Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 15, 2009

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, June 14, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- The Markit iTraxx

Wall Street Journal:

MarketWatch.com:

NY Times:

Forbes.com:

CNNMoney.com:

Business Week:

- From bank bailouts to auto bailouts to executive pay, business is increasingly nervous about the heavy hand of the Obama Administration.

NY Post:

Politico:

LA Times:

Rasmussen Reports:

Treasury & Risk:

TradingMarkets.com:

TheStreet.com:

Reuters:

- U.S. defense companies, some rocked harder than others by Defense Secretary Robert Gates' sweeping program cuts, are looking to international sales and acquisitions to fill the void.

- The rapid rise in bond yields will force the Federal Reserve to "engage again" in the purchases of U.S. Treasuries and mortgage-backed securities, Mohamed El-Erian, the chief executive of bond giant Pacific Investment Management Co., said Friday. The surge in Treasury yields is lifting mortgage rates, threatening to dampen home demand and kill off the refinancing boom that is bolstering the health of some households.

Financial Times:

Telegraph:

The Independent:

Gulf News:

-

Emirates Business 24/7:

- Cement prices in the UAE have declined as much as 40% since April, citing an industry official. The price per ton was around $74.87 as cement makers slashed prices because of low global demand, an official from a Ras Al Khaima cement maker said.

Weekend Recommendations

Barron's:

- Made positive comments on (AUY), (NG), (BAC), (CSC), (NEW), (TM), (THG), (RRC) and (MSFT).

Citigroup:

- Upgraded (YHOO) to Buy, target $21.

Night Trading

Asian indices are -1.50% to +.25% on avg.

S&P 500 futures -.52%.

NASDAQ 100 futures -.52%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (CASY)/.36

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- Empire Manufacturing for June is estimated to fall to -4.60 versus -4.55 in May.

9:00 am EST

- Net Long-term TIC Flows for April are estimated to rise to $57.5B versus $55.8B in March.

1:00 pm EST

- The NAHB Housing Market Index for June is estimated to rise to 17 versus 16 in May.

Other Potential Market Movers

- The Fed’s Duke speaking, Fed’s Evans speaking, Fed’s Tarullo speaking, (IACI) shareholders meeting and the (HLIT) analyst call could also impact trading today.

BOTTOM LINE: Asian indices are mostly lower, weighed down by shipping and commodity stocks in the region. I expect

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are some economic reports of note and just a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Empire Manufacturing, Net Long-term TIC Flows, NAHB Housing Market Index

Tues. – Producer Price Index, Housing Starts, Industrial Production, Capacity Utilization, weekly retail sales report

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory report, Consumer Price Index, Current Account Balance

Thur. – Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. – None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. –

Wed. – FedEx Corp.(FDX)

Thur. – John Wiley(JW/A), JM Smucker(SJM), Discover Financial(DFS), Carnival Corp.(CCL)

Fri. – Carmax(KMX)

Other events that have market-moving potential this week include:

Mon. – The Fed’s Duke speaking, Fed’s Evans speaking, Fed’s Tarullo speaking, (IACI) shareholders meeting, (HLIT) analyst call

Tue. – The Fed’s Warsh speaking, (NVDA) analyst day

Wed. – The Fed’s Bernanke speaking, Fox-Pitt Kelton Small/Mid-cap Bank Conference, Jeffries Healthcare Conference, (MAT) analyst conference

Thur. – The Treasury’s Geithner testifying before the House, Jeffries Healthcare Conference, Fox-Pitt Kelton Small/Mid-cap Bank Conference, (AAP) investor day

Fri. – None of note

Saturday, June 13, 2009

Friday, June 12, 2009

Weekly Scoreboard*

Indices

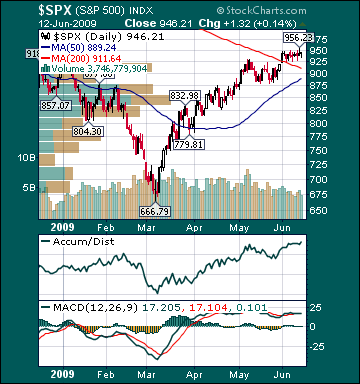

S&P 500 946.21 +.65%

DJIA 8,799.26 +.41%

NASDAQ 1,858.80 +.51%

Russell 2000 526.83 -.67%

Wilshire 5000 9,615.05 +.56%

Russell 1000 Growth 420.01 +.31%

Russell 1000 Value 481.44 +.97%

Morgan Stanley Consumer 567.01 -.96%

Morgan Stanley Cyclical 589.73 +.45%

Morgan Stanley Technology 462.04 +2.08%

Transports 3,361.42 +.34%

Utilities 358.31 +3.98%

MSCI Emerging Markets 33.85 +.75%

Sentiment/Internals

NYSE Cumulative A/D Line 35,944 -.91%

Bloomberg New Highs-Lows Index -13 -148.15%

Bloomberg Crude Oil % Bulls 49.0 +133.3%

CFTC Oil Large Speculative Longs 204,490 +2.50%

Total Put/Call .87 +10.13%

OEX Put/Call 1.22 -94.69%

ISE Sentiment 159.0 +26.19%

NYSE Arms .98 -37.97%

Volatility(VIX) 28.15 -4.96%

G7 Currency Volatility (VXY) 14.52 -6.26%

Smart Money Flow Index 8,342.52 -.79%

AAII % Bulls 39.25 -17.47%

AAII % Bears 39.25 +7.27%

Futures Spot Prices

Crude Oil 72.04 +5.35%

Reformulated Gasoline 204.31 +4.59%

Natural Gas 3.86 -.75%

Heating Oil 183.75 +3.29%

Gold 940.70 -1.76%

Base Metals 156.36 +5.23%

Copper 238.30 +4.52%

Agriculture 338.37 -2.45%

Economy

10-year US Treasury Yield 3.79% -4 basis points

U.S. Sovereign Debt Credit Default Swap 43.0 unch.

10-year TIPS Spread 1.93% -7 basis points

TED Spread 46.0 +1 basis point

N. Amer. Investment Grade Credit Default Swap Index 124.49 +6.09%

Emerging Markets Credit Default Swap Index 376.89 +.27%

Citi US Economic Surprise Index +61.90 -4.48%

Fed Fund Futures imply 82.0% chance of no change, 18.0% chance of 25 basis point cut on 6/24

Iraqi 2028 Govt Bonds 67.37 +1.74%

4-Wk MA of Jobless Claims 621,800 -1.7%

Average 30-year Mortgage Rate 5.59% +30 basis points

Weekly Mortgage Applications 611,000 -7.24%

Weekly Retail Sales -4.40%

Nationwide Gas $2.64/gallon +.05/gallon

US Cooling Demand Next 7 Days 5.0% below normal

ECRI Weekly Leading Economic Index 115.40 +1.67%

US Dollar Index 80.14 -.66%

Baltic Dry Index 3,583 -5.93%

CRB Index 262.25 +1.68%

Best Performing Style

Large-cap Value +.97%

Worst Performing Style

Small-cap Value -1.50%

Leading Sectors

Banks +4.18%

Utilities +3.97%

Oil Service +3.77%

Computer Hardware +3.25%

Software +3.06%

Lagging Sectors

Restaurants -3.16%

Airlines -3.29%

Gold -3.82%

Hospitals -5.46%

HMOs -7.04%