Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 10, 2007

Links of Interest

Sunday, September 09, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Paulson & Co.’s biggest credit hedge fund rose fivefold in 2007 after the New York-based investment firm with $20 billion in assets under management bet US subprime-mortgage defaults would soar.

- China will adjust its financial policies to fund domestic companies and financial institutions’ outbound investment and increase foreign-exchange outflows, Zhou Xiaochuan, governor of the People’s Bank of China, said.

- Federal Reserve Bank of Philadelphia President Charles Plosser said there is an “underlying stability” in the US economy and policy makers need not always cut interest rates in response to financial-market turmoil.

- President Bush said he will tell the nation next week his “vision for future involvement in

- More than 80% of suicide bombers staging attacks in

- An al-Qaeda-linked group claimed responsibility for two bomb attacks in

- Investors such as hedge funds and private equity firms are helping to prevent a sharp decline of reinsurance rates that would threaten the industry’s profitability, Moody’s Investors Service said.

- If Federal Reserve officials cut their 5.25 percent target for the overnight lending rate when they meet on Sept. 18, it will be by only a quarter-percentage point with no promise of more to come.

- Japan’s economy contracted at almost twice the expected pace in the second quarter after companies pared spending on new equipment.

Wall Street Journal:

- Countrywide Financial(CFC) said it expects to reduce its work force by as much as 12,000, or about 20%, in the next three months.

- The global energy market is supplied with sufficient crude oil, forcing it to move the extra amount to inventories, thus taking the pressure off OPEC to raise its output when it meets next, said an Iranian oil official.

- Cellphone carriers don't seem to take chances with customer loyalty. Consumers who end a contract early typically incur a penalty of $150 or more. Fortunately, Web-based services now make it easier to unload a cellphone contract without taking a hit.

NY Times:

- Half of students in NYC’s public middle and high schools said in a city-sponsored survey that their peers with good grades aren’t respected.

- In the Green Marathon, Which Stocks Will Be the Winners?

- Dell Inc.(DELL) CEO and founder Michael Dell plans to buy smaller companies to add technology and intends to boost its computer and software sales to consumers.

- NYC’s downtown financial district is thriving with new businesses and residents, six years after the terror attacks that destroyed the

- Foreign investors who, buoyed by the strong economies and currencies in their own countries, now see an opportunity to scoop up coveted Manhattan real estate.

- A company controlled by political fund-raiser Norman Hsu paid more than $100,000 to at least nine people who made campaign contributions to US Senator Hillary Rodham Clinton and others, citing financial records. The people who received the payments in 2003 from the company, Components Ltd., had a financial relationship with Hsu, who is now in custody after fleeing fraud charges in

- In the race to become a major supplier of original video programming to the Web, Warner Brothers has decided to reverse its direction.

- Who’s the Most Charitable of Us All? Celebrities Don’t Always Make the Cut.

MarketWatch.com:

- 2008 Auto Review: Gas Sippers, Less Pain at the Pump.

CNBC.com:

- Stock Selloff Offers Good Opportunity for Investors.

- Job Cuts May Signal Slowdown, Not Recession.

TheStreet.com:

- Interdigital's(IDCC) licensing deal with Apple(AAPL) could indicate a 3G iPhone is coming.

CNNMoney.com:

- Amid the market uncertainty, leading private-equity shop Carlyle Group has raised $10 billion for two funds, new report says.

- Technology and financial services firms won a key patent reform victory Friday when the House approved legislation the industries have pushed for years by a vote of 220-175.

- 13 great fuel-efficient cars.

San Francisco Chronicle:

- Wells Fargo(WFC) will help mortgage customers who are struggling to make repayments and in some cases will change the terms of loans, citing CEO Stumpf.

New Yorker:

- Profits of Doom. When Wall Street needs bad news.

- British General Mike Jackson said it is “too soon” to declare the war in

Energy Information Administration:

- Last Friday, EIA released monthly data for June, and for the 10th month in a row, total oil demand was lower than suggested by the weekly data for the same period. Gasoline demand was also lower than suggested by the weekly data for the same period for the sixth time in a row.

AP:

- Democratic presidential candidate Christopher Dodd said he would end the

- Hunt Oil Co., a closely held

Financial Times:

- The surprise decision by a Sunni Arab party to rejoin the Iraqi government at the weekend was one of several last-minute moves designed to curb domestic US pressure to withdraw troops and to show that Iraqis are capable of compromise.

- Rodrigo de Rato, managing director of the IMF, has said the dramatic repricing of risk in the financial markets should be healthy for the medium-term stability of the global economy even if it results in short-term pain.

Sunday Tribune:

- Anglo Irish Bank Plc, the country’s third-largest lender by market value, plans to grow US lending by as much as 20% over the next three to five years, citing Finance Director Matt Moran. That would triple Anglo’s

- Hong Kong Exchanges and Clearing Ltd.’s plan to relax a rule that bans so-called short sales will probably be delayed, citing the chief of the city’s regulator.

Weekend Recommendations

Barron's:

- Made positive comments on (XTO) and (ATHR).

- Made negative comments on (IDT).

Citigroup:

- Reiterated Buy on (DD), target $56.

- Reiterated Buy on (MON), target $77

- Reiterated Buy on (COH), target $57.

Night Trading

Asian indices are -2.0% to -1.0% on average.

S&P 500 futures -.38%.

NASDAQ 100 futures -.33%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (DLLR)/.47

- (SHFL)/.13

- (TTWO)/-.72

- (VRNT)/.22

Upcoming Splits

- (FMC) 2-for-1

Economic Releases

3:00 pm EST

- Consumer Credit for July is estimated to fall to $8.0 billion versus $13.2 billion in June.

Other Potential Market Movers

- The Fed’s Lockhart speaking, Fed’s Yellen speaking, Fed’s Fisher speaking, Fed’s Mishkin speaking, Bear Stearns Healthcare Conference, Wachovia Global Transport/Packaging Conference, Oppenheimer Consumer Conference, Jeffries Media/Communications Conference, Morgan Stanley Industrials Conference and Lehman Brothers Financial Services Conference could also impact trading today.

Weekly Outlook

Click here for The Coming Week by TheStreet.com.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are several economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Consumer Credit

Tues. – Trade Balance, weekly retail sales

Wed. – Weekly MBA Mortgage Applications report, weekly EIA energy inventory report

Thur. – Initial Jobless Claims, Monthly Budget Statement

Fri. – Current Account Balance, Import Price Index, Advance Retail Sales, Industrial Production, Capacity Utilization,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Take-Two(TTWO)

Tues. – None of note

Wed. –

Thur. – Diebold(DBD), Pall Corp.(PLL)

Fri. – Pier 1(PIR), Thor Industries(THO)

Other events that have market-moving potential this week include:

Mon. – Fed’s Lockhart speaking, Fed’s Yellen speaking, Fed’s Fisher speaking, Fed’s Mishkin speaking, Bear Stearns Healthcare Conference, Wachovia Global Transport/Packaging Conference, Oppenheimer Consumer Conference, Jeffries Media/Communications Conference, Morgan Stanley Industrials Conference, Lehman Brothers Financial Services Conference

Tue. – Fed’s Bernanke speaking, Wachovia Services Conference, Morgan Stanley Industrials Conference, Jefferies Media/Communications Conference, Lehman Brothers Financial Services Conference, Bear Stearns Healthcare Conference, (TXN) mid-quarter Conference Call, (DUK) analyst meeting, (ECL) analyst meeting, (SLE) analyst meeting, (EAT) investor day

Wed. – Lehman Brothers Financial Services Conference, CSFB Technology Summit, (TMA) mid-quarter update, (KMT) analyst meeting, (ILMN) analyst day, (BDK) analyst meeting

Thur. – None of note

Fri. – None of note

Saturday, September 08, 2007

Friday, September 07, 2007

Weekly Scoreboard*

Indices

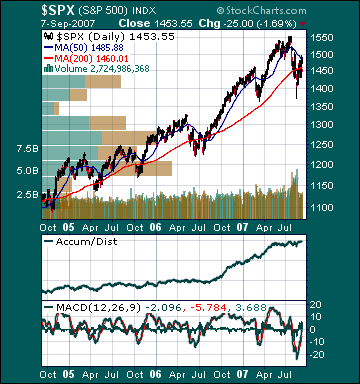

S&P 500 1,453.55 -.28%

DJIA 13,113.38 -.95%

NASDAQ 2,565.70 +.02%

Russell 2000 775.79 -.94%

Wilshire 5000 14,613.18 -.16%

Russell 1000 Growth 587.43 +.11%

Russell 1000 Value 812.61 -.37%

Morgan Stanley Consumer 704.21 -.60%

Morgan Stanley Cyclical 1,003.84 -.86%

Morgan Stanley Technology 632.84 -1.13%

Transports 4,732.93 -1.13%

Utilities 485.23 +.44%

MSCI Emerging Markets 133.29 +1.90%

Sentiment/Internals

NYSE Cumulative A/D Line 66,216 +1.86%

Bloomberg New Highs-Lows Index -215 -56.93%

CFTC Oil Large Speculative Longs 221,536 +9.22%

Total Put/Call 1.15 +26.37%

NYSE Arms 2.70 +82.43%

Volatility(VIX) 26.23 +4.66%

ISE Sentiment 154.0 +18.46%

AAII % Bulls 38.38 -4.76%

AAII % Bears 42.42 -8.32%

Futures Spot Prices

Crude Oil 76.70 +4.38%

Reformulated Gasoline 198.64 +1.24%

Natural Gas 5.50 -2.81%

Heating Oil 214.32 +4.54%

Gold 709.70 +5.32%

Base Metals 230.99 -4.86%

Copper 325.15 -2.82%

Economy

10-year US Treasury Yield 4.37% -15 basis points

4-Wk MA of Jobless Claims 325,800 +.2%

Average 30-year Mortgage Rate 6.46% +1 basis point

Weekly Mortgage Applications 622.90 +1.25%

Weekly Retail Sales +2.40%

Nationwide Gas $2.81 +.02/gallon

US Cooling Demand Next 7 Days 21.0% above normal

ECRI Weekly Leading Economic Index 140.40 +.86%

US Dollar Index 79.96 -1.03%

CRB Index 312.32 +1.66%

Best Performing Style

Mid-cap Growth +.38%

Worst Performing Style

Small-cap Value -1.37%

Leading Sectors

Gold +11.54%

Oil Service +4.17%

Biotech +3.37%

Steel +2.68%

Internet +1.31%

Lagging Sectors

Telecom -2.0%

Oil Tankers -2.09%

Airlines -2.56%

Homebuilders -2.72%

Retail -4.51%