Weekend Headlines

Bloomberg:

- The cost of protecting Asia-Pacific corporate and government bonds from default decreases, according to traders of credit default swaps. The Markit iTraxx Asia index of 50 investment-grade borrowers outside

-

Wall Street Journal:

MarketWatch.com:

CNBC.com:

- If you think crude is marching higher, think again. Option investors are betting that it doesn't!

NY Times:

Business Week:

- Cancer Drugs: News from ASCO.

NY Post:

Politico:

Chicagtribune.com:

Rasmussen Reports:

Crain’s NY Business:

MercuryNews.com:

- 49ers’ Santa Clara stadium plan would cost public $114 million.

AP:

-

Reuters:

Financial Times:

Telegraph:

Xinhua News Agency:

-

Nikkei:

- Nintendo Co. plans to release an updated version of its “Wii Fit” game software this fall. The new version, “Wii Fit Plus,” measures body weight more precisely and has Internet connection so users can compare game data with people at remote locations.

- Semiconductor Manufacturing International Corp.,

Weekend Recommendations

Barron's:

- Made positive comments on (AAPL), (AMZN), (NKE), (BBBY), (CMG), (JCG), (URBN), (SWY), (TGT), (VAR), (RIMM), (BA), (SCHW) and (TM).

- Made negative comments on (GMCR).

Citigroup:

- Reiterated Buy on (DVA), target $62.

Night Trading

Asian indices are +1.25% to +2.50% on avg.

S&P 500 futures +.73%.

NASDAQ 100 futures +.44%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Global Commentary

WSJ Intl Markets Performance

Commodity Futures

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (AZPN)/.22

- (AINV)/.34

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- Personal Income for April is estimated to fall .2% versus a .3% decline in March.

- Personal Spending for April is estimated to fall .2% versus a .2% decline in March.

- The PCE Core for April is estimated to rise .2% versus a .2% gain in March.

10:00 am EST

- ISM Manufacturing for May is estimated to rise to 42.0 versus 40.1 in April.

- ISM Prices Paid for May is estimated to rise to 35.0 versus 32.0 in April.

- Construction Spending for April is estimated to fall 1.5% versus a .3% gain in March.

Other Potential Market Movers

- Geithner’s Visit to

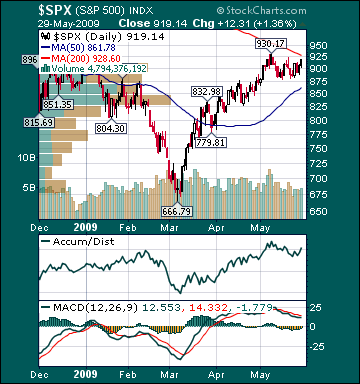

BOTTOM LINE: Asian indices are higher, boosted by gains in financial and mining stocks in the region. I expect US stocks to open modestly higher and to build on gains into the afternoon, finishing higher. The Portfolio is 100% net long heading into the week.