Style Outperformer:

Sector Outperformers:

- 1) Oil Service +3.63% 2) Gaming +1.28% 3) Airlines +.89%

Stocks Rising on Unusual Volume:

Stocks With Unusual Call Option Activity:

- 1) GT 2) CTXS 3) ABT 4) MNST 5) JNJ

Stocks With Most Positive News Mentions:

- 1) SSI 2) COG 3) PG 4) LUFK 5) GS

Charts:

Weekend Headlines

Bloomberg:

- Liquidity Carpet Bombs Fueling Asset Bubbles, Rohde Says. Policy makers steering the global

economy have pumped the financial system with so much liquidity

that any exit risks popping potential asset bubbles or stunting

a recovery, Danish central bank Governor Lars Rohde said. “The risk is we stay in this climate too long

and that the

carpet bombing of liquidity spurs inflation,” Rohde, 59, said in an

April 5 interview from his office in Copenhagen. Though there are no

current signs of consumer price inflation “there is inflation, perhaps a

bubble, in some asset classes,” he said. “Equities (MXWO) are

trading close to all-time highs. Segments of property markets across the

globe, for example London, also display symptoms of this. How do we

exit this without killing whatever nascent recovery there might be at

that time?” The warning from the head of Denmark’s central bank, which

has kept its deposit rate below zero since July, comes as policy makers

in Japan, the euro area and the U.S. deliver unprecedented monetary

stimulus to drag the global economy out of the worst crisis since the

Great Depression. Easy money has fueled equity prices, helping send the

Standard & Poor’s 500 Index to an all-time high on April 2. The

yield on Japan’s benchmark 10-year bond hit its lowest on record last

week. “We’re in a landscape where we’ve never been before, with

regard to extreme monetary accommodation over a very, very long

period of time,” said Rohde, who took over as the head of

Denmark’s central bank in February. “What does that end up

doing to a society? It’s been a necessary policy, but I have my

concerns about what the long-term risks are.”

- Portugal Plans More Spending Cuts After Court Ruling on Salaries. Portugal will carry out more

spending cuts this year after the Constitutional Court blocked a

plan to suspend a monthly salary payment to state workers and

pensioners. “I will give instructions to the ministries to proceed

with the necessary reductions in operating expenses to

compensate for what was blocked by the Constitutional Court’s

ruling,” Prime Minister Pedro Passos Coelho said in Lisbon

yesterday. “The government does not accept more tax increases,

which seems to be the solution that the Constitutional Court

favors in its interpretation.” Passos Coelho is battling rising joblessness and lower

demand from European trading partners as he cuts spending and

raises taxes to meet the terms of the country’s 78 billion-euro

($101 billion) aid plan from the European Union and the

International Monetary Fund. The government on March 15

announced wider deficit targets as it forecast the economy will

shrink twice as much as previously estimated this year. The Constitutional Court’s ruling delays completion of the

seventh review of the aid plan, and the corresponding

disbursement of 2 billion euros won’t be paid until that review

is concluded, Passos Coelho said.

- Cyprus Woes Threaten East Europe Growth, Development Bank Says. Cyprus’s

bailout threatens slowing

eastern European growth through trade and banking links if it

sparks capital flight from the most indebted euro-area nations, the

European Bank for Reconstruction and Development said. Another bout of

uncertainty in Europe’s debt crisis may boost financing costs for banks

and potentially trigger an outflow of “large” deposits and funding in

countries with weaker lenders or sovereigns, EBRD Deputy Chief Economist

Jeromin Zettelmeyer said in an April 5 interview in London. Eastern

Europe relied on foreign capital flows and easy access to credit and

export markets to fuel growth of more than 5 percent a year before the

global crisis of 2008. The Cyprus bailout, where international creditors

forced losses on large depositors in exchange for a 10 billion-euro

($12.8 billion) aid package, may lead to capital flight and weaker

growth in countries such as Italy and Spain, Zettelmeyer said.

“These are very important countries and they are very large and so if

there’s a slowdown in the EU as a result of this

it would certainly affect” the 29 eastern European countries

where the EBRD lends, he said. “The risks are higher than we

thought and they are further to the downside than what we

thought.”

- Slovenia Bailout Signaled by Worsening Debt Swaps: Euro Credit. Slovenia’s creditworthiness is

deteriorating at the fastest pace in the world after Cyprus as

investors speculate a banking crisis will force it to follow the

island nation and become the sixth euro country to need aid. Credit-default swaps insuring Slovenian debt for five years

soared as much as 66 percent to a six-month high of 414 basis

points on March 28 from 250 on March 15, the last trading day

before Cyprus announced plans for its rescue. It’s now up 35

percent at 338 basis points, compared with a 54 percent increase for Cyprus and 13 percent for Portugal in the period.

Slovenia’s two-week old government is struggling to prop up

banks hit by recession and saddled with bad loans worth about a

fifth of the country’s economic output.

- Chinese President Xi Jinping says nation will firmly uphold its sovereignty and territorial integrity. Stability in Asia faces huge challenges, he said. The

global economy has entered a period of profound readjustment,

protectionism is rising and economic recovery remains elusive, Xi says.

- Local Chinese government debt may be more than 20t yuan, Xiang

Huaicheng, former minister of finance, says at the Boao Forum for Asia.

China's National Audit Office said in 2011 report that local government

debt was 10.7 trillion yuan.

- IPO Bankers Become Frogs in Hot Water Amid China’s Market Freeze. Shen

Wei, one of the first 600

investment bankers authorized to sign off on initial public offerings in

China, said the license that made him one of the “golden collared” has

lost its magic. The teacher’s son studied 14-hours a day for a month in 2004 to qualify after China’s securities regulator mandated that

two so-called baodai, or sponsor representatives, conduct due

diligence and sign off on every IPO to curb fraud. Demand for

such bankers is now being eroded by a freeze on IPOs, a surge in

people getting licensed and an easing of underwriting rules.

- China’s Stocks Fall 10% From February High on Bird Flu Concern.

China’s stocks fell after a two-day holiday, dragging the benchmark

index down 10 percent from a February high, amid concern a bird flu

outbreak and property market curbs will hurt the nation’s economic

recovery. A gauge of property shares in Shanghai slid the most in a

month and China Vanke Co. slumped 4 percent after Beijing increased the

minimum downpayment on purchases of second homes. Air China Ltd. and

China Southern Airlines Co. dropped at least 5 percent on speculation

flu deaths may deter people from traveling. Hualan Biological

Engineering Inc. (002007) led gains for health-care companies. The

Shanghai Composite Index (SHCOMP) tumbled 1.9 percent to 2,183.97 at

9:43 a.m. local time, heading for the biggest loss

since March 28. The CSI 300 Index slid 2 percent to 2,434.93.

- China Pressure Key to Ease North Korea Tension, McCain Says.

China should use its economic and

political clout to calm tensions with North Korea and help guard against

an accidental escalation into armed conflict, Arizona Republican

Senator John McCain said. “China does hold the key to this problem,”

McCain said

yesterday on CBS’s “Face the Nation” program. “China can cut

off their economy if they want to.”

- BHP(BHP) Sees Copper Surplus on Weaker Demand, Growing Mine Supply. BHP

Billiton Ltd. (BHP), the world’s largest mining company, said copper

supplies may exceed demand this year and next on growing stockpiles and

as the Melbourne- based company ramps up output at its Escondida mine in

Chile. It’s “possible” that the market may have a “small surplus”

of supply in 2013 and 2014, Peter Beaven, head of the company’s base

metals operations, told reporters in Santiago April 4. Escondida’s

output will grow 10 percent a year through 2015 when it reaches a record

1.3 million metric tons, he said. As copper executives gather in

Santiago this week for an annual dinner organized by industry group

Cesco, Chile, the top producer, sees slowing demand growth in China, the largest

consumer of the metal, Mining Minister Hernan de Solminihac said

in an April 4 interview. Global copper usage will trail supplies

by 97,000 metric tons this year, Barclays Plc said April 4.

- Fisker’s Job Cuts Fuel Political Debate on Green Energy Projects. Fisker

Automotive Inc.’s mass firings after receiving federal loans to build

luxury plug-in cars is adding to the political debate over the U.S.

government’s funding of clean-energy programs. Most of the assets of

Fisker’s battery supplier that received a $249.1 million federal grant,

the former A123 Systems Inc., were acquired last year by a Chinese

company. Now Fisker, awarded $529 million in U.S. loans, is firing 75

percent of its workforce after failing to secure a deal with an

automotive partner to fund operations. The debacle is reviving questions

over whether the government should be funding makers of alternative

energy ventures. Fisker and A123, whose bankruptcy halted Fisker’s

output, have drawn Republican criticism of President Barack Obama’s

support of green-energy programs intended to spur more fuel-efficient

cars. “The Department of Energy has never owned up to its mistakes and

acknowledged it didn’t do a good job of choosing Fisker and A123 as

worthy of taxpayer investment,” Senator Chuck Grassley, an Iowa

Republican, said in an e-mailed statement. Another Republican, Senator

John Thune of South Dakota, predicted “the company could go bankrupt and

cost millions of taxpayer dollars.”

Wall Street Journal:

- China Fund Chief Raps U.S. CIC's Gao Xiqing Says Some Politicians 'Look at Chinese Investment as Suspect'.

The U.S. is telling China's $500 billion sovereign-wealth fund to "go

away," according to the fund's top executive, in the latest sign of

strained investment ties between the world's two largest economies.

During the financial crisis, "we were sort of welcome" in America,

said Gao Xiqing, head of China Investment Corp., in a panel discussion

on Sunday at the Boao Forum for Asia. Since then, "somehow we've become

stigmatized," he said, adding that "there have been quite a few cases

where the U.S. says 'go away.'"

- Hedge-Fund Star Gets a Hip Check. Jeffrey Vinik's Tampa Bay Lightning are struggling, but

the performance of his National Hockey League team isn't the only worry

for the veteran stock-picker. Investors have asked to pull around $1.5

billion from his hedge-fund firm after a period of poor performance,

according to people briefed on the matter. The withdrawal requests

amount to around 18% of the roughly $8 billion that was run by Vinik

Asset Management. Vinik Offshore Fund, which bets on and against stocks,

gained just 0.3%

from July last year through February, according to a March investor

presentation viewed by The Wall Street Journal.

- Disability Fund to Be Depleted by 2016. Even as more people in the U.S. rely on disability benefits, the program

that pays them is running into a problem: there isn’t enough money

coming in to cover the amount that’s going out.

- Syria's Escalating War Bleeds Into Lebanon. Sectarian Tensions Prompt Resignation of Prime Minister in Beirut, as Rival Sunni, Shiite Factions Back Foes Next Door. Syria's civil war, two years in the making, has come to neighboring Lebanon.

Assassinations, firefights and

skirmishes are pulling rival Sunni and Shiite factions here into a

confrontation that threatens to tear Lebanon apart.

- Investors Bankroll Lawsuits. Law would seem to be the furthest thing from a growth industry these

days. But a certain class of investors sees one aspect—big commercial

lawsuits—as an increasingly good bet. A new generation of investors is plunging into "litigation finance,"

putting up millions of dollars to fund lawsuits in hopes of collecting

when verdicts come down. Established financiers are expanding into new

areas, including loans to law firms, and finding clients among the

biggest American companies. Law firms themselves are starting to jump on the bandwagon, too. They

are seeking funding arrangements for clients who need help going after

opponents with deeper pockets, or simply want to keep litigation costs

off their balance sheets.

- Big Question in U.S. vs. S&P. Why is the U.S. government trying to obtain billions of dollars in

damages from Standard & Poor's Ratings Services for allegedly

slipshod work on mortgage-linked securities, but nothing from rival

Moody's?

- Reflections of a Medical Ex-Practitioner. The glow of the personal relationship with patients is being extinguished. A fundamental principle in medicine is that if you get the diagnosis

wrong, you'll probably apply the wrong therapy. A corollary is that if

the therapy isn't working, increasing the dose may make things worse.

That's where we are with ObamaCare.

There are shortcomings aplenty in the

health-care field, and changes and improvements are required. But never

have I seen so many good intentions leading irreversibly to hell.

Fox News:

- Family mourns 25-year-old US diplomat killed in Afghanistan. Anne Smedinghoff had a quiet ambition

and displayed a love of global affairs from an early age, joining the

U.S. Foreign Service straight out of college and volunteering for

missions in perilous locations worldwide.

So when the 25-year-old suburban Chicago woman was killed Saturday in

southern Afghanistan — the first American diplomat to die on the job

since last year's attack in Benghazi, Libya — her family took solace in

the fact that she died doing something she loved.

CNBC:

Business Insider:

Reuters:

- Pension underfunding grows despite U.S. market rally: study. The gap between what major corporations will owe retired workers and how

much they have put aside grew last year despite a strong stock market

rally, according to a study set to be released on Monday by Wilshire

Associates. The cumulative liability among defined benefit pension

plans sponsored by companies in the benchmark Standard and Poor's 500

index increased to $1.56 trillion in 2012 from $1.38 trillion the year

before, outpacing the growth in assets. As a result, the overall funding

ratio - a measure of a plan's assets divided by its commitments - for

all plans fell from 79.7 percent to

78.1 percent, the study found. Low interest rates -

which are used to calculate future benefits - were a significant factor

behind the increase in pension liabilities, said Russell Walker, a vice

president at Wilshire and one of the authors of the report. Mergers and

acquisitions also increased pension funding liabilities.

- Hedge funds' bullish commodity bets down most since Feb. Hedge

funds and other big speculators have cut their bullish bets on

commodities by the most since February, trade data showed on Friday,

amid signs of stagnating U.S. economic recovery and uncertainty over raw

materials demand. Money managers slashed by $9.7 billion their

net-long holdings across 22 commodities to $59.7 billion during the week

to April 2, according to Reuters calculations of data released by the

Commodity Futures Trading Commission (CFTC). The last time net-long

managed money in those markets fell by more was during the week to Feb.

19, when there was a drop of $12.9 billion. Corn, gold and soybeans accounted for nearly 80

percent of the latest decline.

- Italy's centre left divided over nemesis Berlusconi. Two months after placing first in

a vote but falling short of winning power, Italy's main

centre-left party is still divided over whether to swallow its

animosity and consider a government with its scandal-plagued

nemesis, Silvio Berlusconi.

Telegraph:

Welt am Sonntag:

- Central

banks in Italy and Spain may be excessively liberal in applying ECB

collateral rules. Central banks systemically applied sovereign rating to

government-guaranteed bank bonds instead of rating for bank that issued the bonds. Banks using government-backed bank bonds as collateral in Italy and Spain have theoretical financing advantage of as much as EU12.4b using that interpretation of which ratings apply.

- France Crisis Risk Underestimated, Economist Mayer Says. French financial securities could be valued with a higher risk premium than Italian ones, based just on fundamental

data, Thomas Mayer, an economic adviser to Deutsche Bank AG, writes.

Market reaction to risk still small, not putting on "necessary pressure

for reforms," he said. Following analysis of current-account balances,

national debt, budget deficits, bank industries, France lags behind in all areas apart from size of financial sector.

Deutschlandfunk:

- Weidmann Sees

EU Crisis Lasting 'Awhile'. Economic crisis build up over a very long

period, and addressing structural causes will also take time, Bundesbank

President Jens Weidmann said today. Bond-purchasing programs only treat symptoms of crisis. "Chain of liability" should be established to protect taxpayer. The crsis will be solved by politicians by addressing structural causes and no through monetary policy.

Der Spiegel:

- ILO Warns Against Growing Social Unrest in EU. International

Labor Organization to present study at Oslo conference tomorrow on

possible public reaction to EU economic crisis. ILO sees 12 percentage

point higher risk of social unrest than before sovereign debt crisis

emerged, with increases particularly pronounced in Cyprus, Greece,

Portugal and Italy.

Jiji Press:

- Japan Issues N. Korea Missile Interception Order.

Japanese Defense Minister Itsunori Onodera ordered the Self-Defense

Forces on

Sunday to shoot down what is thought to be a North Korean ballistic

missile or

its debris threatening Japanese territory, government officials said.

Following the order, issued on the basis of the SDF law, the SDF is now

authorized to carry out an interception operation above Japanese

territory or

the high seas.

Xinhua:

- Soros Says Investment in China Properties 'Risky' Now. Apartments

in China are now a risky investment, George Soros, the retired chairman

of Soros Fund Management and founder of Quantum Fund, was quoted as

saying. A lot of empty apartments in China will have to be sold, or

maybe taxed, Soros said. Imposing a property tax would be "very

effective" and may create a crash, Soros was cited as saying.

China Daily:

- China shouldn't loosen regulations on Apple Inc.(AAPL) because

the company has issued an ap0logy to Chinese consumers, citing an

official from the State Administration for Industry and Commerce.

China Securities Journal:

- China should impose taxes on existing homes to ease the impact of

unequal wealth distribution after rapid rise in property prices,

according to a commentary published today written by Jia Kang and Su

Jingchun.

- Beijing will likely raise the down payment requirement to 70% for

buyers taking bank loans for buying second homes, citing people

familiar with the matter.

Weekend Recommendations

Barron's:

- Bullish commentary on (UTX).

Night Trading

- Asian indices are -.75% to +.75% on average.

- Asia Ex-Japan Investment Grade CDS Index 121.0 -.5 basis point.

- Asia Pacific Sovereign CDS Index 98.0 +.75 basis point.

- NASDAQ 100 futures +.14%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The Fed's Bernanke speaking, Fed's Pianalto speaking, German industrial production data and China inflation data could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by consumer and automaker shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 50% net long heading into the week.

U.S. Week Ahead by Reuters (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on rising global growth fears, Mideast unrest, Asian tensions, escalating bird flu concerns, more Eurozone

debt angst, earnings worries, profit-taking, technical selling and more

shorting. My intermediate-term trading indicators are giving neutral

signals and the Portfolio is 50% net long heading into the week.

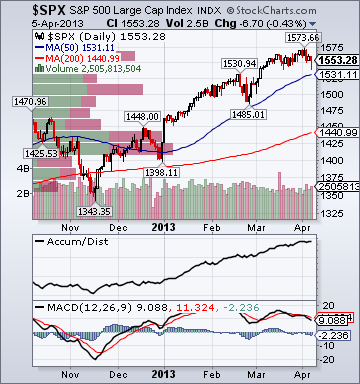

S&P 500 1,553.28 -1.01%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 923.28 -2.97%

- Value Line Geometric(broad market) 398.86 -2.38%

- Russell 1000 Growth 708.02 -1.38%

- Russell 1000 Value 792.25 -.99%

- Morgan Stanley Consumer 964.44 -.95%

- Morgan Stanley Cyclical 1,132.42 -3.33%

- Morgan Stanley Technology 716.96 -2.73%

- Transports 6,037.36 -3.49%

- Bloomberg European Bank/Financial Services 88.39 -2.28%

- MSCI Emerging Markets 41.72 -2.14%

- Lyxor L/S Equity Long Bias 1,147.79 -.09%

- Lyxor L/S Equity Variable Bias 845.05 -.18%

Sentiment/Internals

- NYSE Cumulative A/D Line 178,475 -1.32%

- Bloomberg New Highs-Lows Index -106 -846

- Bloomberg Crude Oil % Bulls 30.77 +15.37%

- CFTC Oil Net Speculative Position 248,850 +1.73%

- CFTC Oil Total Open Interest 1,731,930 +2.26%

- Total Put/Call 1.04 +16.85%

- OEX Put/Call 1.48 -41.50%

- Volatility(VIX) 13.92 +9.61%

- S&P 500 Implied Correlation 55.49 -.54%

- G7 Currency Volatility (VXY) 9.19 -.54%

- Smart Money Flow Index 11,330.68 -.89%

- Money Mkt Mutual Fund Assets $2.631 Trillion +.1%

- AAII % Bulls 35.5 -7.6%

- AAII % Bears 28.2 -1.7%

Futures Spot Prices

- Reformulated Gasoline 286.36 -8.04%

- Bloomberg Base Metals Index 196.13 -2.45%

- US No. 1 Heavy Melt Scrap Steel 368.0 USD/Ton +7.8%

- China Iron Ore Spot 128.0 USD/Ton -6.8%

- UBS-Bloomberg Agriculture 1,477.67 -1.68%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 6.2% -40 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.1411 -5.38%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 114.88 +.20%

- Citi US Economic Surprise Index 4.0 -14.9 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 5/1

- US Dollar Index 82.50 -.60%

- Yield Curve 148.0 -12 basis points

- 10-Year US Treasury Yield 1.71% -14 basis points

- Federal Reserve's Balance Sheet $3.198 Trillion +.41%

- U.S. Sovereign Debt Credit Default Swap 34.62 -8.26%

- Illinois Municipal Debt Credit Default Swap 135.0 -2.87%

- Western Europe Sovereign Debt Credit Default Swap Index 102.72 -2.21%

- Emerging Markets Sovereign Debt CDS Index 200.65 -5.59%

- Israel Sovereign Debt Credit Default Swap 120.41 -3.35%

- South Korea Sovereign Debt Credit Default Swap 87.65 +10.4%

- China Blended Corporate Spread Index 408.0 -5 basis points

- 10-Year TIPS Spread 2.47% -5 basis points

- TED Spread 21.75 +.5 basis point

- 2-Year Swap Spread 15.0 -3.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -17.5 -1.75 basis points

- N. America Investment Grade Credit Default Swap Index 88.10 -2.91%

- European Financial Sector Credit Default Swap Index 175.44 -9.72%

- Emerging Markets Credit Default Swap Index 252.71 -4.81%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 116.0 -19.0 basis points

- M1 Money Supply $2.458 Trillion +1.49%

- Commercial Paper Outstanding 1,002.20 -1.90%

- 4-Week Moving Average of Jobless Claims 354,300 +11,300

- Continuing Claims Unemployment Rate 2.4% unch.

- Average 30-Year Mortgage Rate 3.54% -3 basis points

- Weekly Mortgage Applications 790.70 -4.01%

- Bloomberg Consumer Comfort -34.1 +.3 point

- Weekly Retail Sales +3.0% +20 basis points

- Nationwide Gas $3.62/gallon -.02/gallon

- Baltic Dry Index 861.0 -6.62%

- China (Export) Containerized Freight Index 1,107.55 unch.

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 17.50 unch.

- Rail Freight Carloads 233,587 -.87%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (9)

- CONN, OPTR, HUM, AM, STL, TSLA, FORR, GME and TUMI

Weekly High-Volume Stock Losers (11)

- GIII, GIFI, XOOM, GBX, ADT, RPRX, GPN, BCC, TDC, NDAQ and DLLR

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- ISE Sentiment Index 80.0 +15.94%

- Total Put/Call 1.05 -3.67%

Credit Investor Angst:

- North American Investment Grade CDS Index 87.29 -.79%

- European Financial Sector CDS Index 175.44 -2.02%

- Western Europe Sovereign Debt CDS Index 102.72 -.46%

- Emerging Market CDS Index 252.83 -2.19%

- 2-Year Swap Spread 15.0 -.25 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -17.50 +.75 bp

Economic Gauges:

- 3-Month T-Bill Yield .06% unch.

- China Import Iron Ore Spot $135.90/Metric Tonne unch.

- Citi US Economic Surprise Index 4.0 -1.4 points

- 10-Year TIPS Spread 2.47 -2 bps

Overseas Futures:

- Nikkei Futures: Indicating +313 open in Japan

- DAX Futures: Indicating +7 open in Germany

Portfolio:

- Slightly Lower: On losses in my tech/medical sector longs

- Disclosed Trades: None

- Market Exposure: 50% Net Long