There are a few economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Consumer Credit

Tues. - Preliminary 2Q Non-farm Productivity, Preliminary 2Q Unit Labor Costs, FOMC Rate Decision

Wed. - Wholesale Inventories

Thur. - Trade Balance, Initial Jobless Claims, Monthly Budget Statement

Fri. - Import Price Index, Advance Retail Sales, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - AES Corp.(AES), American Tower(AMT), California Pizza Kitchen(CPKI), Cousins Property(CUZ), El Paso Corp.(EP), Forest Oil(FST), Hansen Natural(HANS), Marvel Entertainment(MVL), McDermott(MDR), Priceline.com(PCLN)

Tues. - Andrx Corp.(ADRX), BMC Software(BMC), Cablevision Systems(CVC), Caremark(CMX), Cisco Systems(CSCO), Clear Channel(CCU), Flour Corp.(FLR), Foundry Networks(FDRY), Jack in the Box(JBX), News Corp.(NWS/A), Overseas Shipholding(OSG), Polo Ralph Lauren(RL), Sara Lee(SLE), Seagate Technologies(STX)

Wed. - American International Group(AIG), Cendant(CD). Comverse Tech(CMVT), Federated Dept. Store(FD), Thomas Weisel(TWPG), Viacom(VIA), Walt Disney(DIS)

Thur. - Analog Devices(ADI), Brinker Intl.(EAT), CA Inc.(CA), EchoStar(DISH), Expedia Inc.(EXPE), Goldcorp(GG), JC Penney(JCP), Kohl’s(KSS), Nvidia(NVDA), Target Corp.(TGT), Urban Outfitters(URBN)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - JPMorgan Auto Conference

Tue. - JPMorgan Auto Conference, RBC North American Tech Conference

Wed. - Bank of America Specialty Pharma Conference, RBC North American Tech Conference, CIBC Software Conference, JPMorgan Auto Conference

Thur. - Bank of America Specialty Pharma Conference, CIBC Software Conference, RBC North American Tech Conference

Fri. - Bank of American Specialty Pharma Conference

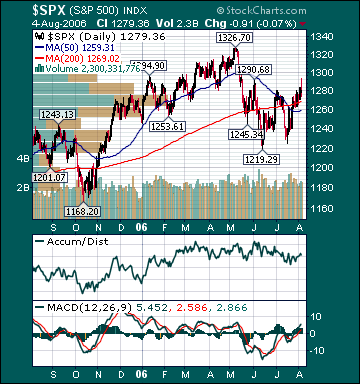

BOTTOM LINE: I expect US stocks to finish the week modestly higher on mostly positive earnings reports, a Fed “pause”, a calming in Middle Eastern tensions, short-covering and bargain hunting. My trading indicators are now give neutral signals and the Portfolio is 100% net long heading into the week.