Style Outperformer:

Sector Outperformers:

- 1) Restaurants +.54% 2) Gaming +.37% 3) Steel +.35%

Stocks Rising on Unusual Volume:

- PL, BRCM, NPSP, CONN, AGN, NDZ, MWV, GLOG and HCT

Stocks With Unusual Call Option Activity:

- 1) GCI 2) BRCM 3) DGX 4) ARIA 5) LNG

Stocks With Most Positive News Mentions:

- 1) AKAM 2) CMG 3) INTC 4) BRCM 5) NOC

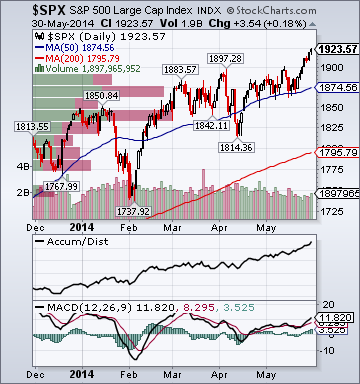

Charts:

Weekend Headlines

Bloomberg:

- Putin Pausing as Russia Volatility Kills Trade-to-Invest. Vladimir

Putin’s territorial ambitions are bumping up against financial markets.

As the Russian president plots his next move on Ukraine,

investors are giving his inner circle pause for thought. Since

Putin annexed Crimea in March in the teeth of international

outrage, Russian stocks have become the most volatile since

2009. Swings in the ruble against the euro are now the most

extreme on record while expectations for fluctuations in the

currency against its emerging-market peers are at the highest in

two years.

- Hagel Says China’s Actions in South China Sea Are Destabilizing. U.S. Defense Secretary Chuck Hagel

today spelled out a series of Chinese actions in parts of the

disputed South China Sea and said they were destabilizing the

region. While China has said it wants a “sea of peace, friendship

and cooperation,” in recent months it “has undertaken

destabilizing, unilateral actions asserting its claims in the

South China Sea,” Hagel said in prepared remarks at an annual

security conference in Singapore.

- Asian Stocks Advance.

Asian stocks rose after a gauge of China’s manufacturing expanded at

the fastest pace in five months and the nation’s policymakers said they

will cut the reserve requirement ratio for some banks. Karoon Gas

Australia Ltd. (KAR) surged 51 percent in Sydney after saying it will

sell energy permits for the Browse Basin, off Australia’s west coast, to

Origin Energy Ltd. Makita Corp. led industrial shares higher, rising

4.9 percent in Tokyo. Dai-ichi Life Insurance Co. sank 4 percent,

leading losses on the regional benchmark index, after the Nikkei

reported the Japanese

firm is preparing to buy Protective Life Corp. for more than 500

billion yen ($4.9 billion) to expand in the U.S.

The MSCI Asia Pacific Index gained 0.3 percent to 142.16 as

of 9:26 a.m. in Tokyo, on course for the highest close in six

months.

- Gas Speculators Least Bullish of ’14 as Prices Retreat. Natural-gas stockpiles are recovering

faster than estimated from a winter battering in the U.S., with

prices now 30 percent below a peak in February. Hedge funds reduced their bets on a rally for a fifth week and to the lowest level since December, U.S. Commodity Futures

Trading Commission data show.

- Fresh Records Getting Stale With S&P 500 Volume at Six-Year Low. Lately, the higher the Standard &

Poor’s 500 Index goes, the less investors care. About 1.8 billion shares traded each day in S&P 500 companies last month, the fewest since 2008, according to data compiled by Bloomberg. When

the gauge hit an all-time high on May 23, only about 20 of its 500

companies reached 52-week highs, the data show. That’s the lowest number

in a year. When volume and breadth wane even as stocks surge, it’s a

warning sign that has preceded losses in the past, according to

Sundial Capital Research Inc. in Blaine, Minnesota. Hayes Miller, who

helps oversee $57 billion at Baring Asset Management Inc., says the

skepticism shows investors distrust a rally built on Federal Reserve

stimulus. “Breadth is suggesting that the market is topping,” Miller, the Boston-based head of multi-asset allocation for

Baring, said in a May 28 telephone interview. “This is not a

good starting point for buying equities at this price. We all

know that investors are induced into risk assets by central bank

policies, which keep your safer options very unattractive.”

Wall Street Journal:

- EPA to Seek 30% Cut in Emissions at Power Plants. Plan Sets in Motion Main Piece of President's Climate-Change Agenda. The Environmental Protection Agency will propose mandating power

plants cut U.S. carbon-dioxide emissions 30% by 2030 from levels of 25

years earlier, according to people briefed on the rule, an ambitious

target that marks the first-ever attempt at limiting such pollution. The

rule-making proposal, to be unveiled Monday, sets in motion the main

piece of President Barack Obama's climate-change agenda and is designed

to give states and power companies flexibility in reaching the target.

But it also will face...

Fox News:

- Obama to announce controversial emissions limit on power plants. The Obama administration is set to announce a rule Monday to limit

carbon emissions in thousands of fossil-fuel burning plants across the

country, a cornerstone of President Obama’s climate-change agenda and

his first-term promise to reduce such emissions by 17 percent by 2020.

Telegraph:

Der Spiegel:

- U.K. Could Leave EU If Juncker Chosen, Cameron Cited by Spiegel.

Prime Minister David Cameron warned German Chancellor Angela Merkel at

European Union summit that choosing Jean-Claude Juncker as next European

Commission president could set U.K. on path to EU exit, citing

participants it doesn't identify. Cameron said on sidelines of May 27-28

summit in Brussels that Juncker victory could destabilize his govt to

the point that proposed U.K. referendum on EU membership might have to

be brought forward and would probably result in vote in favor of leaving.

- Merkel Threatened to Vote Against Juncker at Summit. German

Chancellor Angela Merkel and British Prime Minister David Cameron both

want to block election of Jean-Claude Juncker as president of the

European Commission.

Xinhua:

- China to React if Provoked Over Regional Disputes. Current

situation in South China Sea stable but signs deserving attention have

emerged, citing President Xi Jinping. China's stance on the issue is

clear and consistent. "We will never stir up trouble, but will react in

the necessary way to the provocations of countries involved," he said.

Night Trading

- Asian indices are unch. to +.75% on average.

- Asia Ex-Japan Investment Grade CDS Index 106.50 -3.5 basis points.

- Asia Pacific Sovereign CDS Index 78.75 -1.5 basis points.

- NASDAQ 100 futures +.04%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

9:45 am EST

- Final Markit US Manufacturing PMI for May is estimated at 56.2 versus a prior estimate of 56.2 in April.

10:00 am EST

- ISM Manufacturing for May is estimated to rise to 55.5 versus 54.9 in April.

- ISM Prices Paid for May is estimated to rise to 57.0 versus 56.5 in April.

- Construction Spending for April is estimated to rise +.6% versus a +.2% gain in March.

Upcoming Splits

Other Potential Market Movers

- The

Fed's Evans speaking, Eurozone PMI, HSBC China PMI, (AAPL) Worldwide

Developers Conference, ASCO 2014, RBC Energy Conference, Goldman

Lodging/Gaming/Restaurant Conference, Jefferies Healthcare Conference,

(QSII) analyst day and the (BCR) investor conference could also impact

trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by industrial and technology shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing mixed. The Portfolio is 50% net long heading into the week.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on

rising global growth fears, rising emerging markets debt angst, yen

strength, technical selling and profit-taking. My intermediate-term

trading indicators are giving neutral signals and the Portfolio is 50% net long heading into the week.

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,134.50 +1.85%

- S&P 500 High Beta 31.87 +2.12%

- Wilshire 5000 29,092.60 +1.64%

- Russell 1000 Growth 894.77 +1.84%

- Russell 1000 Value 969.48 +1.35%

- S&P 500 Consumer Staples 461.78 +1.86%

- Morgan Stanley Cyclical 1,552.05 +2.30%

- Morgan Stanley Technology 937.57 +2.26%

- Transports 8,104.57 +2.29%

- Bloomberg European Bank/Financial Services 111.09 +1.81%

- MSCI Emerging Markets 42.58 -1.08%

- HFRX Equity Hedge 1,161.83 +.84%

- HFRX Equity Market Neutral 960.64 -.48%

Sentiment/Internals

- NYSE Cumulative A/D Line 222,986 +1.52%

- Bloomberg New Highs-Lows Index 418 +274

- Bloomberg Crude Oil % Bulls 33.33 -4.17%

- CFTC Oil Net Speculative Position 423,136 +3.15%

- CFTC Oil Total Open Interest 1,635,600 +1.75%

- Total Put/Call .90 +20.0%

- OEX Put/Call 1.86 +20.78%

- ISE Sentiment 100.0 -30.07%

- Volatility(VIX) 11.40 -5.24%

- S&P 500 Implied Correlation 55.24 -3.26%

- G7 Currency Volatility (VXY) 5.93 -4.66%

- Emerging Markets Currency Volatility (EM-VXY) 6.89 -.14%

- Smart Money Flow Index 11,069.16 +.57%

- ICI Money Mkt Mutual Fund Assets $2.587 Trillion +.13%

- ICI US Equity Weekly Net New Cash Flow -$1.802 Billion

- AAII % Bulls 36.46 +19.82%

- AAII % Bears 23.30 -12.12%

Futures Spot Prices

- Reformulated Gasoline 297.19 -.62%

- Heating Oil 288.82 -2.27%

- Bloomberg Base Metals Index 196.63 +.25%

- US No. 1 Heavy Melt Scrap Steel 363.67 USD/Ton unch.

- China Iron Ore Spot 91.80 USD/Ton -5.85%

- UBS-Bloomberg Agriculture 1,489.81 -2.21%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 5.0% unch.

- Philly Fed ADS Real-Time Business Conditions Index -.0307 +37.35%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 123.96 +.22%

- Citi US Economic Surprise Index -4.8 -6.2 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.3 points

- Fed Fund Futures imply 38.0% chance of no change, 62.0% chance of 25 basis point cut on 6/18

- US Dollar Index 80.37 +.02%

- Euro/Yen Carry Return Index 144.81 -.17%

- Yield Curve 210.0 -9 basis points

- 10-Year US Treasury Yield 2.48% -5 basis points

- Federal Reserve's Balance Sheet $4.280 Trillion -.12%

- U.S. Sovereign Debt Credit Default Swap 16.76 +3.68%

- Illinois Municipal Debt Credit Default Swap 150.0 +7.56%

- Western Europe Sovereign Debt Credit Default Swap Index 34.85 -6.71%

- Asia Pacific Sovereign Debt Credit Default Swap Index 78.80 -4.88%

- Emerging Markets Sovereign Debt CDS Index 208.52 -3.57%

- Israel Sovereign Debt Credit Default Swap 80.0 -2.55%

- Russia Sovereign Debt Credit Default Swap 193.34 -2.55%

- China Blended Corporate Spread Index 328.99 -5.95%

- 10-Year TIPS Spread 2.21% -1.0 basis point

- 2-Year Swap Spread 14.0 +2.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -1.25 basis points

- N. America Investment Grade Credit Default Swap Index 62.21 -1.57%

- European Financial Sector Credit Default Swap Index 72.79 -5.91%

- Emerging Markets Credit Default Swap Index 247.0 -5.61%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 86.0 +1.0 basis point

- M1 Money Supply $2.774 Trillion -.40%

- Commercial Paper Outstanding 1,028.0 -.90%

- 4-Week Moving Average of Jobless Claims 311,500 -11,000

- Continuing Claims Unemployment Rate 2.0% unch.

- Average 30-Year Mortgage Rate 4.12% -2 basis points

- Weekly Mortgage Applications 362.20 -1.17%

- Bloomberg Consumer Comfort 33.1 -.8 point

- Weekly Retail Sales +3.80% -30 basis points

- Nationwide Gas $3.66/gallon unch.

- Baltic Dry Index 940.0 -2.69%

- China (Export) Containerized Freight Index 1,103.56 +.58%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 25.0 unch.

- Rail Freight Carloads 269,444 +.89%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (12)

- PTCT, HSH, GTT, PARRE, SHLO, MDBX, BCRX, SN, MGNX, AMSG, TRNO and HPQ

Weekly High-Volume Stock Losers (8)

- DAKT, ARUN, SC, AHC, NTLS, ESI, SCVL and DSW

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- Volatility(VIX) 11.52 -.43%

- Euro/Yen Carry Return Index 144.87 +.25%

- Emerging Markets Currency Volatility(VXY) 6.89 -.58%

- S&P 500 Implied Correlation 55.06 +1.21%

- ISE Sentiment Index 103.0 +18.39%

- Total Put/Call .88 +27.54%

Credit Investor Angst:

- North American Investment Grade CDS Index 62.32 +.18%

- European Financial Sector CDS Index 72.79 +.37%

- Western Europe Sovereign Debt CDS Index 34.85 -.01%

- Asia Pacific Sovereign Debt CDS Index 79.21 -1.14%

- Emerging Market CDS Index 246.83 +.29%

- China Blended Corporate Spread Index 328.99 -5.65%

- 2-Year Swap Spread 14.0 +1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -.5 basis point

Economic Gauges:

- 3-Month T-Bill Yield .03% unch.

- Yield Curve 210.0 +2.0 basis points

- China Import Iron Ore Spot $91.80/Metric Tonne -4.08%

- Citi US Economic Surprise Index-4.80 -1.9 points

- Citi Emerging Markets Economic Surprise Index -20.40 -1.1 points

- 10-Year TIPS Spread 2.21 -2.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating +85 open in Japan

- DAX Futures: Indicating +4 open in Germany

Portfolio:

- Higher: On gains in my medical/retail sector longs and emerging markets shorts

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long