Broad Market Tone: - Advance/Decline Line: About Even

- Sector Performance: Most Sectors Declining

- Volume: Below Average

- Market Leading Stocks: Underperforming

Equity Investor Angst: - VIX 32.24 -6.58%

- ISE Sentiment Index 80.0 +9.59%

- Total Put/Call .83 -35.16%

- NYSE Arms .94 -65.40%

Credit Investor Angst:- North American Investment Grade CDS Index 135.78 +.78%

- European Financial Sector CDS Index 289.47 +4.39%

- Western Europe Sovereign Debt CDS Index 350.40 -1.27%

- Emerging Market CDS Index 325.37 -2.07%

- 2-Year Swap Spread 50.0 -3 bps

- TED Spread 49.0 +1 bp

Economic Gauges:- 3-Month T-Bill Yield .00% unch.

- Yield Curve 172.0 +3 bps

- China Import Iron Ore Spot $147.40/Metric Tonne -.14%

- Citi US Economic Surprise Index 48.90 -.2 point

- 10-Year TIPS Spread 1.97 +5 bps

Overseas Futures: - Nikkei Futures: Indicating +43 open in Japan

- DAX Futures: Indicating +3 open in Germany

Portfolio:

- Slightly Lower: On losses in my tech and medical sector longs.

- Disclosed Trades: None

- Market Exposure: 50% Net Long

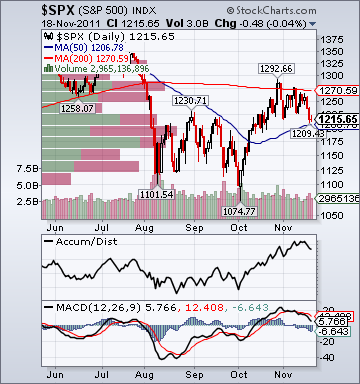

BOTTOM LINE: Today's overall market action is mildly bearish, as the S&P 500 hugs the flatline despite a bounce in the euro, recent equity losses, lower food/energy prices and less financial sector pessimism. On the positive side, Utility, Hospital, Gaming and Road & Rail shares are rising more than +.5%. (XLF) is outperforming. Oil is falling -1.07%, Lumber is rising +2.1%, Copper is rising +.7% and the UBS-Bloomberg Ag Spot Index is declining -.44%. The 10-year yield is rising +4 bps to 2.00%. The Italy sovereign cds is declining -6.44% to 532.67 bps, the Belgium sovereign cds is falling -3.66% to 327.0 bps and the Spain sovereign cds is falling -4.7% to 457.17 bps. On the negative side, Coal, Alt Energy, Oil Service, Internet, Software, Semi, Wireless, Medical, Homebuilding and Education shares are

under pressure, falling more than -.75%. For the second day in a row (XLK) is underperform substantially. Gold is rising +.37%. Major Asian indices fell 1-2% overnight. The Hang Seng fell another -1.73%, which puts it down -19.7% ytd and below its 50-day moving-average. Major European equity indices fell .5-1% today. The China sovereign cds is gaining +4.63% to 153.76 bps, the Germany sovereign cds is gaining +.56% to 95.50 bps and the Brazil sovereign cds is gaining +1.87% to 176.41 bps. Moreover, the Asia Pacific Sovereign CDS Index is gaining +1.5% to 160.64 bps and the Europe Investment Grade CDS Index is gaining +.6% to 177.27 bps. The TED spread continues to trend higher and is at the highest since June 2010. The 2-Year Swap spread is near the highest since May 2010. The FRA/OIS Spread is near the highest since May 2010. The 2yr Euro Swap Spread is at the highest since Nov. 2008. The 3M Euro Basis Swap is falling -.48% to -130.0 bps, which is the worst since November 2008. The Libor-OIS spread is near the widest since July 2009, which is also noteworthy considering the recent strong equity advance off the lows. China Iron Ore Spot has plunged -23.2% since February 16th and -18.6% since Sept. 7th. The average stock is worse than the major averages suggest today. Volume is very light for an option expiration day, as well. "Growth" stocks are substantially underperforming "value" shares. The action in the tech sector is concerning. So far, stocks have just experienced a pullback after a strong surge off the lows, however I still think the risk of another meaningful turn lower in equities is substantial unless a positive catalyst emerges from Europe very soon. I expect US stocks to trade mixed-to-lower into the close from current levels on Eurozone debt angst, US debt Super Committee concerns, rising global growth worries, tech sector pessimism, more shorting, high energy prices and technical selling.