Earnings of Note

Company/Estimate

ADBE/.39

KMX/.27

KBH/2.73

LEN/1.34

NKE/1.11

PLMO/.20

RHAT/.05

SMSC/.03

Splits

None of note.

Economic Data

NAHB Housing Market Index for September estimated at 70 versus 71 in August.

Weekend Recommendations

Louis Rukeyser's Wall Street had guests that were positive on BMET, MON, COH, WSM, ACL and CMX. Wall St. Week w/Fortune had guests that were positive on CSV. Bulls and Bears had guests that were positive on WFC, LUV, XOM, AA, MAT, mixed on PFE, CSCO, GPS, VIA/B, MSO, NFLX and negative on DIS. Forbes on Fox had guests that were positive on BTU and XRAY. Cashin' In had guests that were positive on SUNW, STEI, AKS, PMCS, HD and negative on VIA/B. Barron's had positive columns on RIG, NEM, PDG, COP, CVX, BHI, MUR and FLYI. Goldman Sachs reiterated Outperform on CAT, EBAY and UST. Goldman reiterated Underperform on EK and F. Ken Fisher, writing for Forbes, is positive on CECO, CRL, CHD and APPB.

Weekend News

Mobistar SA, Belgium's second-biggest mobile-phone company, has chosen Nortel Networks for a UMTS high-speed mobile-phone network, De Tijd reported. Carnival Corp., the largest cruise operator, said it may launch cruise lines in China and India because of their "fast-growing" markets, the Financial Times reported. Britain is ready to send more soldiers to Iraq to reinforce its force before the Middle Eastern country's scheduled elections in January, The Times newspaper said. The union for more than 17,000 Atlantic City casino and hotel workers set an Oct. 1 deadline to agree on a new contract or strike, the Philadelphia Inquirer reported. Yahoo! CEO Terry Semel has emerged as one of the top candidates to succeed Walt Disney Co. Chief Michael Eisner, the San Jose Mercury News reported. About one-third of registered voters in November's U.S. presidential election will have to cast their votes on electronic touch-screen machines, which haven't yet been tested on such a large scale, the NY Times said. OAO Yukos Oil suspended crude-oil deliveries to China National Petroleum Corp. because it couldn't pay for transportation costs, Interfax said. Shares of Eastman Kodak and IAC/Interactive rose late last week on speculation that both companies may be takeover targets, Barron's said. Some members of Iran's parliament are trying to reverse some of the women's-rights reforms carried out under moderate President Mohammad Khatami, the NY Times reported. About 40% of the world's biggest companies had their computer networks infected by viruses in the first half of 2004, the Financial Times said. Deposed Iraqi leader Saddam Hussein an 11 other members of his ousted regime will face trial beginning next month, Iraqi Prime Minister Allawi said. China's efforts to slow the economy are working, Vice Premier Huang Ju said, suggesting further tightening measures such as an interest rate hike may be unnecessary, Bloomberg reported. Iran refused a demand by the United Nations' nuclear watchdog to halt all uranium enrichment activities as the Islamic Republic faces possible sanctions, an Iranian security official said. CBS News ignored the advice of outside experts in rushing to broadcast a report on documents pertaining to President Bush's National Guard service that now appear to be fakes, the Washington Post reported. Southern Co., Duke Energy and other utilities said about 700,000 customers in the southeastern U.S. are without power three days after Hurricane Ivan swept though packing 130-mph winds, Bloomberg said.

Late-Night Trading

Asian indices are higher, +.25% to +1.0% on average.

S&P 500 indicated -.09%.

NASDAQ indicated unch.

BOTTOM LINE: I expect U.S. stocks to open modestly higher in the morning on optimism that economic growth in Asia will accelerate. The Portfolio is 100% net long heading into tomorrow.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 20, 2004

Sunday, September 19, 2004

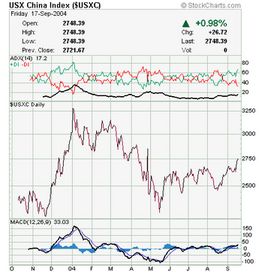

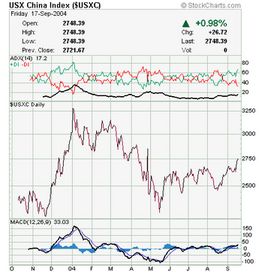

Chart of the Week

The USX China Index

Bottom Line: The China Index began falling in January of this year. It bottomed in May and has been trading in a range since. Last week it broke out of this range and appears to be headed higher as investors anticipate accelerating growth. The USX China Index is still down almost 15% from its highs.

Bottom Line: The China Index began falling in January of this year. It bottomed in May and has been trading in a range since. Last week it broke out of this range and appears to be headed higher as investors anticipate accelerating growth. The USX China Index is still down almost 15% from its highs.

Weekly Outlook

There are several important economic reports and a number of significant corporate earnings reports scheduled for release this week. Economic reports include the Housing Market Index, Housing Starts, Building Permits, Initial Jobless Claims, Leading Indicators, Durable Goods and Existing Home Sales. Housing Starts, Leading Indicators, Durable Goods and Existing Home Sales have market-moving potential.

Adobe Systems(ADBE), Carmax(KMX), Nike(NKE), Autozone(AZO), Red Hat(RHAT), PalmOne(PLMO), Lennar(LEN), General Mills(GIS), Goldman Sachs(GS), Paychex(PAYX), Bed, Bath & Beyond(BBBY), FedEx(FDX), Morgan Stanley(MWD) and Lehman Brothers(LEH) are some of the more important companies that release quarterly earnings this week. There are also a few other events that have market-moving potential. The Fed's interest rate decision/policy statement, Light Reading's Links and Bank of America's Investment Conference could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed as earnings worries, profit-taking and violence in Iraq offset diminishing terrorism fears, declining energy prices, falling inflation/interest rate concerns and economic data showing sustainable growth. As well, investor complacency and the market's technically overbought state should lead to further consolidation. The Fed will raise rates 25 basis points on Tues. and likely say that diminishing inflation concerns will continue to allow measured rate increases. My short-term trading indicators are still giving Buy signals and the Portfolio is 100% net long heading into the week.

Adobe Systems(ADBE), Carmax(KMX), Nike(NKE), Autozone(AZO), Red Hat(RHAT), PalmOne(PLMO), Lennar(LEN), General Mills(GIS), Goldman Sachs(GS), Paychex(PAYX), Bed, Bath & Beyond(BBBY), FedEx(FDX), Morgan Stanley(MWD) and Lehman Brothers(LEH) are some of the more important companies that release quarterly earnings this week. There are also a few other events that have market-moving potential. The Fed's interest rate decision/policy statement, Light Reading's Links and Bank of America's Investment Conference could also impact trading this week.

Bottom Line: I expect U.S. stocks to finish the week mixed as earnings worries, profit-taking and violence in Iraq offset diminishing terrorism fears, declining energy prices, falling inflation/interest rate concerns and economic data showing sustainable growth. As well, investor complacency and the market's technically overbought state should lead to further consolidation. The Fed will raise rates 25 basis points on Tues. and likely say that diminishing inflation concerns will continue to allow measured rate increases. My short-term trading indicators are still giving Buy signals and the Portfolio is 100% net long heading into the week.

Market Week in Review

S&P 500 1,128.55 +.41%

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Last week's modest rise was a nice win for the Bulls considering recent gains, violence in Iraq, rising energy prices and hurricane fears. Energy-related stocks and homebuilders were leaders. Most sectors and stocks rose again, while volume and measures of investor complacency remain a concern. I continue to expect oil prices to decline to around $35/bbl. during the fourth quarter, however profitability at energy-related companies will remain high. I expect the Amex Energy Index(IXE) to break to all-time highs during the final quarter of the year. As well, diminishing inflation fears are leading to falling interest rates. The average 30-yr. mortgage rate has now fallen 59 basis points from its May highs. Lower rates, better job prospects and an increasing stock market should help spur home sales and thus homebuilding stocks to all-time highs during the fourth quarter. Finally, Chinese ADRs broke from the trading range they had been trapped in since April. Investors are anticipating a stabilization or acceleration in Chinese economic growth. This should also boost world growth as China had been a recent drag.

Click here for the Weekly Wrap by Briefing.com

Bottom Line: Last week's modest rise was a nice win for the Bulls considering recent gains, violence in Iraq, rising energy prices and hurricane fears. Energy-related stocks and homebuilders were leaders. Most sectors and stocks rose again, while volume and measures of investor complacency remain a concern. I continue to expect oil prices to decline to around $35/bbl. during the fourth quarter, however profitability at energy-related companies will remain high. I expect the Amex Energy Index(IXE) to break to all-time highs during the final quarter of the year. As well, diminishing inflation fears are leading to falling interest rates. The average 30-yr. mortgage rate has now fallen 59 basis points from its May highs. Lower rates, better job prospects and an increasing stock market should help spur home sales and thus homebuilding stocks to all-time highs during the fourth quarter. Finally, Chinese ADRs broke from the trading range they had been trapped in since April. Investors are anticipating a stabilization or acceleration in Chinese economic growth. This should also boost world growth as China had been a recent drag.

Saturday, September 18, 2004

Economic Week in Review

ECRI Weekly Leading Index 131.70 -.60%

Advance Retail Sales for August fell .3% versus estimates of a .1% decline and a .8% increase in July. Retail Sales Less Autos for August rose .2% versus estimates of a .2% increase and a .3% gain in July. "The August results show a decidedly mixed sales pattern but suggest that consumer spending is emerging from the second quarter "soft patch," said Parul Jain, deputy chief economist at Nomura Securities. "There was a shift in the Labor Day period and that threw us off a little bit," said Terry Lundgren, CEO of Federated. "I'm still optimistic about the fourth quarter." Hurricane Frances, which battered Florida for three days during the Labor Day weekend, reduced profit at the Cincinnati-based retailer, which owns Macy's and Bloomingdale's.

Empire Manufacturing for September rose to 28.3 versus estimates of 20.0 and a reading of 13.2 in August. The gain was the largest since June of last year. Readings above 0 indicate expansion. The employment component of the index rose to the highest level in four months as more factories added workers to meet demand. Production has been spurred by corporate replacement of aging equipment and additions to inventories that are close to a record low relative to sales, Bloomberg said. "The manufacturing expansion is continuing to move forward at a decent pace," said Ian Morris, chief U.S. economist at HSBC Securities. "The jump in the index is consistent with booming manufacturing output growth."

Industrial Production for August rose .1% versus estimates of a .5% increase and a .6% gain in July. Business inventories rose .9% in July versus estimates of a .8% gain and a 1.1% increase in June. Capacity Utilization for August was 77.3% versus estimates of 77.4% and 77.3% in July. "This report was a lot stronger than the headline number suggests, because it was weighed down by utility output," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez. Electric and gas utility production "fell significantly," as the average temperature for August was the seventh-coolest since record-keeping began in 1895, Bloomberg reported.

The Consumer Price Index for August rose .1% versus estimates of a .1% increase and a .1% decline in July. CPI Ex Food & Energy for August rose .1% versus estimates of a .2% increase and a .1% gain in July. Prices for new automobiles fell .3%, airfares plunged 3.7%, gasoline prices dropped 1.4%, prices for dairy products fell 1.8% and clothing prices declined .2%, Bloomberg said. Federal Reserve Chairman Greenspan said in congressional testimony last week that inflation expectations have eased, Bloomberg reported.

Initial Jobless Claims for last week were 333K versus estimates of 340K and 317K the prior week. Continuing Claims were 2882K versus estimates of 2880K and 2885K prior. For the year, initial filings have averaged almost 344K, down from 402K in 2003, Bloomberg said. "The job market is improving and companies are beginning to ramp up hiring again," said Lynn Reaser, chief economist at Banc of America Capital. Brad Anderson, CEO of Best Buy, said he expects job growth will contribute to improved sales in the Christmas shopping season, Bloomberg reported. "There is much reason for optimism as unemployment rates currently are lower than they were a year ago and consumer confidence levels are substantially improved." Manpower Inc. found in a survey of employers that 28% planned to add workers from October through December, compared with 22% in last year's fourth quarter. Finally, a poll by Careerbuilder.com found 49% of hiring managers plan to increase payrolls in the final three months of this year, Bloomberg said.

The Philly Fed came in at 13.4 in September versus estimates of 25.0 and 28.5 in August. Even with the decline in the general index, measures for new orders and employment improved, indicating continued expansion as manufacturing helps pull the U.S. economy out of a mid-year lull, Bloomberg said. "The components of this survey are more positive," said Chris Rupkey, senior economist at Bank of Tokyo Mitsubishi. The general index may have fallen for a variety of reasons, including concerns over terrorism or the impact of the Florida hurricanes on demand, economists said. "It's more significant that both the Philly Fed and Empire State manufacturing surveys reported higher orders and employment this month, which suggests there's really not much of a slowdown going on and that we can anticipate a rise in the overall index next month," said David Sloan, senior economist at 4Cast.

The University of Michigan Consumer Confidence Index for September was 95.8 versus estimates of 96.7 and 95.9 in August. The measure has held above 95 for the last four months, the longest such string since the stock market bubble burst and the economy began to plunge into recession in 2000, Bloomberg reported. The expectations component of the index, based on optimism about the next one to five years, increased to 89.4 from 88.2 last month, Bloomberg said. The university's sentiment index averaged 93.8 in the six months leading up to the 1996 presidential election. "Just how optimistic or pessimistic consumers feel seems to help determine if the incumbent stays or goes," said Neal Soss, chief economist at CSFB.

Bottom Line: Overall, last week's economic data were positive, notwithstanding some disappointment with a couple of the headline numbers. Retail Sales were pretty good considering the very bad weather in some parts of the country. Manufacturing appears to be accelerating after a pause as measures of new orders and employment showed considerable strength. Long-term interest rates fell again last week as another measure of inflation, the Consumer Price Index, showed decelerating inflation. "Soaring inflation" had been one of the main arguments of the Bears and perpetuated in the mainstream press. This myth should now be dispelled as inflation is clearly set to rise less than its 41-year average of 3.0% this year. Historically, mild inflation has benefited stock prices as companies regain some pricing power, boosting profits. Recent employment surveys have shown improvement and point toward even better conditions in the fourth quarter. A better job market, stronger economic growth, a rising stock market, diminishing domestic terrorism fears, an end to the bitter political rhetoric and falling energy prices should spur consumer sentiment over the next several months.

Advance Retail Sales for August fell .3% versus estimates of a .1% decline and a .8% increase in July. Retail Sales Less Autos for August rose .2% versus estimates of a .2% increase and a .3% gain in July. "The August results show a decidedly mixed sales pattern but suggest that consumer spending is emerging from the second quarter "soft patch," said Parul Jain, deputy chief economist at Nomura Securities. "There was a shift in the Labor Day period and that threw us off a little bit," said Terry Lundgren, CEO of Federated. "I'm still optimistic about the fourth quarter." Hurricane Frances, which battered Florida for three days during the Labor Day weekend, reduced profit at the Cincinnati-based retailer, which owns Macy's and Bloomingdale's.

Empire Manufacturing for September rose to 28.3 versus estimates of 20.0 and a reading of 13.2 in August. The gain was the largest since June of last year. Readings above 0 indicate expansion. The employment component of the index rose to the highest level in four months as more factories added workers to meet demand. Production has been spurred by corporate replacement of aging equipment and additions to inventories that are close to a record low relative to sales, Bloomberg said. "The manufacturing expansion is continuing to move forward at a decent pace," said Ian Morris, chief U.S. economist at HSBC Securities. "The jump in the index is consistent with booming manufacturing output growth."

Industrial Production for August rose .1% versus estimates of a .5% increase and a .6% gain in July. Business inventories rose .9% in July versus estimates of a .8% gain and a 1.1% increase in June. Capacity Utilization for August was 77.3% versus estimates of 77.4% and 77.3% in July. "This report was a lot stronger than the headline number suggests, because it was weighed down by utility output," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez. Electric and gas utility production "fell significantly," as the average temperature for August was the seventh-coolest since record-keeping began in 1895, Bloomberg reported.

The Consumer Price Index for August rose .1% versus estimates of a .1% increase and a .1% decline in July. CPI Ex Food & Energy for August rose .1% versus estimates of a .2% increase and a .1% gain in July. Prices for new automobiles fell .3%, airfares plunged 3.7%, gasoline prices dropped 1.4%, prices for dairy products fell 1.8% and clothing prices declined .2%, Bloomberg said. Federal Reserve Chairman Greenspan said in congressional testimony last week that inflation expectations have eased, Bloomberg reported.

Initial Jobless Claims for last week were 333K versus estimates of 340K and 317K the prior week. Continuing Claims were 2882K versus estimates of 2880K and 2885K prior. For the year, initial filings have averaged almost 344K, down from 402K in 2003, Bloomberg said. "The job market is improving and companies are beginning to ramp up hiring again," said Lynn Reaser, chief economist at Banc of America Capital. Brad Anderson, CEO of Best Buy, said he expects job growth will contribute to improved sales in the Christmas shopping season, Bloomberg reported. "There is much reason for optimism as unemployment rates currently are lower than they were a year ago and consumer confidence levels are substantially improved." Manpower Inc. found in a survey of employers that 28% planned to add workers from October through December, compared with 22% in last year's fourth quarter. Finally, a poll by Careerbuilder.com found 49% of hiring managers plan to increase payrolls in the final three months of this year, Bloomberg said.

The Philly Fed came in at 13.4 in September versus estimates of 25.0 and 28.5 in August. Even with the decline in the general index, measures for new orders and employment improved, indicating continued expansion as manufacturing helps pull the U.S. economy out of a mid-year lull, Bloomberg said. "The components of this survey are more positive," said Chris Rupkey, senior economist at Bank of Tokyo Mitsubishi. The general index may have fallen for a variety of reasons, including concerns over terrorism or the impact of the Florida hurricanes on demand, economists said. "It's more significant that both the Philly Fed and Empire State manufacturing surveys reported higher orders and employment this month, which suggests there's really not much of a slowdown going on and that we can anticipate a rise in the overall index next month," said David Sloan, senior economist at 4Cast.

The University of Michigan Consumer Confidence Index for September was 95.8 versus estimates of 96.7 and 95.9 in August. The measure has held above 95 for the last four months, the longest such string since the stock market bubble burst and the economy began to plunge into recession in 2000, Bloomberg reported. The expectations component of the index, based on optimism about the next one to five years, increased to 89.4 from 88.2 last month, Bloomberg said. The university's sentiment index averaged 93.8 in the six months leading up to the 1996 presidential election. "Just how optimistic or pessimistic consumers feel seems to help determine if the incumbent stays or goes," said Neal Soss, chief economist at CSFB.

Bottom Line: Overall, last week's economic data were positive, notwithstanding some disappointment with a couple of the headline numbers. Retail Sales were pretty good considering the very bad weather in some parts of the country. Manufacturing appears to be accelerating after a pause as measures of new orders and employment showed considerable strength. Long-term interest rates fell again last week as another measure of inflation, the Consumer Price Index, showed decelerating inflation. "Soaring inflation" had been one of the main arguments of the Bears and perpetuated in the mainstream press. This myth should now be dispelled as inflation is clearly set to rise less than its 41-year average of 3.0% this year. Historically, mild inflation has benefited stock prices as companies regain some pricing power, boosting profits. Recent employment surveys have shown improvement and point toward even better conditions in the fourth quarter. A better job market, stronger economic growth, a rising stock market, diminishing domestic terrorism fears, an end to the bitter political rhetoric and falling energy prices should spur consumer sentiment over the next several months.

Friday, September 17, 2004

Weekly Scoreboard*

Indices

S&P 500 1,128.55 +.41%

Dow 10,284.46 -.28%

NASDAQ 1,910.09 +.83%

Russell 2000 573.17 +.57%

S&P Equity Long/Short Index 966.69 +.18%

Put/Call .82 -1.20%

NYSE Arms .73 -1.35%

Volatility(VIX) 14.03 +1.96%

AAII % Bulls 45.45 -10.0%

US Dollar 88.91 +.57%

CRB 274.41 +1.03%

Futures Spot Prices

Gold 407.60 +.94%

Crude Oil 45.59 +6.44%

Unleaded Gasoline 127.03 +8.57%

Natural Gas 5.11 +12.14%

Base Metals 109.57 +1.21%

10-year US Treasury Yield 4.12% -1.91%

Average 30-year Mortgage Rate 5.75% -1.37%

Leading Sectors

Oil Service +2.97%

Energy +2.91%

Homebuilders +2.82%

Lagging Sectors

Airlines -1.45%

Tobacco -1.70%

Networking -2.59%

*% Gain or loss for the week

S&P 500 1,128.55 +.41%

Dow 10,284.46 -.28%

NASDAQ 1,910.09 +.83%

Russell 2000 573.17 +.57%

S&P Equity Long/Short Index 966.69 +.18%

Put/Call .82 -1.20%

NYSE Arms .73 -1.35%

Volatility(VIX) 14.03 +1.96%

AAII % Bulls 45.45 -10.0%

US Dollar 88.91 +.57%

CRB 274.41 +1.03%

Futures Spot Prices

Gold 407.60 +.94%

Crude Oil 45.59 +6.44%

Unleaded Gasoline 127.03 +8.57%

Natural Gas 5.11 +12.14%

Base Metals 109.57 +1.21%

10-year US Treasury Yield 4.12% -1.91%

Average 30-year Mortgage Rate 5.75% -1.37%

Leading Sectors

Oil Service +2.97%

Energy +2.91%

Homebuilders +2.82%

Lagging Sectors

Airlines -1.45%

Tobacco -1.70%

Networking -2.59%

*% Gain or loss for the week

Subscribe to:

Comments (Atom)