Click here for Stocks in Focus for Monday by MarketWatch

There are a few economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Durable Goods Orders, Consumer Confidence, Richmond Fed Manufacturing, Existing Home Sales, weekly retail sales

Wed. - MBA Mortgage Applications, Preliminary 4Q GDP, Preliminary 4Q Personal Consumption, Preliminary GDP Price Index, Preliminary 4Q Core PCE, Chicago Purchasing Manager, New Home Sales, EIA energy inventory data

Thur. - Challenger Job Cuts, Personal Income, Personal Spending, PCE Core, Initial Jobless Claims, ISM Manufacturing, ISM Prices Paid, Construction Spending, Total Vehicle Sales

Fri. - Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Marvel Entertainment(MVL), GlobalSantaFe(GSF), Forest Oil(FST), Nordstrom(JWN), Brocade Communications(BRCD), Marvel Tech(MRVL), Netease.com(NTES), XM Satellite Radio(XMSR)

Tues. - Papa Johns(PZZA), Human Genome Sciences(HGSI), Deckers Outdoor(DECK), Federated Dept. Stores(FD), Sirius Satellite(SIRI), El Paso Corp.(EP), Dynegy Inc.(DYN), Kenneth Cole Productions(KCP), Hansen Natural(HANS), Conseco(CNO), CBRL Group(CBRL), Target Corp.(TGT), AutoZone(AZO), AutoDeck(ADSK), American Power Conversion(APCC), Cablevision SystemsCVC), Rowan Companies(RDC), Harrah’s Entertainment(HET), Vornado Realty Trust(VNO), Public Storage(PSA), TXU Corp.(TXU), Radio Shack(RSH), HJ Heinz(HNZ)

Wed. - Dollar Tree Stores(DLTR), Dress Barn(DBRN), Eaton Vance(EV), Forest Oil(FST), Liz Claiborne(LIZ), Ltd Brands(LTD), Martha Stewart(MSO), PetSmart(PETM), Sprint Nextel(S), SPX Corp.(SPW), Station Casinos(STN)

Thur. - Ciena Corp.(CIEN), Del Monte Foods(DLM), Dell Inc.(DELL), EchoStar Communications(DISH), First American Corp.(FAF), Flour Corp.(FLR), Gap Inc.(GPS), General Motors(GM), Hovnanian Enterprises(HOV), Kohl’s Corp.(KSS), Mastec Inc.(MTZ), McDermott Intl.(MDR), Omnivision Tech(OVTI), Pall Corp.(PLL), Revlon Inc.(REV), Smithfield Foods(SFD), Sotheby’s(BID), Staples(SPLS), Viacom Inc.(VIA/B), Wild Oats(OATS)

Fri. - Genesco Inc.(GCO), Novell Inc.(NOVL), Trex Co(TWP)

Other events that have market-moving potential this week include:

Mon. - JPMorgan SMID Cap Conference, (HON) Investor Conference, (BAC) Investor Day, (SNDK) Analyst Meeting, Fed’s Bies speaking

Tue. - Goldman Sachs Tech Symposium, Merrill Lynch Communications Forum, CSFB Networking/Comm. Equipment & Opticals Conference, Bear Stearns Healthcare Conference, Bear Stearns Retail/Restaurants/Consumer Conference

Wed. - Merrill Lynch Communications Forum, Keefe Bruyette & Woods Regional Bank Conference, UBS Nat Gas & Utilities Conference, Goldman Sachs Tech Symposium, Robert Baird Business Solutions Conference, Jeffries Internet Conference, Bear Stearns Retail/Restaurants/Consumer Conference, (NVLS) Mid-quarter Update, (UTX) Analyst Meeting, (HD) Analyst Meeting, Fed’s Geithner speaking

Thur. - CIBC Israeli Tech Equities Conference, UBS Nat Gas & Utilities Conference, CSFB Truck Builders Conference, Robert Baird Business Solutions Conference, Bear Stearns Retail/Restaurants/Consumers Conference, Wachovia Homebuilding Conference, CE Unterberg Towbin Healthcare & Tech Days, Needham Displays & Emerging Electronics Conference, Goldman Sachs Tech Symposium, Keefe Bruyette & Woods Regional Bank Conference, (COF) Annual Investor Conference

Fri. - CE Unterberg Towbin Healcare & Tech Days, Wachovia Homebuilding Conference, Fed’s Bernanke speaking

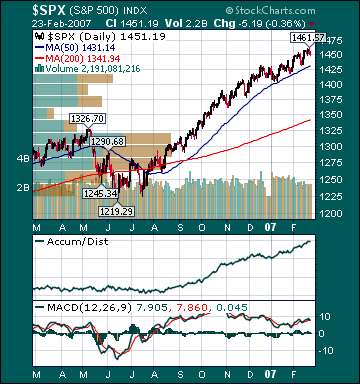

BOTTOM LINE: I expect US stocks to finish the week modestly higher on mostly positive earnings reports, buyout speculation, lower energy prices, short-covering and stable long-term rates. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.