Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, June 12, 2006

Sunday, June 11, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- The military wing of the Hamas movement that controls the Palestinian government fired rockets into Israel in retaliation for attacks in Gaza yesterday, ending a 16-month truce.

- Finance ministers from the G-8 said the global economy is still “strong” after stocks tumbled around the world.

- The US dollar posted its first weekly rally versus the euro since January as Fed officials made hawkish comments and as investors fled emerging markets for US assets.

- The Australian stock market may end a three-year winning streak because of falling metals prices and rising borrowing costs.

- Treasury investors, who two weeks ago questioned Fed Chairman Bernanke’s resolve in fighting inflation, are giving him a vote of confidence.

- Tropical Storm Alberto, the first named storm of the Atlantic Ocean’s 2006 hurricane season, won’t be windy enough to become a hurricane, forecasters said.

- The number of foreign troops in Iraq will drop to fewer than 100,000 by January and most will have left within 18 months, according to that nation’s national security adviser.

- A more peaceful world and fewer major wars globally led to a decrease in the number of refugees last year to 8.4 million, a 26-year low, according to the United Nations agency that cares for people driven from their homes by wars and natural disasters. The number of refuges declined for the fifth straight year, the UN High Commissioner for Refugees said in a recent report. The agency attributed much of the decline to 752,100 Afghans and 56,200 Iraqis who returned home.

Wall Street Journal:

- Banco Bilbao Vizcaya Argentaria SA is considering buying Texas Regional Bancshares(TRBS) to expand its US-Mexico unit, the most profitable.

NY Times:

- Job applicants may find their postings on Internet sites offend future employers who have started conducting background checks of prospects on the Web.

Washington Post:

- Newt Gingrich, former Georgia congressman and House speaker, may run for the Republican presidential nomination in 2008 if no single Republican candidate has emerged by late next year.

- More immigrants seeking to live in the US are buying US businesses to get “investor visas.”

LA Times:

- Los Angeles’s homicide rate has fallen 11% in the first six months of this year.

San Diego Union-Tribune:

- Southern California’s slowing housing sales won’t erode equity gains homeowners have amassed in the past years, citing a report by Harvard University.

Barron’s:

- Merrill Lynch’s(MER) Saly Glassman won the No. 1 spot in Barron’s list of the top 100 women financial advisers for her management of $1.05 billion.

Financial Times:

- Millions of dollars are being transferred out of traditional tax havens and into states such as Delaware, Nevada and Wyoming in the US where information sharing with tax authorities is less strict.

- Emerging Markets are heading for a “period of vulnerability,” citing Charles Dallara, managing director of the Institute of International Finance.

Der Spiegel:

- John Browne, CEO of BP Plc, said it’s “very probable” that oil prices will drop to about $40 a barrel in the medium term, citing an interview. Oil prices of $25 to $30 a barrel are possible “in the very long term,” Brown said.

Mail on Sunday:

- Signet Group Plc, the world’s largest jeweler, is in talks with US rival Zale Corp.(ZLC) about a possible $4.2 billion alliance.

Weekend Recommendations

Barron's:

- Had positive comments on (LM), (WEBX), (APA), (APC), (XTO), (ELY), (ROLL), (PDCO), (GNTX) and (GRMN).

Night Trading

Asian indices are -.75% to unch. on average.

S&P 500 indicated unch.

NASDAQ 100 indicated +.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LEH)1.61

Upcoming Splits

- (BECN) 3-for-2

- (CEDC) 3-for-2

Economic Releases

2:00 pm EST

- The budget deficit for May is estimated to widen to -$39.0B versus -$35.4B in April.

Bloomberg:

- The military wing of the Hamas movement that controls the Palestinian government fired rockets into Israel in retaliation for attacks in Gaza yesterday, ending a 16-month truce.

- Finance ministers from the G-8 said the global economy is still “strong” after stocks tumbled around the world.

- The US dollar posted its first weekly rally versus the euro since January as Fed officials made hawkish comments and as investors fled emerging markets for US assets.

- The Australian stock market may end a three-year winning streak because of falling metals prices and rising borrowing costs.

- Treasury investors, who two weeks ago questioned Fed Chairman Bernanke’s resolve in fighting inflation, are giving him a vote of confidence.

- Tropical Storm Alberto, the first named storm of the Atlantic Ocean’s 2006 hurricane season, won’t be windy enough to become a hurricane, forecasters said.

- The number of foreign troops in Iraq will drop to fewer than 100,000 by January and most will have left within 18 months, according to that nation’s national security adviser.

- A more peaceful world and fewer major wars globally led to a decrease in the number of refugees last year to 8.4 million, a 26-year low, according to the United Nations agency that cares for people driven from their homes by wars and natural disasters. The number of refuges declined for the fifth straight year, the UN High Commissioner for Refugees said in a recent report. The agency attributed much of the decline to 752,100 Afghans and 56,200 Iraqis who returned home.

Wall Street Journal:

- Banco Bilbao Vizcaya Argentaria SA is considering buying Texas Regional Bancshares(TRBS) to expand its US-Mexico unit, the most profitable.

NY Times:

- Job applicants may find their postings on Internet sites offend future employers who have started conducting background checks of prospects on the Web.

Washington Post:

- Newt Gingrich, former Georgia congressman and House speaker, may run for the Republican presidential nomination in 2008 if no single Republican candidate has emerged by late next year.

- More immigrants seeking to live in the US are buying US businesses to get “investor visas.”

LA Times:

- Los Angeles’s homicide rate has fallen 11% in the first six months of this year.

San Diego Union-Tribune:

- Southern California’s slowing housing sales won’t erode equity gains homeowners have amassed in the past years, citing a report by Harvard University.

Barron’s:

- Merrill Lynch’s(MER) Saly Glassman won the No. 1 spot in Barron’s list of the top 100 women financial advisers for her management of $1.05 billion.

Financial Times:

- Millions of dollars are being transferred out of traditional tax havens and into states such as Delaware, Nevada and Wyoming in the US where information sharing with tax authorities is less strict.

- Emerging Markets are heading for a “period of vulnerability,” citing Charles Dallara, managing director of the Institute of International Finance.

Der Spiegel:

- John Browne, CEO of BP Plc, said it’s “very probable” that oil prices will drop to about $40 a barrel in the medium term, citing an interview. Oil prices of $25 to $30 a barrel are possible “in the very long term,” Brown said.

Mail on Sunday:

- Signet Group Plc, the world’s largest jeweler, is in talks with US rival Zale Corp.(ZLC) about a possible $4.2 billion alliance.

Weekend Recommendations

Barron's:

- Had positive comments on (LM), (WEBX), (APA), (APC), (XTO), (ELY), (ROLL), (PDCO), (GNTX) and (GRMN).

Night Trading

Asian indices are -.75% to unch. on average.

S&P 500 indicated unch.

NASDAQ 100 indicated +.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LEH)1.61

Upcoming Splits

- (BECN) 3-for-2

- (CEDC) 3-for-2

Economic Releases

2:00 pm EST

- The budget deficit for May is estimated to widen to -$39.0B versus -$35.4B in April.

BOTTOM LINE: Asian Indices are mostly lower, weighed down by exporting shares in the region. I expect US stocks to open modestly lower and to rise into the afternoon, finishing mixed. The Portfolio is 75% net long heading into the week.

Weekly Outlook

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Monthly Budget Statement

Tues. - Producer Price Index, Advance Retail Sales, Business Inventories

Wed. - Consumer Price Index, Fed’s Beige Book

Thur. - Initial Jobless Claims, Empire Manufacturing, Net Foreign Security Purchases, Industrial Production, Philly Fed.

Fri. - Current Account Balance, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Lehman Brothers(LH)

Tues. - Best Buy(BBY), CA Inc.(CA), Flowserve Corp.(FLS), Freddie Mac(FRE), Goldman Sachs(GS)

Wed. - None of note

Thur. - Adobe Systems(ADBE), Bear Stearns(BSC), KB Home(KBH), Omnivision Technologies(OVTI), Pier 1 Imports(PIR)

Fri. - Carnival Corp.(CCL), Circuit City(CC), Winnebago Industries(WGO)

Other events that have market-moving potential this week include:

Mon. - Bear Stearns Tech Conference, Goldman Sachs Global Healthcare Conference

Tue. - Goldman Sachs Global Healthcare Conference, CSFB Consumer and Retail Conference, Bear Stearns Tech Conference, CIBC Industrial Products & Capital Goods Conference, Merrill Lynch Global Transport Conference, Deutsche Bank Media & Telecom Conference

Wed. - Merrill Lynch Global Transport Conference, Deutsche Bank Media & Telecom Conference, CSFB Consumer and Retail Conference, Merrill Lynch Agricultural Chemicals Conference, Needham Biotech Conference, CIBC Industrial Products & Capital Goods Conference

Thur. - Goldman Sachs Global Healthcare Conference, CSFB Consumer and Retail Conference, Merrill Lynch Global Transport Conference, Needham Biotech Conference

Fri. - None of note

Economic reports for the week include:

Mon. - Monthly Budget Statement

Tues. - Producer Price Index, Advance Retail Sales, Business Inventories

Wed. - Consumer Price Index, Fed’s Beige Book

Thur. - Initial Jobless Claims, Empire Manufacturing, Net Foreign Security Purchases, Industrial Production, Philly Fed.

Fri. - Current Account Balance, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Lehman Brothers(LH)

Tues. - Best Buy(BBY), CA Inc.(CA), Flowserve Corp.(FLS), Freddie Mac(FRE), Goldman Sachs(GS)

Wed. - None of note

Thur. - Adobe Systems(ADBE), Bear Stearns(BSC), KB Home(KBH), Omnivision Technologies(OVTI), Pier 1 Imports(PIR)

Fri. - Carnival Corp.(CCL), Circuit City(CC), Winnebago Industries(WGO)

Other events that have market-moving potential this week include:

Mon. - Bear Stearns Tech Conference, Goldman Sachs Global Healthcare Conference

Tue. - Goldman Sachs Global Healthcare Conference, CSFB Consumer and Retail Conference, Bear Stearns Tech Conference, CIBC Industrial Products & Capital Goods Conference, Merrill Lynch Global Transport Conference, Deutsche Bank Media & Telecom Conference

Wed. - Merrill Lynch Global Transport Conference, Deutsche Bank Media & Telecom Conference, CSFB Consumer and Retail Conference, Merrill Lynch Agricultural Chemicals Conference, Needham Biotech Conference, CIBC Industrial Products & Capital Goods Conference

Thur. - Goldman Sachs Global Healthcare Conference, CSFB Consumer and Retail Conference, Merrill Lynch Global Transport Conference, Needham Biotech Conference

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on decelerating inflation readings, short-covering, bargain hunting and declining long-term rates. My trading indicators are still giving mostly bearish signals and the Portfolio is 75% net long heading into the week.

Saturday, June 10, 2006

Market Week in Review

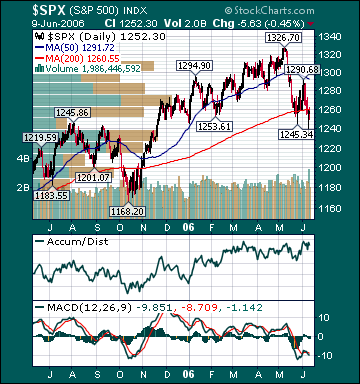

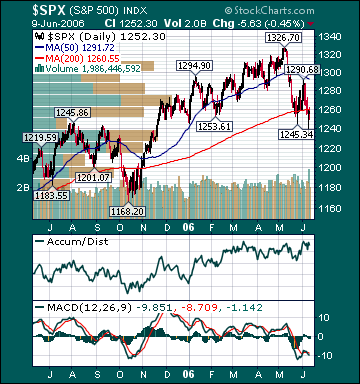

S&P 500 1,252.30 -2.79%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bearish. The advance/decline line fell, most sectors declined and volume was above average on the week. Measures of investor anxiety were mostly higher. Moreover, the AAII % Bulls fell to 26.23% and is now at depressed levels, which is a big positive. Most other measures of investor sentiment are also at levels associated with meaningful market bottoms.

The average 30-year mortgage rate fell to 6.62% which is 141 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. I see little evidence of a nationwide “hard landing” for housing at this point.

The benchmark 10-year T-note yield fell 2 basis points on the week on US dollar strength, a flight to safety by global investors and more hawkish comments by the Fed. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose again even as refinery utilization fell. Unleaded Gasoline futures declined and are now 26.0% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, a significant amount of Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 14% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation should further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose less than expectations this week, however supplies are still 41.3% above the 5-year average, near an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 60.7% since December 2005 highs. Notwithstanding this collapse, industrial demand for natural gas has shown few signs of increasing in any meaningful way. US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down .24%, while global supplies have increased 4.94%. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen during the next qauarter.

Gold fell for the week as the US dollar gained and the situations in Iraq and Iran improved. The US dollar rose on hawkish Fed comments, a flight to safety by global investors and dovish comments from the European Central Bank.

Commodity stocks underperformed substantially for the week on increasing worries over slower global growth, a subsiding of the mania for these securities and a stronger US dollar. The forward p/e on the S&P 500 has contracted relentlessly over the last few years and now stands at a very reasonable 14.6. The average US stock, as measured by the Value Line Geometric Index(VGY), is up 1.14%. Moreover, the Russell 2000 Index is still up 4.63% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback has provided longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. A chain reaction of events has likely begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. Over the coming months, a Fed pause, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I continue to believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index rose this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Friday, June 09, 2006

Weekly Scoreboard*

Indices

S&P 500 1,252.30 -2.79%

DJIA 10,891.92 -3.16%

NASDAQ 2,135.06 -3.80%

Russell 2000 701.39 -4.89%

Wilshire 5000 12,598.13 -3.09%

S&P Equity Long/Short Index 1,152.42 unch.

S&P Barra Growth 579.50 -2.59%

S&P Barra Value 671.08 -2.98%

Morgan Stanley Consumer 600.95 -1.41%

Morgan Stanley Cyclical 799.95 -5.67%

Morgan Stanley Technology 485.55 -4.82%

Transports 4,542.35 -4.61%

Utilities 412.23 -.88%

S&P 500 Cum A/D Line 7,024 -9.0%

Bloomberg Crude Oil % Bulls 20.9 -16.4%

Put/Call 1.01 -16.53%

NYSE Arms 1.38 +7.81%

Volatility(VIX) 18.12 +26.54%

ISE Sentiment 105.0 -3.67%

AAII % Bulls 26.23 -14.75%

AAII % Bears 45.08 -9.84%

US Dollar 85.72 +1.99%

CRB 340.09 -2.84%

ECRI Weekly Leading Index 137.40 +.73%

Futures Spot Prices

Crude Oil 71.64 -1.39%

Unleaded Gasoline 214.50 -1.26%

Natural Gas 6.20 -4.25%

Heating Oil 204.28 -.06%

Gold 611.60 -5.62%

Base Metals 212.09 -7.05%

Copper 323.15 -10.11%

10-year US Treasury Yield 4.97% -.40%

Average 30-year Mortgage Rate 6.62% -.75%

Leading Sectors

HMOs +.62%

REITs +.29%

Restaurants -.31%

Telecom -.79%

Utilities -.88%

Lagging Sectors

Oil Service -8.53%

Alternative Energy -8.81%

Steel -9.66%

Coal -10.06%

Gold & Silver -10.6%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,252.30 -2.79%

DJIA 10,891.92 -3.16%

NASDAQ 2,135.06 -3.80%

Russell 2000 701.39 -4.89%

Wilshire 5000 12,598.13 -3.09%

S&P Equity Long/Short Index 1,152.42 unch.

S&P Barra Growth 579.50 -2.59%

S&P Barra Value 671.08 -2.98%

Morgan Stanley Consumer 600.95 -1.41%

Morgan Stanley Cyclical 799.95 -5.67%

Morgan Stanley Technology 485.55 -4.82%

Transports 4,542.35 -4.61%

Utilities 412.23 -.88%

S&P 500 Cum A/D Line 7,024 -9.0%

Bloomberg Crude Oil % Bulls 20.9 -16.4%

Put/Call 1.01 -16.53%

NYSE Arms 1.38 +7.81%

Volatility(VIX) 18.12 +26.54%

ISE Sentiment 105.0 -3.67%

AAII % Bulls 26.23 -14.75%

AAII % Bears 45.08 -9.84%

US Dollar 85.72 +1.99%

CRB 340.09 -2.84%

ECRI Weekly Leading Index 137.40 +.73%

Futures Spot Prices

Crude Oil 71.64 -1.39%

Unleaded Gasoline 214.50 -1.26%

Natural Gas 6.20 -4.25%

Heating Oil 204.28 -.06%

Gold 611.60 -5.62%

Base Metals 212.09 -7.05%

Copper 323.15 -10.11%

10-year US Treasury Yield 4.97% -.40%

Average 30-year Mortgage Rate 6.62% -.75%

Leading Sectors

HMOs +.62%

REITs +.29%

Restaurants -.31%

Telecom -.79%

Utilities -.88%

Lagging Sectors

Oil Service -8.53%

Alternative Energy -8.81%

Steel -9.66%

Coal -10.06%

Gold & Silver -10.6%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)