Style Outperformer:

Mid-cap Growth (+2.03%)

Sector Outperformers:

Steel (+3.53%), Oil Service (+3.5%) and Restaurants (+2.17%)

Stocks Rising on Unusual Volume:

CLMT, HTX, WBMD, ROCM, PETS, PEET, MMSI, ASML, BCPC, BIDU, AMAT, SYNA, CRZO, LPHI, IVGN, CERN, SLGN, HURC, CWEI, CHRW, DRYS, MICC, ING, NRG, IFN, TPL, EBS, LNY, ABI, IRE and EDU

Stocks With Unusual Call Option Activity:

1) AMAG 2) SIRI 3) DOW 4) NDAQ 5) AMLN

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 20, 2008

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, October 19, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Bond Default Risk Has First Weekly Fall Since Lehman Collapse.

Wall Street Journal:

Barron’s:

MarketWatch.com:

NY Times:

CBS News:

CNNMoney.com:

AP:

Reuters:

Financial Times:

Telegraph:

21st Century Business Herald:

-

- Las Vegas Sands Corp.(LVS) scrapped its plan to raise $5.25 billion in loans for its expansion in

Weekend Recommendations

Barron's:

- Made positive comments on EMKR, MTU, AFFX, BGG, ABT, UPS, BBY, BBBY and CDNS.

- Made negative comments on EBAY.

Citigroup:

- Reiterated Buy on (FHN), target $14.

- Upgraded (CVS) to Buy, target $23.

- Reiterated Buy on (CRM), target $51.

- Reiterated Buy on (HON), target $50.

Night Trading

Asian indices are -1.50% to +2.0% on avg.

S&P 500 futures +.91%.

NASDAQ 100 futures +.95%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (ETN)/1.88

- (HAL)/.74

- (MAT)/.71

- (TXN)/.44

- (NFLX)/.31

- (AXP)/.59

- (LNCR)/.72

- (SNDK)/-.27

- (HAS)/.86

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Leading Indicators for September are estimated to fall .1% versus a .5% decline in August.

Other Potential Market Movers

- None of note

BOTTOM LINE: Asian indices are mostly higher, boosted by automaker and financial shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for a weekly preview by MarketWatch.

Click here for stocks in focus for Monday by MarketWatch.

There are a few economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Leading Indicators

Tues. – Weekly retail sales

Wed. – Weekly EIA energy inventory report, weekly MBA Mortgage Applications report

Thur. – Initial Jobless Claims, House Price Index

Fri. – Existing Home Sales

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Halliburton Co.(HAL), Eaton Corp.(ETN), Mattel Inc.(MAT), NetFlix(NFLX), Texas Instruments(TXN), American Express(AXP), Lincare Holdings(LNCR), SanDisk Corp.(SNDK), Hasbro Inc.(HAS)

Tues. – Brinker International(EAT), Freeport-McMoRan(FCX), 3M Co.(MMM), Quest Diagnostics(DGX), Biogen Idec(BIIB), Lockheed Martin(LMT), BlackRock Inc.(BLK), Forest Labs(FRX), Du Pont(DD), Caterpillar Inc.(CAT), Keycorp(KEY), AK Steel(AKS), Manpower Inc.(MAN), Norfolk Southern(NSC), Boston Scientific(BSX), QLogic Corp.(QLGC), Cerner Corp.(CERN), VMware Inc.(VMW), Panera Bread(PNRA), Illumina(ILMN), Broadcom(BRCM), Coach Inc.(COH), UAL Corp.(UAUA), Omnicom Group(OMC), Raymond James(RJF), Lexmark(LXK), Pfizer(PFE), Apple Inc.(AAPL), Schering-Plough(SGP), Stanley Works(SWK), National City(NCC), Yahoo! Inc.(YHOO)

Wed. – Foundation Coal(FCL), Baker Hughes(BHI), McDonald’s(MCD), WellPoint(WLP), Philip Morris(PM), PF Changs(PFCB), Wyeth(WYE), Boeing(BA), AT&T(T), ConocoPhillips(COP), Chipotle Mexican Grill(CMG), Allstate(ALL), Pulte Homes(PHM), Ryland Group(RYL), Wachovia Corp.(WB), EMC Corp.(EMC), Genzyme Corp.(GENZ), General Dynamics(GD), Northrop Grumman(NOC), Travelers(TRV), Kimberly-Clark(KMB), Lam Research(LRCX), Amgen Inc.(AMGN), Amazon.com(AMZN), Merck(MRK)

Thur. – New York Times(NYT), Goodrich(GR), SunTrust Banks(STI), L-3 Communications, Starwood Hotels(HOT), Dow Chemical(DOW), Altria Group(MO), Raytheon(RTN), Zimmer(ZMH), United Parcel Service(UPS), Burlington Northern(BNI), Microsoft Corp.(MSFT), Juniper Networks(JNPR), YRC Worldwide(YRCW), Western Digital(WDC), Ingram Micro(IM), Cheesecake Factory(CAKE), Aflac(AFL), Celgene Corp.(CELG), Deckers Outdoor(DECK), Eli Lilly(ELY), Diamond Offshore(DO), Black & Decker(BDK), Bristol-Myers(BMY), RadioShack(RSH), Microchip Tech(MCHP)

Fri. – ITT Corp.(ITT), Fortune Brands(FO), ImClone(IMCL)

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. – None of note

Wed. – (UTEK) analyst meeting

Thur. – (CETV) investor day

Fri. – None of note

Friday, October 17, 2008

Weekly Scoreboard*

Indices

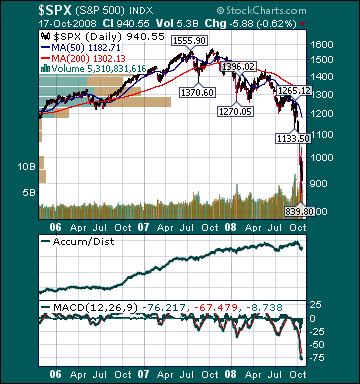

S&P 500 940.55 +4.60%

DJIA 8,852.22 +4.75%

NASDAQ 1,711.29 +3.75%

Russell 2000 526.43 +.76%

Wilshire 5000 9,475.35 +4.26%

Russell 1000 Growth 388.18 +3.58%

Russell 1000 Value 504.79 +5.33%

Morgan Stanley Consumer 565.68 +3.84%

Morgan Stanley Cyclical 558.70 -4.65%

Morgan Stanley Technology 371.33 +2.19%

Transports 3,692.73 -1.39%

Utilities 354.60 +9.25%

MSCI Emerging Markets 24.28 -1.53%

Sentiment/Internals

NYSE Cumulative A/D Line 22,478 -7.57%

Bloomberg New Highs-Lows Index -1,788 +64.63%

Bloomberg Crude Oil % Bulls 36.0 +20.0%

CFTC Oil Large Speculative Longs 164,118 -1.0%

Total Put/Call .97 -27.07%

OEX Put/Call 1.39 +78.21%

ISE Sentiment 127.0 +4.96%

NYSE Arms 1.41 -11.87%

Volatility(VIX) 70.33 +.54%

G7 Currency Volatility (VXY) 16.73 -15.46%

Smart Money Flow Index 6,140.42 -6.25%

AAII % Bulls 40.94 +30.09%

AAII % Bears 39.77 -34.63%

Futures Spot Prices

Crude Oil 72.12 -9.77%

Reformulated Gasoline 167.05 -10.09%

Natural Gas 6.87 +3.55%

Heating Oil 213.75 -5.61%

Gold 786.50 -7.56%

Base Metals 146.12 -6.39%

Copper 214.95 -.85%

Agriculture 295.83 +.04%

Economy

10-year US Treasury Yield 3.92% +5 basis points

10-year TIPS Spread 1.06% +13 basis points

TED Spread 3.63 -101 basis points

N. Amer. Investment Grade Credit Default Swap Index 200.06 -3.41%

Emerging Markets Credit Default Swap Index 654.65 +4.0%

Citi US Economic Surprise Index -38.80 -557.63%

Fed Fund Futures imply 48.0% chance of 25 basis point cut, 52.0% chance of 50 basis point cut on 10/29

Iraqi 2028 Govt Bonds 55.0 -3.93%

4-Wk MA of Jobless Claims 483,300 +.2%

Average 30-year Mortgage Rate 6.46% +52 basis points

Weekly Mortgage Applications 489,300 +5.11%

Weekly Retail Sales +.5%

Nationwide Gas $3.04/gallon -.31/gallon

US Cooling Demand Next 7 Days 19.0% below normal

ECRI Weekly Leading Economic Index 117.0 -2.99%

US Dollar Index 82.53 -.70%

Baltic Dry Index 1,506 -39.83%

CRB Index 282.14 -2.67%

Best Performing Style

Large-cap Value +5.33%

Worst Performing Style

Small-cap Value +.23%

Leading Sectors

Airlines +37.58%

I-Banks +12.63%

HMOs +10.77%

Drugs +9.47%

Utilities +9.25%

Lagging Sectors

Road & Rail -1.66%

Semis -3.77%

Papers -9.63%

REITs -11.69%

Gold -14.43%