Style Outperformer:

Sector Outperformers:

- 1) Gaming +1.27% 2) Computer Hardware +.73% 3) Disk Drives +.65%

Stocks Rising on Unusual Volume:

- CYCC, DELL, CLR, QIHU, DECK, EFX, VRSN and GMCR

Stocks With Unusual Call Option Activity:

- 1) MDRX 2) AMD 3) DISH 4) SWN 5) XRX

Stocks With Most Positive News Mentions:

- 1) DISH 2) CATO 3) WYNN 4) LMT 5) DELL

Charts:

Weekend Headlines

Bloomberg:

- Geithner Joins Boehner to Trade Blame on Fiscal Cliff Talks. U.S.

Treasury Secretary Timothy F. Geithner and House Speaker John Boehner

hardened their positions over the fiscal cliff, each blaming the other

for a standoff that could lead to more than $600 billion in tax

increases and spending cuts in January. “There’s not going to be an

agreement without rates going up,” Geithner said in a taped interview

that aired today on CNN’s “State of the Union.” Republican Boehner said

the White House is wasting time. “I would say we’re nowhere, period,”

Boehner said on the “Fox News Sunday”

program. “We’ve put a serious offer on the table by putting revenues up

there to try to get this question resolved. But the White House has

responded with virtually nothing.”

- U.S. Credit-Default

Swaps Advance Versus Bunds on Fiscal Cliff. The cost to insure

Treasuries rose to a 16-month high relative to German bunds on concern

U.S. officials are putting their nation's debt rating at risk as they

struggle to avoid the fiscal cliff. Credit-default swaps covering

Treasuries changed hands at 36.57 basis points, or about six basis

points more than swaps on German government securities. The difference

was 8 bps on Nov. 28, the most since July 2011, according to data

provider CMA. "The rating companies, as well as investors, are focused

on whether the U.S. can resolve its budget issues," said Hiroki Shimazu,

an economist in Tokyo at SMBC Nikko Securities Inc., a unit of Japan's

third-largest publicly traded bank by assets. "Investors fear there will

be a downgrade."

- Obama Plans for Climate Deal as Fiscal Cliff Negotiations Rage. As leaders in Washington obsess about

the fiscal cliff, President Barack Obama is putting in place the

building blocks for a climate treaty requiring the first fossil-

fuel emissions cuts from both the U.S. and China. State Department envoy Todd Stern is in Doha this week

working to clear the path for an international agreement by

2015. While Obama failed to deliver on his promise to start

a cap-and-trade program in his first term, he’s working on

policies that may help cut greenhouse gases 17 percent in

2020 in the U.S., historically the world’s biggest polluter. Obama has moved forward with greenhouse-gas rules for

vehicles and new power plants, appliance standards and

investment in low-emitting energy sources. He’s also called for

80 percent of U.S. electricity to come from clean energy

sources, including nuclear and natural gas, by 2035. “The president is laying the foundations for real action

on climate change,” Jake Schmidt, who follows international

climate policy for the Washington-based Natural Resources

Defense Council, said in an interview in Doha. “Whether or not

he decides to jump feet first into the international arena,

we’ll see.”

- Climate Gridlock Frustrating Envoys at UN Talks in Doha. International efforts to curb global

warming are moving so slowly that that delegates from both rich

nations and poorer ones are expressing frustration with the

process. “I don’t see as much public interest for governments to

take on more ambitious and more courageous decisions,”

Christiana Figueres, the diplomat organizing two weeks of United

Nations climate-change talks in Doha, said at a briefing

yesterday. “Each one of us needs to assume responsibility. It’s

not just about national governments. It’s about individuals.

It’s about civil society.”

- EFSF, European Stability Mechanism Ratings Cut by Moody’s. The European Stability Mechanism and

European Financial Stability Facility were downgraded by Moody’s

Investors Service, which cited a high correlation in credit risk

present among the entities’ largest financial supporters. The ESM was cut to Aa1 from Aaa, while the EFSF provisional

rating was lowered to (P)Aa1 from (P)Aaa. Moody’s said in a

statement that it would maintain a negative outlook on each. The

EFSF has about 161.8 billion euros ($210.1 billion) of bonds

outstanding according to data compiled by Bloomberg. The move follows

downgrades of the EFSF’s second-biggest contributor after France lost

its top grade at Moody’s and Standard and Poor’s this year. Investors

often ignore such ratings actions, evidenced by the drop in France’s

10-year bond yields since last week’s Moody’s downgrade and a rally in

Treasuries after the U.S. lost its AAA at S&P in 2011. The EFSF’s

“rating is at the mercy of the creditworthiness of its biggest

backers,” Nicholas Spiro, managing director of Spiro Sovereign Strategy

in London, said before the actions.

“Another downgrade of the EFSF would show how the

creditworthiness of the euro zone’s rescue fund itself is being

affected by the worsening economic conditions in the core.”

- French Socialists Defend Mittal ‘Arm Twist’ With Nationalization. French

Socialists defended Industry

Minister Arnaud Montebourg’s threat to nationalize an ArcelorMittal (MT)

steel plant, saying the tactic spurred the company to maintain jobs and

invest. “Without the action of Montebourg, the issue wouldn’t have

attained such a high profile,” Claude Bartolone, the Socialist

president of the National Assembly said late today on France

Inter radio. Montebourg helped “twist Mittal’s arm.”

Environment Minister Delphine Batho on Europe 1 radio said

Montebourg played a “decisive” role in preserving jobs and

showed that the government will hold Mittal to his promises.

- Fed’s Stein Sees Diminishing Returns From Treasury Buying. Federal Reserve Governor Jeremy Stein said there may be “diminishing returns” from additional

purchases of Treasury securities because companies may respond

to lower borrowing costs by refinancing debt or returning money

to shareholders instead of making business investments. If “corporate investment reacts only weakly to further

changes in term premiums, there may be more ‘kick’ to be had by

focusing efforts on a sector that is more responsive,” Stein

said today in a speech at the Federal Reserve Bank of Boston.

“Mortgage purchases may confer more macroeconomic stimulus

dollar-for-dollar than Treasury purchases.”

- Egypt Opposition to Take Constitution Fight to Mursi. Egyptian President Mohamed Mursi’s

opponents vowed to take their fight over a new constitution to

his doorstep. The highest court suspended operations before it could hear

a challenge to the panel that drafted the charter. Egypt’s

judges won’t supervise a Dec. 15 constitutional referendum and

will boycott the vote, according to Egypt’s state-run Middle

East News Agency, which cited Judge Ahmed El Zind, head of the

nation’s judge’s association.

- Senate Votes to Add Iran Sanctions as White House Objects. The U.S. Senate approved new economic

sanctions on Iran, overriding objections from the White House

that the legislation could undercut existing efforts to rein in

Iran’s nuclear ambitions. The Senate voted 94-0 yesterday to impose additional U.S.

financial penalties on foreign businesses and banks involved in

Iran’s energy, ports, shipping and shipbuilding sectors, and

impose sanctions on metals trade with Iran.

- Hedge Funds Increase Bullish Bets Most Since August: Commodities. Hedge funds increased bullish bets on

commodities by the most since August as evidence that China is

accelerating outweighed concern that U.S. lawmakers have yet to

resolve an impasse over automatic spending cuts and tax rises. Speculators and money manager increased net-long positions

across 18 U.S. futures and options by 9.8 percent to 929,588

contracts in the week ended Nov. 27, the biggest gain since Aug.

21, U.S. Commodity Futures Trading Commission data show. Gold

holdings reached a six-week high, and wagers on a wheat rally

jumped the most since June. Cattle bets more than doubled.

- North Korea Defies Sanctions, Plans Rocket Launch This Month. North Korea said it will test a long-

range rocket this month in defiance of international sanctions

and as South Koreans hold an election for a new president. The launch will take place between Dec. 10 and Dec. 22, the

state-run Korean Central News Agency said on Dec. 1. South Korea

“sternly” warned its neighbor against the plan, saying the

firing would bring a “forceful response” from the world. North Korea is trying to interfere in South Korea’s Dec. 19

election, President Lee Myung Bak told South Korea’s Yonhap news

agency yesterday.

Wall Street Journal:

Marketwatch.com:

- Asia stocks mostly higher, China stuggles.

Hong Kong’s Hang Seng Index HK:HSI +0.07% traded flat after rising

0.6% in early moves to near its highest level for the year, while the

Shanghai Composite Index CN:000001 -0.33% saw brief post-data gains

evaporate to trade 0.3% lower.

- Shanghai’s disturbing stock slump.

The benchmark Shanghai Composite Index ended last week near four-year

lows, having lost a total of 67% since its October 2007 record high.

Business Insider:

Reuters:

- Greece set to unveil terms of crucial bond buy-back. Greece will unveil details of a bond buy-back crucial to efforts by

foreign lenders to trim the country's ballooning debt, hoping the terms

will draw enough investors and unblock vital aid. Since plans for the buy-back were announced on Tuesday, questions have

swirled about whether it will tempt enough bondholders to cut Greek debt

by a net 20 billion euros.

- Syrian forces pound Damascus suburbs, flights to resume. Syrian forces pounded rebel-held

suburbs around Damascus with fighter jets and rockets on Sunday,

opposition activists said, killing and wounding dozens in an

offensive to push rebels away from the airport and stop them

closing in on the capital.

- UK lawmakers call for tax crackdown on multinationals.

- RPT-Toyota China sales tumble again in Nov, though pace eases - exec. The pace of the last month's decline - roughly 25 percent

from a year earlier - eased from the previous two months but was

still "far off from our more normalised and targeted sales

pace," said the Toyota executive who declined to be named

because the information had not yet been made public. Toyota's numbers indicate that sales in China by other

Japanese carmakers are also likely to be down.

Financial Times:

- Quant fund launches at record high.

Trend-following quantitative “black-box” hedge funds are accounting for

their highest-ever proportion of hedge fund start-ups, despite weak

returns since the financial crisis. A record 187 quant, or algorithmic funds, launched last year and

account for 12 per cent of all hedge fund start-ups, another record,

according to Preqin, a data provider whose figures go back to 2000.

- UK’s Euro Trade Supremacy Under Attack. The City of London should be deposed as the euro's main financial

center so the single currency club can "control" most financial business

in the euro zone, France's central bank governor has said. Christian

Noyer of the Banque de France said there was "no rationale" for

allowing the euro area's financial hub to be "offshore", in a blunt

assessment that will fan UK concerns over EU rules being rigged against

it. "Most of the euro business should be done inside the euro

area. It's linked to the capacity of the central bank to provide

liquidity and ensure oversight of its own currency," Mr Noyer told the

Financial Times while touring Asia to promote Paris as a renminbi

trading center. "We're not against some business being done in

London, but the bulk of the business should be under our control. That's

the consequence of the choice by the UK to remain outside the euro

area."

- Rules will ‘stifle alternative lending’. A

plethora of new regulation will hamper the ability of investment funds,

insurers and asset managers to provide the world economy with

alternative sources of credit as banks in the US and Europe shrink, a

study by Allen & Overy has warned.

Wirtschafts Woche:

- Portugal Demands Easier Conditions for EFSF Funds. Euro-area finance ministers will speak about Portuguese request as soon as Monday in Brussels. Easier conditions for Greece prompted Portugal's demand.

The Chosunilbo:

- Senate Reaffirms U.S. Support for Japan in Land Dispute with China. The U.S. Senate has unanimously approved an amendment that reaffirms

Washington's commitment to Japan in its territorial dispute with China

over islands in the East China Sea. The measure was attached

Thursday to the National Defense Authorization Bill for Fiscal Year

2012, which is still being debated in the Senate -- the upper body of

Congress. The amendment says that the U.S. acknowledges Japan's

administration over the Senkaku Islands, but does not take a position on

the ultimate sovereignty of the territory. It also notes U.S.

opposition to any efforts to coerce, threaten or use force to resolve

the territorial dispute.

Financial News:

- People's Bank of China's recent open market operations have resulted in a net draining of liquidity, suggesting the central bank won't further ease monetary policy, according to a commentary by reporter Xu Shaofeng.

Weekend Recommendations

Barron's:

- Made positive comments on (JPM), (HTBI), (RIG), (LMCA) and (INTC).

Night Trading

- Asian indices are -.25% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 111.05 +.5 basis point.

- Asia Pacific Sovereign CDS Index 82.75 unch.

- FTSE-100 futures +.23%.

- S&P 500 futures +.21%.

- NASDAQ 100 futures +.37%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:58 am EST

- Markit US PMI Final for November is estimated at 51.7 versus a prior estimate of 52.4.

10:00 am EST

- ISM Manufacturing for November is estimated to fall to 51.5 versus 51.7 in October.

- ISM Prices Paid for November is estimated to fall to 53.5 versus 55.0 in October.

- Construction Spending for October is estimated to rise +.5% versus a +.6% gain in October.

Afternoon:

- Total Vehicle Sales for November is estimated to rise to 14.8M versus 14.22M in October.

Upcoming Splits

Other Potential Market Movers

- The

Fed's Bullard speaking, Fed's Rosengren speaking, Eurozone

Manufacturing PMI, EuroGroup Meeting, RBA rate decision, HSBC India PMI,

UBS Media/Communications Conference, Barclays Precious Metals Conference, (SLG) investor day and the (EW) investor conference could also impact trading today.

BOTTOM LINE: Asian

indices are mostly higher, boosted by technology and automaker

shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing modestly lower. The Portfolio is 25% net long heading into the week.

U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on Eurozone debt angst, rising US fiscal cliff concerns, more Mideast unrest, technical selling, profit-taking, more shorting

and increasing global growth fears. My intermediate-term trading indicators are giving neutral signals and the Portfolio is 25% net long heading into the week.

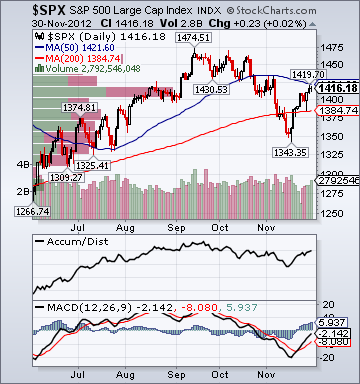

S&P 500 1,416.18 +.50%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- S&P 500 1,416.18 +.50%

- DJIA 13,025.58 +.12%

- NASDAQ 3,010.24 +1.46%

- Russell 2000 821.92 +1.83%

- Value Line Geometric(broad market) 358.11 +1.43%

- Russell 1000 Growth 659.40 +.74%

- Russell 1000 Value 703.78 +.44%

- Morgan Stanley Consumer 835.79 +.76%

- Morgan Stanley Cyclical 1,007.51 +.45%

- Morgan Stanley Technology 662.85 +.74%

- Transports 5,119.11 +1.33%

- Utilities 454.12 +3.07%

- Bloomberg European Bank/Financial Services 87.81 +1.36%

- MSCI Emerging Markets 41.75 +.99%

- Lyxor L/S Equity Long Bias 1,054.15 +.15%

- Lyxor L/S Equity Variable Bias 801.38 +.37%

Sentiment/Internals

- NYSE Cumulative A/D Line 158,653 +1.20%

- Bloomberg New Highs-Lows Index 186 +285

- Bloomberg Crude Oil % Bulls 33.33 unch.

- CFTC Oil Net Speculative Position 137,254 -22.8%

- CFTC Oil Total Open Interest 1,522,133 +1.6%

- Total Put/Call 1.17 +31.46%

- OEX Put/Call 1.44 +182.35%

- ISE Sentiment 90.0 -20.4%

- NYSE Arms .88 +109.5%

- Volatility(VIX) 15.87 +4.82%

- S&P 500 Implied Correlation 62.64+.98%

- G7 Currency Volatility (VXY) 7.53 +.93%

- Smart Money Flow Index 10,974.20 +1.65%

- Money Mkt Mutual Fund Assets $2.612 Trillion +.40%

- AAII % Bulls 40.9 +14.3%

- AAII % Bears 34.4 -15.7%

Futures Spot Prices

- CRB Index 298.98 -.03%

- Crude Oil 88.91 +.74%

- Reformulated Gasoline 273.03 +.40%

- Natural Gas 3.56 -8.58%

- Heating Oil 306.07 -.62%

- Gold 1,712.70 -2.23%

- Bloomberg Base Metals Index 216.64 +4.81%

- Copper 365.0 +3.43%

- US No. 1 Heavy Melt Scrap Steel 304.33 USD/Ton unch.

- China Iron Ore Spot 115.60 USD/Ton -2.77%

- Lumber 340.10 +7.29%

- UBS-Bloomberg Agriculture 1,617.96 +1.28%

Economy

- ECRI Weekly Leading Economic Index Growth Rate +3.4% -40 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.3697 +8.87%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 112.0 +.38%

- Citi US Economic Surprise Index 43.10 -4.3 points

- Fed Fund Futures imply 58.0% chance of no change, 42.0% chance of 25 basis point cut on 12/12

- US Dollar Index 80.15 -.08%

- Yield Curve 137.0 -5 basis points

- 10-Year US Treasury Yield 1.62% -7 basis points

- Federal Reserve's Balance Sheet $2.834 Trillion-.69%

- U.S. Sovereign Debt Credit Default Swap 36.57 +3.01%

- Illinois Municipal Debt Credit Default Swap 177.0 +.36%

- Western Europe Sovereign Debt Credit Default Swap Index 105.33 -8.09%

- Emerging Markets Sovereign Debt CDS Index 167.90 -5.04%

- Israel Sovereign Debt Credit Default Swap 140.0 -7.01%

- Iraq Sovereign Debt Credit Default Swap 500.0 +9.64%

- China Blended Corporate Spread Index 386.0 -12 basis points

- 10-Year TIPS Spread 2.42% +2 basis points

- TED Spread 23.5 +1.0 basis point

- 2-Year Swap Spread 12.75 -.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -24.75 +2.5 basis points

- N. America Investment Grade Credit Default Swap Index 99.45 +.21%

- European Financial Sector Credit Default Swap Index 160.21 -.21%

- Emerging Markets Credit Default Swap Index 237.46 -6.0%

- CMBS Super Senior AAA 10-Year Treasury Spread 90.0 unch.

- M1 Money Supply $2.406 Trillion +.90%

- Commercial Paper Outstanding 1,025.60 +2.80%

- 4-Week Moving Average of Jobless Claims 405,300 +9,000

- Continuing Claims Unemployment Rate 2.6% unch.

- Average 30-Year Mortgage Rate 3.32% +1 basis point

- Weekly Mortgage Applications 838.90 -.85%

- Bloomberg Consumer Comfort -33.0 +.9 point

- Weekly Retail Sales +2.20% +80 basis points

- Nationwide Gas $3.40/gallon -.03/gallon

- U.S. Heating Demand Next 7 Days 41.0% below normal

- Baltic Dry Index 1,086 -.37%

- China (Export) Containerized Freight Index 1,122.90 -1.93%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 30.0 -7.69%

- Rail Freight Carloads 194,538 -21.9%

Best Performing Style

Worst Performing Style

Leading Sectors

- Gaming +4.39%

- Alt Energy +4.26%

- Networking +3.97%

- I-Banking +3.84%

- Internet +3.32%

Lagging Sectors

- Homebuilders -1.48%

- Restaurants -1.49%

- Computer Services -1.74%

- Coal -2.23%

- Gold & Silver -2.37%

Weekly High-Volume Stock Gainers (7)

- SHS, GMCR, BLOX, RAH, EXPR, TIVO and SMTC

Weekly High-Volume Stock Losers (6)

- BKS, MCF, CAP, HITK, JOSB and TFM

Weekly Charts

ETFs

Stocks

*5-Day Change

Today's Market Take:

Broad Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Volume: Below Average

- Market Leading Stocks: Underperforming

Equity Investor Angst:

- VIX 16.11 +6.97%

- ISE Sentiment Index 87.0 -27.5%

- Total Put/Call 1.16 +16.0%

- NYSE Arms 1.26 +54.97%

Credit Investor Angst:

- North American Investment Grade CDS Index 98.57 -.69%

- European Financial Sector CDS Index 160.19 +.04%

- Western Europe Sovereign Debt CDS Index 105.33 bps -.60%

- Emerging Market CDS Index 237.43 bps +.85%

- 2-Year Swap Spread 12.75 +.75 basis point

- TED Spread 23.50 +.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -24.75 unch.

Economic Gauges:

- 3-Month T-Bill Yield .08% unch.

- Yield Curve 137.0 +1 basis point

- China Import Iron Ore Spot $116.90/Metric Tonne -1.11%

- Citi US Economic Surprise Index 43.10 -.8 point

- 10-Year TIPS Spread 2.42 +2 basis points

Overseas Futures:

- Nikkei Futures: Indicating +59 open in Japan

- DAX Futures: Indicating +6 open in Germany

Portfolio:

- Slightly Higher: On gains in my Tech sector longs and index hedges

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long