Weekend Headlines

Bloomberg:

- Spain May Have to Revise Its 2011 Budget Deficit. Concern grew for the stability of Spain's place in the fragile eurozone economy after reports of a rise in the level of bad loans on the books of its banks and word from the government Friday that it may have to revise its 2011 budget deficit upwards for a second time. The Bank of Spain reported that lenders' and savings banks' bad loan ratio had risen in March to an 18-year high of 8.36 percent from 8.15 percent the previous month. The Finance Ministry then said in a statement late Friday the deficit could reach 8.9 percent of GDP after four of its 17 regions overshot their expected budgets. The regions mentioned were Madrid, Valencia, Andalusia and Castilla-Leon. News of the increase in bad loans followed a downgrading by credit ratings agency Moody's late Thursday of the country's banking industry. Spain's budget deficit is higher than the 3 percent threshold that was supposedly part of the euro's economic framework. The incoming government of Prime Minister Mariano Rajoy earlier had to revise the figure upwards to 8.5 percent of GDP from the 6 percent forecast by the previous, Socialist government.

- French PM Says ‘No Taboos’ in Greek Solution, Liberation Reports. French Prime Minister Jean-Marc Ayrault said no potential solutions to the Greek debt crisis should be regarded as “taboo” when European heads of state meet on May 23, Liberation reported, citing an interview. Measures such as allowing states to borrow directly from the European Central Bank should not be excluded from discussions, the new premier said, according to the newspaper. “A climate of uncertainty” in Europe is driving Greece to a “panic” over banks and contributing to political instability, Liberation quoted Ayrault as saying. A report from the French state audit board on the status of public accounts should be delivered by June so that President Francois Hollande’s government can plan to offset new expenses with equivalent savings as it seeks to cut the public deficit to zero by the end of his five-year term, Liberation said.

- Euro Crisis Resolution Sought by Franco-German Leaders After G-8. German and French leaders meet this week to map out a revised plan for the euro as the Group of Eight exposed disagreement on a rescue strategy, Greece lurched toward a possible exit and Spain’s budget deficit widened. German Finance Minister Wolfgang Schaeuble will for the first time discuss the 17-nation currency at a meeting with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare for a summit meeting in Brussels on May 23. After three shorter meetings in the last week, Chancellor Angela Merkel and French President Francois Hollande will seek to balance France’s desire to jump-start growth with Germany’s preference for spending cuts.

- Greek Anti-Bailout Leader to Meet French, German Left, AFP Says. Alexis Tsipras, the head of Greek anti-bailout party Syriza, will hold a meeting tomorrow in Paris with Jean-Luc Melenchon, leader of France’s radical left party, and Pierre Laurent, president of the European left party of which Tsipras is vice president, Agence France-Presse said. Tsipras will also stage a press conference with Laurent and Melenchon before traveling to Berlin on May 22 to meet with Klaus Ernst and Gregor Gysi, co-presidents of Germany’s Die Linke party, AFP reported, citing Athens-based Syriza.

- Germany’s Bosbach Says Greece Should Leave Euro Area, WiWo Says. Wolfgang Bosbach, chairman of the domestic affairs committee in Germany’s lower house of Parliament, or Bundestag, said Greece should leave the euro region to overhaul its economy, WirtschaftsWoche reported, citing an interview. “That would clear the way for new growth,” Bosbach was quoted as saying in an e-mailed pre-release of a story that will run in the May 21 issue of the German magazine. “Then we could also talk about some kind of European Marshall Plan for Greece.”

- Thomas Cook Says German Vacationers Shun Greece, Euro Reports. German vacationers are avoiding Greece amid violent protests over the country’s response to the fiscal crisis, even as tour operators offer discounts, Euro am Sonntag reported, citing an interview with Michael Tenzer, tourism chief at Thomas Cook Group Plc. German bookings for Greece until the beginning of the summer season fell 30 percent from a year earlier, Tenzer told the newspaper. Thomas Cook is passing on discounts of as much as 20 percent from airlines and hotel operators, he said.

- EU Plans to Phase Out Solar, Wind-Energy Subsidies, FAZ Reports. The European Commission plans to phase out solar and wind-power subsidies as soon as possible, Frankfurter Allgemeine Zeitung reported, citing a strategy paper Energy Commissioner Guenther Oettinger will present next month in Brussels. European Union countries have to increase the flexibility of their plans and reduce subsidies because renewable energy technology has developed much faster than expected and prices have dropped, the newspaper said, citing the paper.

- Greek Euro Exit May Deepen U.K. Recession, Chote Tells Guardian. A Greek exit from the euro would send the U.K. into a recession equal to the downturn in 2008 and 2009, Robert Chote, chairman of the U.K.’s Office for Budget Responsibility, told the Guardian in an interview. “The concern is that you end up with an outcome in the euro zone that creates the same sort of structural difficulties in the financial system and in the economy that we saw in the past recession,” Chote told the newspaper. “That has consequences both for hitting economic activity in the economy, but also its underlying potential.” Chote said the deepening crisis in the euro area may force him to revise his forecast made two months ago that the U.K. economy would grow 0.8 percent this year. A second deep recession may cause permanent damage to the economy, he said. “You go down and you never quite get back up to where you started,” he told the Guardian.

- Spanish Prosecutor Calls for Probe of Savings Banks, Europa Says. Spain’s state prosecutor, Eduardo Torres-Dulce, has called for an investigation into the management of the nation’s savings banks, Europa Press reported, citing an interview. Torres-Dulce ordered the anti-corruption prosecutor, Antonio Salinas, to investigate “penal responsibility that may derive from the management of the savings banks,” the Madrid- based news service reported.

- France May Nationalize Mortgage Lender CCCIF, Sunday Times Says. France may nationalize Caisse Centrale Credit Immobilier de France, one of its largest mortgage lenders, the Sunday Times reported, citing unidentified people with knowledge of the matter. A purchase of CCCIF by a competitor may be another option and HSBC Holdings Plc (HSBA) has been asked to find a buyer, the newspaper said.

- JPMorgan's(JPM) Home-Loan Debt in Europe Increases Anxiety: Mortgages. JPMorgan Chase & Co. holdings of home-loan bonds from outside the U.S. soared 35-fold in the past three years. Now, with its chief investment office facing scrutiny after a $2 billion trading loss, investors are raising concern the European market’s biggest buyer will pull back. The largest U.S. bank by assets accelerated its purchases last quarter, adding $8.5 billion to lift its total to $74.5 billion, according to regulatory filings. The New York-based company’s investments approached 9 percent of the size of the Dutch and U.K. mortgage-bond markets it’s been focusing on. “If they stop buying, it would be pretty bad as they are one of the major buyers at the moment,” said Frank Erik Meijer, head of asset-backed securities at The Hague-based Aegon Asset Management, which manages 220 billion euros ($280 billion). “If they need to sell, that would certainly give rise to quite some” increases in yields relative to benchmark rates. JPMorgan bolstered prices and issuance when Europe’s lenders were forced to shrink and other potential buyers shunned asset-backed notes after U.S. subprime mortgage debt sparked a global credit crisis, according to six people at banks and investment firms active in the home-loan bond market who declined to be identified because they were speaking about a competitor. Chief Executive Officer Jamie Dimon, 56, last month described the securities as part of the chief investment office’s “very conservative” holdings, four weeks before announcing an unrelated $2 billion derivative loss that highlighted the division’s influence in certain credit markets.

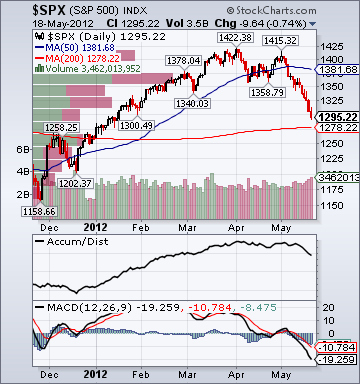

- S&P 500 Falls at 3 Times 2011 Rate As May Losses Deepen. Investors who warned stock losses in May would mimic last year’s decline in the Standard & Poor’s 500 Index (SPX) from the highest level since 2008 were wrong. The losses are three times worse. About $1 trillion has been erased from American equity values this month after speculation Greece will leave the euro region reversed the biggest first-quarter rally since 1998, according to data compiled by Bloomberg. That compares with $345 billion in the 13 days after April 29, 2011, when the S&P 500 reached its highest level in three years. Faltering stocks, reports showing weaker economic growth and concern about the economic health of countries from Spain to Italy is reminding investors of 2011, one of the most volatile years on record as the S&P 500 dropped as much as 19 percent. Investors bracing for a retreat pulled $18 billion from U.S. equity mutual funds in April, the most since at least 1984, according to the Investment Company Institute. “We are looking at bigger risks,” Peter Sorrentino, a fund manager who helps oversee $14.7 billion at Huntington Asset Advisors in Cincinnati, said in a telephone interview yesterday. “Unlike last year, where we had some time to kick the can down the road and there was room for hope, this year is worse because it looks like Europe is hitting the wall and the can’s not gonna go any further.”

- Investors Least Bullish in 2012 as Crisis Escalates: Commodities. Hedge funds reduced wagers on a rally in commodities to the lowest this year on mounting speculation that Greece will leave the euro, slowing global growth and curbing demand for everything from copper to soybeans. Money managers reduced net-long positions across 18 U.S. futures and options by 15 percent to 616,841 contracts in the week ended May 15, the lowest since Dec. 27, Commodity Futures Trading Commission data show. Gold bets fell for a second week and to the lowest since December 2008, while copper holdings tumbled 69 percent, the most in five weeks. Cotton wagers tumbled to the lowest in five years.

- Justice Department Probe of Credit Swaps Said to Widen. The U.S. Justice Department is expanding its antitrust investigation into data provider Markit Group Ltd. to include other companies in the credit-default swap market, according to three people familiar with the matter. Investigators are asking market participants about firms that are owned by Wall Street’s largest banks and whether that presents conflicts of interest, said the people, who spoke on condition of anonymity. The Justice Department is also asking about Tradeweb LLC and The Clearing Corp., which was bought by Atlanta-based Intercontinental Exchange Inc. (ICE) in 2009.

- Asia Currencies to Extend Slide as Slump Deepens, Citigroup Says. Asian currencies are poised to keep falling after the biggest decline in eight months as the region’s economy slumps more than investors expect, spurring more interest-rate cuts, according to Citigroup Inc. Volatility will increase as Europe’s debt crisis hurts demand for Asian exports and prompts global money managers to favor the dollar’s safety over riskier assets, said Nadir Mahmud, the head of Asia-Pacific markets at Citigroup in Singapore, which ranked second in worldwide currency trading volume after Deutsche Bank AG in a Euromoney Institutional Investor Plc (ERM) survey. He has spent 26 years in the industry and oversees a team of more than 1,500 staff in 17 countries. “The slowdown in Asia which we’ll see in the very near term will catch the markets off guard,” Mahmud said in a May 16 interview. “What you will see is an up move in the dollar and a down move in interest rates which most people are not expecting.”

- JPMorgan(JPM) Risk Overseer Said To Have Trading Losses Record. Irvin Goldman, who oversaw risks in the JPMorgan Chase & Co. (JPM) unit that suffered more than $2 billion in trading losses, was fired by another Wall Street firm in 2007 for money-losing bets that prompted a regulatory probe, three people with direct knowledge of the matter said. JPMorgan appointed Goldman in February this year as the top risk official in its chief investment office while the unit was managing trades that later spiraled into what Chief Executive Officer Jamie Dimon called “egregious,” self-inflicted mistakes. The bank knew when it picked Goldman that his earlier work at Cantor Fitzgerald LP led to regulatory sanctions against Cantor, according to a person briefed on the situation.

- Afghanistan Commitment Tests Obama's Influence In NATO. President Barack Obama faces the task of persuading financially pressed European governments and their war-weary citizens to back Afghanistan’s security over the next decade. Obama met this morning in Chicago with Afghan President Hamid Karzai, who is sometimes harshly critical of his NATO allies. Obama is seeking to prevent a rush to withdraw from Afghanistan by U.S. allies ahead of 2014, when Afghan forces are to take over full security. The U.S. also wants allies, many enduring budget cuts, to help cover the $4.1 billion a year needed to finance Afghan security forces after 2014.

- For Some, Disaster Is Spelled CDS. Figuring in the 2008-2009 financial crisis and the recent $2 billion blowup at JPMorgan Chase, this form of risk insurance often has turned out to pose a risk itself.

Wall Street Journal:

- Austerity Plan Is Key for Athens, EU Chief Says. Greece shouldn't expect its international lenders to back down with any significant concessions to the austerity program it agreed on earlier this year, the head of the European Union executive said after he attended the Group of Eight summit at the U.S. presidential retreat here.

- Critics: Chesapeake's(CHK) Murky Books Obscure Costs. As investors struggle to assess the health of embattled natural-gas producer Chesapeake Energy Corp., some say they are facing an obstacle: the company's accounting. Chesapeake, which pumps more gas in the U.S. than any company besides Exxon Mobil Corp., accounts for its exploration and drilling expenses using a method that accounting experts say is generally more aggressive and less transparent than the approach many other big energy companies use.

- A Few Disconnects in CEO Pay. Some Delivered More Bang for the Buck, While Others Were Well Rewarded Despite Poor Results.

- German Wages Are on the Upswing.

Marketwatch.com:

Business Insider:- Chinese Dissident Arrives in U.S.: Reports. Chen Guangcheng, the Chinese dissident whose escape from 19 months of house arrest has tested Chinese-U.S. relations, has arrived in the U.S., ending a month-long diplomatic dispute, according to media reports.

- The Knives Come Out For Popular Democratic Mayor Cory Booker. Cory Booker seemed to shock the left this morning on "Meet the Press." Calling himself an "Obama surrogate," he said this when asked about the Obama campaign's attack ads this week on Mitt Romney's record at Bain Capital: “I’m not about to sit here and indict private equity. To me, we’re getting to a ridiculous point in America. "Especially that I know I live in a state where pension funds, unions and other people invest in companies like Bain Capital. If you look at the totality of Bain Capital’s record, they’ve done a lot to support businesses, to grow businesses. And this, to me, I’m very uncomfortable with.” Heads started to roll. Keith Olbermann tweeted that Booker "may have done progressive things, but he believes in nothing but Cory Booker." The left-heavy Think Progress went with an unflattering "Booker attacks Obama" headline for the "popular, progressive mayor" from Newark. Truth is, though, that Booker has always been thought of as something of a "moderate" or "centrist" Democrat, despite being perhaps their favorite rising star.

- Traders Are Flipping Out Over Facebook(FB) SNAFU, And Want $100 Million From The NASDAQ(NDAQ).

- Goldman(GS) Identifies Which Economic Indicators Really Matter.

- JPMorgan's Potential Trading Loss Just Keeps Spiraling Higher.

- Crumbling BRICs... And Why The Developed World Is Not "Taking Off" Either. (graphs)

- The Mortgage Crisis Hits France Front And Center: Are French Bank Nationalizations Imminent? (graphs)

- Europ'e Firewall Is Insufficient - A One Chart Explanation.

CNBC:

- China Buyers Defer Raw Material Cargos. Chinese consumers of thermal coal and iron ore are asking traders to defer cargos and – in some cases – defaulting on their contracts, in the clearest sign yet of the impact of the country’s economic slowdown on the global raw materials markets. The deferrals and defaults have only emerged in the last few days, traders said, and have contributed to a drop in iron ore and coal prices. “We have some clients in China asking us this week to defer volumes,” said a senior executive with a global commodities trading house, who warned that consumers were cautious. “China is hand to mouth at the moment.”

- Rising Greek Political Star, Foe of Austerity, Puts Europe on Edge. At 37, and looking not a bit his years, Alexis Tsipras is clearly enjoying his moment. He vaulted to prominence less than two weeks ago, when his previously obscure left-wing party placed second in national elections with the promise of repudiating the loan agreement Greece’s previous leaders signed in February. Since then, he has engaged in a high-stakes game of chicken with Europe’s leaders. While they have scrambled to put together contingency plans in case Greece exits the euro zone, Mr. Tsipras has calmly stated his case and let the rest of Europe sweat about the possibly disastrous ramifications if it does. “It’s true,” he said Friday, with a smile and a glint in his eye, during an interview in his small office in the Greek Parliament. “I like to play poker.” While Mr. Tsipras clearly has much of Europe on the run, he hardly seems to be breaking a sweat. “Our goal isn’t to blackmail or to terrorize, our goal is to shake them,” Mr. Tsipras said coolly of the foreign lenders whose austerity-for-loans deal he wants upended. “We want to convince them,” he said. “They need to change the policies in Greece and change the policies in Europe, otherwise Europe will be at very large risk.” In Mr. Tsipras’s view — which neatly dovetails with the rising anti-austerity tide across Europe — Greece’s problem is a European problem that needs a European solution. He insisted that he wants Greece to stay in the euro, just not under the terms of its current bailout. “The euro zone is a chain with 17 links,” he said, referring to its members. “Greece is one of these links. If one of these links breaks, the link is destroyed, but the chain falls apart, too.” Poker references aside, Mr. Tsipras insisted that it was really the financial markets driving much of the crisis, not him or Greece. “They don’t have any moral scruples, and if they push Greece out, they’ll just move on to the next country,” he said. The next countries in the firing line, he added, happen to be Italy and Spain — both too big to fail.

- Obama: Stop Condescending to Women by Campbell Brown.

- Ex-Paulson Partner Launching Own Hedge Fund. John Paulson’s stubborn bullishness cost the hedge fund superstar billions of dollars last year. Now one of the partners overseeing the bank stocks that dragged the firm down is starting a hedge fund of his own. Robert Lacoursiere, a former partner and head of global banks at Paulson, is launching equity hedge fund Petrarca Capital. He’s teaming with former Paulson & Co. colleague James Fotheringham, who was a senior vice president in the bank group. The new fund will also invest in financial stocks.

Washington Times:

- Occupy Chicago Protests Rahm Emanuels House (video). Protesters gathered at a Chicago Transit Authority el station near Chicago Mayor Rahm Emanuel’s home this morning. They were starting a morning and afternoon of awareness about mental health issues. They are protesting the closing of several mental health clinics throughout the city, blaming Mayor Emanuel.

- Samsung Sees Slowdown in China Demand for Technolo0gy Goods. China's market for technology products may grow 7% this year, compared with 10% in 2011, citing Kim Young-ha, Samsung Electronics China CEO. The end of subsidies introduced by China to boost sales of electronic appliances is one of the reasons for weakening demand and "a bigger impact comes from lower consumer sentiment," he said.

- US and UK Eye Reaction to Bank Failure. Regulators and central bankers in the US and UK are crafting the world’s first concrete plans to protect the broader financial system in the event that any of seven leading cross-border banks were to collapse. The “resolution plans”, being worked on by the Bank of England and the Financial Services Authority in the UK and the Federal Deposit Insurance Corporation in the US, have focused on “top-down bail-in” measures. These would see the authorities take over a failing group and force its shareholders and bondholders to take losses while keeping critical operating companies open.

The Telegraph:

- The Most Pro-European Thing To Do Now Is Reject The Euro. Those readers who have been berating me for years for even considering the possibility of a country leaving the euro have recently fallen silent. (You know who you are.)

- Multinationals Sweep Euros From Accounts On Daily Basis. When it comes to contingency planning for a eurozone break-up, it is typically a German company that has been ahead of the game.

- Cracks Are Appearing In Europe's State-Backed Lenders. European taxpayers face having to bankroll a new wave of bailouts amid growing funding problems at state-backed borrowers across the region, according to senior bankers.

The Independent:

- UK Warned of Credit Downgrade. The UK will lose its prized triple-A credit rating next year as a result of the recession and the euro crisis, according to one of the City's most respected bond fund managers. Richard Hodges, the manager of the Legal & General dynamic bond trust, said in the light of the euro sovereign debt crisis: "The question isn't will the UK be downgraded, but when? The ratings agencies haven't moved partly because they have bigger fish to fry. But as this crisis plays out it is inevitable that they will downgrade the UK, with its huge current account deficit, by 2013 at the latest."

The Guardian:

- Santander UK Funds Ringfenced Under FSA Order. Santander UK has been prevented from transferring any cash back to its Spanish parent company since December under a voluntary agreement with the Financial Services Authority. The so-called "regulatory order" means that Santander UK needs the regulator's permission to transfer cash, underlining Santander UK's claim that its assets are ringfenced from its parent company. Concerns about the health of Spain's banks were growing following the mass downgrade by Moody's late on Thursday.

Sunday Times:

- One third of British-owned homes in Greece and Spain have been put up for sale as the European debt crisis escalates, citing a report by HiFx, a foreign-exchange company. Thirty-nine percent of British property owners in Greece, and 34% in Spain are seeking to sell, about twice the normal rate, according to HiFx research. The value of homes in Greece would probably plunge 50% if the country exits the euro, citing HiFx.

Der Spiegel:

- EU Ministers Doubtful About Greek Euro Membership. Luxembourg Prime Minister Jean-Claude Juncker, who heads a group of European finance ministers, said a majority of his peers have doubts about Greek membership of the euro. "If we had a secret vote about Greece remaining in the euro zone we'd have an overwhelming majority against it," the magazine quotes Juncker as telling Greek Finance Minister Filippos Sachinidis at a May 14 meeting in Brussels. Elections on June 17 are Greece's "last chance," and if no government can be formed to implement the agreed reform program "it is over," Juncker said.

- French President Francois Hollande has "strong doubts" about plans to appoint German Finance Minister Wolfgang Schaeuble as chief of the Eurogroup.

NZZ am Sonntag:

- Switzerland is seeing "enormous" investment inflows because of increasing concern about the future of the euro zone, citing a major business partner of UBS AG. Swiss financial market inflows were as much as 400% higher than normal on some days during the past week.

Cinco Dias:

- Spain plans to reduce the number of public workers in its 2013 budget as a result of closing down public companies and foundations, citing people in the ruling People's Party it didn't name.

Sunday Business Post:

- Irish home loans in arrears for more than 90 days may have risen to 10.5% in the first quarter from 9.2% at the end of last year, citing "informed sources".

Commercial Times:

- Apple(AAPL) will probably ship 10m iPad Mini tablet computers this year, more than 6m previously planned.

Financial News:

- China Cut of RRR Doesn't Imply 'Loosening'. China lowering its reserve requirement ratio doesn't imply that monetary policy has entered a "loosening phase," according to a commentary published in the Financial News newspaper by Xu Shaofeng. The commentary reiterated Chinese central bank governor Zhou Ziaochuan's comment that changes to the reserve requirement ratio are mainly for adjustment to market liquidity.

Weekend Recommendations

Barron's:- Made positive comments on (CPMK), (HES), (JCP) and (NEM).

- Made negative comments on (FB).

- Asian indices are -.25% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 199.50 -2.0 basis points.

- Asia Pacific Sovereign CDS Index 161.0 +5.5 basis points.

- FTSE-100 futures -.03%.

- S&P 500 futures +.51%.

- NASDAQ 100 futures +.65%.

Earnings of Note

Company/Estimate

- (TECD)/1.16

- (CPB)/.52

- (TDW)/.60

- (URBN)/.20

- (LOW)/.42

- None of note

Upcoming Splits

- (FMC) 2-for-1

- The Chicago Fed National Activity Index for April, Deutsche Bank Financial Services Conference, UBS Oil/Gas Conference, Janney Consumer Conference and the Wells Fargo Gaming Conference could also impact trading today.