into the week.

Friday, January 23, 2009

Weekly Scoreboard*

Indices

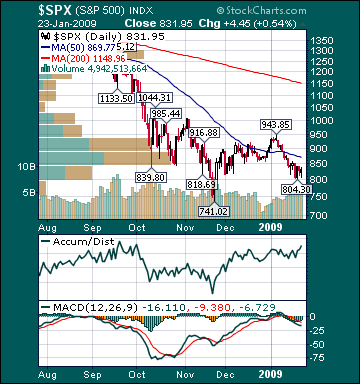

S&P 500 831.95 -1.40%

DJIA 8,077.56 -1.64%

NASDAQ 1,477.29 -2.29%

Russell 2000 444.36 -3.95%

Wilshire 5000 8,356.78 -1.68%

Russell 1000 Growth 354.98 -.60%

Russell 1000 Value 434.27 -2.38%

Morgan Stanley Consumer 521.30 -.92%

Morgan Stanley Cyclical 425.54 -5.13%

Morgan Stanley Technology 336.31 -.32%

Transports 2,965.89 -6.43%

Utilities 366.19 +1.18%

MSCI Emerging Markets 22.05 -4.0%

Sentiment/Internals

NYSE Cumulative A/D Line 18,791 -5.87%

Bloomberg New Highs-Lows Index -381 -26.16%

Bloomberg Crude Oil % Bulls 43.0 +26.47%

CFTC Oil Large Speculative Longs 225,424 -1.52%

Total Put/Call .76 -34.48%

OEX Put/Call 1.04 +8.33%

ISE Sentiment 172.0 +59.26%

NYSE Arms .61 -37.11%

Volatility(VIX) 47.27 -7.31%

G7 Currency Volatility (VXY) 20.41 +6.25%

Smart Money Flow Index 7,402.65 +1.46%

AAII % Bulls 27.21 -1.52%

AAII % Bears 46.32 -2.22%

Futures Spot Prices

Crude Oil 45.82 +5.67%

Reformulated Gasoline 114.50 -.56%

Natural Gas 4.51 -7.84%

Heating Oil 143.50 -3.09%

Gold 901.30 +10.41%

Base Metals 103.23 -7.95%

Copper 147.25 -1.17%

Agriculture 305.70 +4.24%

Economy

10-year US Treasury Yield 2.62% +30 basis points

10-year TIPS Spread .72% +19 basis points

TED Spread 1.07 +4 basis points

N. Amer. Investment Grade Credit Default Swap Index 213.20 +1.08%

Emerging Markets Credit Default Swap Index 753.99 +1.66%

Citi US Economic Surprise Index -76.30 -9.0%

Fed Fund Futures imply 90.0% chance of no change, 10.0% chance of 25 basis point cut on 1/28

Iraqi 2028 Govt Bonds 40.28 -2.10%

4-Wk MA of Jobless Claims 519,300 unch.

Average 30-year Mortgage Rate 5.12% +16 basis points

Weekly Mortgage Applications 1,195,300 -9.78%

Weekly Retail Sales -2.10%

Nationwide Gas $1.85/gallon +.03/gallon

US Heating Demand Next 7 Days 1.0% below normal

ECRI Weekly Leading Economic Index 107.45 -1.17%

US Dollar Index 85.61 +1.38%

Baltic Dry Index 945.0 +4.07%

CRB Index 225.79 +3.14%

Best Performing Style

Large-cap Growth -.60%

Worst Performing Style

Small-cap Value -4.83%

Leading Sectors

HMOs +6.57%

Oil Service +4.34%

Education +3.65%

Telecom +3.44%

Computer Services +3.12%

Lagging Sectors

Airlines -5.66%

Alternative Energy -6.67%

Oil Tankers -6.72%

Insurance -7.86%

Banks -13.61%