Bloomberg:

- Medvedev in Crimea as Ukraine Rejects Russia Proposal. Prime

Minister Dmitry Medvedev arrived in Crimea in the first visit by a top

official since Russia annexed the peninsula, as Ukraine rejected the

Kremlin’s demands that it grant its regions greater powers.

Medvedev’s trip today came just hours after U.S. Secretary of State John

Kerry demanded Russia pull its forces back from Ukraine’s border at

talks in Paris with Russian Foreign Minister Sergei Lavrov, saying they

are “creating a climate of fear and intimidation in Ukraine.” Lavrov

demanded that Ukraine should

devolve power to give its regions more autonomy and ensure the

rights of Russian speakers.

- IMF Says European Banks Had Up to $300 Billion Subsidy. Large banks in the euro area

benefited from as much as $300 billion in implicit public

subsidies four years after the global financial crisis because

of investors’ expectations that governments would not let them fail, according to the International Monetary Fund.

- European Stocks Climb After Weekly Gain as Novartis Rises. European advanced, after the

biggest weekly gain in more than a month, as investors awaited

economic data out of Europe and America later this week. Novartis AG climbed 3.5 percent after the Swiss drugmaker

said the last phase of a clinical trial showed a treatment for

chronic heart failure helped patients live longer. Banca Monte

dei Paschi di Siena SpA jumped to a 14-month high after its

biggest investor said it is selling an additional stake. RWE AG

lost 1.3 percent after UBS AG recommended avoiding the stock. The Stoxx Europe 600 Index added 0.2 percent to 334.31 at the close of trading in London.

- Hedge Fund Letters to Tell of Favorite Trades Unraveling.

Pity the poor folks who have to write letters to investors on behalf of

equity-focused hedge funds this month. Various measures of

performance indicate the alternative investment vehicles may have a lot

of explaining to do in March. The Global X Guru Index ETF (GURU),

which aims to mimic returns of the top hedge-fund stock holdings, has

lost 2 percent this month for its worst performance versus the Standard

& Poor’s 500 Index since it was created in 2012.

Wall Street Journal:

- South Korea Fires Back at North Amid Pyongyang's Drills. Shells From Both Countries Fell in the Sea, South Korean Official Says. North Korea fired artillery across its

maritime border with South Korea in the Yellow Sea on Monday as part of a

military drill, prompting South Korea to return fire in the latest

reminder of the unstable security situation on the Korean peninsula. The

latest provocation from Pyongyang came just as the U.S. and South Korea

conducted a large-scale joint military exercise focused on amphibious

operations in South Korea.

- WSJ's Hilsenrath: Yellen Sees Slack in Economy. Federal Reserve Chairwoman Offers Defense of Central Bank's Easy-Money Policies.

Fox News:

ZeroHedge:

Business Insider:

Telegraph:

Style Underperformer:

Sector Underperformers:

- 1) Gold & Silver -1.90% 2) Oil Service -.31% 3) Energy -.22%

Stocks Falling on Unusual Volume:

- OCIP, MNTA, UTIW, BIS, OCRX, MX, MEOH, GY, MZOR, SSTK, HAWK, SNN, UFS, PBYI, CHMI, PGTI, CXW, FIVE, CLVS, CGIX, GSK, MYL, CACI and HDS

Stocks With Unusual Put Option Activity:

- 1) NUAN 2) XLU 3) XLP 4) MRO 5) KRE

Stocks With Most Negative News Mentions:

- 1) GM 2) BBRY 3) TSLA 4) TWTR 5) BA

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Gaming +2.62% 2) Airlines +1.98% 3) Biotech +1.96%

Stocks Rising on Unusual Volume:

- NDZ, ACAS, EXAS, TEVA, NVS, EW, ECHO and COMM

Stocks With Unusual Call Option Activity:

- 1) ACAS 2) COP 3) CI 4) FDO 5) CHRW

Stocks With Most Positive News Mentions:

- 1) T 2) COP 3) JNJ 4) MU 5) CMI

Charts:

Weekend Headlines

Bloomberg:

- Russia’s Sovereign Bond Rating May Be Cut, Moody’s Says. Russia’s government bond rating was

put on review for downgrade by Moody’s Investors Service, which

cited a weakening economy amid the conflict with Ukraine. The ratings company said if the review leads to a

downgrade, the most likely outcome would be a one-level

adjustment. Russia’s Baa1 rating is the third-lowest investment

grade.

- McCain Looks to U.S. Companies in Russia If Putin Pushes. The

U.S. should consider forcing major American companies such as General

Electric (GE:US) and Exxon Mobil to suspend business in or pull out of

Russia if President Vladimir Putin attempts to take more territory from

Ukraine or

other neighboring nations, said Senator John McCain of Arizona.

- Abe Bliss Broken as Foreigners Flee Topix in Biggest Drop. In

just one quarter, the developed world’s biggest stock rally has given

way to its worst slump. Japan’s Topix index, up 51 percent last year,

has fallen 8.9 percent in the three months since, almost twice as much

as the next-worst market, Hong Kong. The retreat is emboldening

short sellers, whose trades made up as much as 36 percent of daily Tokyo

Stock Exchange volume this month. Foreign

investors sold 975 billion yen ($9.5 billion) of Japanese shares in one

week in March, the most since the crash of 1987.

- Japan Industrial Output Unexpectedly Drops as Tax Hike Looms. Japan’s industrial production fell in February, undershooting all

forecasts by economists surveyed by Bloomberg News, as the first

sales-tax increase since 1997 risks stalling recovery in the world’s

third-biggest economy. Output fell 2.3 percent from the previous

month, the steepest drop in eight months, the trade ministry said in

Tokyo today. The median estimate of 28 economists was for a 0.3 percent

gain.

A separate gauge of manufacturing fell in March for a second straight

month.

- China Defaults Sow Property Cash Crunch Concern: Distressed Debt.

The specter of default in China's trust loans market is deepening the

distress of property developers that also borrowed in dollars. Eighteen

companies owning $15.2 billion, from behemoth China Vanke Co. to

junk-rated Glorious Property Holdings Ltd., have "material exposure" in

excess of 10% to trust financing, a form of non-bank lending that's

helped homebuilders proliferate in China, Moody's Investors Service

said. This year alone, the number of bonds from Chinese developers

considered distressed based on their yields has almost doubled to 18.

Part of China's $7.5 trillion shadow-banking system, trust financing has

been key to fueling the nation's 10% annual growth rate in the past

decade by providing easy credit to companies considered too risky by

banks. After trust loans to the property, solar, coal and other

industries tripled in the past three years to 10.9 trillion yuan($1.8

trillion).

- Taiwan Protest Draws More Than 100,000 Against China Trade Deal. More

than 100,000 Taiwanese marched

in Taipei to protest a trade deal with China, challenging President Ma

Ying-jeou’s plan to improve economic relations between the political

rivals. As many as 350,000 people joined the rally yesterday in a

turnout that was “more than we expected,” said Chen Wei-ting,

a leader of students against the pact. The National Police

Agency estimated there were 116,000 demonstrators. Protesters

gathered outside the presidential office a day after Ma rejected

demands to withdraw an agreement to open Taiwan’s service

industries to competitors from China.

- China’s Stocks Fall to Extend Biggest Quarterly Loss Since June. China’s stocks fell, extending the

benchmark index’s bigest quarterly loss since June, before

tomorrow’s official manufacturing report and as China Minsheng

Bank Corp.’s profit disappointed investors.

Minsheng Bank dropped more than 3 percent in Shanghai and Hong Kong.

BesTV New Media Co., which formed a game console venture with Microsoft

Corp. in Shanghai’s free-trade zone, plunged 6.7 percent after resuming

trade. Poly Real Estate Group Co. slumped 2.6 percent as a measure of

real-estate companies fell the most among industry groups. The Shanghai Composite Index (SHCOMP) slid 0.4 percent to 2,032.67

at 10:55 a.m. local time.

- Asia Stocks Rise 4th Day as Consumer Shares Lead Gain. Asian stocks rose, with the regional benchmark heading for its fourth straight daily gain, as consumer shares led advances. The MSCI Asia Pacific Index climbed 0.4 percent to 137.22 as of 10:54 a.m. in Tokyo.

Japan’s Topix (TPX) index added 0.3 percent as the yen held last week’s

losses versus the dollar and even as data showed industrial production

unexpectedly fell 2.3 percent

in February from January. A three percentage-point sales-tax

increase takes effect in Japan tomorrow.

- Copper Set for Biggest Quarterly Drop Since June on China. Copper fell, extending a quarterly

loss on concern that an economic slowdown in China, the biggest metals consumer, will lower demand. The metal for delivery in three months on the London Metal Exchange retreated 0.5 percent to $6,640 a metric ton by 10:05

a.m. in Hong Kong. Prices are down 9.8 percent since the start

of the year, poised for the biggest quarterly drop since June.

- Flight 370 Search Gains Vessel With Black Box-Detector.

Australian ship Ocean Shield will join the hunt for the missing

Malaysian jet after being fitted with equipment to detect the black-box

recorder, as Prime Minister Tony Abbott said there was no time limit on

the search.

- Latin America More Vulnerable Than Pre-2008 Crisis, IDB Says.

Latin America’s vulnerability to

external shocks is greater today than before the 2008 financial crisis

because governments have increased spending and companies have taken on

more foreign debt to fuel growth, the Inter-American Development Bank

said. “History teaches that exits from extremely low U.S. interest

rates may be smooth or bumpy,” the IDB said in a report released today

at its annual meeting in Costa do Sauipe, Brazil. “Changes to the

expected path of short-term U.S. interest rates could affect capital

inflows that have strong and

persistent effects on growth in some countries.”

- Obama Changes to Health Law Illegal, McMorris Rodgers Says. President Barack Obama is “picking

and choosing” how the 2010 health-care law will be implemented

and “doesn’t have the flexibility” legally to do so,

Representative Cathy McMorris Rodgers said. Asked if she was saying such changes to the law are

illegal, McMorris Rodgers, a Republican from Washington State,

replied, “Yes, I am.”

- GM(GM) Widens Ignition Recall by 971,000 to 2.59 Million Cars. General Motors Co. (GM) is expanding the recall of small-car ignition switches by 971,000

vehicles worldwide to cover 2008 to 2011 vehicles that were built with

safe parts yet may have received faulty replacements. It also increased

the death toll linked to the switches.

- High-Speed Traders Rip Investors Off, Michael Lewis Says. The U.S. stock market is a rigged

game where high-frequency traders with advanced computers make tens of billions of dollars by jumping in front of investors, according to author Michael Lewis, who spent the past year

researching the topic for his new book “Flash Boys.”

Wall Street Journal:

- Investors Breathe Life Into European Banks' Bad Loans. Lack of Restructuring in U.S. Has Driven Up Demand. Hedge funds and private-equity investors are bidding up prices of some

troubled assets in Europe, sparking a surge in sales by banks seeking to

rid themselves of soured corporate loans.

Fox News:

- Rogers: Troop movement, 'covert operation' suggests Putin not finished in Ukraine. Russian President Vladimir Putin is showing telltale signs that he

intends to extend his control over Ukraine and perhaps elsewhere in

Eastern Europe, House Intelligence Committee Chairman Rep. Mike Rogers

said Sunday. Beyond assembling military armor and tens of thousands of troops

along the Russia-Ukraine border, Putin is moving troops in northern

Georgia and planting intelligence officers in Ukraine, the Michigan

Republican told “Fox News Sunday.” He said Russian troops in the northern region of Georgia, known as

South Ossetia, are on the move, perhaps to go into Armenia or toward the

Baltic Sea. “There’s no way I’d take this as any other way than [Putin] is working for a land bridge,” Rogers said.

CNBC:

ValueWalk:

Business Insider:

Reuters:

Financial Times:

- Bad loan writedowns soar at China banks.

The

five biggest Chinese banks, which account for more than half of all

loans in the country, removed Rmb59bn ($9.5bn) from their books in debts

that could not be collected, according to their 2013 results. That was

up 127 per cent from 2012, and the highest since the banks were rescued

from insolvency, recapitalised and publicly listed over the past decade.

The sharp acceleration in write-offs is the latest indication of the

turbulence now buffeting China’s financial system.

Telegraph:

Svenska Dagbladet:

- Putin Wants to Regain Baltics, Finland, Former Adviser Says.

Baltics, Finland "not of Putin's agenda today or tomorrow, but it no one

stops him, the issue will come up sooner or later," Andrei Illarionov,

former adviser to Russian President Vladimir Putin, is quoted as saying.

Putin will say "Bolsheviks committed treason against Russian national

interests in 1917 by granting independence to Finland."

Korea Central News Agency:

- North

Korea Says It Doesn't Rule Out 'New Form' of Nuclear Test. North Korea

will "utilize" its nuclear deterrent in its military exercises in

response to U.S. drills, its foreign ministry says in statement. The

test may take place in "a new form", the statement said.

Financial News:

- Cutting RRR Would Delay China's Deleveraging Process. Using

reserve ratio tool will cause markets to get the wrong signal that

monetary policy is starting to be loosened, which is not in line with

the goal of controlling liquidity, according to a commentary on page 2

of today's Financial News written by Xu Shaofeng. China's monetary

authority currently appears to lean toward using reform for liquidity

control, such as the standing lending facility trial that started in

January and the re-lending quota in March, the commentary said. Cutting

banks reserve ratio will delay the deleveraging process of financial

institutions and enterprises considering that the nation's economy still

relies on investment and debt, the commentary said.

Caixin:

- Minister Says China Faces Downward Economic Pressure. Industry

Minister Miao Wei said China still faces strong downward economic

pressure in an interview with Caixin's New Century magazine. Some reforms will be good in the long term while they may affect current economic growth, Miao said.

Night Trading

- Asian indices are -.25%. to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 128.0 -2.0 basis points.

- Asia Pacific Sovereign CDS Index 92.5 -.25 basis point.

- NASDAQ 100 futures +.45%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

9:00 am EST

- The ISM Milwaukee for March is estimated to rise to 51.0 versus 48.59 in February.

9:45 am EST

- The Chicago Purchasing Manager for March is estimated to fall to 59.5 versus 59.8 in February.

10:30 am EST

- The Dallas Fed Manufacturing Activity Index for March is estimated to rise to 2.5 versus .3 in February.

Upcoming Splits

Other Potential Market Movers

- The

Fed's Yellen speaking, France GDP, Eurozone CPI, USDA Crop report,

China Manufacturing PMI, Reserve Bank of Australia decision and the

(ING) investor day could also impact trading today.

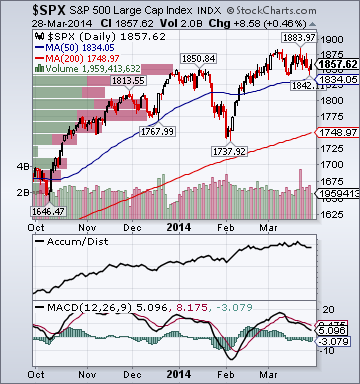

BOTTOM LINE: Asian indices are mostly higher, boosted by consumer and commodity shares in the region. I expect US stocks to open modestly higher and to maintain gains into the afternoon. The Portfolio is 50% net long heading into the week.

U.S. Week Ahead by MarketWatch (audio).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week mixed as Russia/Ukraine

tensions, global growth fears and increasing emerging markets/European

debt angst offset central bank hopes, short-covering and

bargain-hunting. My intermediate-term trading indicators are giving

neutral signals and the Portfolio is 50% net long heading into the week.