Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – NAHB Housing Market Index

Tues. – Weekly retail sales reports, Housing Starts, Building Permits, Oct. FOMC Minutes

Wed. – Weekly EIA energy inventory report, weekly MBA Mortgage Applications report, Initial Jobless Claims, Univ. of Michigan Consumer Confidence, Leading Indicators

Thur. – US markets closed

Fri. – US stock market 1pm EST close

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Lowe’s(LOW), Campbell Soup(CPB), Medtronic(MDT), Hewlett-Packard(HPQ), Nordstrom(JWN), Focus Media(FMCN), Perry Ellis(PERY), Leap Wireless(LEAP)

Tues. – Dick’s Sporting Goods(DKS), GameStop(GME), Freddie Mac(FRE), Barnes & Noble(BKS), Stage Stores(SSI), BJ’s Wholesale(BJ), Hormel Foods(HRL), Aruba Networks(ARUN), Ltd Brands(LTD), Borders Group(BGP), Aspen Tech(AZPN), Hibbett Sports(HIBB), Whole Foods Market(WFMI), Hott Topic(HOTT), Target Corp.(TGT), Mothers Work(MWRK), DR Horton(DHI), Ross Stores(ROST), Gymboree(GYMB), J Crew(JCG), Office Depot(ODP), Zoltek(ZOLT), Foot Locker(FL), Pall Corp(PLL), Zale Corp.(ZLC), Eaton Vance(EV), Saks Inc.(SKS)

Wed. – Charming Shoppes(CHRS), Patterson Cos(PDCO), Children’s Place(PLCE), Gap Inc.(GPS), Deere & Co.(DE), Buckle Inc.(BKE), Abercrombie & Fitch(ANF)

Thur. – US markets closed

Fri. – Central Garden(CENT), Dillard’s(DDS)

Other events that have market-moving potential this week include:

Mon. – (LMAT) analyst meeting, (RAI) analyst meeting, Bank of America Defense Day

Tue. – (IART) analyst meeting, Bank of America Defense Day, Scotia Capital Telecom & Tech Conference

Wed. – None of note

Thur. – US markets closed

Fri. – None of note

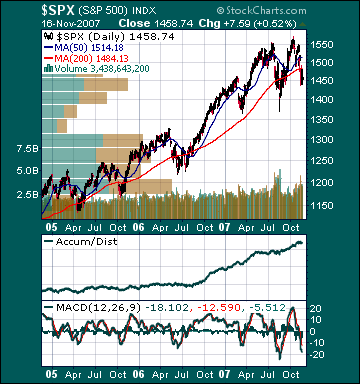

BOTTOM LINE: I expect US stocks to finish the week modestly higher on bargain-hunting, a firmer dollar, seasonal strength and short-covering. My trading indicators are giving mixed signals and the Portfolio is 100% net long heading into the week.