U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on rising global growth fears, less US economic optimism, rising Eurozone debt angst, technical selling, profit-taking, more shorting and high energy prices. My intermediate-term trading indicators are giving neutral signals and the Portfolio is 50% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, May 06, 2012

Friday, May 04, 2012

Weekly Scoreboard*

Indices

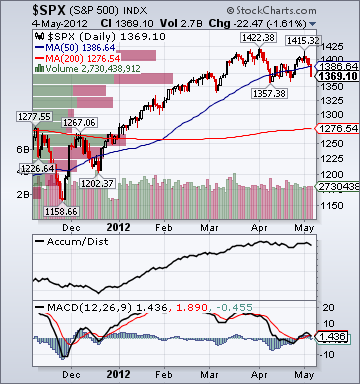

- S&P 500 1,369.10 -2.44%

- DJIA 13.038.20 -1.44%

- NASDAQ 2,956.44 -3.68%

- Russell 2000 791.84 -4.07%

- Value Line Geometric(broad market) 352.79 -3.79%

- Russell 1000 Growth 647.01 -2.79%

- Russell 1000 Value 669.94 -2.28%

- Morgan Stanley Consumer 795.57 -1.90%

- Morgan Stanley Cyclical 962.25 -2.86%

- Morgan Stanley Technology 684.84 -3.03%

- Transports 5,227.64 -.76%

- Utilities 467.88 -.34%

- Bloomberg European Bank/Financial Services 74.03 -3.31%

- MSCI Emerging Markets 42.24 -.23%

- Lyxor L/S Equity Long Bias 1,033.50 +1.30%

- Lyxor L/S Equity Variable Bias 820.20 +1.10%

- Lyxor L/S Equity Short Bias 539.12 unch.

- NYSE Cumulative A/D Line 143,652 -1.96%

- Bloomberg New Highs-Lows Index 24 -165

- Bloomberg Crude Oil % Bulls 33.0 +3.1%

- CFTC Oil Net Speculative Position 226,643 +6.71%

- CFTC Oil Total Open Interest 1,602,007 +4.08%

- Total Put/Call 1.02 +21.43%

- OEX Put/Call 1.37 -31.84%

- ISE Sentiment 75.0 -2.60%

- NYSE Arms 1.88 +35.25%

- Volatility(VIX) 19.16 +17.40%

- S&P 500 Implied Correlation 68.05 +8.02%

- G7 Currency Volatility (VXY) 9.24 +4.17%

- Smart Money Flow Index 11,251.21 +.93%

- Money Mkt Mutual Fund Assets $2.567 Trillion -.60%

- AAII % Bulls 35.40 +28.08%

- AAII % Bears 28.47 -23.88%

- CRB Index 297.15 -2.74%

- Crude Oil 98.49 -6.02%

- Reformulated Gasoline 297.58 -5.23%

- Natural Gas 2.28 +3.83%

- Heating Oil 300.88 -5.40%

- Gold 1,645.20 -1.05%

- Bloomberg Base Metals Index 215.38 -1.94%

- Copper 372.10 -2.94%

- US No. 1 Heavy Melt Scrap Steel 402.67 USD/Ton unch.

- China Iron Ore Spot 144.10 USD/Ton -.89%

- Lumber 286.70 +.42%

- UBS-Bloomberg Agriculture 1,482.63 -2.02%

- ECRI Weekly Leading Economic Index Growth Rate .00% -60 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.1421 +14.71%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 110.67 +.31%

- Citi US Economic Surprise Index -23.40 -15.4 points

- Fed Fund Futures imply 58.0% chance of no change, 42.0% chance of 25 basis point cut on 6/20

- US Dollar Index 79.50 +1.0%

- Yield Curve 162.0 -6 basis points

- 10-Year US Treasury Yield 1.88% -5 basis points

- Federal Reserve's Balance Sheet $2.847 Trillion -.08%

- U.S. Sovereign Debt Credit Default Swap 40.13 +8.46%

- Illinois Municipal Debt Credit Default Swap 221.0 +2.55%

- Western Europe Sovereign Debt Credit Default Swap Index 273.51 -.65%

- Emerging Markets Sovereign Debt CDS Index 278.77 -2.84%

- Saudi Sovereign Debt Credit Default Swap 117.50 -2.49%

- Iraq Sovereign Debt Credit Default Swap 420.54 -9.12%

- China Blended Corporate Spread Index 576.0 -52 basis points

- 10-Year TIPS Spread 2.22% -5 basis points

- TED Spread 39.5 +1.5 basis points

- 2-Year Swap Spread 29.0 -1.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -41.50 +3.5 basis points

- N. America Investment Grade Credit Default Swap Index 98.25 +3.68%

- Euro Financial Sector Credit Default Swap Index 244.24 +.85%

- Emerging Markets Credit Default Swap Index 247.02 -2.53%

- CMBS Super Senior AAA 10-Year Treasury Spread 161.0 -1 basis point

- M1 Money Supply $2.256 Trillion +.36%

- Commercial Paper Outstanding 939.90 +1.50%

- 4-Week Moving Average of Jobless Claims 383,500 +2,700

- Continuing Claims Unemployment Rate 2.6% unch.

- Average 30-Year Mortgage Rate 3.84% -4 basis points

- Weekly Mortgage Applications 698.20 +.07%

- Bloomberg Consumer Comfort -37.6 -1.8 points

- Weekly Retail Sales +3.20% -10 basis points

- Nationwide Gas $3.80/gallon -.02/gallon

- U.S. Cooling Demand Next 7 Days 16.0% above normal

- Baltic Dry Index 1,157 +.09%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 40.0 unch.

- Rail Freight Carloads 242,365 +1.29%

- Large-Cap Value -2.28%

- Small-Cap Value -4.20%

- Utilities -.34%

- Homebuilders -.64%

- Disk Drives -.66%

- REITs -.67%

- Drugs -.87%

- Steel -5.38%

- HMOs -5.55%

- Education -6.14%

- Networking -6.84%

- Oil Tankers -6.90%

- SYNC, BKS, SMSC, KNSY, CPTS, EXPE, CRAY, PFCB, CAR, SUN, Z, PZZA, WWWW, VECO, NUVA, TRIP, VOCS, SAIA, GPRO, ELLI, VHC, FIRE, AZPN, LBY, WWW, FBHS, WMGI, BGC, CERN, MDSO, CNW, SAM, RRTS, AEIS, CRBC, CSU, TWTC, TAYC and CYNO

- HBHC, ITC, EGBN, ABMD, WMS, LPLA, RUSHA, CW, MGLN, CTCT, HUM, USNA, HF, ABFS, NSP, TRS, DPZ, KAMN, PAY, NANO, RATE, NUS, INT, TEN, ACM, PRLB, PLT, NEWP, KEYN, FST, WTW, HOLX, UBNT, CACI, CEVA, PBH, ECOL, SREV, MANT, VCLK, HNT, PBY, CBOU and GMCR

ETFs

Stocks

*5-Day Change

Stocks Falling into Final Hour on More Weak US Economic Data, Rising Eurozone Debt Angst, Rising Global Growth Fears, Less Tech Sector Optimism

Broad Market Tone:

- Advance/Decline Line: Substantially Lower

- Sector Performance: Almost Every Sector Declining

- Volume: Below Average

- Market Leading Stocks: Underperforming

- VIX 19.19 +9.28%

- ISE Sentiment Index 79.0 -28.83%

- Total Put/Call 1.01 unch.

- NYSE Arms 1.71 +8.88%

- North American Investment Grade CDS Index 98.75 +2.77%

- European Financial Sector CDS Index 244.39 +1.98%

- Western Europe Sovereign Debt CDS Index 273.51 -.06%

- Emerging Market CDS Index 247.63 +1.94%

- 2-Year Swap Spread 29.0 +.75 basis point

- TED Spread 39.5 +.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -41.5 +1.25 basis point

- 3-Month T-Bill Yield .07% -1 basis point

- Yield Curve 162.0 -4 basis points

- China Import Iron Ore Spot $144.10/Metric Tonne -.55%

- Citi US Economic Surprise Index -23.40 +.8 point

- 10-Year TIPS Spread 2.21 -5 basis points

- Nikkei Futures: Indicating a -205 open in Japan

- DAX Futures: Indicating -12 open in Germany

- Slightly Lower: On losses in my Tech, Biotech, Medical and Retail sector longs

- Disclosed Trades: Added to my (IWM), (QQQ) hedges, added to my (EEM) short, then covered some of them

- Market Exposure: 50% Net Long

Today's Headlines

Bloomberg:

- Schaeuble Says Germany Will Negotiate With Hollande on Growth. The German government will allow a victorious Francois Hollande to “save face” while expecting him to uphold French commitments to Europe’s budget treaty, Finance Minister Wolfgang Schaeuble said. Schaeuble’s comments are the clearest indication yet that Chancellor Angela Merkel’s government is preparing for a Hollande victory at France’s presidential election May 6 after publicly backing Nicolas Sarkozy to win a second term. Earlier today, the German government said that diplomatic contact had been made with the Hollande camp. “We’ve told Mister Hollande that the fiscal pact has been signed and that Europe works along the principle of pacta sunt servanda,” meaning agreements must be kept, Schaeuble said in a speech in the western German city of Cologne today. “I’ve said that everybody who gets freshly elected into office must be able to save face,” Schaeuble said. “So we will discuss this with Hollande in a very friendly way. But we won’t change our principles.”

- Majority of Germans Back Merkel's European Austerity, Welt Says. A majority of Germans support Chancellor Angela Merkel’s austerity policies for Europe, Die Welt reported today, citing a poll by Infratest Dimap. Some 55 percent of the population in Germany are in favor of “stern austerity” in Europe rather than growth programs financed with new credit, the German newspaper said, citing the Infratest Dimap poll of 1,004 people taken between April 30 and May 1.

- Barclays Recommends Banks' CDS to Protect Against Europe Risks. Investors should buy protection on the debt of financial firms to guard against the risks from an escalation of Europe's debt crisis amid signs this year's credit market rally is stalling, according to Barclays. "Financials appear most attractive as cost-effecitive macro hedges," the strategists led by Jeffrey Meli and Bradley Rogoff wrote today. "We recommend buying CDS protection on a basket of financial credits as an alternative to hedging with the CDX Index."

- European Stocks Fall on US Payrolls Data. Hays Plc (HAS) and Randstad Holding NV (RAND) led losses in recruitment companies, sinking more than 5 percent. Wacker Chemie AG (WCH), the world’s second-biggest maker of solar-grade silicon, slumped 6.1 percent after net income dropped. Taylor Wimpey Plc (TW/), a U.K. homebuilder, slid 7.7 percent as the nation’s house prices fell the most in 1 1/2 years. BHP Billiton Ltd. (BHP) and Rio Tinto Group led mining companies lower. The Stoxx Europe 600 Index (SXXP) retreated 1.8 percent to 253 at the close of trading, the lowest level since April 23. The benchmark gauge tumbled 2.4 percent this week, trimming its 2012 advance to 3.5 percent, as Spain entered a recession and reports on U.S. business activity and services-industry growth trailed economists’ forecasts.

- UK Home Prices Drop the Most in 1 1/2 Years as Recession bites. U.K. house prices dropped the most in 1 1/2 years in April as a stamp-duty exemption for first-time buyers ended and the economy fell into its first double-dip recession since the 1970s, Halifax said. Prices dropped 2.4 percent from March, the largest monthly decline since September 2010, to an average 159,883 pounds ($258,700), the mortgage unit of Lloyds Banking Group Plc (LLOY) said in a statement in London today. Prices had risen 2.2 percent in March. From a year earlier, values were down 0.6 percent.

- Banks May Have to Disclose Profits From ECB Emergency Loans. Banks may have to disclose profits from carry trades derived from 1 trillion euros ($1.3 trillion) in European Central Bank loans and exclude the money from bonus pools, under draft proposals from European Union lawmakers. Profit from carry trades, where investors borrow money at a low interest rate to buy higher yielding securities, “should not count toward computation of remuneration and bonus pools” at banks, under plans being weighed by European Union lawmakers, according to a document obtained by Bloomberg News. The measure is one of dozens of proposed amendments to legislation to implement global capital and liquidity rules for EU lenders.

- Employers in U.S. Added Fewer Jobs Than Forecast in April. American employers added fewer workers than forecast in April and the jobless rate unexpectedly fell as people left the labor force, adding to concern the economic expansion is cooling. Payrolls climbed 115,000, the smallest increase in six months, after a revised 154,000 gain in March that was larger than initially estimated, Labor Department figures showed today in Washington. The median estimate of 85 economists surveyed by Bloomberg News called for a 160,000 advance. The jobless rate fell to a three-year low of 8.1 percent, and earnings stagnated. Transportation and warehousing, government agencies and construction all cut jobs in April. Bloomberg survey estimates ranged from increases of 89,000 to 210,000 after a previously reported 120,000 rise in March. The unemployment rate was forecast to hold at 8.2 percent, according to the survey median. It has exceeded 8 percent since February 2009, the longest such stretch since monthly records began in 1948. The participation rate, which indicates the share of working-age people in the labor force, fell to 63.6 percent, the lowest since December 1981, from 63.8 percent. The report showed a drop in long-term unemployed Americans. The number of people out of work for 27 weeks or longer fell as a percentage of all jobless, to 41.3 percent. Average hourly earnings were $23.38 in April, essentially unchanged from the month before, today’s report showed. It was the first time without an increase since August. Compared with April of last year, earnings climbed 1.8 percent, matching January as the smallest in a year. The average work week for all workers held at 34.5 hours. The so-called underemployment rate -- which includes part- time workers who’d prefer a full-time position and people who want work but have given up looking -- held at 14.5 percent.

- S&P 500 Poised for Worst Week in 2012 on US Jobs Report. U.S. stocks declined a third day, sending the Standard & Poor’s 500 Index toward its worst week in 2012, as data showing employers added fewer jobs than forecast intensified concern about the pace of economic recovery. “The data point to sluggish job growth, declining labor market participation and for those employed, stagnant purchasing power,” Mohamed El-Erian, the chief executive officer of Pacific Investment Management Co., said in an e-mail today. “Consumption is less dynamic at a time when headwinds from Europe and a potential fiscal cliff are still material.”

- U.K. Ready to Down Planes Threatening Olympics, Standard Says. Defense Secretary Philip Hammond said U.K. ministers are prepared to order the shooting-down of a hijacked airliner if it presents a Sept. 11-style terror threat to the London Olympics, the Evening Standard newspaper reported. “The decision to engage would be made at the highest levels of government,” Hammond told the newspaper in an interview published today. “I’m certainly prepared to make decisions.” Britain’s armed forces have been mounting exercises around London this week to rehearse security for the games, which open on July 27. Anti-aircraft missile batteries will be located around London, while Typhoon jets have flown practice sorties from a Royal Air Force base in northwest London. “Anyone who is thinking malign thoughts should be aware that there will be the latest and most sophisticated military hardware ready and able to defend the games,” the Standard cited Hammond as saying.

- Oil Falls to Lowest Since February on Disappointing US Jobs Report. Oil fell below $100 a barrel for the first time since February as U.S. employers added fewer workers than forecast, stoking concern that demand won’t be enough to cap inventories at their highest level in 21 years. Futures declined as much as 4.9 percent after Labor Department figures showed payrolls climbed 115,000, the smallest gain in six months. Crude oil for June delivery dropped $4.82, or 4.7 percent, to $97.72 a barrel at 12:58 p.m. on the New York Mercantile Exchange. The contract touched $97.51, the lowest level since Feb. 10. Prices are down 6.9 percent this week, heading for the biggest weekly decline since September. Brent oil for June settlement fell $3.66, or 3.2 percent, to $112.42 a barrel on the London-based ICE Futures Europe exchange.

- Facebook(FB) at 99 Times Profit Exceeds 99% of S&P 500 Index. Facebook Inc. (FB) is betting its growth prospects will persuade investors to pay 99 times earnings for its initial public offering, a higher multiple than 99 percent of companies in the Standard & Poor’s 500 Index. The world’s most popular social-networking site will seek a market value of as much as $96 billion, offering shares at $28 to $35 each, a regulatory filing showed yesterday. The Menlo Park, California-based company will begin meeting investors next week and is scheduled to price the offering on May 17, data compiled by Bloomberg show.

- Drugmakers' Deal With Obama Said to Be Probed by House. Pfizer Inc. (PFE) and Merck & Co. (MRK) are being pulled into an expanding congressional investigation into the agreement drugmakers reached with the Obama administration to support the Democrats’ overhaul of the U.S. health-care system, according to three people familiar with the talks.

- U.S. Jobs Data Add to Fears of Spring Slowdown. U.S. job growth slowed again in April and more Americans dropped out of the work force, a fresh sign that the economy could be settling into a sluggish spring.

- Deal Sought for Chinese Activist to Study in U.S. Blind Chinese activist Chen Guangcheng would move to the U.S. with his family to study law under a new deal being discussed between Washington and Beijing, according to U.S. officials. A New York University professor who is an adviser to Mr. Chen said he had an offer from that school. Also on Friday, the Chinese government released a statement saying that Mr. Chen could apply to study abroad "like other Chinese citizens."

CNBC.com:

- Australia Heading for 'Mother of All Hard Landings': Pros. Australia is headed for the “mother of all hard landings,” according to Société Générale strategist Albert Edwards, who says the country’s “credit bubble” could burst if China’s economy suffers a sharp slowdown.

- Fitch CEO: Another US Debt Downgrade Unlikely Before Election.

- New Dan Loeb Letter On Yahoo(YHOO): Fire Scott Thompson By Monday.

- Here's Everything You Need to Know About The Greek Elections That Could Determine the Fate of the Euro.

- The Euro Area Economy Is Deteriorating At A Disastrous Pace. (graph)

- Norway Sovereign Wealth Fund Purges All Insolvent Eurozone Debt Holdings, US Hedge Funds Buying.

- Lack of Trust - Caused by Institutional Corruption - Is Killing the Economy.

- The 2 Scariest Charts From Today's Jobs Report, Or The Real "New Part-Time Normal".

- Real U-3 Unemployment Rate: 11.6%. (graph)

- Bank of America(BAC) Facing $6.2 Billion Collateral Call.

- The Fiscal Cliff Cometh by Mohamed A. El-Erian. Economists are rightly starting to warn that the United States faces a worrisome “fiscal cliff” at year’s end. The blunt spending cuts mandated by the 2011 compromise on the debt ceiling — and the failure of the “supercommittee” that followed — along with across-the-board tax increases would derail the U.S. recovery and undermine the well-being of the global economy. We should be avoiding the edge of this cliff — and politicians should not believe that they have until the end of this year to act.

Cleveland.com:

- Mitt Romney Issues Ohio Challenge to President Obama. Dear Mr. President, Welcome to Ohio. I have a simple question for you: Where are the jobs?

- Fitch Warns on Risk of Eurozone Breakup. Fitch rating agency published a report in which it implies that the Eurozone might be at risk of a breakup, especially in case of Greece's secession, which would trigger contagion among peripheral countries such as Italy, Spain, Ireland, Portugal and Cyprus. According to Fitch's report the possibility of such a breakup is low, but the risk is nevertheless present. If Greece was forced to leave the Eurozone or did it voluntarily, it would bring about an immediate rating cut for Italy, Spain, Ireland, Portugal and Cyprus.

Reuters:

- Misery builds for the euro zone. The euro zone economy worsened markedly in April, according to business surveys that clashed with the prospect of a gradual recovery augured by European Central Bank President Mario Draghi this week. Friday's purchasing managers indexes (PMIs), primarily covering services, suggested a recession across Europe's currency union could now extend to mid-year and be deeper than previously thought.

- Analysis: Spain Bad Loan Mess Revives Debate On Who Should Pay. Spain's plan to rid banks of toxic real estate assets is reviving the politically heated debate over how creditors and taxpayers should share the vast losses still being incurred by the euro zone debt crisis. Nowhere is the issue in sharper relief than in Ireland.

- Copper Dips to Lowest In More Than a Week on Weak US Jobs Report.

- S&P Cuts Ratings of 7 Spanish Regions.

- Fed May Exit Sooner if Growth Beats Forecasts - Williams. The U.S. Federal Reserve could move away from its years-long, zero-rate policy sooner than expected if growth exceeds forecasts or inflation rises above the central bank's 2 percent target, a top Fed official said on Friday. "All else being equal, that's a sign that you would want to raise rates sooner," San Francisco Federal Reserve Bank President John Williams told reporters on Friday.

Financial Times:

- Wealthy French Eye Cross-Channel Move. The “soak the rich” rhetoric that has punctuated the presidential campaign has prompted a sharp rise in the numbers weighing a move across the Channel, according to London-based wealth managers, lawyers and property agents specialising in French clients. François Hollande, the Socialist candidate who leads the presidential race after the first round of voting last week, wants to impose a tax rate of 75 per cent on income above €1m and at the launch of his bid in January said: “My true adversary in this battle has no name, no face, no party ... It is the world of finance.”

Telegraph:

- Debt Crisis: Live.

- Eurozone Services Sector Contracts Sharply in April. The final reading of April's Markit Eurozone Services PMI came in at 46.9, a full point lower than the preliminary reading of 47.9 reported two weeks ago, which itself was far weaker than any economist polled by Reuters had expected. It was the steepest downward revision to the PMI since October 2008 - a month after Lehman Brothers collapsed - and a sharp fall from 49.2 in March.

Linkiesta:

Kathimerini:

- Greek Banks' Bad Loans Rise to 17% of Total. Greek banks collectively saw the level of non-performing loans rise to 17% of their total loan portfolio at the end of the first quarter from 14.7% at the end of the third quarter of 2011. Bad mortgages climbed to 16% of the total, or 12.5 billion euros, from 14%, citing Greek banking officials. Bad consumer loans increased to 29%, or 9.6 billion euros, from 26.4% and bad business loans rose to 15%, or 18 billion euros, from 13%, it said.

- Greek Election Set to Rock Shaky Euro Zone. Either they will secure just enough to work together, albeit uncomfortably and with a very slim majority, or steps will have to be taken to form a broad coalition with minor parties firmly opposed to the European Union's austerity measures. That in turn will increase the pressure on the new government to renegotiate parts of the second bailout programme, an ambitious deal struck in February that aims to clear the way for Greece to return to financial markets by 2015. Some economists take the view that Sunday's election could push Greece back to the nadir it touched in November last year, when there was widespread talk of an exit from the euro zone. The contagion effect would drive Spanish and Italian bond yields straight back into the danger zone, economists say.

- India's Sensex Dips Below 17,000 After Four Months. Falling for the third session in a row, the BSE benchmark Sensex on Friday closed 320 points down, slipping below the psychologically important 17,000 levels amid heavy selling by foreign funds due to fresh concerns over the Mauritius tax treaty review and a weak rupee. The 30-share Sensex, which had lost 168 points in last two trading sessions, plunged further by 320.11 points, or 1.87 per cent to 16,831.08, its lowest level since January 30, 2012.

Bear Radar

Style Underperformer:

- Large-Cap Growth -1.91%

- 1) Oil Service -4.01% 2) Steel -2.94% 3) Networking -2.70%

- PBR, RIO, MANT, DRIV, KOS, SWN, IVN, SU, DELL, NRG, CPN, BODY, CHEF, CBOU, QLGC, ROVI, ANIK, MTSC, FSYS, TRMB, PEGA, INWK, AREX, MKTX, MGRC, MFLX, BLKB, RZV, IRF, MTD, ACM, TDC, MD, SKUL, AIG, SYNA, NCMI, CACI, FSLR, USO, CLR, CROX, PVH, EL, KBR, AON, FRAN, LAMR, WRC, TKR, CF, TAL, BPL, UCO, MTW and INVN

- 1) CI 2) DTV 3) LYB 4) FITB 5) XHB

- 1) BODY 2) JPM 3) PRU 4) TGT 5) SBUX

Subscribe to:

Comments (Atom)