S&P 500 1,076.38 +1.12%

NASDAQ 1,780.74 +1.34%

Leading Sectors

Airlines +4.60%

Biotech +2.70%

I-Banks +2.68%

Lagging Sectors

Restaurants +.42%

Hospitals +.14%

Foods -.29%

Other

Crude Oil 45.90 -.28%

Natural Gas 5.43 -1.95%

Gold 404.50 +.82%

Base Metals 112.48 +1.27%

U.S. Dollar 88.07 +.19%

10-Yr. T-note Yield 4.28% +1.24%

VIX 17.77 -1.17%

Put/Call .87 -17.14%

NYSE Arms .40 -66.67%

Market Movers

PRV +39.2% after saying LPNT agreed to buy it for $1.13 billion in cash and stock, LPNT -17.3%.

KMRT +13.8% on better-than-expected 2Q results.

LOW +6.1% after missing 2Q estimates and raising 3Q outlook.

SYY -7.8% after missing 4Q estimates and BB&T downgrade to Hold.

Economic Data

Empire Manufacturing for August came in at 12.57 versus estimates of 32.30 and a reading of 35.75 in July.

Recommendations

BRL rated Buy at Bank of America, target $46. JTX rated Buy at Bank of America, target $21. BLT rated Overweight at JP Morgan. BRO raised to Overweight at JP Morgan, target $50. EL raised to Buy at Oppenheimer, target $51. IPXL rated Buy at Bank of America, target $17. LPNT cut to Underweight at JP Morgan. Goldman Sachs raised KSS to Outperform. Goldman reiterated Outperform on AET, AMGN, KRB, FS, IGT. Goldman rated HEP Outperform. Citi SmithBarney downgraded LF to Sell, target $17. Citi upgraded DOW to Buy, target $46. Citi upgraded LYO to Buy, target $21. Citi reiterated Buy on NCX, target $30.37. Citi reiterated Buy on HAS, target $24. Citi upgraded MAT to Buy, target $21. Citi reiterated Buy on HCA, target $48. Citi reiterated Buy on SBUX, target $54.

Mid-day News

U.S. stocks are higher mid-day on short-covering and bargain-hunting after recent weakness. Micrel Inc., a Silicon Valley semiconductor maker, denied accusations of improper conduct made by an IRS auditor, the NY Times said. Gateway Inc. said CompUSA will begin selling its desktop computers this week, Bloomberg said. Panasonic and other high-definition tv makers are hoping the Olympics gives consumers a reason to try digital TV, the LA Times reported. Lowe's said second-quarter earnings rose 18%, helped by new stores in metro areas and record U.S. home sales, Bloomberg reported. Venezuelan President Chavez overcame a referendum to remove him from office two years before his term expires, Bloomberg said. Crude oil futures fell after Chavez's victory eased concerns that shipments from the country would be disrupted, Bloomberg said. The first two days of full competition in Athens were marked by near-empty stadiums in many sports, Bloomberg reported. International investors purchased a net $71.8 billion of U.S. Treasuries, stocks, corporate bonds and other securities in June, up from $65.2 billion in May, Bloomberg reported. The $53 billion U.S. missile defense shield being developed by Boeing, Lockheed Martin and Northrop Grumman may be derailed by a John Kerry presidency, Bloomberg said. Bank of America and Wachovia are among the banks doing business in Florida that stand to benefit from a rise in deposits and loans following Hurricane Charley, Bloomberg reported. Goldman Sachs economists call higher oil prices "excuses" in explaining the deceleration in U.S. consumer spending this year as the real culprit is the withdrawal of fiscal and monetary stimulus from the economy, Bloomberg reported.

BOTTOM LINE: The Portfolio is slightly higher mid-day as strength in my retail and internet longs is offsetting losses in my steel and Russian ADR shorts. I added a few technology longs this morning, bringing the Portfolio's market exposure to 50% net long. One of my new longs is CYMI and I am using a stop-loss of $24.30 on the position. The tone of the market is better today, but it appears to be mostly short-covering and a lack of sellers. However, the rally could gain legs on a further drop in energy prices and better earnings reports over the next couple of days. The odds of a major terrorist attack this year are diminishing with each passing day.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, August 16, 2004

Monday Watch

Earnings of Note

Company/Estimate

CEN/.19

KMRT/.14

LBTYA/-.24

LOW/.90

SYY/.45

Splits

QCOM 2-for-1

Economic Data

Empire Manufacturing for August estimated at 32.3 versus 36.54 in July.

NAHB Housing Market Index for August estimated at 66 versus 67 in July.

Weekend Recommendations

Barron's had positive comments on TWX, EMC, EK and negative comments on HPQ. Goldman Sachs reiterated Outperform on MRVL, EBAY and ALL. Bloomberg has a positive column by Caroline Baum on the exaggerated death of the U.S. consumer.

Weekend News

China sold 15.8 million cell phones in the second quarter, down 23 percent from a year earlier, Shanghai Daily said. The U.S. bipartisan Commission for Presidential Debates named the moderators for four events it will hold in late September and early October, the NY Times reported. The commission said Jim Lehrer of PBS, Bob Schieffer of CBS and Charles Gibson of ABC will each moderate one of the three presidential debates. PBS's Gwen Ifill will moderate the vice-presidential debate. Al-Qaeda is regrouping in Pakistan and planning attacks in the U.S. with a "motley collection of old hands and recent recruits," the Washington Post reported. President Bush on Monday will announce plans to transfer 70,000 to 100,000 troops from Europe and Asia as the U.S. military shifts its focus to the war on terrorism from the cold war, the Washington Post said. OAO Yukos Oil Co.'s share price is being manipulated by senior Kremlin officials for their own benefit, the Business newspaper reported. Iraq's Prime Minister Ayad Allawi ordered troops from the country's newly formed army to lead an attack against Shiite Muslim militia in Najaf, the Washington Post reported. Lawyers for Golan Cipel, the Israeli who was given $110,000-a-year job by New Jersey Democratic Governor James McGreevey, said Cibel is heterosexual and didn't consent to any intimate contact with McGreevey, the NY Times said. New Jersey residents' approval of Governor McGreevey actually rose 2% to 45% after a recent flurry of scandalous allegations, according to the Star-Ledger. OAO Yukos Oil may "very likely" file for bankruptcy in the next few days unless Russia eases the pressure it's been applying, the Financial Times said. Posco's record earnings may not last until the first half of next year as the Korean steelmaker faces a number of threats such as higher oil prices, the Seoul Economic Daily reported. U.S. gas prices fell about 4.9 cents in the past three weeks, the AP reported, citing the Lundberg Survey of about 8,000 gas stations. Electronic Arts may be interested in buying U.K. publisher Eidos Plc as part of its European expansion, the Financial Times reported. Caterpillar workers rejected a six-year contract proposal, the AP reported. Allstate Corp., State Farm Mutual and other insurers may lose about $5 billion from Hurricane Charley, less than initially forecast, Bloomberg said. A weakened Hurricane Charley, the most powerful storm to hit the U.S. in 12 years, left Florida with deaths and damage estimated in the billions of dollars as it headed for the South Carolina coast this morning, Bloomberg reported. Crude oil prices may fall to $30/bbl. next year as concerns about supply disruptions in Iraq, Russia and Venezuela ease and OPEC boosts output, the group's President said. China will provide low-interest loans to cable companies to convert 100 million urban households to digital television by 2008, Bloomberg said. Crude oil futures in New York rose to a record on concern violence may spread in Venezuela, the fourth-largest exporter to the U.S., as the nation votes in a referendum that could remove President Chavez from office, Bloomberg reported.

Late-Night Trading

Asian indices are lower, -1.0% to -.50% on average.

S&P 500 indicated -.26%.

NASDAQ 100 indicated -.27%.

BOTTOM LINE: I expect U.S. stocks to open modestly lower in the morning on worries over Venezuelan political unrest and terrorism fears. However, equities will likely rally higher by day's end on short-covering and bargain-hunting. The Portfolio is 25% net long heading into tomorrow.

Company/Estimate

CEN/.19

KMRT/.14

LBTYA/-.24

LOW/.90

SYY/.45

Splits

QCOM 2-for-1

Economic Data

Empire Manufacturing for August estimated at 32.3 versus 36.54 in July.

NAHB Housing Market Index for August estimated at 66 versus 67 in July.

Weekend Recommendations

Barron's had positive comments on TWX, EMC, EK and negative comments on HPQ. Goldman Sachs reiterated Outperform on MRVL, EBAY and ALL. Bloomberg has a positive column by Caroline Baum on the exaggerated death of the U.S. consumer.

Weekend News

China sold 15.8 million cell phones in the second quarter, down 23 percent from a year earlier, Shanghai Daily said. The U.S. bipartisan Commission for Presidential Debates named the moderators for four events it will hold in late September and early October, the NY Times reported. The commission said Jim Lehrer of PBS, Bob Schieffer of CBS and Charles Gibson of ABC will each moderate one of the three presidential debates. PBS's Gwen Ifill will moderate the vice-presidential debate. Al-Qaeda is regrouping in Pakistan and planning attacks in the U.S. with a "motley collection of old hands and recent recruits," the Washington Post reported. President Bush on Monday will announce plans to transfer 70,000 to 100,000 troops from Europe and Asia as the U.S. military shifts its focus to the war on terrorism from the cold war, the Washington Post said. OAO Yukos Oil Co.'s share price is being manipulated by senior Kremlin officials for their own benefit, the Business newspaper reported. Iraq's Prime Minister Ayad Allawi ordered troops from the country's newly formed army to lead an attack against Shiite Muslim militia in Najaf, the Washington Post reported. Lawyers for Golan Cipel, the Israeli who was given $110,000-a-year job by New Jersey Democratic Governor James McGreevey, said Cibel is heterosexual and didn't consent to any intimate contact with McGreevey, the NY Times said. New Jersey residents' approval of Governor McGreevey actually rose 2% to 45% after a recent flurry of scandalous allegations, according to the Star-Ledger. OAO Yukos Oil may "very likely" file for bankruptcy in the next few days unless Russia eases the pressure it's been applying, the Financial Times said. Posco's record earnings may not last until the first half of next year as the Korean steelmaker faces a number of threats such as higher oil prices, the Seoul Economic Daily reported. U.S. gas prices fell about 4.9 cents in the past three weeks, the AP reported, citing the Lundberg Survey of about 8,000 gas stations. Electronic Arts may be interested in buying U.K. publisher Eidos Plc as part of its European expansion, the Financial Times reported. Caterpillar workers rejected a six-year contract proposal, the AP reported. Allstate Corp., State Farm Mutual and other insurers may lose about $5 billion from Hurricane Charley, less than initially forecast, Bloomberg said. A weakened Hurricane Charley, the most powerful storm to hit the U.S. in 12 years, left Florida with deaths and damage estimated in the billions of dollars as it headed for the South Carolina coast this morning, Bloomberg reported. Crude oil prices may fall to $30/bbl. next year as concerns about supply disruptions in Iraq, Russia and Venezuela ease and OPEC boosts output, the group's President said. China will provide low-interest loans to cable companies to convert 100 million urban households to digital television by 2008, Bloomberg said. Crude oil futures in New York rose to a record on concern violence may spread in Venezuela, the fourth-largest exporter to the U.S., as the nation votes in a referendum that could remove President Chavez from office, Bloomberg reported.

Late-Night Trading

Asian indices are lower, -1.0% to -.50% on average.

S&P 500 indicated -.26%.

NASDAQ 100 indicated -.27%.

BOTTOM LINE: I expect U.S. stocks to open modestly lower in the morning on worries over Venezuelan political unrest and terrorism fears. However, equities will likely rally higher by day's end on short-covering and bargain-hunting. The Portfolio is 25% net long heading into tomorrow.

Sunday, August 15, 2004

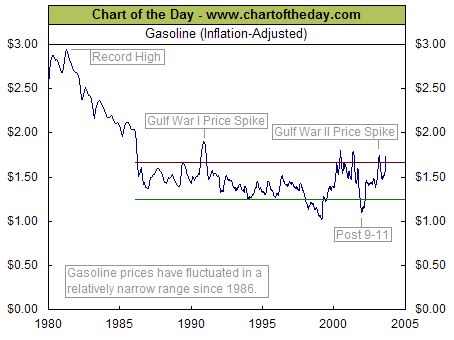

Charts of the Week

Bottom Line: As the top chart illustrates, gasoline prices on an inflation-adjusted basis are at the upper end of the trading range they have been in since 1986. Gas prices would have to soar another 70% to reach levels seen during the late 70's/early 80's. As well, the survey illustrated in the bottom chart seems to point to an overstatement by the media and some companies of the effects of gas prices on consumers at current levels.

Weekly Outlook

There are a few important economic reports and some significant corporate earnings reports scheduled for release this week. Economic reports this week include Empire Manufacturing, Housing Market Index, Consumer Price Index, Housing Starts, Building Permits, Industrial Production, Capacity Utilization, Initial Jobless Claims, Leading Indicators and Philadelphia Fed. Consumer Price Index, Housing Starts, Leading Indicators and Philly Fed. all have market-moving potential.

Lowe's(LOW), Kmart Holding(KMRT), BJ's Wholesale(BJ), Deere & Co.(DE), Home Depot(HD), J.C. Penney(JCP), Staples(SPLS), Applied Materials(AMAT), Brocade(BRCD), Intuit(INTU), Medtronic(MDT), Nortel(NT), Barnes & Noble(BKS), Limited Brands(LTD), The Gap(GPS), Nordstrom(JWN) and Novell(NOVL) are some of the more important companies that release quarterly earnings this week. There are also several other events that have market-moving potential. The CS First Boston Small Cap IT Services Conference and SEMI Book-to-Bill Report could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week modestly higher, led by an oversold bounce in technology shares. However, equities will likely weaken the following week on terrorism fears ahead of the Republican Convention. I expect measures of investor anxiety to spike higher again during this period. I continue to believe stocks will make an intermediate-term bottom during the next 6 weeks, setting the stage for an exceptional fourth quarter. Short Funds with substantial gains for the year will likely begin to cover to protect profits. The Hennessee Hedge Fund US Short-biased Index rose 10.2% in July, its best performance since the terror-induced market sell-off of September 2001. Moreover, the 4 week average of Specialist Short Sales to Total Short Sales is at the lowest levels since at least the 1960's. I expect fundamental demand to snap back in the fourth quarter as political uncertainty lifts, terrorism fears subside, energy prices fall and businesses increase spending on capital equipment to take advantage of tax incentives before they expire at year-end. Many companies should beat their recently lowered earnings forecasts.

Lowe's(LOW), Kmart Holding(KMRT), BJ's Wholesale(BJ), Deere & Co.(DE), Home Depot(HD), J.C. Penney(JCP), Staples(SPLS), Applied Materials(AMAT), Brocade(BRCD), Intuit(INTU), Medtronic(MDT), Nortel(NT), Barnes & Noble(BKS), Limited Brands(LTD), The Gap(GPS), Nordstrom(JWN) and Novell(NOVL) are some of the more important companies that release quarterly earnings this week. There are also several other events that have market-moving potential. The CS First Boston Small Cap IT Services Conference and SEMI Book-to-Bill Report could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week modestly higher, led by an oversold bounce in technology shares. However, equities will likely weaken the following week on terrorism fears ahead of the Republican Convention. I expect measures of investor anxiety to spike higher again during this period. I continue to believe stocks will make an intermediate-term bottom during the next 6 weeks, setting the stage for an exceptional fourth quarter. Short Funds with substantial gains for the year will likely begin to cover to protect profits. The Hennessee Hedge Fund US Short-biased Index rose 10.2% in July, its best performance since the terror-induced market sell-off of September 2001. Moreover, the 4 week average of Specialist Short Sales to Total Short Sales is at the lowest levels since at least the 1960's. I expect fundamental demand to snap back in the fourth quarter as political uncertainty lifts, terrorism fears subside, energy prices fall and businesses increase spending on capital equipment to take advantage of tax incentives before they expire at year-end. Many companies should beat their recently lowered earnings forecasts.

Market Week in Review

S&P 500 1,064.80 +.08%

Click here for the Weekly Wrap by Briefing.com.

Bottom Line: Overall, last week's market action was mildly negative. A number of sectors advanced, notwithstanding another dismal performance by tech stocks. The fact that the market didn't fall in the face of hurricane Charley, potential political unrest in Venezuela, a worsening of Russia's OAO Yukos situation, rising energy prices, worse-than-expected outlooks from Cisco and Hewlett, the Fed's hawkish comments and the possibility of acts of terror at the Olympics is very impressive. Dell's bullish outlook, positive reports from Wal-Mart and Target, decelerating inflation readings and the Fed's positive comments with respect to future economic growth offset these negatives to an extent. However, it is definitely bad for the Bulls that measures of investor anxiety fell last week in the face of such uncertainty. As well, mutual fund outflows reached $1.25 billion for the week.

Click here for the Weekly Wrap by Briefing.com.

Bottom Line: Overall, last week's market action was mildly negative. A number of sectors advanced, notwithstanding another dismal performance by tech stocks. The fact that the market didn't fall in the face of hurricane Charley, potential political unrest in Venezuela, a worsening of Russia's OAO Yukos situation, rising energy prices, worse-than-expected outlooks from Cisco and Hewlett, the Fed's hawkish comments and the possibility of acts of terror at the Olympics is very impressive. Dell's bullish outlook, positive reports from Wal-Mart and Target, decelerating inflation readings and the Fed's positive comments with respect to future economic growth offset these negatives to an extent. However, it is definitely bad for the Bulls that measures of investor anxiety fell last week in the face of such uncertainty. As well, mutual fund outflows reached $1.25 billion for the week.

Saturday, August 14, 2004

Economic Week in Review

ECRI Weekly Leading Index 131.50 -.30%

Wholesale Inventories for June rose 1.1% versus estimates of a .6% increase and a rise of 1.4% in May. Consumer spending, that cooled by the most in almost three years during the month, helped give companies the chance to replenish inventories that had been drained to record lows earlier this year, Bloomberg reported. "We expect a general recovery in inventories relative to sales in the wholesale sector to provide solid support for GDP growth through the remainder of 2004," said Michael Englund, chief economist at Action Economics. Wholesalers had enough supply to last 1.15 months at the current sales pace, up from the record low of 1.12 months in April.

Preliminary 2Q Non-farm Productivity rose 2.9% versus estimates of a 2.0% rise and a 3.7% increase in 1Q. Preliminary 2Q Unit Labor Costs rose 1.9% versus estimates of a 2.0% increase and a .3% rise in 1Q. The gain in productivity suggests that companies have become efficient enough to hold down payrolls until the economy rebounds form a second-quarter lull, economists said. The second-quarter rise in productivity is in line with the average annual increase of 3% since 1996. By contrast, productivity rose an average 1.5% a year in the previous two decades, Bloomberg reported. The number "is still quite healthy, productivity is incredibly strong," Douglas Porter, senior economist at BMO Nesbitt Burns said. Labor costs, while increasing, are still at moderate levels, Bloomberg reported.

Federal Reserve policy makers raised the benchmark U.S. interest rate a quarter-point to 1.5% and restated a pledge to lift borrowing costs at a "measured" pace to suppress inflation without choking off growth, Bloomberg said. "Output growth has moderated and the pace of improvement in labor market conditions has slowed recently, however the economy appears poised to resume a stronger pace of expansion going forward," the Fed's rate-setting Open Market Committee said. The year's second rate increase was overshadowed by the decision to keep the "measured" pace language, which some investors expected the Fed to abandon, Bloomberg said.

The Import Price Index for July rose .2% versus estimates of a .4% rise and a .1% fall in June. The recent acceleration in core prices "has probably just about run its course," Joshua Shapiro, chief U.S. economist at MFR Inc. said. Imports account for about 15% of all goods and services bought in the U.S., Bloomberg reported.

Advance Retail Sales for July rose .7% versus estimates of a 1.2% increase and an upwardly revised .5% decline in June. Retail Sales Less Autos for July rose .2% versus estimates of a .4% increase and an upwardly revised .3% rise in June. Retailers said same-store sales rose in July and Wal-Mart boosted its annual earnings forecast, Bloomberg reported. "The slowing that was apparent in earlier months likely overstated the weakness in consumer spending," said Richard DeKaser, chief economist at National City. Consumer spending is now forecast to rise at a 3.2% annual rate in the third quarter, based on the median estimate of 48 economists polled by Bloomberg.

Initial Jobless Claims fell to 333K last week versus estimates of 340K and 337K the prior week. Continuing Claims were 2896K versus estimates of 2895K and 2901K prior. The figures on jobless claims "suggest that the recent weakness in payroll employment should be transitory," Steven Wood, president of Insight Economics said. Moreover, the four-week moving average of continuing claims fell to 2.88M, the lowest since the week that ended June 2, 2001.

Business Inventories rose .9% versus estimates of a .6% rise and an increase of .7% in May. The inventory-sales ratio rose to 1.31 months, boosted by more autos on dealer lots. From March through May, the ratio was at a record low of 1.3 months, Bloomberg said. "Companies are continuing to rebuild their inventories but are doing so basically in line with growing sales," said Steven Wood, chief economist at Insight Economics. The increase in stockpiles will add more to economic growth in the second quarter than the government initially reported, economists said.

The Producer Price Index for July rose .1% versus estimates of a .3% rise and a decrease of .3% in June. PPI Ex Food & Energy for July rose .1% versus estimates of a .1% increase and a .2% rise in June. Prices rose less than forecast in July, restrained by cheaper cars and the biggest drop in the cost of food in more than two years, Bloomberg reported. Moreover, the cost of dairy products fell 6.2%, the biggest decline since April 1999, Bloomberg said. Smaller increases in core prices support the central bankers' view and may make it possible for them to continue to raise the target benchmark interest rate at a "measured" pace.

The Preliminary Univ. of Mich. Consumer Confidence reading for August came in at 94.0 versus estimates of 97.2 and a reading of 96.7 in July. The Current Conditions Index, based on perceptions of consumers' financial situation and whether it's a good time to make big purchases, rose to 108.4 in August from 105.2 last month, Market News said. Sentiment was likely negatively affected by the many reports of terror plots across the globe, rather than by weaker payroll numbers and rising oil prices. Stephen Gallagher, chief economist at Societe Generale in New York, said the index is influenced more by the unemployment rate, which fell, than by job creation, Bloomberg reported. Furthermore, the average all-grades price of a gallon of gasoline has fallen since reaching a record in late May, Bloomberg said.

Bottom Line: Overall, the economic data last week were mixed. Inventories are rising slightly, which could be a positive or negative depending on final demand in future months. However, the inventory rebuilding will help boost GDP growth this quarter. Payroll increases will likely remain underwhelming until demand reaccelerates in the fourth quarter and productivity drops. Unit labor costs, the largest component of inflation, remain at relatively subdued levels. In my opinion, the Fed made a mistake by leaving the "measured" language in their policy statement without qualifying it. While I agree with the Fed that the economy will reaccelerate, current weakness resulting from anti-business political rhetoric and terrorism fears, will likely restrain growth through the election in November. With interest rates plunging, most commodity prices dropping and recent inflation readings decelerating, I believe the Fed should wait at least until the November 10th meeting to hike rates further. However, at this point it appears a September rate increase is likely. Retail Sales for June were revised higher and July saw a rebound from June's temporarily depressed levels. The July reading for the Current Conditions component of Univ. of Mich. Consumer Sentiment Index bodes well for retail sales during the third quarter. The fall in the overall index was a direct result of the multiple terror warnings and reports during the month. Negative political rhetoric and the media's intense focus on higher oil prices and slower payroll growth also contributed to the decline. There were very few stories on the recent deceleration in inflation readings and the fall in the Unemployment Rate. The Unemployment Rate is now back to levels seen right before the 9/11 terrorist attacks. Finally, the CRB Index(a broad-based measure of commodity prices) is now down almost 6% from its highs set in March. Oil comprises less than 5% of inflation, yet every story related to inflation or commodities revolves around it being at all-time highs. Crude oil and gasoline would have to rise by 70% each to just reach the inflation-adjusted levels seen in the late 70's/early 80's. Rising energy prices and decelerating payroll growth are definitely not good for the economy, but the media's intense focus on everything negative is currently far more destructive to economic growth, in my opinion.

Wholesale Inventories for June rose 1.1% versus estimates of a .6% increase and a rise of 1.4% in May. Consumer spending, that cooled by the most in almost three years during the month, helped give companies the chance to replenish inventories that had been drained to record lows earlier this year, Bloomberg reported. "We expect a general recovery in inventories relative to sales in the wholesale sector to provide solid support for GDP growth through the remainder of 2004," said Michael Englund, chief economist at Action Economics. Wholesalers had enough supply to last 1.15 months at the current sales pace, up from the record low of 1.12 months in April.

Preliminary 2Q Non-farm Productivity rose 2.9% versus estimates of a 2.0% rise and a 3.7% increase in 1Q. Preliminary 2Q Unit Labor Costs rose 1.9% versus estimates of a 2.0% increase and a .3% rise in 1Q. The gain in productivity suggests that companies have become efficient enough to hold down payrolls until the economy rebounds form a second-quarter lull, economists said. The second-quarter rise in productivity is in line with the average annual increase of 3% since 1996. By contrast, productivity rose an average 1.5% a year in the previous two decades, Bloomberg reported. The number "is still quite healthy, productivity is incredibly strong," Douglas Porter, senior economist at BMO Nesbitt Burns said. Labor costs, while increasing, are still at moderate levels, Bloomberg reported.

Federal Reserve policy makers raised the benchmark U.S. interest rate a quarter-point to 1.5% and restated a pledge to lift borrowing costs at a "measured" pace to suppress inflation without choking off growth, Bloomberg said. "Output growth has moderated and the pace of improvement in labor market conditions has slowed recently, however the economy appears poised to resume a stronger pace of expansion going forward," the Fed's rate-setting Open Market Committee said. The year's second rate increase was overshadowed by the decision to keep the "measured" pace language, which some investors expected the Fed to abandon, Bloomberg said.

The Import Price Index for July rose .2% versus estimates of a .4% rise and a .1% fall in June. The recent acceleration in core prices "has probably just about run its course," Joshua Shapiro, chief U.S. economist at MFR Inc. said. Imports account for about 15% of all goods and services bought in the U.S., Bloomberg reported.

Advance Retail Sales for July rose .7% versus estimates of a 1.2% increase and an upwardly revised .5% decline in June. Retail Sales Less Autos for July rose .2% versus estimates of a .4% increase and an upwardly revised .3% rise in June. Retailers said same-store sales rose in July and Wal-Mart boosted its annual earnings forecast, Bloomberg reported. "The slowing that was apparent in earlier months likely overstated the weakness in consumer spending," said Richard DeKaser, chief economist at National City. Consumer spending is now forecast to rise at a 3.2% annual rate in the third quarter, based on the median estimate of 48 economists polled by Bloomberg.

Initial Jobless Claims fell to 333K last week versus estimates of 340K and 337K the prior week. Continuing Claims were 2896K versus estimates of 2895K and 2901K prior. The figures on jobless claims "suggest that the recent weakness in payroll employment should be transitory," Steven Wood, president of Insight Economics said. Moreover, the four-week moving average of continuing claims fell to 2.88M, the lowest since the week that ended June 2, 2001.

Business Inventories rose .9% versus estimates of a .6% rise and an increase of .7% in May. The inventory-sales ratio rose to 1.31 months, boosted by more autos on dealer lots. From March through May, the ratio was at a record low of 1.3 months, Bloomberg said. "Companies are continuing to rebuild their inventories but are doing so basically in line with growing sales," said Steven Wood, chief economist at Insight Economics. The increase in stockpiles will add more to economic growth in the second quarter than the government initially reported, economists said.

The Producer Price Index for July rose .1% versus estimates of a .3% rise and a decrease of .3% in June. PPI Ex Food & Energy for July rose .1% versus estimates of a .1% increase and a .2% rise in June. Prices rose less than forecast in July, restrained by cheaper cars and the biggest drop in the cost of food in more than two years, Bloomberg reported. Moreover, the cost of dairy products fell 6.2%, the biggest decline since April 1999, Bloomberg said. Smaller increases in core prices support the central bankers' view and may make it possible for them to continue to raise the target benchmark interest rate at a "measured" pace.

The Preliminary Univ. of Mich. Consumer Confidence reading for August came in at 94.0 versus estimates of 97.2 and a reading of 96.7 in July. The Current Conditions Index, based on perceptions of consumers' financial situation and whether it's a good time to make big purchases, rose to 108.4 in August from 105.2 last month, Market News said. Sentiment was likely negatively affected by the many reports of terror plots across the globe, rather than by weaker payroll numbers and rising oil prices. Stephen Gallagher, chief economist at Societe Generale in New York, said the index is influenced more by the unemployment rate, which fell, than by job creation, Bloomberg reported. Furthermore, the average all-grades price of a gallon of gasoline has fallen since reaching a record in late May, Bloomberg said.

Bottom Line: Overall, the economic data last week were mixed. Inventories are rising slightly, which could be a positive or negative depending on final demand in future months. However, the inventory rebuilding will help boost GDP growth this quarter. Payroll increases will likely remain underwhelming until demand reaccelerates in the fourth quarter and productivity drops. Unit labor costs, the largest component of inflation, remain at relatively subdued levels. In my opinion, the Fed made a mistake by leaving the "measured" language in their policy statement without qualifying it. While I agree with the Fed that the economy will reaccelerate, current weakness resulting from anti-business political rhetoric and terrorism fears, will likely restrain growth through the election in November. With interest rates plunging, most commodity prices dropping and recent inflation readings decelerating, I believe the Fed should wait at least until the November 10th meeting to hike rates further. However, at this point it appears a September rate increase is likely. Retail Sales for June were revised higher and July saw a rebound from June's temporarily depressed levels. The July reading for the Current Conditions component of Univ. of Mich. Consumer Sentiment Index bodes well for retail sales during the third quarter. The fall in the overall index was a direct result of the multiple terror warnings and reports during the month. Negative political rhetoric and the media's intense focus on higher oil prices and slower payroll growth also contributed to the decline. There were very few stories on the recent deceleration in inflation readings and the fall in the Unemployment Rate. The Unemployment Rate is now back to levels seen right before the 9/11 terrorist attacks. Finally, the CRB Index(a broad-based measure of commodity prices) is now down almost 6% from its highs set in March. Oil comprises less than 5% of inflation, yet every story related to inflation or commodities revolves around it being at all-time highs. Crude oil and gasoline would have to rise by 70% each to just reach the inflation-adjusted levels seen in the late 70's/early 80's. Rising energy prices and decelerating payroll growth are definitely not good for the economy, but the media's intense focus on everything negative is currently far more destructive to economic growth, in my opinion.

Subscribe to:

Comments (Atom)