Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Friday, December 04, 2015

Weekly Scoreboard*

Indices

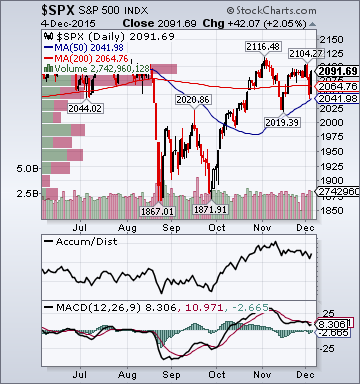

- S&P 500 2,091.69 +.08%

- DJIA 17,847.63 +.28%

- NASDAQ 5,142.27 +.29%

- Russell 2000 1,183.40 -1.59%

- S&P 500 High Beta 31.0 -1.40%

- Goldman 50 Most Shorted 106.74 -2.56%

- Wilshire 5000 21,632.31 -.19%

- Russell 1000 Growth 1,024.33 +.09%

- Russell 1000 Value 987.91 -.26%

- S&P 500 Consumer Staples 515.31 +.91%

- Solactive US Cyclical 128.92 -.49%

- Morgan Stanley Technology 1,122.61 +.94%

- Transports 7,954.83 -3.17%

- Utilities 561.30 -.32%

- Bloomberg European Bank/Financial Services 101.77 -2.48%

- MSCI Emerging Markets 33.64 -1.53%

- HFRX Equity Hedge 1,162.32 -.33%

- HFRX Equity Market Neutral 1,041.94 +.40%

Sentiment/Internals

- NYSE Cumulative A/D Line 232,056 -.97%

- Bloomberg New Highs-Lows Index -389 -259

- Bloomberg Crude Oil % Bulls 26.5 -15.3%

- CFTC Oil Net Speculative Position 208,478 -1.67%

- CFTC Oil Total Open Interest 1,661,176 +1.76%

- Total Put/Call .89 -20.54%

- OEX Put/Call 1.39 -70.64%

- ISE Sentiment 130.0 -2.99%

- NYSE Arms 1.11 -40.21%

- Volatility(VIX) 14.96 +.40%

- S&P 500 Implied Correlation 55.81 -2.23%

- G7 Currency Volatility (VXY) 9.0 -10.0%

- Emerging Markets Currency Volatility (EM-VXY) 10.59 -.38%

- Smart Money Flow Index 17,705.53 -2.06%

- ICI Money Mkt Mutual Fund Assets $2.741 Trillion +.65%

- ICI US Equity Weekly Net New Cash Flow -$3.528 Billion

- AAII % Bulls 29.5 -8.9%

- AAII % Bears 21.2 -18.6%

Futures Spot Prices

- CRB Index 183.24 unch.

- Crude Oil 40.10 -4.0%

- Reformulated Gasoline 128.08 -4.43%

- Natural Gas 2.18 -2.07%

- Heating Oil 135.09 -.69%

- Gold 1,086.10 +2.74%

- Bloomberg Base Metals Index 135.96 +.75%

- Copper 207.85 +1.27%

- US No. 1 Heavy Melt Scrap Steel 139.0 USD/Ton unch.

- China Iron Ore Spot 40.03 USD/Ton -10.04%

- Lumber 252.10 +1.90%

- UBS-Bloomberg Agriculture 1,078.81 +3.07%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -1.2% +80.0 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.0408 +2.86%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 125.95 +.1%

- Citi US Economic Surprise Index -25.80 -10.3 points

- Citi Eurozone Economic Surprise Index 19.10 -9.1 points

- Citi Emerging Markets Economic Surprise Index 12.10 +6.7 points

- Fed Fund Futures imply 24.0% chance of no change, 76.0% chance of 25 basis point hike on 12/16

- # of Months to 1st Fed Rate Hike(Morgan Stanley) 1.61 -12.97%

- US Dollar Index 98.36 -1.72%

- Euro/Yen Carry Return Index 139.98 +2.99%

- Yield Curve 133.0 +3.0 basis points

- 10-Year US Treasury Yield 2.27% +5.0 basis points

- Federal Reserve's Balance Sheet $4.440 Trillion +.03%

- U.S. Sovereign Debt Credit Default Swap 20.50 -.15%

- Illinois Municipal Debt Credit Default Swap 279.0 +1.27%

- Western Europe Sovereign Debt Credit Default Swap Index 17.73 -.03%

- Asia Pacific Sovereign Debt Credit Default Swap Index 68.86 -.27%

- Emerging Markets Sovereign Debt CDS Index 165.65 +3.56%

- Israel Sovereign Debt Credit Default Swap 78.50 unch.

- Iraq Sovereign Debt Credit Default Swap 834.50 +1.28%

- Russia Sovereign Debt Credit Default Swap 280.32 +4.62%

- iBoxx Offshore RMB China Corporates High Yield Index 123.87 -.22%

- 10-Year TIPS Spread 1.63% -1.0 basis points

- TED Spread 23.75 -.5 basis point

- 2-Year Swap Spread 10.0 +4.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -35.25 +18.0 basis points

- N. America Investment Grade Credit Default Swap Index 82.55 -2.29%

- America Energy Sector High-Yield Credit Default Swap Index 1,336.0 +2.03%

- European Financial Sector Credit Default Swap Index 70.93 +3.50%

- Emerging Markets Credit Default Swap Index 336.95 +5.57%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 130.0 unch.

- M1 Money Supply $3.115 Trillion +.76%

- Commercial Paper Outstanding 1,042.40 -1.40%

- 4-Week Moving Average of Jobless Claims 269,250 -1,750

- Continuing Claims Unemployment Rate 1.6% unch.

- Average 30-Year Mortgage Rate 3.93% -2.0 basis points

- Weekly Mortgage Applications 418.90 -.24%

- Bloomberg Consumer Comfort 39.6 -1.3 points

- Weekly Retail Sales +1.90% +60.0 basis points

- Nationwide Gas $2.05/gallon unch.

- Baltic Dry Index 574.0 -1.20%

- China (Export) Containerized Freight Index 718.58 -4.26%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 50.0 +33.33%

- Rail Freight Carloads 219,470 -17.09%

Best Performing Style

- Large-Cap Growth unch.

Worst Performing Style

- Small-Cap Value -1.7%

Leading Sectors

- Gold & Silver +10.4%

- Alt Energy +3.5%

- Semis +3.1%

- Coal +2.9%

- Airlines +2.9%

Lagging Sectors

- Hospitals -3.5%

- Oil Service -3.6%

- Energy -3.7%

- Road & Rail -7.2%

- Oil Tankers -9.4%

Weekly High-Volume Stock Gainers (9)

- BLOX, ONDK, CTMX, ITC, SCVL, PLAB, DYAX, FIZZ and HSII

Weekly High-Volume Stock Losers (15)

- AMSG, PFPT, TRNO, UHAL, TIER, CMI, REX, BKS, IMS, MPG, CHRW, INCR, VRNT, ISLE and CSC

Weekly Charts

ETFs

Stocks

*5-Day Change

Stocks Surging into Afternoon on Diminished Global Growth Fears, Central Bank Hopes, Seasonal Optimism, Financial/Homebuilding Sector Strength

Broad Equity Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Volume: Around Average

- Market Leading Stocks: Performing In Line

- Volatility(VIX) 15.44 -14.74%

- Euro/Yen Carry Return Index 139.76 -.27%

- Emerging Markets Currency Volatility(VXY) 10.64 unch.

- S&P 500 Implied Correlation 55.70 -3.60%

- ISE Sentiment Index 141.0 +78.48%

- Total Put/Call .86 -22.52%

- NYSE Arms 1.15 +52.40%

- North American Investment Grade CDS Index 81.95 -1.10%

- America Energy Sector High-Yield CDS Index 1,334.0 +3.27%

- European Financial Sector CDS Index 71.50 +.53%

- Western Europe Sovereign Debt CDS Index 17.74 +2.16%

- Asia Pacific Sovereign Debt CDS Index 68.86 -.58%

- Emerging Market CDS Index 339.27 -.31%

- iBoxx Offshore RMB China Corporate High Yield Index 123.87 -.03%

- 2-Year Swap Spread 10.0 +2.0 basis points

- TED Spread 23.75 +2.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -35.25 -1.0 basis point

- Bloomberg Emerging Markets Currency Index 70.61 -.15%

- 3-Month T-Bill Yield .21% +1.0 basis point

- Yield Curve 133.0 -4.0 basis points

- China Import Iron Ore Spot $40.03/Metric Tonne -1.77%

- Citi US Economic Surprise Index -25.80 -4.0 points

- Citi Eurozone Economic Surprise Index 19.10 +1.4 points

- Citi Emerging Markets Economic Surprise Index 12.1 +1.9 points

- 10-Year TIPS Spread 1.63 -1.0 basis point

- # of Months to 1st Fed Rate Hike(Morgan Stanley) 1.61 -.03

- Nikkei 225 Futures: Indicating +171 open in Japan

- China A50 Futures: Indicating -144 open in China

- DAX Futures: Indicating +89 open in Germany

- Slightly Higher: On gains in my medical/biotech/retail/tech sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges and some of my (EEM) short

- Market Exposure: Moved to 75% Net Long

Bear Radar

Style Underperformer:

- Small-Cap Value +.56%

- 1) Coal -9.41% 2) Oil Tankers -3.45% 3) Oil Service -2.01%

Stocks Falling on Unusual Volume:

- COO, KMI, MPLX, BIG, AMBA, IEP, NSH, MMLP, P, NGLS, CMG, CORR, ETE, NSC, KYN, PTLA, NGL, TITN, BPT, ZIOP, TYG, EQM, CEQP, BPL, SUPN, GEL, PII, FGP, PAA, TLLP, VECO, WPZ, OKE, KYE, DYN, TRGP, NGLS and RYAM

- 1) HAS 2) CCL 3) KMI 4) OXY 5) NSC

Stocks With Most Negative News Mentions:

- 1) GPRO 2) COO 3) PBR 4) AMBA 5) CMG

Bull Radar

Style Outperformer:

- Large-Cap Growth +1.28%

Sector Outperformers:

- 1) Gold & Silver +3.59% 2) Banks +2.36% 3) HMOs +2.28%

Stocks Rising on Unusual Volume:

- ULTA, ZUMZ, PLAB, RYLP, USLV, NPTN, SHLD and EXPR

Stocks With Unusual Call Option Activity:

- 1) AMLP 2) RAD 3) ULTA 4) NRG 5) BKD

Stocks With Most Positive News Mentions:

- 1) DGX 2) HPQ 3) EMC 4) FIVE 5) LMT

Charts:

Morning Market Internals

NYSE Composite Index:

- Volume Running +8.9% Above 100-Day Average

- 9 Sectors Rising, 1 Sector Declining

- 56.9% of Issues Advancing, 40.5% Declining

- 24 New 52-Week Highs, 176 New Lows

- 34.1% of Issues Above 200-day Moving Average

- Average 14-Day RSI 40.3

- Vix 16.3

- Total Put/Call .85

- TRIN/Arms 1.16

Subscribe to:

Comments (Atom)