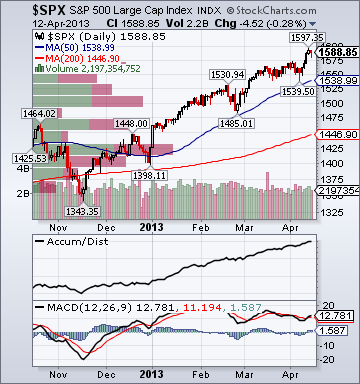

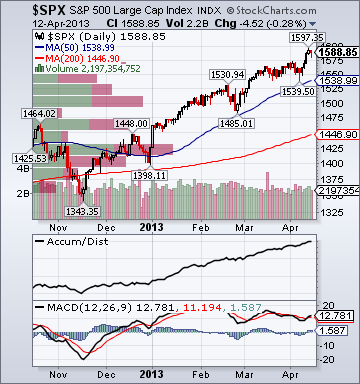

S&P 500 1,588.85 +2.29%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 942.85 +2.12%

- Value Line Geometric(broad market) 407.99 +2.29%

- Russell 1000 Growth 725.81 +2.51%

- Russell 1000 Value 809.11 +2.13%

- Morgan Stanley Consumer 993.18 +2.98%

- Morgan Stanley Cyclical 1,163.24 +2.72%

- Morgan Stanley Technology 733.41 +2.29%

- Transports 6,143.75 +1.76%

- Bloomberg European Bank/Financial Services 91.02 +2.98%

- MSCI Emerging Markets 42.22 +1.20%

- Lyxor L/S Equity Long Bias 1,138.01 -.27%

- Lyxor L/S Equity Variable Bias 842.12 -.55%

Sentiment/Internals

- NYSE Cumulative A/D Line 181,630 +1.77%

- Bloomberg New Highs-Lows Index 871.0 +977

- Bloomberg Crude Oil % Bulls 38.9 +26.4%

- CFTC Oil Net Speculative Position 223,398 -10.2%

- CFTC Oil Total Open Interest 1,768,185 +2.1%

- Total Put/Call 1.14 +9.62%

- OEX Put/Call 2.82 +90.54%

- ISE Sentiment 56.0 -28.21%

- Volatility(VIX) 12.06 -13.36%

- S&P 500 Implied Correlation 51.59 -7.02%

- G7 Currency Volatility (VXY) 9.24 +.65%

- Smart Money Flow Index 11,729.18 +3.52%

- Money Mkt Mutual Fund Assets $2.623 Trillion -.3%

- AAII % Bulls 19.3 -45.6%

Futures Spot Prices

- Reformulated Gasoline 280.18 -2.48%

- Heating Oil 287.18 -1.85%

- Bloomberg Base Metals Index 197.83 +.87%

- US No. 1 Heavy Melt Scrap Steel 368.0 USD/Ton unch.

- China Iron Ore Spot 141.0 USD/Ton +3.75%

- UBS-Bloomberg Agriculture 1,499.98 +1.5%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 6.2% unch.

- Philly Fed ADS Real-Time Business Conditions Index -.3283 +1.38%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 115.13 +.22%

- Citi US Economic Surprise Index 7.8 +3.8 points

- Citi Emerging Mkts Economic Surprise Index -37.7 -8.4 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 5/1

- US Dollar Index 82.31 -.32%

- Euro/Yen Carry Return Index 134.41 +1.71%

- Yield Curve 149.0 +1 basis point

- 10-Year US Treasury Yield 1.72% +1 basis point

- Federal Reserve's Balance Sheet $3.210 Trillion +.39%

- U.S. Sovereign Debt Credit Default Swap 32.50 -5.39%

- Illinois Municipal Debt Credit Default Swap 124.0 -8.29%

- Western Europe Sovereign Debt Credit Default Swap Index 97.26 -3.83%

- Emerging Markets Sovereign Debt CDS Index 186.95 -6.83%

- Israel Sovereign Debt Credit Default Swap 116.61 -3.15%

- South Korea Sovereign Debt Credit Default Swap 82.0 -6.45%

- China Blended Corporate Spread Index 402.0 -6 basis points

- 10-Year TIPS Spread 2.44% -3 basis points

- 2-Year Swap Spread 14.50 -.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -17.75 -.25 basis point

- N. America Investment Grade Credit Default Swap Index 82.85 -5.95%

- European Financial Sector Credit Default Swap Index 167.55 -4.50%

- Emerging Markets Credit Default Swap Index 222.89 -11.80%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 110.50 -5.5 basis points

- M1 Money Supply $2.511 Trillion +2.16%

- Commercial Paper Outstanding 1,021.70 +1.90%

- 4-Week Moving Average of Jobless Claims 358,000 +3,700

- Continuing Claims Unemployment Rate 2.4% unch.

- Average 30-Year Mortgage Rate 3.43% -11 basis points

- Weekly Mortgage Applications 826.10 +4.48%

- Bloomberg Consumer Comfort -34.0 +.1 point

- Weekly Retail Sales +2.90% -10 basis points

- Nationwide Gas $3.56/gallon -.06/gallon

- Baltic Dry Index 875.0 +1.63%

- China (Export) Containerized Freight Index n/a

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 17.50 unch.

- Rail Freight Carloads 231,648 -.83%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (9)

- FSLR, LUFK, TSRO, SPWR, NUS, PICO, FSCI, NGVC and FBC

Weekly High-Volume Stock Losers (10)

- IGTE, INFI, TTEK, BRLI, MG, HMA, FTNT, FFIV, SHLM and TITN

Weekly Charts

ETFs

Stocks

*5-Day Change

Today's Market Take:

Broad Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- ISE Sentiment Index 54.0 -50.0%

- Total Put/Call 1.12 +28.74%

Credit Investor Angst:

- North American Investment Grade CDS Index 81.90 +.32%

- European Financial Sector CDS Index 167.55 +5.4%

- Western Europe Sovereign Debt CDS Index 97.26 +1.5%

- Emerging Market CDS Index 223.32 -.78%

- 2-Year Swap Spread 14.50 +.5 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -17.75 -.5 bp

Economic Gauges:

- 3-Month T-Bill Yield .06% unch.

- Yield Curve 149.0 -7 basis points

- China Import Iron Ore Spot $141.0/Metric Tonne +.07%

- Citi US Economic Surprise Index 7.80 -1.2 points

- 10-Year TIPS Spread 2.44 -3 bps

Overseas Futures:

- Nikkei Futures: Indicating -45 open in Japan

- DAX Futures: Indicating +42 open in Germany

Portfolio:

- Slightly Higher: On gains in my biotech sector longs and emerging markets shorts

- Disclosed Trades: None

- Market Exposure: 50% Net Long

Bloomberg:

- Slovenia to Test Debt Appetite as Financing Pressure Mounts. Slovenia’s government failed to raise 100 million

euros ($131 million) at a debt sale this week. Now it’s shooting for

five times that amount next week. With bond yields

approaching levels that prompted bailouts of other euro nations, the

government will offer 500 million euros of 18-month Treasury bills on

April 17. The International Monetary Fund estimates Slovenia will need

to borrow about 3 billion euros this year to repay maturing debt, aid

banks and finance the budget. The debt sale will test the willingness of investors abroad to finance

Slovenia’s economy as a banking crisis strains the budget, government

bonds plunge and soaring default risk threaten to make the country the

euro region’s sixth bailout recipient after Cyprus last month. The

largest local lenders are state owned and struggling with rising

bad debt.

- Demetriades Says Cyprus Central Bank’s Independence Under Attack. The head of Cyprus’s central bank

said the government is attacking his institution’s independence

at the same time as his family receives death threats from

people who lost money in the country’s recent bailout. “The independence of the central bank of Cyprus is being

attacked at this time,” Panicos Demetriades, who is also a

member of the European Central Bank’s Governing Council, said in

an interview in Dublin today. His ability to manage the

situation is being made more difficult by “death threats not

only to myself, but toward my children and my wife,” he said.

- VW Sales Growth Slows in March on Europe Market Declines.

Volkswagen AG (VOW), Europe’s biggest automaker, said global sales

growth slowed in March and that headwinds in its home region are

intensifying. VW eked out a 0.2 percent rise in deliveries last month to

864,400 vehicles as demand in China and North America more than offset

shrinking sales across Europe, the Wolfsburg, Germany-

based carmaker said today. In the first two months of the year,

VW vehicle deliveries rose 8.3 percent to 1.4 million. “The data for March clearly show that the markets are

becoming even more difficult,” Christian Klingler, VW’s sales

chief, said in the statement.

- Bank Risk Models to Face Further Basel Probe on Capital Concerns.

Banks (BEBANKS) face further scrutiny from global regulators into their

risk models amid concerns lenders are underestimating the amount of

capital they need to cope with losses. Initial studies of how lenders

measure risk on assets they intend to trade as well as those they

intend to hold to maturity found “substantial” differences in the amount

of capital different banks hold against identical securities, the Basel Committee on Banking Supervision said in a report to finance

ministers from the Group of 20 nations and central bank chiefs. Banks’ modeling choices are a “key source of variation,”

the group said. “Further analysis is therefore under way, and

areas where Basel committee standards might be modified to

reduce excessive variation are becoming apparent.” The

committee is considering tightening its rules to narrow banks’

freedom to design models and said it’s also weighing the need

for tougher scrutiny by supervisors and stronger disclosure

requirements.

- China Said to Plan Replacing Chen at Largest Policy Lender.

China Development Bank Corp. Chairman Chen Yuan will step down, handing

the reins of the world’s largest policy lender to Bank of

Communications Co.’s Hu Huaibang, said two people with knowledge of the

matter. CDB is the biggest lender to so-called local government

financing vehicles that have accumulated at least 10.7 trillion

yuan in debt. Half of the bank’s lending this year will go to

urbanization, according to a Jan. 29 notice on its website.

- Commodities Fall to Lowest Since July on ‘Soft’ U.S. Data. Commodities tumbled to the lowest

since July, led by a plunge in precious metals, as U.S. retail

sales fell the most in nine months and consumer sentiment

unexpectedly declined. The Standard & Poor’s GSCI Spot Index

of 24 raw materials dropped 1.6 percent to 621.49 at 12:08 p.m. New York

time. Earlier, the gauge touched 617.55, the lowest since July 13. Gold headed for a bear market, and silver plummeted to the lowest since November 2010. Crude oil slumped to a one-month

low.

- Gold Heading for Bear Market Plunges to Lowest Since July 2011. Gold tumbled to the lowest price

since July 2011, heading for a bear market, on signs that investors are favoring the dollar and equities as the global

economy recovers. Silver dropped more than 5 percent.

- Wells Fargo(WFC) Uses Cost Cuts to Set Profit Record as Revenue Slips. Wells Fargo & Co., the largest U.S. home lender, said lower

expenses helped the company post a record profit in the first quarter

even as revenue dropped and lending margins narrowed. Net

income advanced 22 percent to a record $5.17 billion, or 92 cents a

diluted share, from $4.25 billion, or 75 cents, a year earlier,

according to a statement today from the San Francisco-based bank. While

the results topped estimates from analysts surveyed by Bloomberg, new

home loans and mortgage banking income weakened, and the shares slipped

2.3 percent in New York trading.

Wall Street Journal:

- J.P. Morgan, Wells Fargo Struggle With Weak Demand for Loans. Banks Report Higher First-Quarter Profits But See Declines in Mortgage Business, Profit on Lending.

- EU Lawmaker Sees Fight Over ECB Scrutiny.

The European Central Bank must open itself up to greater democratic

scrutiny as it prepares to take on major new powers, a senior European

lawmaker said Thursday. "The biggest alarm bell I would say has been the attitude of the

European Central Bank, [which] is causing the Parliament a lot of

concern," Sharon Bowles, chairwoman of the European Parliament's

influential economic and monetary affairs committee, said in an

interview.

Fox News:

CNBC:

- 'Zombie' Buyers Threaten 'Consumer is Back' Meme: Economist. (video)

- The Euro Zone Crisis Is Back—On Multiple Fronts. Europe's finance ministers meeting in Dublin on Friday are facing a

renewed crisis on multiple fronts,with a backlash against austerity

acting as a gloomy backdrop for negotiations over bailout extensions for

Portugal and Ireland, while tackling Cyprus's botched bailout and

growing worries about Slovenia. Investors, increasingly aware of the euro zone's disarray, will be closely watching the results of that meeting.

Zero Hedge:

Business Insider:

Reuters:

- Brazil's Mantega says c.bank could raise rates if needed. Brazil's central bank could

raise interest rates if needed to control rising inflation,

Finance Minister Guido Mantega said on Friday, helping to

increase bets that policymakers could tighten monetary policy as

early as next week. "We will not hesitate to take measures, even measures that

are considered less popular, like for example those related to

interest rates," Mantega said during an economic event organized

by a magazine in Sao Paulo. Although

Mantega has previously said that the central bank

is free to raise rates if needed, his latest comments are seen

as confirmation that President Dilma Rousseff, as prices continue to

rise in Latin America's biggest economy, agrees it is time to increase

borrowing costs.

- Copper drops on growth worries, ample supply.

Telegraph:

Style Underperformer:

Sector Underperformers:

- 1) Gold & Silver -4.70% 2) Oil Tankers -2.33% 3) Steel -2.03%

Stocks Falling on Unusual Volume:

- NGD, CLF, TVL, PCS, SU, SJR, IMGN, INFI, JCP, CSTE, CHUY, KUB, INFY, MPW, CEF, ABX, IEP, IMGN, MTB, PRLB, HRS, TFX, IM, CRS, ASA, AU, SLW, CG, BAP, CF, CTF, AUY, CTSH, IART, EWY, PCS, GGN, DNR, JCP, GLD, IAU, RGLD, GDX, NEM, UCO, HRS and EEFT

Stocks With Unusual Put Option Activity:

- 1) FTK 2) M 3) XLF 4) MYGN 5) HL

Stocks With Most Negative News Mentions:

- 1) CHRW 2) EEFT 3) CG 4) HLF 5) DECK

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Restaurants +.89% 2) Biotech -.03% 3) Homebuilders -.05%

Stocks Rising on Unusual Volume:

- SBGI, ASH, IOC, BZH and RATE

Stocks With Unusual Call Option Activity:

- 1) RAD 2) ACAD 3) MDVN 4) BKS 5) AGQ

Stocks With Most Positive News Mentions:

- 1) CSX 2) JBHT 3) MCD 4) HLF 5) WAG

Charts: