Style Outperformer:

Sector Outperformers:

- 1) Alt Energy +4.44% 2) Gold & Silver +3.50% 3) Coal +3.14%

Stocks Rising on Unusual Volume:

- PXP, WPX, RBS, IBKC, WBSN, WCRX, NOAH, SCTY, ACT, GIVN, AMBA, QIHU, FWLT, INSM, YELP, BYI, UNXL, YRCW, YY, TSO, WWWW, CBI, ACAD, FSLR, SPWR, BKS, INFI, VOYA, KBR, SZYM, CVI, XONE, TSO, RH and SN

Stocks With Unusual Call Option Activity:

- 1) FLR 2) HCA 3) PPHM 4) FXY 5) KSS

Stocks With Most Positive News Mentions:

- 1) NOV 2) MMR 3) WBSN 4) C 5) CAT

Charts:

Weekend Headlines

Bloomberg:

- Europe's Debt Frenzy Undeterred by Record Recession: Euro Credit.

Investors are snapping up long-dated bonds from Europe's high debt and

deficit nations even as prices reach the most expensive levels since

2010 and the region's deepening recession threatens to hamper

deficit-reduction plans. Bonds maturing in more than 10 years from Greece, Spain, Portugal,

Italy and Ireland are the best performers in the world this quarter.

"At the moment, the power of monetary policy and the hunt for yields are

outweighing the growth factors," said Joost van Leenders, who helps

oversee $657 billion as a strategist at BNP Paribas Investment Partners in Amsterdam. "We are not sure how much patience the markets have. Growth prospects in Europe are really a problem and a risk for government finances, so we don't see that as a positive for markets. The rally has gone a bit too far."

- Yen Climbs as Japan Signals Negative Impact From Further Losses. The

yen climbed versus all 16 major

peers after Japan’s Economy Minister Akira Amari said further losses in

the currency would threaten to negatively affect people and the

government’s job is to minimize that. The yen retreated from near its weakest in more than four

years versus the dollar after Amari said yesterday there’s

speculation the Japanese currency’s past strength has “been

corrected a lot.”

- China Small-Cap Bubble Seen Bursting by Chen. Chen Li,

the UBS AG strategist who predicted the tumble in China’s smallest

shares two years ago, says the companies are poised to retreat again

after valuations rose to the biggest premium over larger stocks since

2010. The smaller-company gauge trades for 4.6 times net assets versus 1.7 for the CSI index,

the widest gap since June 2010, data compiled by Bloomberg show.

- China’s Aluminum Producers Seen Having to Make Cuts Amid Surplus. China, the world’s largest producer of aluminum, will have a “manageable” surplus of the metal for

the next five years if companies cut back 4 million to 5 million

metric tons of production, according to researcher CRU. China has cut output 1 million metric tons this year and

will probably reduce it 2 million tons by 2015, with about 24

million tons produced this year, according to Marco Georgiou, an

analyst at CRU in London. Aluminum fell 3.8 percent this year in

China and 10 percent in London.

- Asia Stocks Head For Highest Close in Nearly Five Years. Asian

stocks rose the first time in three days, with the regional gauge

heading for the highest close since June 2008, after U.S. consumer

sentiment topped

estimates and Tokyo Electric Power Co. led Japanese utilities

higher. Li & Fung Ltd., a supplier of toys and clothing that

gets

63 percent of its sales in the U.S., gained 2.2 percent in Hong

Kong. Osaka Gas Co. advanced to the highest in more than five years

after the U.S. conditionally approved a Texas liquefied natural gas

project partially owned by the energy supplier. Tokyo Electric Power

soared 14 percent after the Yomiuri newspaper said it will apply to

restart reactors. The MSCI Asia Pacific Index gained 1.3 percent to 144.28 as

of 10:13 a.m. in Hong Kong.

- Silver Plunges to Lowest Since 2010 as Gold Drops for Eighth Day. Silver

plunged to the lowest level

since September 2010, sending its ratio to gold to the highest

in 33 months, while bullion extended the longest slump in four

years as investment holdings contracted and stocks rallied. Silver for

immediate delivery tumbled as much as 7 percent to $20.6985 an ounce,

and was at $21.345 at 11:32 a.m. in Singapore. The ratio surged to 64.89, the highest since August 2010. Gold lost as much as 1.5 percent to $1,338.85 an ounce,

the lowest price since April 18, and was at $1,347.23.

- Copper Declines for First Day in Three on China Demand Concerns. Copper dropped for the first time in

three days on speculation that China will continue to curb its

property market, reducing demand from the world’s biggest

consumer. Tin, lead and zinc also fell. Copper for delivery in three months on the London Metal

Exchange fell as much as 0.6 percent to $7,260 a metric ton and

was at $7,265 at 10:45 a.m. in Tokyo. The metal retreated 1

percent last week. Futures for delivery in July on the Comex

were down 0.8 percent at $3.2970 per pound. China’s new-home prices rose last month in 68 of 70 cities

tracked by the government, indicating Premier Li Keqiang will

need to maintain efforts to cool the property market even as

economic growth slows. The nation’s policy makers are trying to

avoid property bubbles and make homes more affordable while bolstering an economy that lost steam in the first quarter. “Any measures to cool down China’s property market would

be negative for metals,” Hwang Il Doo, a senior trader at Korea

Exchange Bank Futures Co. in Seoul. An increase in LME

stockpiles and an outflow of funds to stock markets also weighed

on copper, he said. Copper stockpiles monitored by the LME rose 0.9 percent to

629,950 tons, the highest since Aug. 20, 2003, data from the

bourse showed on May 17.

- Intelligence Panel Head Says Justice’s AP Probe ’Large Dragnet’. The Justice Department’s subpoena of

Associated Press phone records appears to be “a large dragnet”

that lacked a clear focus, Michigan Republican Representative

Mike Rogers said. “It doesn’t appear to me to be appropriate,” Rogers said

in an interview on Bloomberg Television’s “Political Capital

with Al Hunt,” airing this weekend. Rogers’ criticism of the Justice Department is significant

because the lawmaker is chairman of the House Intelligence

committee and a former FBI agent who had asked for an

investigation into leaks of national security information.

Wall Street Journal:

- Obama's Counsel Told of IRS Audit Findings Weeks Ago. The White House's chief lawyer learned weeks ago that an audit of the

Internal Revenue Service likely would show that agency employees

inappropriately targeted conservative groups, a senior White House

official said Sunday.

That disclosure has prompted a debate over whether the president should have been notified at that time.

- Embassy Threats Grow in Mideast. The U.S. is seeing a spike in al Qaeda-related terror plots and

threats against its embassies in Libya, Yemen and Egypt, say current and

former U.S. officials citing domestic and foreign intelligence reports.

The threats against U.S. missions in

Tripoli and Yemen's capital, Sana'a, are believed to involve bomb plots

by Sunni extremists and perhaps al Qaeda-linked individuals, and have

set off alarms among U.S. officials still shaken by last September's

attack on a diplomatic outpost in Benghazi, Libya.

- Senate Launches Pension-Sale Probe. A Senate committee launched an investigation of a controversial business

in which retirees sell pieces of their future pension income to

investors for a lump-sum cash payment.

- Criminal Charges Weighed Against SAC. Hedge-Fund Company Has Discussed Alternatives Such as Deferred-Prosecution Agreement. U.S. prosecutors are considering possible criminal charges against

SAC Capital Advisors LP as a result of the government's insider-trading

investigation of the hedge-fund firm, according to people familiar with

the matter. The move came before the company told clients Friday that it will no

longer provide "unconditional" cooperation with the multiyear probe of

SAC and billionaire founder Steven A. Cohen. The firm didn't tell

clients the reason for the reversal.

- China Property Gains Defy Government Plans. Rapid Rise in Prices Comes Despite Beijing's Efforts to Keep Homes Affordable for First-Time Buyers. Surging credit has kept China's real estate-sector humming despite a

renewed attempt by the government to bring prices under control,

supporting short-term economic growth but risking a destabilizing

decline in prices down the line.

- Syria Sweeps Into Rebel Stronghold.

Syrian government forces, backed by members of Lebanese militant

group Hezbollah, launched a sweeping operation Sunday to capture a rebel

stronghold near the Lebanese border, according to Syrian state media

and activists opposed to the regime.

Taking the town of Qusayr, southwest

of the city of Homs, would bolster recent gains by regime forces in

central Syria and around the capital, Damascus. It also could further

embolden Syrian President Bashar al-Assad, who told an Argentine

newspaper over the weekend that his fate would be decided in elections

scheduled for next year.

- Big Government Loses Control. Tea party and other groups use social media to spread the news about IRS abuse world-wide. What to make of the political scandals that are dominating the headlines

and forcing the Obama administration into Nixonian damage control?

Technology is finally doing to big government what it has done to big

business, big media and other institutions that once could operate with

nearly full control over information. The government is losing the

ability to manipulate information to avoid accountability.

Marketwatch.com:

- Too big to fail is now bigger than ever: Andy Xie. The flawed global financial system essentially holds all major

governments hostage. Whenever a crisis happens, the policy priority is

to stabilize the financial system for short-term economic stability.

This tends to favor TBTF financial institutions. Every crisis makes the

problem bigger.

- Republicans link IRS scandal, health reform. “Just think about the fact that it’s the IRS that will be responsible

for enforcing many of these regulations. If we’ve learned anything this

week, it’s that the IRS needs less power, not more,” said Rep. Andy

Harris of Maryland, who delivered the Republican response.

Fox News:

- Top Obama adviser stakes out defiant defense on IRS, Benghazi, AP scandals. A top White House adviser staked out a defiant defense Sunday on a

series of scandals that have hit the Obama administration, going so far

as to say it was an “irrelevant fact” where the president was the night

of the Benghazi terror attacks and saying the Obama administration

wouldn’t cooperate in “partisan fishing expeditions” over IRS officials

targeting Tea Party groups. Dan Pfeiffer went on five Sunday talk shows where he tried to reverse

the damage done to the Obama administration this week by a series of

scandals. On “Fox News Sunday” he tried to hammer home that the

president only heard that the IRS unfairly targeted Tea Party groups

“when it came out in the news.”

CNBC:

- China April Housing Inflation Quickens.

China's housing inflation quickened in April, marking the fourth

consecutive year-on-year rise and challenging policymakers who are

trying to cool record home prices while supporting economic expansion.

Average new home prices rose 4.9 percent last month from a year ago,

after a year-on-year increase of 3.6 percent in March, according to

Reuters calculations from data released by the National Bureau of

Statistics (NBS) on Saturday. Rising

home prices have reignited concerns about property inflation, adding to

pressure on policymakers who are struggling to curb house prices and

still spur a strong economic recovery. "The market expectations

on rising home prices have not changed thoroughly and the property

tightening campaign is still at a critical stage to strictly enforce

(curbing measures)," Liu Jianwei, a senior statistician at the NBS, said

in a statement.

- Bernanke’s Testimony Critical to Oil Prices. The U.S. dollar and its reaction to the Federal Reserve Chairman Ben

Bernanke's Congress testimony on Wednesday will prove central for crude

oil price direction this week, according to CNBC's weekly survey of

market sentiment.

Business Insider:

IBD:

San Francisco Chronicle:

- Gun control: Cartridge ID law to take effect. A

hotly contested gun-control law that was passed in 2007 is finally

ready to be implemented, Attorney General Kamala Harris said Friday: a

requirement that every new semiautomatic handgun contain

"micro-stamping" technology that would allow police to trace a weapon

from cartridges found at a crime scene. The law, signed by then-Gov.

Arnold Schwarzenegger, made California the first state to require

micro-stamping, which engraves the gun's serial number on each

cartridge. But the legislation specified that it would take effect only

when the technology was available and all private patents had expired.

The gun owners' group Calguns Foundation tried to forestall the law at

one point by paying a $555 fee in an attempt to extend a patent held by

the inventor, who wanted it to lapse. Gun manufacturers said the

technology was expensive and ineffective, and a National Rifle

Association lawyer has threatened a lawsuit. But at a Los Angeles news

conference Friday, Harris announced that micro-stamping had cleared all

technological and patenting hurdles and

would be required on newly sold semiautomatics, effective immediately.

Washington Post:

- A rare peek into a Justice Department leak probe. When the Justice Department began investigating possible leaks of

classified information about North Korea in 2009, investigators did more

than obtain telephone records of a working journalist suspected of

receiving the secret material. They used security badge access records to track the reporter’s

comings and goings from the State Department, according to a newly

obtained court affidavit. They traced the timing of his calls with a

State Department security adviser suspected of sharing the classified

report. They obtained a search warrant for the reporter’s personal

e-mails.

ValueWalk:

Reuters:

- Bundesbank

President Jens Weidmann says France must take deficit cut rules

seriously to reduce budget deficits. Weidmann points out that Germany

and France have special responsibilities in the eurozone.

France

has a special responsibility as a euro zone heavyweight to take deficit

reduction rules seriously, even though its budget deficit is above

target, Bundesbank President Jens Weidmann said in an interview

published yesterday. Weidmann told the Bild am Sonntag newspaper that

the credibility of the new euro zone rules would be hurt if their

flexibility were pushed to the limit right at the start. “The

economic developments in some countries have indeed been weaker than

expected and the European rules offer in such cases a certain amount of

flexibility,” Weidmann said when asked about Italy, France and Slovenia

getting more time to fulfill the stability criteria. “France, but also

Germany, has a special responsibility, as heavyweights in the euro zone,

to take seriously the new deficit reduction rules created last year to

reduce budget deficits.” Weidmann noted that France’s budget deficit was still “far above 3 percent.”

- Analysis: High speed trading a stiff challenge for U.S. regulators. Financial trading in world markets has grown so lightning-fast that

effective regulation is growing tougher by the second, increasing the

threat of crashes sparked by hoaxes, electronic glitches or yet-unknown

causes. The latest alarm was

triggered by a fake tweet saying that the White House was bombed,

prompting a U.S. market nosedive that ended minutes later when the

Associated Press said its Twitter account had been hacked. In 2010 U.S.

stocks plunged in a "flash crash" following aggressive sales of

stock-index futures by a mutual fund.

Financial Times:

- Portugal’s banks fear ‘Cyprus virus’.

Portugal’s top bankers have called on Europe’s leaders to stop “playing

with fire” and moderate their stance towards the eurozone periphery, or

risk instilling alarm among bank depositors in future. In separate

interviews, the heads of the country’s two biggest banks – Millennium

BCP and Banco Espírito Santo – said they were concerned that the

precedent set by Europe’s treatment of Cyprus’s recent troubles had

increased nervousness across the eurozone to dangerous levels.

Telegraph:

- Meet the man who is betting against China. Carson Block, the founder of Muddy Waters Research, believes that China’s

banks hold more toxic assets than Western peers did ahead of the 2008

financial crash. He is listened to by institutional investors, regulators and politicians but

he rarely speaks publicly. Last week, his analysis of Standard Chartered’s

exposure to China caused a tremble in its share price and its backers to

leap to the bank’s defence. Carson Block has broken his silence this weekend to reveal his fears for the

global economy. The secretive fund manager said the risks within China’s

banking system are more severe than those in Western financial institutions

before the crisis.

Frankfurt Allgemeine Sonntagszeitung:

- German SPD to Introduce Referendum Law Next Month. Germany's Social Democratic Party may push for a new law on country-wide referendums. Draft law due to be debated in mid-June allows for referendum to repeal legislation already passed in parliament. Chancellor Angela Merkel's CDU/CSU opposed the introduction of country-wide referendums.

Kathimerini:

- EU's Barnier Says ESM Is Last Resort. The ESM will intervene to directly recapitalize euro-area banks only after lenders have exhausted all alternatives, citing an interview with European Commissioner Michel Barnier. Barnier says alternatives include imposing losses on uninsured deposits as in Cyprus.

Apple Daily:

- Hong Kong Competitiveness Waning on Possible Bubble. Hong Kong economy shows

signs of a possible bubble because of its high dependency on financials

and real estate industries, citing the latest Chinese cities

competitiveness report from the Chinese Academy of Social Sciences.

Shanghai Securities News:

- BOC

President Wants Lending-Rate Floor Canceled. Bank of China Ltd.

President Li Lihui suggested that China cancel the floor on lending

rates and let banks price credit risk, citing Li's speech at a forum yesterday.

People's Daily:

- China faces "relatively large pressures" from capital inflows and

yuan appreciation, citing Ji Zhihong, an official at the research

bureau of the People's Bank of China.

China Securities Journal:

- China May Expand Property Tax Trial This Year. China may expand

property tax trail to several new cities this year, citing people

familiar with the matter.

- China Needs Restructuring for

Outstanding Debt. China should proactively push forward restructuring of

banks' outstanding debt to eliminate possible "external risks," Liu

Yuhui, a researcher at the Chinese Academy of Social Sciences, writes in

a commentary. China's total debt-to-GDP ratio rose by nearly 60

percentage points between 2009 and 2012, according to the commentary.

Debt ratio is still rising as the social financing growth in 1Q was 12

percentage points faster than nominal GDP, Liu wrote. U.S. monetary

policy may normalized, putting pressure on capital markets in the

Asia-Pacific, he said.

Weekend Recommendations

Barron's:

- Bullish commentary on (C), (S), (R) and (RIG).

Night Trading

- Asian indices are unch. to +1.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 101.0 -1.5 basis points.

- Asia Pacific Sovereign CDS Index 84.75 unch.

- NASDAQ 100 futures -.01%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The Fed's Evans speaking, Fed's Williams speaking, Chicago Fed Nat Activity Index for April, RBA minutes, Stifel Nicolaus Internet/Media/Communications Conference, UBS Healthcare Conference and the UBS Oil & Gas Conference could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by automaker and financial shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the week.

U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on rising global growth fears, more Mideast unrest, Eurozone debt angst, profit-taking, more shorting and technical selling. My intermediate-term trading indicators are giving neutral signals and the Portfolio is 75% net long heading into the week.

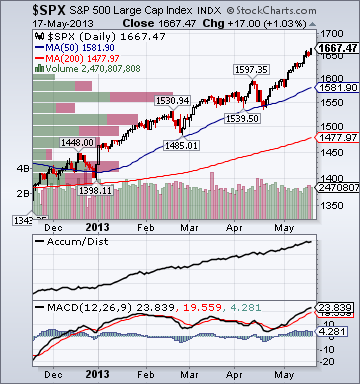

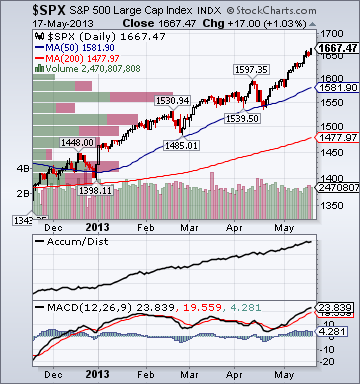

S&P 500 1,667.47 +2.07%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 996.28 +2.17%

- S&P 500 High Beta 25.99 +2.61%

- Value Line Geometric(broad market) 430.82 +1.93%

- Russell 1000 Growth 763.92 +1.66%

- Russell 1000 Value 846.21 +2.31%

- Morgan Stanley Consumer 1,032.47 +1.90%

- Morgan Stanley Cyclical 1,236.52 +1.92%

- Morgan Stanley Technology 773.72 +2.26%

- Transports 6,549.16 +2.72%

- Bloomberg European Bank/Financial Services 101.02 +2.45%

- MSCI Emerging Markets 43.30 -.55%

- HFRX Equity Hedge 1,127.74 +.66%

- HFRX Equity Market Neutral 939.92 +.03%

Sentiment/Internals

- NYSE Cumulative A/D Line 192,643 +.71%

- Bloomberg New Highs-Lows Index 609 -202

- Bloomberg Crude Oil % Bulls 20.0 -49.23%

- CFTC Oil Net Speculative Position 232,590 +5.42%

- CFTC Oil Total Open Interest 1,758,686 -.66%

- Total Put/Call .80 +8.11%

- ISE Sentiment 90.0 -27.42%

- Volatility(VIX) 12.45 -1.11%

- S&P 500 Implied Correlation 56.74 +.05%

- G7 Currency Volatility (VXY) 9.94 +3.76%

- Emerging Markets Currency Volatility (EM-VXY) 7.97 +11.2%

- Smart Money Flow Index 12,138.95 +1.28%

- Money Mkt Mutual Fund Assets $2.582 Trillion unch.

Futures Spot Prices

- Reformulated Gasoline 290.69 +1.74%

- Heating Oil 293.70 +1.13%

- Bloomberg Base Metals Index 192.81 -.75%

- US No. 1 Heavy Melt Scrap Steel 349.33 USD/Ton unch.

- China Iron Ore Spot 123.10 USD/Ton -5.01%

- UBS-Bloomberg Agriculture 1,470.69 -.73%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 7.0% -30 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.4709 +2.61%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 115.56 +.17%

- Citi US Economic Surprise Index -17.50 -10.2 points

- Citi Emerging Mkts Economic Surprise Index -47.40 +2.8 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 6/19

- US Dollar Index 84.25 +1.39%

- Euro/Yen Carry Return Index 138.13 +.38%

- Yield Curve 171.0 +5 basis points

- 10-Year US Treasury Yield 1.95% +5 basis points

- Federal Reserve's Balance Sheet $3.312 Trillion +.93%

- U.S. Sovereign Debt Credit Default Swap 29.81 -5.35%

- Illinois Municipal Debt Credit Default Swap 117.0 -4.1%

- Western Europe Sovereign Debt Credit Default Swap Index 85.50 -2.84%

- Emerging Markets Sovereign Debt CDS Index 176.76 +4.45%

- Israel Sovereign Debt Credit Default Swap 122.0 +8.54%

- China Blended Corporate Spread Index 400.0 -1 basis point

- 10-Year TIPS Spread 2.26% -8 basis points

- TED Spread 24.25 +.25 basis point

- 2-Year Swap Spread 14.5 +1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -17.25 -3.25 basis points

- N. America Investment Grade Credit Default Swap Index 70.20 -2.70%

- European Financial Sector Credit Default Swap Index 130.83 -2.83%

- Emerging Markets Credit Default Swap Index 246.51 +5.61%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 98.0 +13 basis points

- M1 Money Supply $2.517 Trillion -2.21%

- Commercial Paper Outstanding 1,013.60 +2.1%

- 4-Week Moving Average of Jobless Claims 339,300 +2,500

- Continuing Claims Unemployment Rate 2.3% unch.

- Average 30-Year Mortgage Rate 3.51% +9 basis points

- Weekly Mortgage Applications 876.60 -7.3%

- Bloomberg Consumer Comfort -30.2 -.7 point

- Weekly Retail Sales +2.80% +60 basis points

- Nationwide Gas $3.62/gallon +.06/gallon

- Baltic Dry Index 841.0 -4.86%

- China (Export) Containerized Freight Index 1,069.97 -1.19%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 22.50 unch.

- Rail Freight Carloads 248,266 +1.05%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (24)

- SCTY, MGMB, TEAR, MRIN, TSLA, OPTR, RH, OLP, ENV, SRI, PANL, FANG, ONE, HTH, NNI, WWAV, UBNT, CUB, BBOX, WAGE, CUBI, SSYS, ACET and EOPN

Weekly High-Volume Stock Losers (5)

- PIKE, GEVA, WLH, CSC and INFI

Weekly Charts

ETFs

Stocks

*5-Day Change

Today's Market Take:

Broad Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Outperforming

Equity Investor Angst:

- ISE Sentiment Index 77.0 -28.7%

- Total Put/Call .82 -15.46%

Credit Investor Angst:

- North American Investment Grade CDS Index 70.08 -2.16%

- European Financial Sector CDS Index 130.83 -2.24%

- Western Europe Sovereign Debt CDS Index 87.17 -3.51%

- Emerging Market CDS Index 246.38 +.58%

- 2-Year Swap Spread 14.5 +.5 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -17.25 -.5 bp

Economic Gauges:

- 3-Month T-Bill Yield .03% unch.

- China Import Iron Ore Spot $123.10/Metric Tonne -1.52%

- Citi US Economic Surprise Index -17.5 +5.6 points

- 10-Year TIPS Spread 2.26 unch.

Overseas Futures:

- Nikkei Futures: Indicating +272 open in Japan

- DAX Futures: Indicating +57 open in Germany

Portfolio:

- Higher: On gains in my biotech/retail/tech sector longs and emerging markets shorts

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 75% Net Long