Style Outperformer:

Small-cap Value (+4.52%)

Sector Outperformers:

Banks (+10.29%), Oil Service (+7.61%) and Homebuilders (+7.54%)

Stocks Rising on Unusual Volume:

PCZ, RTP, HBC, JPM, CHK, CLF, PTR, TLK, CGX, ANDE, WAG, APA, GXDX, CNQR, CETV, SSRI, SOHU, ASIA, TNDM, CME, CHSI, IBKC, STBA, JNPR, CHCO, WIRE, MBFI, NEOG, PCLN, VSEA, TIF, IYZ, GNI, GLW, ALV, KIE and PHI

Stocks With Unusual Call Option Activity:

1) NVLS 2) GCI 3) AGN 4) ERIC 5) CCL

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, March 23, 2009

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, March 22, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- Hedge-Fund Investors Hire Private Eyes to Avoid New Madoffs.

Wall Street Journal:

Barron’s:

MarketWatch.com:

NY Times:

Time:

Politico:

Forbes.com:

American Research Group:

AP:

Reuters:

Financial Times:

Guardian:

Interfax:

- Deputy Prime Minister Igor Sechin said oil’s contribution to the

Focus:

- Deutsche Bahn AG, the German state-owned railway, anticipates a 30% drop in cargo revenue in the first quarter, a trend that may carry on the entire year, citing company sources.

-

- Dollar-denominated assets remain a “relatively safe” choice for

Nikkei:

- Toshiba Corp. will begin mass-producing fuel cells for recharging mobile phones, laptops and other devices as early as next month.

Haaretz.com:

Weekend Recommendations

Barron's:

- Made positive comments on (WLP), (NWS/A), (KEY), (STI), (LO) and (HPQ).

- Made negative comments on (INTC) and (AMAT).

Citigroup:

- Reiterated Buy on (GOOG), target $450.

Night Trading

Asian indices are +.75% to +2.50% on avg.

S&P 500 futures +1.57%.

NASDAQ 100 futures +1.37%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (TIF)/.79

- (WAG)/.66

- (SONC)/.09

- (PVH)/.28

- (BPT)/2.93

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Existing Home Sales for February are estimated to fall to 4.45M versus 4.49M in January.

Other Potential Market Movers

- Geithner Addressing Future of Finance Initiative Conference, (CRM) analyst day, (GLW) investors meeting and the Howard Weil Energy Conference could also impact trading today.

BOTTOM LINE: Asian indices are higher, boosted by financial and technology shares in the region. I expect US stocks to open higher and to maintain gains into the afternoon. The Portfolio is 75% net long heading into the week.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Existing Home Sales

Tues. – House Price Index, Richmond Fed Manufacturing Index, weekly retail sales reports

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory report, Durable Goods Orders, New Home Sales

Thur. – Final 4Q GDP, Final 4Q Personal Consumption, Final 4Q GDP Price Index, Final 4Q Core PCE, Initial Jobless Claims

Fri. – Personal Income, Personal Spending, PCE Core,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Tiffany & Co.(TIF), Walgreen

Tues. – Williams-Sonoma(WSM), Jabil Circuit(JBL), Carnival Corp.(CCL)

Wed. – Paychex(PAYX), Red Hat(RHT)

Thur. – Dr. Pepper Snapple(DPS), ConAgra Foods(CAG), Best Buy(BBY), GameStop(GME), Lennar Corp.(LEN)

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – Geithner Addressing Future of Finance Initiative Conference, (CRM) analyst day, (GLW) investors meeting, Howard Weil Energy Conference

Tue. – The Fed’s Evans speaking, Fed’s Bullard speaking, Geithner/Bernanke Testifying on Rescue of AIG, Howard Weil Energy Conference, (SNX) shareholders meeting, (SIGI) investor day

Wed. – The Fed’s Pianalto speaking, Fed’s Yellen speaking, (ADP) analyst meeting, Howard Weil Energy Conference, (MKC) shareholders meeting, (GLW) investor luncheon, Think Equity ThinkGreen Conference, Lazard Medical Device Tech Conference, (BIIB) R&D Day, (CIEN) shareholders meeting

Thur. – The Fed’s Lockhart speaking, Fed’s Lacker speaking, Geithner Testifying on Financial Market Regulation, Fed’s Fisher speaking, Fed’s Lacker speaking, Fed’s Stern speaking, Needham Healthcare Conference, (LXK) analyst meeting, (SRE) analyst meeting, Lazard Medical Device Tech Conference, (HIG) special meeting of shareholders, Think Equity ThinkGreen Conference

Fri. – (POM) analyst meeting

BOTTOM LINE: I expect US stocks to finish the week mixed as less credit market angst, declining economic fear, lower energy prices and diminishing financial sector pessimism offset more shorting and profit-taking. My trading indicators are giving mostly bullish signals and the Portfolio is 75% net long heading into the week.

Friday, March 20, 2009

Weekly Scoreboard*

Indices

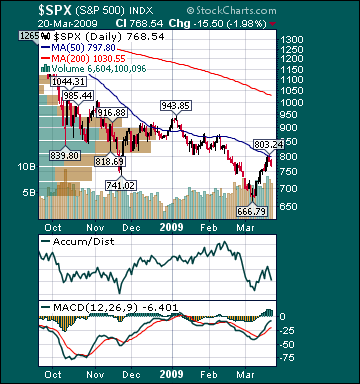

S&P 500 768.54 +1.59%

DJIA 7,278.38 +.75%

NASDAQ 1,457.27 +1.80%

Russell 2000 400.11 +1.79%

Wilshire 5000 7,739.20 +1.61%

Russell 1000 Growth 341.66 +1.68%

Russell 1000 Value 385.69 +1.44%

Morgan Stanley Consumer 482.42 +2.96%

Morgan Stanley Cyclical 355.14 +6.73%

Morgan Stanley Technology 355.15 +3.78%

Transports 2,516.96 +4.01%

Utilities 327.37 +7.72%

MSCI Emerging Markets 23.93 +3.23%

Sentiment/Internals

NYSE Cumulative A/D Line 13,224 +23.69%

Bloomberg New Highs-Lows Index -187 +29.17%

Bloomberg Crude Oil % Bulls 36.0 -16.28%

CFTC Oil Large Speculative Longs 195,950 -.56%

Total Put/Call .88 +22.22%

OEX Put/Call 1.16 +30.34%

ISE Sentiment 120.0 -28.57%

NYSE Arms 1.25 +16.82%

Volatility(VIX) 45.89 +8.33%

G7 Currency Volatility (VXY) 17.59 +3.23%

Smart Money Flow Index 7,244.81 +3.57%

AAII % Bulls 45.06 +63.02%

AAII % Bears 38.27 -29.74%

Futures Spot Prices

Crude Oil 52.07 +11.47%

Reformulated Gasoline 145.70 +8.33%

Natural Gas 4.23 +8.25%

Heating Oil 138.34 +15.44%

Gold 954.20 +3.30%

Base Metals 118.77 +5.33%

Copper 179.90 +3.66%

Agriculture 298.09 +5.16%

Economy

10-year US Treasury Yield 2.63% -26 basis points

10-year TIPS Spread 1.24% +19 basis points

TED Spread 1.02 -11 basis points

N. Amer. Investment Grade Credit Default Swap Index 198.50 -18.19%

Emerging Markets Credit Default Swap Index 751.78 -4.11%

Citi US Economic Surprise Index -23.20 -12.56%

Fed Fund Futures imply 90.0% chance of no change, 10.0% chance of 25 basis point cut on 4/29

Iraqi 2028 Govt Bonds 49.63 -1.62%

4-Wk MA of Jobless Claims 654,800 +.6%

Average 30-year Mortgage Rate 4.98% -5 basis points

Weekly Mortgage Applications 876.90 +21.22%

Weekly Retail Sales -1.20%

Nationwide Gas $1.94/gallon +.02/gallon

US Heating Demand Next 7 Days 17.0% below normal

ECRI Weekly Leading Economic Index 105.80 +.57%

US Dollar Index 83.84 -4.10%

Baltic Dry Index 1,782 -16.02%

CRB Index 226.08 +7.11%

Best Performing Style

Small-cap Value +2.43%

Worst Performing Style

Small-cap Growth +1.15%

Leading Sectors

Utilities +7.72%

Computer Hardware +7.17%

Oil Service +7.14%

Insurance +6.63%

Papers +6.61%

Lagging Sectors

Biotech -1.66%

Medical Equipment -1.91%

Construction -3.64%

Airlines -7.22%

REITs -10.51%