U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on profit-taking, financial sector pessimism, global debt angst, global growth worries, technical selling, more shorting, earnings outlooks and emerging market inflation fears. My intermediate-term trading indicators are giving mostly bearish signals and the Portfolio is 75% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, October 23, 2011

Friday, October 21, 2011

Weekly Scoreboard*

Indices

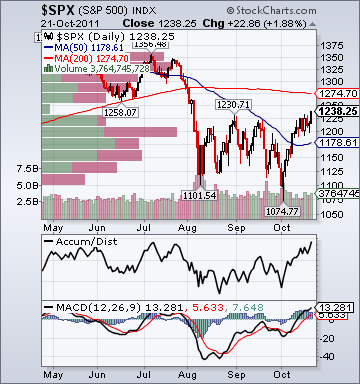

- S&P 500 1,238.25 +1.12%

- DJIA 11,808.80 +1.41%

- NASDAQ 2,637.46 -1.14%

- Russell 2000 712.42 -.01%

- Wilshire 5000 12,796.27 +.99%

- Russell 1000 Growth 576.73 +.04%

- Russell 1000 Value 611.30 +2.12%

- Morgan Stanley Consumer 732.61 +1.58%

- Morgan Stanley Cyclical 882.67 +1.82%

- Morgan Stanley Technology 626.90 -.78%

- Transports 4,813.83 +2.61%

- Utilities 452.66 +3.17%

- MSCI Emerging Markets 38.30 -1.56%

- Lyxor L/S Equity Long Bias Index 950.05 +1.48%

- Lyxor L/S Equity Variable Bias Index 840.41 -.22%

- Lyxor L/S Equity Short Bias Index 618.32 -1.65%

- NYSE Cumulative A/D Line 124,605 +1.39%

- Bloomberg New Highs-Lows Index -182 -56

- Bloomberg Crude Oil % Bulls 45.0 +80.0%

- CFTC Oil Net Speculative Position 144,371 +19.25%

- CFTC Oil Total Open Interest 1,431,568 +.49%

- Total Put/Call .85 -14.14%

- OEX Put/Call .69 -69.06%

- ISE Sentiment 107.0 -23.02%

- NYSE Arms 1.01 +50.75%

- Volatility(VIX) 31.32 +10.91%

- S&P 500 Implied Correlation 79.19 +14.70%

- G7 Currency Volatility (VXY) 13.29 +5.39%

- Smart Money Flow Index 10,638.05 +1.78%

- Money Mkt Mutual Fund Assets $2.635 Trillion -.10%

- AAII % Bulls 35.99 -9.5%

- AAII % Bears 34.60 -4.84%

- CRB Index 311.08 -1.92%

- Crude Oil 87.40 -.06%

- Reformulated Gasoline 268.46 -5.40%

- Natural Gas 3.63 -1.73%

- Heating Oil 301.75 -1.43%

- Gold 1,636.10 -2.72%

- Bloomberg Base Metals 198.94 -4.54%

- Copper 322.30 -6.17%

- US No. 1 Heavy Melt Scrap Steel 418.33 USD/Ton unch.

- China Iron Ore Spot 142.60 USD/Ton -9.46%

- UBS-Bloomberg Agriculture 1,575.30 -2.27%

- ECRI Weekly Leading Economic Index Growth Rate -10.10% -50 basis points

- S&P 500 EPS Estimates 1 Year Mean 96.35 +.16%

- Citi US Economic Surprise Index 14.80 +12.6 points

- Fed Fund Futures imply 29.7% chance of no change, 70.3% chance of 25 basis point cut on 11/02

- US Dollar Index 76.40 -.28%

- Yield Curve 195.0 -3 basis points

- 10-Year US Treasury Yield 2.22% -3 basis points

- Federal Reserve's Balance Sheet $2.835 Trillion -.27%

- U.S. Sovereign Debt Credit Default Swap 44.06 -7.10%

- Illinois Municipal Debt Credit Default Swap 268.0 +1.02%

- Western Europe Sovereign Debt Credit Default Swap Index 337.77 -2.16%

- Emerging Markets Sovereign Debt CDS Index 271.0 +2.07%

- Saudi Sovereign Debt Credit Default Swap 112.52 -2.22%

- Iraqi 2028 Government Bonds 82.55 +3.81%

- China Blended Corporate Spread Index 758.0 +17 basis points

- 10-Year TIPS Spread 2.02% +3 basis points

- TED Spread 40.0 +1 basis point

- 3-Month Euribor/OIS Spread 75.0 +1 basis point

- N. America Investment Grade Credit Default Swap Index 131.55 +1.40%

- Euro Financial Sector Credit Default Swap Index 222.93 -1.33%

- Emerging Markets Credit Default Swap Index 312.06 +5.35%

- CMBS Super Senior AAA 10-Year Treasury Spread 315.0 unch.

- M1 Money Supply $2.152 Trillion -1.83%

- Commercial Paper Outstanding 949.30 -1.80%

- 4-Week Moving Average of Jobless Claims 403,000 -1.50%

- Continuing Claims Unemployment Rate 2.9% unch.

- Average 30-Year Mortgage Rate 4.11% +17 basis points

- Weekly Mortgage Applications 633.10 -14.93%

- Bloomberg Consumer Comfort -48.4 +2.4 points

- Weekly Retail Sales +4.70% unch.

- Nationwide Gas $3.47/gallon +.03/gallon

- U.S. Cooling Demand Next 7 Days 8.0% above normal

- Baltic Dry Index 2,153 -.92%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 34.0 +4.62%

- Rail Freight Carloads 244,389 +.99%

- Large-Cap Value +2.12%

- Small-Cap Growth -.73%

- Homebuilders +5.28%

- Road & Rail +4.02%

- Energy +3.94%

- Education +3.23%

- Utilities +3.17%

- Steel -3.53%

- Alt Energy -3.62%

- Computer Services -4.19%

- Networking -6.49%

- Gold & Silver -6.52%

- EP, BEXP, SCSS and HGSI

- MAIN, NFX, APEI, CKP, NCMI, HSP, PLCM, GMCR and CROX

ETFs

Stocks

*5-Day Change

Stocks Surging into Final Hour on Less Eurozone Debt Angst, Dovish Fed Commentary, Short-Covering, Less Financial Sector Pessimism

Broad Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Almost Every Sector Rising

- Volume: Slightly Below Average

- Market Leading Stocks: Performing In Line

- VIX 31.94 -8.17%

- ISE Sentiment Index 104.0 +4.0%

- Total Put/Call .89 -35.97%

- NYSE Arms .90 +15.78%

- North American Investment Grade CDS Index 131.55 -3.02%

- European Financial Sector CDS Index 220.29 -8.16%

- Western Europe Sovereign Debt CDS Index 334.0 -1.96%

- Emerging Market CDS Index 312.76 -1.93%

- 2-Year Swap Spread 38.0 +1 bp

- TED Spread 41.0 unch.

- 3-Month T-Bill Yield .01% unch.

- Yield Curve 194.0 +3 bps

- China Import Iron Ore Spot $153.40/Metric Tonne -2.19%

- Citi US Economic Surprise Index 14.80 +.4 point

- 10-Year TIPS Spread 2.00 +2 bps

- Nikkei Futures: Indicating +58 open in Japan

- DAX Futures: Indicating -3 open in Germany

- Higher: On gains in my Medical, Retail and Tech sector longs

- Disclosed Trades: Covered all of my (IWM)/(QQQ) hedges and then added them back

- Market Exposure: 75% Net Long

Today's Headlines

Bloomberg:

- EU Sees Worsening Greek Data as Talks Begin. European finance ministers grappled with an assessment that Greece’s economy is deteriorating as they began a six-day battle to stave off a default and shield banks from the fallout. A review by European and International Monetary Fund experts showed Greek bond writedowns of 60 percent and more official aid would still leave the country with a debt load bigger than its annual economic output by 2020. Finance ministers braced for “tough” talks at a crisis- management marathon running until Oct. 26, as pressure mounted to stamp out debt woes that threaten to infect the global economy. Aid of 256 billion euros ($354 billion) for Greece, Ireland and Portugal have failed to stabilize markets or prevent the turmoil spreading to France, co-anchor with Germany of the European economy. Europe’s international image is “disastrous,” Luxembourg Prime Minister Jean-Claude Juncker told reporters before the Brussels meeting. “We’re not really giving a great example of a high standing of state governance.” Juncker, chairing today’s talks, cancelled the normal post- meeting press conference. Finance ministers from all 27 European Union countries meet tomorrow. EU and euro-area leaders gather on Oct. 23, to be capped by another euro summit on Oct. 26. The negotiations “will be tough and the situation is serious,” Dutch Finance Minister Jan Kees de Jager said. “We really need to step up efforts, make extra reforms, extra cuts and strict agreements on budgets.”

- CDS Traders Raise French Bets as EU Debates Greece: Euro Credit. Credit-default swaps traders are scaling back bets on Europe's most indebted countries to focus on France and Germany as leaders of the region's two biggest economies wrangle over a solution to the debt crisis. The net amount of swaps protecting French debt climbed 41 percent since the start of the year to $24.6 billion, making it the world's most-insured government, according to the Depository Trust & Clearing Corp. Contracts on Germany rose 28 percent to $19.3 billion in the same period, while CDS outstanding on Greece tumbled 42 percent to $3.7 billion. Investors are speculating French President Nicolas Sarkozy and German Chancellor Angela Merkel will have to increase the firepower of the 440 billion-euro ($604 billion) European Financial Stability Facility. "The market has moved on to the next game in town," said Georg Grodzki, head of credit research at Legal & General Group Plc in London. France's credit rating is under pressure, Moody's Investors Service said Oct. 17, because the crisis has made its debt the weakest among the region's top-ranked nations. French credit- default swaps cost 191 basis points, up from 108 at the start of the year, and are the most expensive of any AAA-rated nation. Investors demanded a record 119.7 basis points more to hold French bonds than German notes today, up from 29 in April, and the nation's 10-year borrowing costs increased to about 3.2 percent from 2.6 percent at the start of the month.

- Global seaborne trade growth in iron ore will slow to 3% next year from 6% in 2011, according to a unit of Clarkson Plc, the largest shipbroker. The total trade in raw materials will grow 3% to 3.75 billion tons, down from 5% this year, it said. The dry bulk fleet will grow 10% to 672.3 million deadweight tons, meaning freight rates will weaken, Clarkson said.

- Payrolls Declined in 25 U.S. States, Led by NC. Payrolls fell in 25 U.S. states in September, led by North Carolina and Ohio, a sign the weakness in the job market is broad-based. Employers cut staff by 22,200 in North Carolina last month and by 21,600 in Ohio, according to Labor Department data issued today in Washington. The report also showed the jobless rate decreased in 25 states. Nevada continued to lead the nation in unemployment with a rate of 13.4 percent.

- Dollar Drops to Post WWII Low Against Yen. The dollar dropped to a post-World War II low against the yen and fell versus most major currencies on speculation Europe is moving closer to resolving its debt crisis and the Federal Reserve may seek further monetary easing.

- China Stocks Drop for Biggest Weekly Loss in Five Months; PetroChina Falls. China’s stocks fell, capping the benchmark index’s steepest weekly drop in five months, on speculation slowing economic growth and the nation’s tighter monetary policies are hurting earnings. PetroChina Co. slid to a one-month low as the nation’s largest oil producer said it may have a 2011 refining loss of over 50 billion yuan ($7.8 billion). Yanzhou Coal Mining Co. led declines for coal producers. China Minsheng Banking Corp. and Huaxia Bank Co. gained at least 1.9 percent as the finance ministry said cities such as Shanghai will be able to sell debt themselves instead of going through the central government. “China’s economic slowdown will hurt companies’ earnings in the fourth quarter and next year,” said Mei Luwu, a fund manager at Lion Fund Management Co. in Shenzhen. “The market will fluctuate at the current low levels before bottoming out.” The Shanghai Composite Index slumped 14.1 points, or 0.6 percent, to 2,317.28 at the close, extending this week’s slump to 4.7 percent, the most since the week ended May 27. The CSI 300 Index (SHSZ300) retreated 0.5 percent to 2,507.88. Gauges of energy and material companies in the CSI 300 slid 1.5 percent and 2.3 percent today, extending losses this week to 7.6 percent and 10 percent respectively.

- Fed's Fisher Says Operation Twist Benefits Traders. Federal Reserve Bank of Dallas President Richard Fisher said the central bank’s plan to buy $400 billion of long-term bonds while selling the same amount of short-term debt is benefiting financiers and not aiding job creation. The bond swap program, known as Operation Twist for its goal of bending the yield curve, has “so far been of greater benefit to traders and large monied interests than to job- creating businesses,” Fisher said today in a speech in Dallas. “I would submit that adding more liquidity, or making money still cheaper, is not the answer to our problems,” Fisher said, renewing his criticism of Congress and the White House who “have conspired over time, however unwittingly, to drive fiscal policy into the ditch.”

- Obama Pulling Troops From Iraq by End of Year. President Barack Obama announced that the U.S. will pull out all of its troops from Iraq by the end of December, drawing the war to a conclusion. "As promised, the rest of our troops in Iraq will come home by the end of the year," Mr. Obama said in a briefing at the White House. "After nearly nine years, America's war in Iraq will be over."

- Crisis in Euro Zone Weighs on Emerging-Market Banks. The euro-zone debt crisis is spilling over to emerging-market banks, signaling new risks for economies that had largely brushed off European troubles for the past two years, an industry survey found. Across Asia, Eastern Europe, Latin America and elsewhere around the world, banks are tightening credit standards and facing an increase in bad loans, according to the survey to be released Friday by the Institute of International Finance, a global association of big banks. The report found that funding conditions in international markets have "deteriorated significantly" even as local funding conditions remained stable.

- GE's(GE) Profit Climbs, but Margins Get Squeezed. General Electric Co. posted higher third-quarter earnings and a record backlog of industrial orders Friday, but shrinking margins raised questions about the price the conglomerate is paying for growth.

- ECRI Leading Index: Yes, It's Still Falling. (graph) You wouldn’t know it from the rally in risk assets today — even copper is jumping — but there are still reasons to worry about future economic growth. The Economic Cycle Research Institute’s weekly leading index continues to fall, for one thing. This week its rolling growth rate fell to -10.1%, the lowest level since July 2010.

CNBC.com:

Financial Times:

- What Happens If the US 'Super Committee' Fails? The deadline for the U.S. congressional "super committee" to produce a deficit-cutting plan is just a few weeks away with no clear sign the panel will overcome partisan differences and succeed.

- Bernanke's Latest 'Hints' Should Infuriate 280 Million Americans.

- 10,000 Wall Street Jobs Will Be Gone By New Year's.

- Tons of Radioactive Waste Are Piling Up In Japan As Number Of Reported Hotspots Grow.

- Why The French and German Governments Disagree.

- The 2 Biggest Risks in Europe.

- 5 Head Scratching Chartys - EFSF is Failing to Help European Sovereign Debt Markets.

- The Truth Behind Europe's (€1.7 Trillion) "Triangle Of Terror".

- Wal-Mart(WMT) Cuts Some Health Care Benefits. Citing rising costs, Wal-Mart, the nation’s largest private employer, told its employees this week that all future part-time employees who work less than 24 hours a week on average will no longer qualify for any of the company’s health insurance plans. In addition, any new employees who average 24 hours to 33 hours a week will no longer be able to include a spouse as part of their health care plan, although children can still be covered. This is a big shift from just a few years ago when Wal-Mart expanded coverage for employees and their families.

- More Than 80% of Hedge Funds Underwater. The selloff in most of the global markets in the third quarter heavily impacted a large number of hedge funds. In fact, not only did it put many funds into the red for the year, it pushed a huge number of hedge funds below their high water mark. According to HFR, at the end of the third quarter just 19.3 percent of all hedge funds were above that critical level that determines whether their investors’ accounts are in the black. This is way down from 44.2 percent at the end of the second quarter and less than half the level of each of the three prior quarters. In fact, the 19.3 percent is the lowest level since the end of the first quarter of 2009, when it bottomed at 18.7 percent, by far the all-time low since HFR began keeping score in 2003. But even the 19.3 percent figure could be overstating how the average investor in those funds is faring in general. While those invested in these underwater funds for many years before the current slide could still be in the black, many hedge funds with good long-term records traditionally gather the biggest chunk of their assets after their big run-up. So, this means many of them made their initial investments at or near that recent high water mark.

- Fundamental Update: Europe: 5 Days to Salvation? In our view, the resolution to Europe’s crisis is a zero sum game for the markets and once we know the details from Wednesday’s summit markets will price in quickly either disappointment or optimism. In the past investors have been happy with the “muddle-through” kicking the can down the road solutions from Eurozone leaders, which is one of the reasons why markets have remained range bound for the past few months; however we believe the time has come for some decisive action, especially now that Italy and even France are coming under pressure. Thus it is important to know what the markets are expecting so you can gauge the likely reaction.

Financial Times:

- KKR Bets on China Slowdown With Hong Kong Expansion. The buy-out group, which is among the largest in the world, is planning to expand into Hong Kong in the next six to nine months with its $2bn special situations unit to profit from investments into faltering and over-indebted companies.The move comes amid increasing interest among distressed-debt investors in China. Bill Sonneborn, head of KKR Asset Management, said that the group was positioning itself for a period of more dented growth in the area. “If [large Asian economies such as China] would be slowing to half the rate of growth, that would be the equivalent of a massive recession in the US or Europe and would create opportunities to invest,” he told the Financial Times.

- European Union Economic and Monetary Affairs Commissioner Olli Rehn said EU contracts may make it difficult to establish a direct connection between European Central Bank refinancing and the region's EFSF bailout fund, he said in an interview. Asking for assistance from countries like Russia, China or Brazil would have 'far-reaching political consequences" because it would give them negotiating power within the euro zone, citing Rehn.

- European Union Economic and Monetary Affairs Commissioner Olli Rehn said the European Central Bank shouldn't be linked to the EFSF, citing an interview. Rehn said the European treaty and all its provisions should be respected. "That makes it difficult to include ECB financing facilities," Rehn said.

- Italy needs to present "a firm commitment" at a meeting of government leaders this weekend to eliminating its budget deficit with "precise objectives," European Union Economic and Monetary Affairs Commissioner Olli Rehn said. "The goal of a return to a balanced budget in 2013 is good," Rehn said. "The manner of getting there on the other hand isn't yet clear enough. We think that if Italy shows a firm commitment with a calendar and some precise objectives, that will facilitate greatly the negotiations among member states Sunday."

Bear Radar

Style Underperformer:

- Large-Cap Growth (+.88%)

- 1) Airlines -.82% 2) Networking +.06% 3) Gaming +.09%

- BAS, WYNN, PENN, HAL, ALK, VRUS, LLY, VRUS, APKT, CPHD, INFA, HITT, EZPW, ATHN, BSFT, MBFI, MMYT, AIXG, VRTX, RNST, TZOO, IIVI, PTEN, GDI, CYN, APD, QNST, CYN and FSL

- 1) DTG 2) WFT 3) STX 4) LOW 5) ANF

- 1) PENN 2) FLIR 3) SSI 4) AMR 5) FSL

Subscribe to:

Comments (Atom)