Weekend Headlines

Bloomberg:

Wall Street Journal:

- The Jobless Stimulus. It’s still not too late to redirect $400 billion to business tax cuts.

NY Times:

- Movie Studios See a Threat in Growth of Redbox.

LA Times:

Business Week:

- Housing’s Hidden Strength. Industry lobbyists are urging more tax credits, but home sales seem to have momentum of their own.

- Why China’s Chip Industry Won’t Catch America’s.

Politico:

Rasmussen Reports:

Forbes:

Foreign Policy:

Reuters:

Financial Times:

TimesOnline:

- Cut bankers’ bonuses and we will all suffer.

Telegraph:

Handelsblatt:

- HSBC Holdings Plc Chairman Stephen Green said world economic activity shows signs of bottoming out, predicting Europe and the

The Age:

-

Nikkei English News:

- Advantest Corp. expects July-September orders for its chip-testing equipment to exceed levels for the preceding quarter, citing President Haruo Matsuno. The Japanese company had earlier forecast orders would fall 14% from the previous quarter to $107 million, the report said.

Alrroya Aleqtissadiya:

- New car registrations in

Weekend Recommendations

Barron's:

- Made positive comments on (MS), (SOHU), (AMZN), (TGT), (SKS), (KSS), (PAYX), (PM), (KR), (AMGN), (EOG), (MBT) and (MRVL).

Night Trading

Asian indices are +.25% to +1.0% on avg.

Asia Ex-Japan Inv Grade CDS Index 134.50 +1.5 basis points.

S&P 500 futures -.27%.

NASDAQ 100 futures -.18%.

Morning Preview

BNO Breaking Global News of Note

Yahoo Most Popular Biz Stories

MarketWatch Pre-market Commentary

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Stock Quote/Chart

WSJ Intl Markets Performance

Commodity Futures

IBD New America

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Politico Headlines

Rasmussen Reports Polling

Earnings of Note

Company/Estimate

- (SFD)/-.56

- (AVAV)/.12

Upcoming Splits

- None of note

Economic Releases

3:00 pm EST

- Consumer Credit for July is estimated at -$4.0B versus -$10.3B in June.

Other Potential Market Movers

- The weekly retail sales reports, ABC consumer confidence reading, TAF auction and the Treasury’s 3-year note auction could also impact trading today.

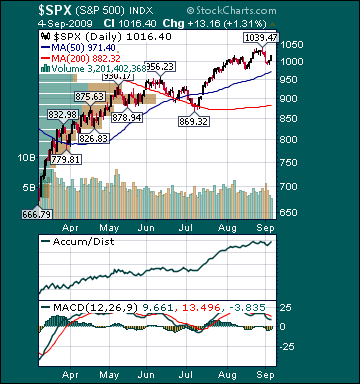

BOTTOM LINE: Asian indices are higher, boosted by technology and financial stocks in the region. I expect