Style Underperformer:

Large-cap Growth (+1.24%)

Sector Underperformers:

Hospitals (-.24%), Education (-.15%) and HMOs (+.51%)

Stocks Falling on Unusual Volume:

HIBB, INTU, VRGY, JRJC, SPTN, CISG, FSLR, FL and GLT

Stocks With Unusual Put Option Activity:

1) SGP 2) BRCD 3) CF 4) ANN 5) AMAG

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Friday, August 21, 2009

Bear Radar

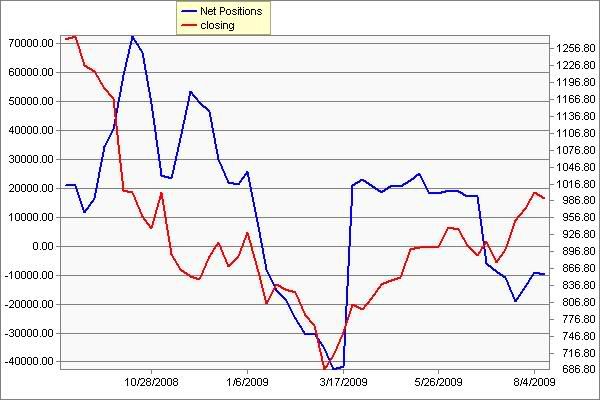

S&P 500 Large Speculators Are Net Short(Graph)

BOTTOM LINE: Given the recent sharp rise in US stocks, many believe investor sentiment has become way too bullish and thus an imminent correction is a certainty. However, the chart above from Schaeffer's Investment Research indicates one group of investors that is positioned net short again. As you can see, large speculators in the S&P 500 have had EXCEPTIONALLY poor market timing over the last year as they were positioned very net long right before the accelerated down move began and were positioned very net short right at the stock market bottom in March. Moreover, the AAII % Bulls plunged to 34.1 this week from 51.0 the prior week, while the % Bears jumped to 40.0 from 33.0 the prior week. The S&P 500 is taking out its recent high today. There are an unusual number of stocks rising meaningfully on volume today for a sleepy summer Friday. Considering these investor sentiment readings and the overwhelming belief that a correction is imminent during the seasonally weak month of September, another push higher is likely over the coming weeks on short-covering, performance chasing and technical buying.

Bull Radar

Small-Cap Value (+2.37%)

Sector Outperformers:

Homebuilders (+4.0%), REITs (+3.38%) and Gaming (+3.20%)

Stocks Rising on Unusual Volume:

ROSE, AIXG, WTI, VIP, DLLR, UBS, SU, PCAR, IR, TBL, SCSC, NDSN, ZUMZ, IRBT, OTEX, AIRM, TECD, SHEN, VECO, SHLD, LANC, RAVN, WINN, LCAPA, CTCT, CRDN, OPTR, WCRX, LAYN, ARL, ARO, SJM, CX, SNY, VGK, BKI, GLP and ACO

Stocks With Unusual Call Option Activity:

1) ARO 2) CRM 3) INTU 4) BBBY 5) ALTH

Trading Links

BNO Breaking Global News of Note

Yahoo Most Popular Biz Stories

Briefing.com Stock Market Update

Stocks On The Move

Upgrades/Downgrades

StockCharts Market Performance Summary

Sector Performance

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

CNBC Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Thursday, August 20, 2009

Friday Watch

Late-Night Headlines

Bloomberg:

- Hynix Semiconductor Inc., the world’s second-largest maker of computer memory, had its share-price estimate raised to 25,500 won from 20,800 won by Korea Investment & Securities, which cited higher-than-expected chip prices. The brokerage reiterated its “buy” recommendation.

- Hezbollah Readies for War as UN Peacekeepers Can Only Observe.

Wall Street Journal:

Fox News:

NY Times:

CNNMoney.com:

- How banks really used TARP money.

Forbes:

Politico:

Rasmussen:

LA Times:

Reuters:

- Nordson Corp (NDSN.O), which makes precision dispensing equipment, posted better-than-expected third-quarter results, helped by rising sequential demand in its technology end markets, and forecast a strong fourth quarter, sending the company's shares up 10 percent after the bell.

Sankei:

- Toyota Motor Corp. sold 21,300 vehicles as of Aug. 18, an increase of 8% from a year earlier. Sales for the entire month may exceed those of August last year if the current pace is maintained.

Late Buy/Sell Recommendations

Citigroup:

- Upgraded (LTD) to Buy, target $18.

- Reiterated Buy on (HNZ), target $46.

- Upgraded (VAR) to Buy, target $45.

- Reiterated Buy on (COV), target $46.

- Upgraded (TECD) to Buy, target $43.

- Upgraded (PLCE) to Buy, target $37.

Goldman Sachs:

- Raised (HBC) share-price target 22% to HK$122.

Morgan Stanley:

- Rated (NFLX) Overweight, target $56.

- Rated (VPRT) Overweight, target $58.

- Reiterated Overweight on (PVH), boosted target to $38.

Night Trading

Asian Indices are -1.50% to +.50% on average.

S&P 500 futures -.62%.

NASDAQ 100 futures -.64%.

Morning Preview

BNO Breaking Global News of Note

Yahoo Most Popular Biz Stories

MarketWatch Pre-market Commentary

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Stock Quote/Chart

WSJ Intl Markets Performance

Commodity Futures

IBD New America

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Politico Headlines

Rasmussen Reports Polling

Earnings of Note

Company/EPS Estimate

- (ANN)/.02

- (SJM)/.80

Economic Releases

10:00 am EST

- Existing Home Sales for July are estimated to rise to 5.0M versus 4.89M in June.

Upcoming Splits

- None of note

Other Potential Market Movers

- The Fed’s Bernanke speaking and the Fed’s Madigan speaking could also impact trading today.

BOTTOM LINE: Asian indices are mostly lower, weighed down by automaker and commodity shares in the region. I expect