Broad Equity Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- Volatility(VIX) 14.85 +3.85%

- Euro/Yen Carry Return Index 140.77 -.49%

- Emerging Markets Currency Volatility(VXY) 10.37 +.19%

- S&P 500 Implied Correlation 63.78 +3.51%

- ISE Sentiment Index 114.0 +5.56%

- Total Put/Call .86 +8.86%

Credit Investor Angst:

- North American Investment Grade CDS Index 63.35 -.15%

- America Energy Sector High-Yield CDS Index 684.0 +.93%

- European Financial Sector CDS Index 58.88 -4.41%

- Western Europe Sovereign Debt CDS Index 24.46 -4.49%

- Asia Pacific Sovereign Debt CDS Index 64.79 -.32%

- Emerging Market CDS Index 387.82 +2.76%

- iBoxx Offshore RMB China Corporates High Yield Index 113.80 +.06%

- 2-Year Swap Spread 29.5 +1.0 basis point

- TED Spread 24.75 +.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -23.0 +1.75 basis points

Economic Gauges:

- 3-Month T-Bill Yield .02% +1.0 basis point

- Yield Curve 145.0 -3.0 basis points

- China Import Iron Ore Spot $63.44/Metric Tonne n/a

- Citi US Economic Surprise Index -45.60 +1.8 points

- Citi Eurozone Economic Surprise Index 50.1 -6.0 points

- Citi Emerging Markets Economic Surprise Index -10.70 +1.0 point

- 10-Year TIPS Spread 1.76 +1.0 basis point

Overseas Futures:

- Nikkei Futures: Indicating +3 open in Japan

- DAX Futures: Indicating -21 open in Germany

Portfolio:

- Higher: On gains in my biotech/medical sector longs and emerging markets shorts

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long

Style Underperformer:

Sector Underperformers:

- 1) Steel -2.66% 2) Oil Tankers -2.07% 3) Gaming -1.93%

Stocks Falling on Unusual Volume:

- SLXP, CYBR, WBAI, CTB, DNOW, BCC, I, HURN, HSBC, DTLK, RCPT, NSP, DISH, SODA, ATRO, FEYE, ATLS, BA, COHU, CRTO, MHK, TSU, TSLA, ERF, VNDA, BCC and FUEL

Stocks With Unusual Put Option Activity:

- 1) VRX 2) BBY 3) ESRX 4) CRM 5) M

Stocks With Most Negative News Mentions:

- 1) RIG 2) NVDA 3) PCP 4) BA 5) WSM

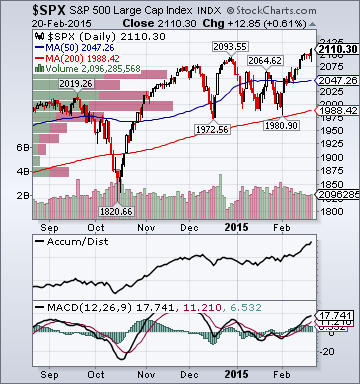

Charts:

Style Outperformer:

Sector Outperformers:

- 1) HMOs +2.26% 2) Biotech +1.09% 3) Drugs +.39%

Stocks Rising on Unusual Volume:

- PPO, HLSS, VRX, DGLY, TSEM, CLDX, GSM, DISCA, AWI, NSM, CSC, NRZ, HUM, KITE and XON

Stocks With Unusual Call Option Activity:

- 1) SLXP 2) ANGI 3) AFL 4) AMAT 5) CLDX

Stocks With Most Positive News Mentions:

- 1) LH 2) RTN 3) ITRI 4) VRX 5) CL

Charts:

Weekend Headlines

Bloomberg:

- Kerry Warns of More Russia Sanctions as Ukraine Simmers. U.S. Secretary of State John Kerry warned

that further sanctions may be imposed against Russia over the

next few days if further breaches of a truce in Ukraine

continue. “Some additional steps will be taken in response to the

breaches of this cease-fire,” Kerry told reporters at the U.S.

Embassy in London after talks Saturday with U.K. Foreign

Secretary Philip Hammond. “There are some yet very serious

sanctions that can be taken which have a profound, increased

negative impact on the Russian economy.”

- Putin’s Stealth Incursions Hinder NATO’s Ability to Strike Back. As the Kremlin’s warplanes probe

the edges of NATO airspace, the alliance says its forces are ready if

the Russians come. Political leaders will need a little longer to issue

the marching orders. Whatever the scenario -- an overt Russian attack on eastern Europe,

a proxy war fought by pro-Russian rebels, a Crimea-style infiltration

-- the immediate suspicion will fall on Russian President Vladimir Putin

as the man behind it. Who will order the North Atlantic Treaty Organization to strike

back is less clear. The 28 governments in the U.S.-led alliance will all

want a say, potentially slowing the deployment of a 5,000-man

rapid-reaction force being set up to defend eastern Europe.

- Greece's Tsipras Is on a High Wire. Greek Prime Minister Alexis Tsipras walks

another high wire over the next 24 hours as he tries to come up

with financial measures that satisfy both the demands of euro-region creditors and his anti-austerity party. After talks in Brussels between officials from the 19 euro

members concluded late on Feb. 20 with an agreement to extend

bailout funds for four months, the government in Athens now has

until the end of Monday to complete a list of policies in return

for the continued funding. Finance chiefs will then decide

whether the proposals go far enough or trigger another round of

emergency negotiations this week.

- The Real Battle Over Greece Still Lies Ahead. Greek Prime Minister Alexis Tsipras began

the task of selling domestically a provisional deal with euro-area partners to extend bailout funds after securing a reprieve

from the prospect of the country’s insolvency. “We won a battle, but not the war as the difficulties, the

real difficulties, not only those related to the discussions and

the relationship with our partners, are ahead of us,” Tsipras

said in a televised speech on Saturday.

- Yen at ‘Comfortable’ Level, BOJ Needn’t Act for Now: Abe Adviser. The yen has weakened to a “comfortable”

level and the Bank of Japan can hold off expanding stimulus for

now, given prospects for a recovery in the economy, said Etsuro

Honda, an adviser to Prime Minister Shinzo Abe. It will take about six to eight months for the effects of

the increase in monetary stimulus on Oct. 31 to filter through

the economy, Honda said in an interview on Feb. 20. “So the BOJ

can wait until at least around June to gauge the impact.”

- Asian Stocks Advance to Five-Month High After Greek Bailout Deal. Asian stocks rose, with the regional

benchmark index heading for its highest close since September,

after U.S. equity gauges climbed to records as Greece reached a

provisional deal on its bailout program.

The MSCI Asia Pacific Index added 0.1 percent to 145.21 as

of 9:01 a.m. in Tokyo.

Wall Street Journal:

- Tsipras Can Expect More Humble Pie. Greek leader will have to give way on many more issues to secure a place in the eurozone. Greece’s membership in the eurozone looked less precarious by the end of

last week than it did at the beginning—but it still hangs in the

balance.

- U.S. Units of Deutsche Bank, Santander Expected to Fail Fed’s Stress Test. Shortcomings seen in how banks measure and predict potential losses and risks.

Two large European banks, Deutsche Bank AG and Banco Santander SA,

are expected to fail the Federal Reserve’s stress test over

shortcomings in how they measure and predict potential losses and risks,

according to people familiar with the matter.

- New Cancer Technology Gives Investors a Shot in the Arm. Immunotherapy’s promise is drawing some marquee financiers. George Soros, Michael Milken and David Bonderman are among marquee

investors benefiting from early bets on a red-hot sector: young

companies developing drugs that fight cancer by using the body’s immune

system.

- Carlyle Hedge-Fund Unit Has Big Outflow. Withdrawals follow losses due to investments in Fannie Mae, Freddie Mac. Investors have pulled about $2.5 billion since October from a hedge-fund

firm owned by Carlyle Group LP after an outsize bet on mortgage giants

Fannie Mae and Freddie Mac led to steep losses last year, people

familiar with the matter said.

- Islamic State’s Global Ambitions. ISIS—no longer a regional problem—is executing a complex strategy across three geographic rings. Last week’s Pentagon briefing outlined plans for Iraqi and Kurdish

forces to retake Mosul from Islamic State, also known as ISIS. This

strategy largely assumes that if ISIS is expelled from Mosul, Iraq’s

second largest city, pushed out of Anbar province and degraded in Syria,

the organization will collapse because its narrative of victory will be

tarnished and its legitimacy as a “Caliphate” will end.

Fox News:

- Al Shabaab calls for attack on Mall of America in new video. (video) A

new video from Al Shabaab purportedly shows the terror group calling

for an attack on Mall of America, in Bloomington, Minn. According to Fox

9, the mall is one of three similar targets the

terror group specifically names, including West Edmonton Mall in Canada

and the Oxford Street shopping area in London. The video purportedly shows 6 minutes of graphic images and the

terrorists celebrating the 2013 Westgate Mall attack in Nairobi, Kenya,

that killed more than 60 people.

Zero Hedge:

- There's No Way Out Now: "That Choice Was Yours". Inevitably this all time high market overvaluation will blow up

the same as last time despite the pundits laughing at such predictions. But do remember the choice was yours. You will have nobody to

blame but yourself when and if it all comes tumbling down and you were

too busy laughing.

Telegraph:

- How the eurozone could tear apart. A standoff between Greece and its creditors nearly ended in the breakup of the

euro project. How could a country leave the currency union?

Die Zeit:

- ECB QE Creates Moral Hazard, Deutsche Bank's Jain Says. ECB bond

buying won't have same success as in U.S. as creates moral hazard in

Europe by reducing need for govt reform, Deutsche Co-Chief Executive

Officer Anshu Jain said in an interview.

Bild:

- Germany's Steinmeier Warns Russia of Ukraine Escalation. Russia

needs to continue pressure on rebels to end military action, citing

interview with German Foreign Minister Fran-Walter Steinmeier. Rebel

advance to Mariupol would cross "red line" and mean end of Minsk accord.

Night Trading

- Asian indices are unch. to +.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 100.5 -3.0 basis points.

- Asia Pacific Sovereign CDS Index 65.0 -.25 basis point.

- NASDAQ 100 futures +.08%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:30 am EST

- The Chicago Fed National Activity Index for January is estimated to rise to .05 versus -.05 in December.

10:00 am EST

- Existing Home Sales for January are estimated to fall to 4.95M versus 5.04M in December.

10:30 am EST

- Dallas Fed Manufacturing Activity for February is estimated to rise to -4.0 versus -4.4 in January.

Upcoming Splits

Other Potential Market Movers

- The BOJ Minutes, German IFO Business Climate Index and the Credit Suisse Energy Summit could

also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by industrial and technology shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 50% net long heading into the week.

Wall St. Week Ahead by Reuters.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week mixed as Russia/Ukraine

tensions, fed rate hike worries and earnings concerns offset diminished

European debt angst, buyout speculation and short-covering. My

intermediate-term trading indicators are giving neutral signals and the

Portfolio is 50% net long heading into the week.