Click here for Wall St. Week Ahead by Reuters.

Click here for US Equity Preview for Monday by Bloomberg.

There are a number of economic reports of note and just a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. –

Tues. – Weekly Retail Sales reports, S&P/CaseShiller Home Price Index, Chicago Purchasing Manager, Consumer Confidence, NAPM-Milwaukee

Wed. – Weekly EIA energy inventory report, weekly MBA mortgage applications report, Challenger Job Cuts, ADP Employment Change, ISM Manufacturing, ISM Prices, Paid, Construction Spending, Pending Home Sales, Total Vehicle Sales

Thur. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Initial Jobless Claims, Factory Orders

Fri. – US Markets Closed

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Apollo Group(APOL), H&R Block(HRB)

Tues. – Schnitzer Steel(SCHN)

Wed. – Constellation Brands(STZ), General Mills(GIS)

Thur. – Acuity Brands(AYI)

Fri. – US Markets Closed

Other events that have market-moving potential this week include:

Mon. – The Fed’s Rosengren speaking

Tue. – The Fed’s Bullard speaking, Fed’s Hoenig speaking, Fed’s Yellen speaking, Goldman Sachs Data Center Conference, (TDG) analyst meeting, (BBBY) shareholders meeting, (PBH) shareholders meeting

Wed. – The Fed’s Evans speaking

Thur. – (DDUP) shareholders meeting

Fri. – US Markets Closed

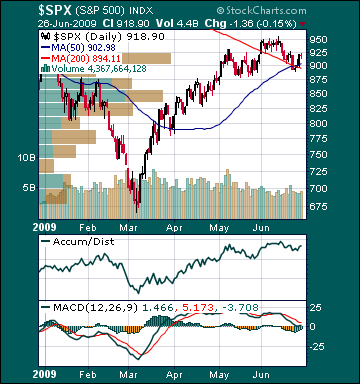

BOTTOM LINE: I expect US stocks to finish the week modestly higher on diminishing financial sector pessimism, short-covering, diminishing credit market angst, quarter-end window dressing, investment manager performance anxiety, lower long-term rates and declining energy prices. My trading indicators are giving mixed signals and the Portfolio is 100% net long heading into the week.