Style Underperformer:

Small-cap Growth (-2.88%)

Sector Underperformers:

Medical Equipment (-.34%), Education (-.50%) and Retail (-1.41%)

Stocks Falling on Unusual Volume:

SA, BVN, WMT, DLTR, FOSL, THO, IWA, DCM, OSIS, CVLT, TEVA, AFAM, LPHI, GOLD, LIHR, STRA, CHE, RNT and FTI

Stocks With Unusual Put Option Activity:

1) PCLN 2) TEVA 3) CX 4) EGO 5) XCO

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Tuesday, February 17, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Monday, February 16, 2009

Tuesday Watch

Weekend Headlines

Bloomberg:

- The euro probably won’t rise from its current price over concern some European governments may miss out on a recovery, according to UBS AG.

- The rising cost of insuring against default by a “peripheral” European government is likely to weigh on the euro, according to Merrill Lynch. “This remains an important background negative for the euro,” Steven Pearson, a strategist in

-

- ASM International NV, Europe’s second-largest maker of semiconductor equipment, rose the most in more than a week in

- Oil prices won’t rise above current levels of $40 a barrel even if OPEC decides to cut output by more than 2 million barrels a day at its next meeting in March, Annahar said, citing a Kuwati oil official. Prices are affected by a huge surplus because of non-compliance to quotas by many members of OPEC, citing Mussa Maarafi, a member of

Wall Street Journal:

- Vodafone, HTC Close to Pact on Use of Google(GOOG) Software.

NY Times:

- US Survey Shows 90% Don’t Like New Economic Policy.

- US Coal Industry Faces Increased Oppostion.

- What Convergence? TV’s Hesitant March to the Net.

- Zagat Guide to Review Doctors for Wellpoint(WLP) Customers.

NY Post:

- Dow Chemical Co.(DOW) says it aims to start selling power-generating roof shingles by 2011.

G2Weather Intelligence:

Reuters:

Financial Times:

- ARM Holdings(ARMH) believes its strength lies in sharing.

- Ireland ‘could default on debt’

Die Welt:

- Deutsche Telekom AG’s T-Mobile division is doing “solid” business in the

WirtschaftsBlatt:

- European Central Bank Executive Board member Gertrude Tumpel-Gugerell said speculation about a breakup of the euro area is “nonsense” as countries have benefited from monetary union especially in times of crisis.

Haaretz.com:

Weekend Recommendations

Barron's:

- Made positive comments on (VFC), (MRK), (GOOG), (JNJ), (WMT), (ABT), (IACI) and (RAI).

- Made negative comments on (MON), (CVS) and (EBAY).

Citigroup:

- Reiterated Buy on (CELG), target $73.

Night Trading

Asian indices are -2.25% to -.75% on avg.

S&P 500 futures -1.54%.

NASDAQ 100 futures -1.85%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (FOSL)/.68

- (RIG)/3.68

- (LPX)/-.46

- (UTHR)/.53

- (WMT)/.99

- (GGC)/-.95

- (MDT)/.70

- (A)/.31

- (JACK)/.52

- (CGNX)/.05

- (CHK)/.75

- (GPC)/.56

- (FTI)/.68

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- Empire Manufacturing for February is estimated to fall to -23.75 versus -22.20 in January.

9:00 am EST

- Net Long-term TIC Flows for December are estimated to rise to $20.0B versus -$21.7B in November.

1:00 pm EST

- The NAHB Housing Market Index for February is estimated at 8.0 versus 8.0 iun January.

Other Potential Market Movers

- The Fed’s Bullard speaking, (OMTR) analyst meeting, Morgan Stanley Basic Materials Conference and Roth Growth Stock Conference could also impact trading today.

BOTTOM LINE: Asian indices are lower, weighed down by financial and automaker shares in the region. I expect

Sunday, February 15, 2009

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Tuesday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. –

Tues. – Empire Manufacturing, Total Net TIC Flows, NAHB Housing Market Index

Wed. – Weekly retail sales reports, weekly MBA mortgage applications report, Import Price Index, Housing Starts, Building Permits, Industrial Production, Capacity Utilization, Minutes of Jan 28th FOMC Meeting

Thur. – Producer Price Index, Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. – Consumer Price Index

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. –

Tues. – Louisiana-Pacific(LPX), Transocean (RIG), Wal-Mart(WMT), Medtronic(MDT), Agilent Technologies(A), Jack in the Box(JACK),

Wed. – Owens

Thur. – Williams Cos(WMB), Expedia(EXPE), Barnes Group(B), Sprint Nextel(S), CVS Caremark(CVS), Apache Corp.(APA), Career Education(CECO), Intuit(INTU), Newmont(NEM), Wynn Resorts(WYNN), XTO Energy(XTO)

Fri. – JC Penney(JCP), Campbell Soup(CPB), Blackstone(BX), MGM Mirage(MGM), Lowe’s(LOW), Zale Corp.(ZLC)

Other events that have market-moving potential this week include:

Mon. –

Tue. – The Fed’s Bullard speaking, (OMTR) analyst meeting, Morgan Stanley Basic Materials Conference, Roth Growth Stock Conference

Wed. – The Fed’s Pianalto speaking, Fed’s Bernanke speaking, Fed’s Evans speaking, Kaufman Bros. Green Tech Conference, Morgan Stanley Basic Materials Conference, Roth Growth Stock Conference

Thur. – The Fed’s Lockhart speaking, (PVTB) Investor Day, (AIPC) shareholders meeting, (SAFM) annual meeting(CBE$) annual outlook, Oppenheimer REITs/Real Estate Forum, CSFB Paper Conference, Piper Clean Tech Conference, (CR) analyst conference, Oppenheimer Semi Summit, CIBC Institutional Investor Conference

Fri. – (BEAV) Investor Meeting

Friday, February 13, 2009

Weekly Scoreboard*

Indices

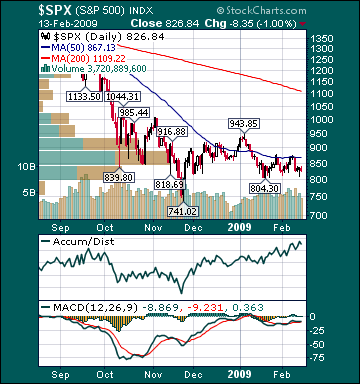

S&P 500 826.84 -4.81%

DJIA 7,850.41 -5.20%

NASDAQ 1,534.36 -3.60%

Russell 2000 448.36 -4.75%

Wilshire 5000 8,341.67 -4.62%

Russell 1000 Growth 362.13 -3.84%

Russell 1000 Value 421.70 -5.66%

Morgan Stanley Consumer 507.01 -4.66%

Morgan Stanley Cyclical 399.93 -7.24%

Morgan Stanley Technology 351.71 -4.99%

Transports 2,957.28 -7.69%

Utilities 365.37 -5.05%

MSCI Emerging Markets 23.95 -2.43%

Sentiment/Internals

NYSE Cumulative A/D Line 20,920 +1.41%

Bloomberg New Highs-Lows Index -429 -12.89%

Bloomberg Crude Oil % Bulls 30.0 +3.45%

CFTC Oil Large Speculative Longs 239,563 +2.06%

Total Put/Call .89 +23.61%

OEX Put/Call .85 +70.0%

ISE Sentiment 150.0 +13.64%

NYSE Arms 1.51 +287.18%

Volatility(VIX) 42.93 -1.01%

G7 Currency Volatility (VXY) 18.19 +.44%

Smart Money Flow Index 7,587.61 -.88%

AAII % Bulls 32.91 +33.62%

AAII % Bears 39.24 -10.88%

Futures Spot Prices

Crude Oil 37.51 -5.24%

Reformulated Gasoline 120.63 -1.93%

Natural Gas 4.45 -7.89%

Heating Oil 130.0 -3.64%

Gold 942.20 +3.42%

Base Metals 109.44 -2.95%

Copper 155.45 -5.79%

Agriculture 293.49 -2.39%

Economy

10-year US Treasury Yield 2.89% -10 basis points

10-year TIPS Spread 1.25% +4 basis points

TED Spread .95 -2 basis points

N. Amer. Investment Grade Credit Default Swap Index 199.84 +3.28%

Emerging Markets Credit Default Swap Index 788.44 +5.86%

Citi US Economic Surprise Index -26.0 +35.0%

Fed Fund Futures imply 94.0% chance of no change, 6.0% chance of 25 basis point hike on 3/17

Iraqi 2028 Govt Bonds 44.0 -4.97%

4-Wk MA of Jobless Claims 607,500 +4.1%

Average 30-year Mortgage Rate 5.16% -9 basis points

Weekly Mortgage Applications 600,600 -24.49%

Weekly Retail Sales -1.70%

Nationwide Gas $1.96/gallon +.05/gallon

US Heating Demand Next 7 Days 2.0% below normal

ECRI Weekly Leading Economic Index 106.10 -.47%

US Dollar Index 86.04 +.81%

Baltic Dry Index 1,989 +21.13%

CRB Index 213.14 -5.0%

Best Performing Style

Small-cap Growth -3.07%

Worst Performing Style

Small-cap Value -6.38%

Leading Sectors

HMOs -.96%

Biotech -1.75%

Medical Equipment -1.82%

Construction -1.94%

Computer Services -2.07%

Lagging Sectors

Gaming -7.95%

Homebuilders -8.87%

Road & Rail -10.18%

REITs -13.03%

Banks -14.03%