Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, August 20, 2007

Links of Interest

Sunday, August 19, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- The Federal Reserve reduced the interest rate it charges banks and acknowledged for the first time that an extraordinary policy shift is needed to contain the subprime-mortgage collapse that began roiling the world’s financial markets two months ago.

- Sentinel Management Group, the cash-management firm that froze client withdrawals three days ago, was accused of selling investors’ assets at below-market rates to hedge fund company Citadel Investment Group.

- President Bush said local communities in

- Hurricane Dean was on course to lash Jamica today with rain and sustained winds of about 145 miles per hour, then bear down on the Cayman Islands and Mexico’s Yucatan Peninsula.

- Senator Hillary Rodham Clinton warned Democrats not to “oversell” plans to withdraw US troops from Iraq, setting a cautious tone on the war that was echoed by the party’s two other leading presidential candidates.

- ‘Double Dip’ Stock-Buying Opportunities Emerge as Shares Fall.

- Economists at Wall Street’s biggest bond trading firms are rushing to change their interest-rate forecasts after the futures market more accurately predicted the Fed’s surprise rate cut.

- Crude oil is falling $.78/bbl. in NY on signs Hurricane Dean’s more southerly track may mean it will miss the largest oil production regions of the Gulf of Mexico.

NY Times:

- The John Edwards presidential campaign said on Friday that Mr. Edwards would divest his portfolio at a New York hedge fund of investments in subprime mortgage companies that have foreclosed on victims of Hurricane Katrina. But the campaign said he would keep his $16 million investments in the hedge fund, the Fortress Investment Group.

- The Fed’s Sudden Action Eases a Logjam in Corporate Borrowing.

- Google Wins the Most Hearts on the Web.

AccuWeatherr.com:

- Hurricane Dean path and strength projections.

MarketWatch.com:

- An analyst at Banc of American Securities upgraded shares of troubled mortgage lender Countrywide Financial(CFC) to neutral from sell Friday, saying that tapping its $11.5 billion credit facility should provide Countrywide the time needed to address liquidity and capital concerns.

- Short-term timing letters shorting the market is bullish evidence for contrarians.

- Dell embraces the ‘Stodgy Factor’ in tech.

- China’s Internet giants ready to rumble. Commentary: Google, Alibaba, and Focus Media target China advertising.

- Looking for growing small-cap niches. Citizens’ Gallipo likes Crocs(CROX), Priceline(PCLN) and BE Aerospace(BEAV).

IBD:

- Jumbo Rates Soon Might Settle Down.

Reuters:

- More US hedge funds likely to crumble in ’07.

- Cisco Systems(CSCO) is best known for selling routers and switches to telecom companies, but its strongest sales growth these days comes from an area that seldom gets much attention: hospitals.

- Italian Finance Minister Tommaso Padoa-Schioppa said steps by the US Federal Reserve and the European Central Bank to help ease the global credit crunch were “impeccable,” citing an interview.

- China eyes investing in private equity, hedge funds.

- More than half of the executives surveyed, from 240 leading companies across 24 countries and 20 industries, told the NYSE CEO Report 2008 they would budget more for customer relationship management in 2008.

Crain’s

- Mesirow Financial Inc. CEO James Tyree wants to buy or start a commercial bank, hiring management for the new service from ABN Amro Bank’s LaSalle Bank unit.

- Companies see profit potential in green efforts.

Financial Times:

- Multinational companies with US subsidiaries could face huge new tax bills under a law passing through the US Congress, diplomats and business groups have warned.

- European central banks are standing ready this week to take further steps to east the credit squeeze following the US Fed’s unexpected move on Friday to stem the turmoil in money and credit markets.

Sunday Times:

- American Express(AXP) plans to sell its private banking business for as much as $500 million.

- Toy jewelry imported from China contained levels of lead that could potentially cause brain damage and even kill children, citing Birmingham’s hallmark-setting Assay Office.

Financial Mail:

- Nasdaq Stock Market(NDAQ) is prepared to trump Borse Bubai’s $3.96 billion bid for

News of the World:

- The UK plans to send 2,000 extra troops to

- The recent global stock-market slide was “irrational” and the worst of the correction may be over, said Joseph Yam Chi-kong, chief executive of the Hong Kong Monetary Authority.

Economic Daily News:

-

Kyodo:

- Brazilians are taking the final steps in order to kick off a giant entrepreneurial project that will produce billions of liters of fuel alcohol from sugar cane to be exported exclusively to

Weekend Recommendations

Barron's:

- Made positive comments on (MI), (EMC), (NBR), (MTN), (RDN), (CFC) and (CAB).

Citigroup:

- Reiterated Buy on (SNDK), target $71. Contract outlook puts potential upward pressure on our recently-raised (SNDK) estimates. Valuation looks benign (17.2x our 08 estimates) and near term catalysts are plentiful (contract pricing, new product activity (AAPL, others), EPS revisions, IDF (Sept.), CTIA (Oct) and new handsets ahead of 1Q08’s 3GSM).

- Upgraded (CNP) to Buy, target $19.50.

Night Trading

Asian indices are +2.75% to +4.5% on average.

S&P 500 futures -.31%.

NASDAQ 100 futures -.25%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LOW)/.61

- (PERY)/-.14

Upcoming Splits

- (AAON) 3-for-2

- (ARO) 3-for-2

- (TXT) 2-for-1

Economic Releases

10:00 am EST

- Leading Indicators for July are estimated to rise .4% versus a -.3% decline in June.

Other Potential Market Movers

- The Oil & Gas Conference could also impact trading today.

Weekly Outlook

Click here for The Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are several economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Leading Indicators

Tues. – Weekly Retail Sales

Wed. – Weekly MBA Mortgage Applications, Weekly EIA Energy Inventory Data

Thur. – Initial Jobless Claims, Continuing Claims

Fri. – Durable Goods Orders, New Home Sales

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Lowe’s(LOW), Perry Ellis(PERY)

Tues. – Affiliated Computer Services(ACS), American Eagle Outfitters(AEO), Analog Devices(ADI), BJ’s Wholesale Club(BJ), Dick’s Sporting Goods(DKS), Jack Henry(JKHY), Medtronic Inc.(MDT), PEP Boys(PBY), Saks Inc.(SKS), Staples Inc.(SPLS), Target Corp.(TGT), Toll Brothers(TOL)

Wed. – Abercrombie & Fitch(ANF), Diebold Inc.(DBD), Eaton Vance(EV), Foot Locker(FL), Gymboree Corp.(GYMB), HOT Topic(HOTT), Intuit Inc.(INTU), JDS Uniphase(JDSU), Ltd Brands(LTD), Men’s Wearhouse(MW), Phillips-Van Heusen(PVH), Ross Stores(ROST), Synopsys(SNPS), Talbots Inc.(TLB), Tech Data(TECD), Tween Brands(TWB), Zumiez(ZUMZ)

Thur. – Aeropostale Inc.(ARO), Barnes & Noble(BKS), Bebe Stores(BEBE), Brocade Communications(BRCD), Children’s Place(PLCE), GameStop Corp.(GME), Gap Inc.(GPS), Hibbett Sports(HIBB), Hormel Foods(HRL), Marvell Tech(MRVL), Pacific Sunwear(PSUN), Patterson Cos(PDCO), Smithfield Foods(SFD), Stage Stores(SSI), Stein Mart(SMRT), Toro Co.(TTC)

Fri. – AnnTaylor Stores(ANN), Burger King(BKC), Genesco Inc.(GCO), HJ Heinz(HNZ), J Crew Group(JCG), Quanex Corp.(NX)

Other events that have market-moving potential this week include:

Mon. – Oil & Gas Conference

Tue. – The Fed’s Lacker speaking, Oil & Gas Conference

Wed. – (DE) Analyst Meeting, Oil & Gas Conference

Thur. – (DE) Analyst Meeting, (CEG) Analyst Meeting, Oil & Gas Conference

Fri. – None of note

Saturday, August 18, 2007

Friday, August 17, 2007

Weekly Scoreboard*

Indices

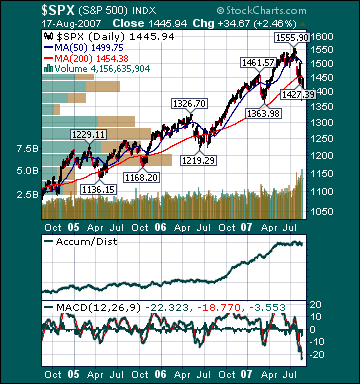

S&P 500 1,445.94 -.53%

DJIA 13,079.08 -1.21%

NASDAQ 2,505.03 -1.57%

Russell 2000 786.03 -.35%

Wilshire 5000 14,498.54 -.70%

Russell 1000 Growth 574.14 -1.87%

Russell 1000 Value 816.39 +.36%

Morgan Stanley Consumer 707.47 -.86%

Morgan Stanley Cyclical 989.71 -2.02%

Morgan Stanley Technology 611.01 -1.63%

Transports 4,767.98 -3.90%

Utilities 487.39 -.80%

MSCI Emerging Markets 120.77 -6.26%

Sentiment/Internals

NYSE Cumulative A/D Line 61,937 -4.96%

Bloomberg New Highs-Lows Index -438 +45.32%

Bloomberg Crude Oil % Bulls 31.0 +9.9%

CFTC Oil Large Speculative Longs 220,585 -4.47%

Total Put/Call 1.22 +11.9%

NYSE Arms .70 -4.11%

Volatility(VIX) 30.0 +5.97%

ISE Sentiment 129.0 +21.70%

AAII % Bulls 42.22 -7.74%

AAII % Bears 45.56 +16.88%

Futures Spot Prices

Crude Oil 71.98 +.57%

Reformulated Gasoline 203.88 +4.66%

Natural Gas 7.01 +2.60%

Heating Oil 201.73 +2.16%

Gold 666.80 -2.2%

Base Metals 223.99 -5.12%

Copper 314.75 -6.46%

Economy

10-year US Treasury Yield 4.67% -12 basis points

4-Wk MA of Jobless Claims 312,500 +1.5%

Average 30-year Mortgage Rate 6.59% +3 basis points

Weekly Mortgage Applications 678.70 +3.38%

Weekly Retail Sales +2.3%

Nationwide Gas $2.76 -.04/gallon

US Cooling Demand Next 7 Days 19.0% above normal

ECRI Weekly Leading Economic Index 141.80 -.07%

US Dollar Index 81.43 +.93%

CRB Index 306.15 -1.53%

Best Performing Style

Small-cap Value +.46%

Worst Performing Style

Mid-cap Growth -2.40%

Leading Sectors

Banks +4.01%

Insurance +2.64%

Biotech +2.2%

HMOs +1.35%

I-Banks +.73%

Lagging Sectors

Alternative Energy -8.2%

Steel -8.3%

Engineering & Construction -8.73%

Homebuilders -9.42%

Gold -11.29%

Stocks Soaring into Final Hour as Fed Cuts Discount Rate

BOTTOM LINE: The Portfolio is higher into the final hour on gains in my Computer longs, Medical longs, Semi longs and Retail longs. I covered the remainder of my (IWM)/(QQQQ) hedges, added to my (PWR) long and took some more profits in my (EEM) short today, thus leaving the Portfolio 100% net long. The overall tone of the market is very positive today as the advance/decline line is sharply higher, every sector is rising and volume is heavy. My intraday gauge of investor angst is still elevated. The AAII percentage of bulls fell to 42.22% this week from 45.76% the prior week. This reading is slightly below average levels. The AAII percentage of bears rose to 45.56% this week from 38.98% the prior week. This reading is now approaching elevated levels. Moreover, the 10-week moving average of the percentage of bears is currently at 37.4%, a high level. The 10-week moving average of the percentage of bears peaked at 43.0% at the major bear-market low during 2002. The 50-week moving average of the percentage of bears is currently 36.5%, an elevated level seen during only two other periods since tracking began in the 1980s. Those periods were October 1990-July 1991 and March 2003-May 2003, both of which were near major stock market bottoms. The extreme readings in the 50-week moving average of the percentage of bears during those periods peaked at 41.6% on Jan. 31, 1991, and 38.1% on April 10, 2003. We are still very close to eclipsing the peak in bearish sentiment during the 2000-2003 market meltdown, which I still find astonishing, notwithstanding the recent correction. Here are a few other gauges showing extreme bearishness:

2) According to Hays Advisory, the NYSE Overbought/Oversold Ratio is the second-highest in 42 years.

3) The 10-day total put/call recently hit the second-highest reading in history.

4) The 10-day ISE Sentiment Index reading recently hit the second lowest on record.

5) The 21-day Arms Index is at the highest level since around the March lows.

6) The Rydex Nova/Ursa Ratio Sentiment Indicator is at levels last seen in 2002.

7) Domestic stock mutual funds continue to see significant outflows.

8) Money market fund assets soared this week and are at record levels.

9) At yesterday’s lows, the 2-year note yield had plunged 71 basis points in 6 days as investors sought safety.

10) Both public and professional short interest readings are at record levels.

11) Index futures traders are positioned at historically net short levels.