Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 02, 2008

Links of Interest

Sunday, June 01, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Whenever pension funds, mutual funds and insurance companies decide they should own US dollar assets that are out of favor with hedge funds, the hedge funds lose. Institutional investors bought more dollars than they’ve sold this year, according to State Street Corp.(STT) and Bank of New York Mellon Corp.(BK), the largest money managers for institutions. That’s significant because speculators such as hedge funds raised bets against the greenback by 36%, data from the CFTC show. History indicates institutional investors may be on to something. The US dollar gained in 71% of the quarters over the past decade when they were net buyers, according to State Street. Dollar buying among institutional investors from mid-March has been twice as strong as the 12-month average, according to Bank of NY Mellon(BK). Pension, mutual fund and insurance companies, which tend to hold their positions longer than speculators, controlled $59.4 trillion in 2006, according to McKinsey Global Institute. Hedge funds and private equity investors had $2.1 trillion under management. The total number of contracts, owned by hedge funds and futures traders, betting on a decline in the US dollar against major currencies net of those betting on a gain numbered 201,103 on May 27, up from 147,887 on Dec. 31, the CFTC data shows.

- An investigation of oil traders by the US Commodity Futures Trading Commission will likely target evidence that traders intended to manipulate markets rather than just schemed to make money, former officials said.

- Genentech’s(DNA) said research showed that boosting the dose of its Avastin treatment may add to the drug’s effectiveness in slowing breast tumors.

- ImClone’s(IMCL) only drug, Erbitux, extended life by five weeks for lung cancer patients in s study that may help partners Bristol-Myers Squibb(BMY) and Germany’s Merck KGaA win regulatory approval for the new use.

- Barack Obama quit the Chicago church he’s attended for more than two decades and said the firestorm that erupted around his former pastor is something he “didn’t see coming.” Obama is parting with the church after comments made from the pulpit by Michael Pfleger. Pfleger mocked Obama’s Democratic rival, Hillary Clinton, suggesting she would be handed the nomination because she’s white.

- Six months after the People’s Bank of China signaled a stepped-up battle against inflation, it has only fallen further behind in the fight. With inflation the highest in almost 12 years, central bank Governor Zhou Xiaochuan has lifted interest rates once, by just 0.18 percentage points, since the PBOC declared in December it was shifting to a ``tight'' monetary stance. ``Policy makers are making a big mistake,'' said Andy Xie, a former Morgan Stanley economist now working independently in Shanghai. ``Inflation takes years to build up and then it is like a flood. To engineer a soft landing they have to raise interest rates quickly by half a percentage point four or five times.''

- US Treasury Secretary Henry Paulson said Middle East leaders haven’t indicated concerns with their fixed exchange rates to the dollar and understand that abandoning the peg would have little impact on rising prices.

Wall Street Journal:

- Banks Fumble At Operating Hedge Funds. Eager Foray Turns Into Billions Lost, Marred Client Ties.

- Hillary Clinton triumphed in Puerto Rico’s presidential primary Sunday, despite a Democratic Party committee’s ruling a day earlier that dealt a fresh blow to her hopes of catching Barack Obama and securing the party’s nomination.

- One Bold Analyst's Latest View: Worst is Over for Economy, Stocks. During five decades on Wall Street, Barton Biggs has probably made as many predictions as Nostradamus, some of them almost as dire. Many times, he has been right.

NY Times:

- The US may have a shortage of as many as 14 million skilled workers by 2020 as baby boomers retire and new jobs are created, citing a study by labor economists Anthony Carnevale and Donna Desrochers. The trend has already started in Iowa, where there are 48,000 job vacancies in industries such as financial services, health care and skilled manufacturing with projected shortages of 198,000 by 2014, citing a study by Iowa Workforce Development.

- This year’s college graduates are finding about the same number of job opportunities and offers as in 2007, though they aren’t being presented with as many choices.

- The Human Hands Behind the Google(GOOG) Money Machine.

- Closely held Quividi and TruMedia Technologies have developed small digital billboards that play videos as advertisements, and can feature cameras to measure who is looking at the ad and for how long.

- The Problem With the Corporate Tax. A cut in the corporate tax is perhaps the best simple recipe for promoting long-run growth in American living standards.

- Do Railroad Stocks Have More Power to Burn?

LA Times:

- A San Diego company said Wednesday that it could turn algae into oil, producing a green-colored crude yielding ultra-clean versions of gasoline and diesel without the downsides of biofuel production. CEO Pyle said that the company’s green crude could be processed in existing oil refineries and that the resulting fuels could power existing cars and trucks just as today’s more polluting versions of gasoline and diesel do. “What we’re talking about is something that is radically different,” Pyle said. “We really look at this as a paradigm change.” It expects to introduce its first fuels in three years and reach full commercial scale in five years.

- No question, many consumers and businesses are struggling. But the first-quarter data, and many of the economic reports since, just aren’t accommodating the depression mongers. In part, we can credit globalization, as foreign demand for US exports has mushroomed. There is also a big reason to doubt that a ‘70s-style inflation spiral could take hold this time around: It takes two to spiral – meaning, you need rising wages to give consumers the wherewithal to pay higher prices and create the vicious cycle of one feeding the other.

- Soaring fuel prices drive some companies and local governments to try four-day workweeks.

Financial Times:

- Sovereign wealth funds have provided more than half the equity for the BlackRock(BLK) fund that bought $15 billion of troubled mortgage debt from UBS AG this month.

- Adair Turner, head of the UK Committee on Climate Change and incoming chief of the country’s financial markets regulator, said high energy prices are a “legitimate” way to cut greenhouse gases. Raising the price of energy is a “crucial” way to cut emissions, he said.

-

- A hedge fund has come up with an innovative way of capitalizing on the US housing market crash, buying tracts of abandoned development land in California, one of the states hardest hit by the downturn. The fund, which has a target size of $150 million to $250 million, provides an alternative to commercial property funds or residential property index derivatives for those seeking to benefit from any upswing in the property sector. The manager of the fund believes the medium-term dynamics of the state’s housing market are robust, particularly with completion rates having slumped from 1.6 million in 2005 to 500,000 in the past 12 months. “It won’t take more than 11 months for the current inventories to be wiped out if we get back to conventional demand,” he said. “Market conditions have not been this opportune for 16 years.”

- US regulators plan to introduce, as soon as tomorrow, measures to strengthen their oversight of booming agricultural commodities markets such as corn, wheat and cotton, which have increasingly attracted hedge funds and other speculators in recent years. Traders and bankers said there is a risk lawmakers could impose tougher measures in agricultural futures trading if the CFTC does not boost its own surveillance.

- The CME Group’s(CME) attempt to enhance its position as the world’s biggest financial exchange by taking over Nymex(NMX) is looking increasingly likely to be derailed by shareholder opposition.

- Why free markets have little to do with inequality. The countries most at risk of rising social inequalities are those with underperforming education systems.

- Intel(INTC) to re-enter mobile phone market.

- The Chinese government has instructed domestic media outlets to rein in coverage of the schools that collapsed during last month’s devastating earthquake in Sichuan province, journalists say.

TimesOnline:

- Rental prices for office space in London’s main financial district will fall at least 40% from their peak before recovering, citing property investor Chris Bartram.

- Three software companies lodged final bids for Iona Technologies Plc(IONA), meeting this weekend’s deadline. Red Hat(RHT) is believed to be in the running for Dublin-based

- Why Britain could lose out in a global game of chance. As warnings go, it is as chilling as it is, perhaps, predictable. Increase the tax burden at your peril, Britain, because you will pay a high price if you get it wrong. Moreover, David Childs knows what he is talking about. The global managing partner of Clifford Chance presides over a London-based worldwide law firm - and his clients are looking anew at their relationship with London and Britain as an international financial centre. Put bluntly, they are thinking of upping sticks and moving. The sudden changes to taxation of non-domiciled UK residents caused some disquiet; capital gains tax upheavals lifted that to real unease; and the latest proposals to taxation of companies' overseas earnings is threatening to turn chatter into change.

- Apple’s(AAPL) next generation iPhone may be for sale in

International Herald Tribune:

- Lawsuit provides a rare glimpse at credit default swaps.

Globe and Mail:

- Sunny future for Lululemon(LULU), despite slowdown: analysts.

Auto Motor und Sport:

- Volvo Car Corp. is considering buying a

Dagens Naeringsliv:

- The Norwegian Petroleum Directorate may recall license if oil companies don’t focus more on raising output from Norwegian oil fields, citing Eva Halland, who oversees output numbers at the NPD.

CNBC TV18:

- Indian oil refiners increased jet fuel prices by 18% for June.

Khaleej Times:

- GE(GE) Energy has won contracts worth more than $500 million to help Saudi Arabia meet its growing energy demands and population growth.

Weekend Recommendations

Barron's:

- Made positive comments on (NITE), (GM), (MKL), (ETN) and (NG).

Citigroup:

- Reiterated Buy on (HOLX), target $36.

- Reiterated Buy on (CELG), target $79.

Night Trading

Asian indices are -.25% to +.50% on avg.

S&P 500 futures -.21%.

NASDAQ 100 futures -.05%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (IPI)/.24

- (LULU)/-.02

- (ABM)/.27

- (TMA)/-3.32

- (QSII)/.40

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- ISM Manufacturing for May is estimated to fall to 48.5 versus 48.6 in April.

- ISM Prices Paid for May is estimated to rise to 85.0 versus 84.5 in April

- Construction Spending for April is estimated to fall .6% versus a 1.1% decline in March.

Other Potential Market Movers

- The Fed’s Lockhart speaking, (MDT) analyst meeting, (NVDA) investor briefing, (PMTC) analyst event, (EXEL) investor briefing, (UDR) investor day, RBC Energy Conference, Goldman Lodging/Gaming/Restaurant/Leisure Conference and ASCO 2008 could also impact trading today.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are several economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – ISM Manufacturing, ISM Prices Paid, Construction Spending

Tues. – Weekly retail sales, Vehicle Sales, Factory Orders

Wed. – Weekly MBA Mortgage Applications Report, Weekly EIA Energy Inventory Data, Challenger Job Cuts Report, ADP Employment Report, Non-farm Productivity, Unit Labor Costs, ISM Non-Manufacturing

Thur. – Initial Jobless Claims, ICSC Chain Store Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Wholesale Inventories, Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Intrepid Potash(IPI), Lululemon Athletica(LULU)

Tues. – Toll Brothers(TOL), Bob Evans Farms(BOBE), Hovnanian(HOV), Copart Inc.(CPRT), Guess?(GES)

Wed. – Williams-Sonoma(WSM), Martek Biosciences(MATK), ADC Telecom(ADCT)

Thur. – Ciena Corp.(CIEN), Dr Pepper Snapple(DPS), Smithfield Foods(SFD), Jackson Hewitt(JTX), Brown-Forman(BF/B), National Semi(NSM), Cooper Cos(COO), Focus Media(FMCN), Quiksilver Inc.(ZQK), Take-Two Interactive(TTWO), Vail Resorts(MTN), Del Monte(DLM)

Fri. – Forn/Ferry(KFI)

Other events that have market-moving potential this week include:

Mon. – The Fed’s Lockhart speaking, (MDT) analyst meeting, (NVDA) investor briefing, (PMTC) analyst event, (EXEL) investor briefing, (UDR) investor day, RBC Energy Conference, Goldman Lodging/Gaming/Restaurant/Leisure Conference, ASCO 2008

Tue. – (ALTR) mid-quarter update, (CNC) analyst meeting, (THC) analyst meeting, (INFA) analyst meeting, Goldman Lodging/Gaming/Restaurant/Leisure Conference, JPMorgan Basics/Industrials Conference, RBC Energy Conference, Oppenheimer Communications/Tech Conference

Wed. – The Fed’s Lockhart speaking, (NFP) analyst meeting, (SPR) investor day, (BOBE) analyst meeting, Keefe Bruyette Woods Financial Services Conference, JPMorgan Basics/Industrials Conference, KeyBanc Transports Conference, Stephens Investment Conference, Oppenheimer Communications/Tech Conference

Thur. – (CSC) investor meeting, (HD) investor conference, (KLAC) analyst day, Jefferies Global Clean Tech Conference, BMO Healthcare Staffing Forum, Stephens Investment Conference, CSFB Environmental/Engineering Services Conference, Keefe Bruyette Woods Financial Services Conference, Merrill Ag Chemicals Conference, Citi Power/Gas/Utilities Conference

Fri. – The Fed’s Evans speaking, Fed’s Bullard speaking, Canaccord Adams Diabetes/Obesity Conference, Sandler O’Neil Global Exchange/Electronic Trading Conference

Saturday, May 31, 2008

Friday, May 30, 2008

Weekly Scoreboard*

Indices

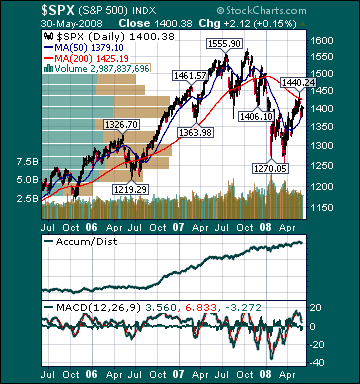

S&P 500 1,400.38 +.43%

DJIA 12,638.32 +.10%

NASDAQ 2,522.66 +2.36%

Russell 2000 748.28 +2.08%

Wilshire 5000 14,193.68 +.82%

Russell 1000 Growth 596.63 +1.63%

Russell 1000 Value 752.12 -.52%

Morgan Stanley Consumer 704.58 +1.41%

Morgan Stanley Cyclical 982.14 +.09%

Morgan Stanley Technology 617.63 +3.49%

Transports 5,437.54 +3.66%

Utilities 521.65 -.57%

MSCI Emerging Markets 151.44 -.10%

Sentiment/Internals

NYSE Cumulative A/D Line 59,198 -1.07%

Bloomberg New Highs-Lows Index -117

Bloomberg Crude Oil % Bulls 30.0 -37.5%

CFTC Oil Large Speculative Longs 215,999 -11.3%

Total Put/Call .84 -13.4%

OEX Put/Call 1.22 +93.65%

ISE Sentiment n/a

NYSE Arms 1.07 +5.94%

Volatility(VIX) 17.83 -1.22%

G7 Currency Volatility (VXY) 9.96 -4.96%

Smart Money Flow Index 8,798.33 +.70%

AAII % Bulls 31.36 -32.27%

AAII % Bears 45.76 +33.57%

Futures Spot Prices

Crude Oil 127.57 -2.29%

Reformulated Gasoline 335.48 +1.24%

Natural Gas 11.77 +.03%

Heating Oil 367.80 -7.20%

Gold 890.70 -3.41%

Base Metals 236.22 -3.18%

Copper 360.40 -2.67%

Agriculture 397.75 +.74%

Economy

10-year US Treasury Yield 4.05% +21 basis points

10-year TIPS Spread 2.52% unch.

TED Spread .80 unch.

N. Amer. Investment Grade Credit Default Swap Index 101.21 -6.68%

Emerging Markets Credit Default Swap Index 207.31 -4.79%

Citi US Economic Surprise Index -9.70 +47.3%

Fed Fund Futures 2.0% chance of 25 cut, 98.0% chance of no cut on 6/25

Iraqi 2028 Govt Bonds 74.50 +.53%

4-Wk MA of Jobless Claims 370,500 -.7%

Average 30-year Mortgage Rate 6.08% +10 basis points

Weekly Mortgage Applications 593,300 -4.55%

Weekly Retail Sales +1.8%

Nationwide Gas $3.96/gallon +.05/gallon.

US Cooling Demand Next 7 Days 21.0% above normal

ECRI Weekly Leading Economic Index 132.80 -.15%

US Dollar Index 72.88 +1.36%

Baltic Dry Index 11,347 -2.58%

CRB Index 422.17 -1.54%

Best Performing Style

Small-cap Growth +2.72%

Worst Performing Style

Large-cap Value -.51%

Leading Sectors

Road & Rail +4.84%

Computer Services +4.46%

Computer Hardware +4.0%

Gaming +2.91%

Internet +2.87%

Lagging Sectors

Tobacco -1.81%

Energy -2.21%

Banks -2.34%

Oil Tankers -2.63%

Gold -5.01%

Stocks Finish Higher, Boosting by Technology, Commodity, Construction, Defense and HMO Shares

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play